- BMW i3 insurance costs an average of $2,384 per year, or around $199 per month for full coverage.

- The i3 is one of the cheaper small luxury cars to insure, costing $64 less per year on average as compared to the rest of the segment.

- The cheapest BMW i3 insurance is on the base Sedan at an estimated $2,340 per year, or about $195 per month.

How much does BMW i3 insurance cost?

Expect to pay around $2,384 a year for full coverage to insure a BMW i3. From the perspective of individual coverages, comprehensive costs about $590 a year, liability and medical coverage will cost approximately $620, and the remaining collision insurance is around $1,174.

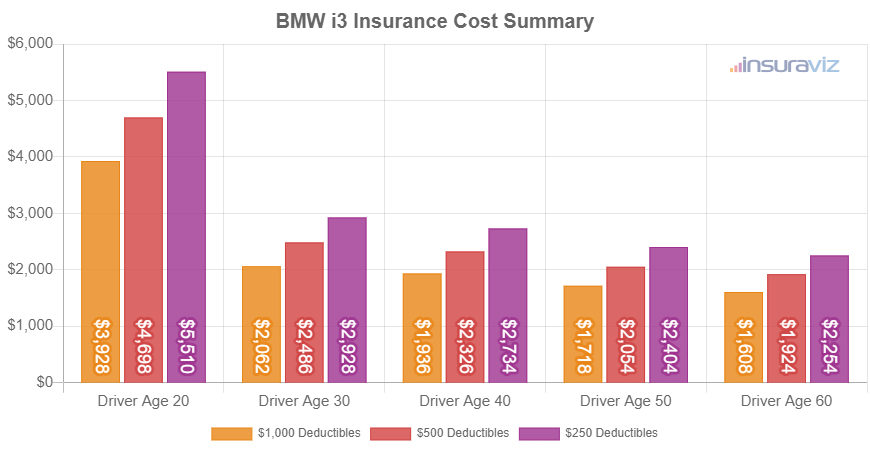

The chart below illustrates how average BMW i3 car insurance cost changes based on the age of the rated driver and policy deductibles.

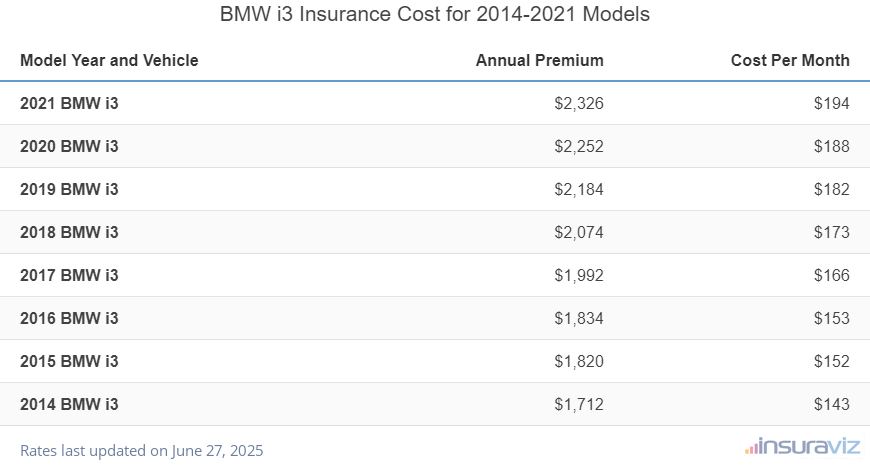

While the chart above detailed car insurance costs for the 2021 BMW i3 model, the table below breaks down average rates back to the 2014 model year. Prices range from $1,750 for a 2014 BMW i3 to the highest average rate of $2,384 for a 2021 model.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2021 BMW i3 | $2,384 | $199 |

| 2020 BMW i3 | $2,306 | $192 |

| 2019 BMW i3 | $2,238 | $187 |

| 2018 BMW i3 | $2,124 | $177 |

| 2017 BMW i3 | $2,038 | $170 |

| 2016 BMW i3 | $1,880 | $157 |

| 2015 BMW i3 | $1,862 | $155 |

| 2014 BMW i3 | $1,750 | $146 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW i3 trim levels for each model year. Updated October 24, 2025

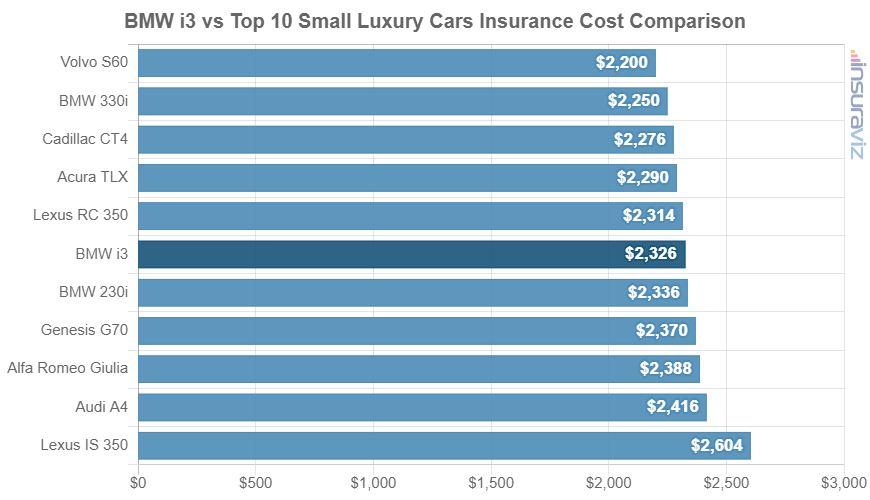

Is the BMW i3 a cheap luxury car to insure?

The BMW i3 ranks seventh out of 17 comparison vehicles in the small luxury car segment. The i3 costs an estimated $2,384 per year to insure and the segment median rate is $2,448 per year, a difference of $64 per year.

When insurance rates are compared to other small luxury cars, the BMW i3 costs $80 more per year than the BMW 330i, $192 less than the Mercedes-Benz C300, $132 more than the Volvo S60, and $40 more than the Acura TLX.

The chart below shows how average BMW i3 car insurance rates compare to the top 10 selling small luxury cars in the United States. Car insurance cost rankings for the entire 17 vehicle small luxury car segment can be found following the chart.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Mercedes-Benz A220 | $2,082 | -$302 |

| 2 | Volvo S60 | $2,252 | -$132 |

| 3 | BMW 330i | $2,304 | -$80 |

| 4 | Cadillac CT4 | $2,330 | -$54 |

| 5 | Acura TLX | $2,344 | -$40 |

| 6 | Lexus RC 350 | $2,370 | -$14 |

| 7 | BMW i3 | $2,384 | -- |

| 8 | BMW 230i | $2,394 | $10 |

| 9 | Genesis G70 | $2,424 | $40 |

| 10 | Audi S3 | $2,438 | $54 |

| 11 | Alfa Romeo Giulia | $2,446 | $62 |

| 12 | Audi A4 | $2,474 | $90 |

| 13 | Mercedes-Benz C300 | $2,576 | $192 |

| 14 | BMW M240i | $2,580 | $196 |

| 15 | Audi RS 3 | $2,618 | $234 |

| 16 | Lexus IS 350 | $2,666 | $282 |

| 17 | BMW 340i | $2,936 | $552 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2021 model year. Updated October 24, 2025

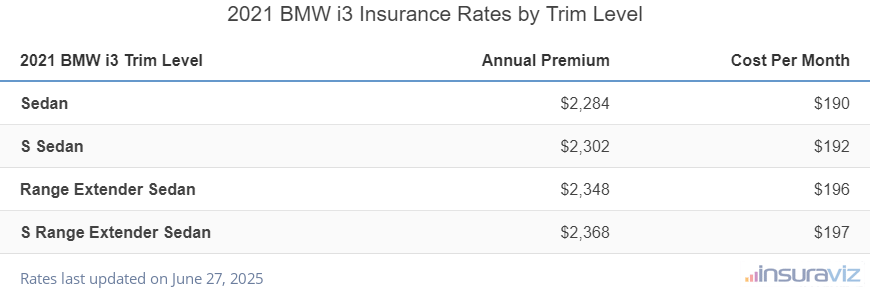

Which BMW i3 model has the cheapest car insurance?

The cheapest trim level of BMW i3 to insure is the base Sedan at $2,340 per year, or about $195 per month. The second cheapest trim is the S Sedan at $2,360 per year.

For the higher-priced trim levels, the two highest cost BMW i3 models to insure are the Range Extender Sedan, and the S Range Extender Sedan trim levels at an estimated $2,406, and $2,424 per year, respectively.

The next table shows the average yearly and 6-month auto insurance policy costs, plus a monthly budget estimate, for each 2021 BMW i3 package and trim.

| 2021 BMW i3 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sedan | $2,340 | $195 |

| S Sedan | $2,360 | $197 |

| Range Extender Sedan | $2,406 | $201 |

| S Range Extender Sedan | $2,424 | $202 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Below are some additional points to ponder when shopping around for a new or replacement insurance policy.

- Avoid tickets to save money. If you want to get the best BMW i3 insurance rates, it’s necessary to drive safe. Not surprisingly, just one or two minor driving infractions can result in insurance policy rates increasing by up to $628 per year.

- BMW i3 insurance rates for teens are expensive. Average rates for full coverage i3 insurance costs $8,433 per year for a 16-year-old driver, $8,205 per year for a 17-year-old driver, and $7,416 per year for an 18-year-old driver.

- Great credit can mean great car insurance rates. Having a credit rating over 800 could save you as much as $374 per year versus a decent credit rating of 670-739. Conversely, a mediocre credit rating could cost around $434 more per year.

- Be a careful driver and pay less for insurance. Being the cause of frequent accidents will raise rates, possibly by an additional $3,410 per year for a 20-year-old driver and even as much as $562 per year for a 60-year-old driver.

- High risk i3 insurance is expensive. For a 30-year-old driver, the requirement to buy a high-risk policy can potentially increase rates by $2,938 or more per year.

- Age and gender affect car insurance rates. For a 2021 BMW i3, a 20-year-old man will have an average rate of $4,810 per year, while a 20-year-old female driver will pay an average of $3,438, a difference of $1,372 per year. The females get the cheaper rate by far. But by age 50, male driver rates are $2,104 and the female rate is $2,054, a difference of only $50.

- Increasing deductibles lowers insurance cost. Increasing your policy deductibles from $500 to $1,000 could save around $400 per year for a 40-year-old driver and $788 per year for a 20-year-old driver.

- Decreasing deductibles will cost more. Decreasing deductibles from $500 to $250 could cost an additional $416 per year for a 40-year-old driver and $832 per year for a 20-year-old driver.