- Honda Accord car insurance rates average $2,316 per year, $1,158 for a 6-month policy, or $193 per month, depending on the trim level.

- The cheapest model of Honda Accord to insure is the EX-L Hybrid at around $2,232 per year, or about $186 per month.

- When compared to other midsize cars, the 2024 Honda Accord is one of the cheaper to insure, costing $131 less per year on average.

- Insurance for a used Honda Accord could save $852 or more each year over the cost of buying a new one.

How much does Honda Accord insurance cost?

Insurance on a 2024 Accord costs an average of $2,316 a year, or $193 on a monthly basis. The Accord costs slightly less to insure than the average rate for 2024 midsize sedans, which is $2,447.

When compared to all 2024 models, not just to the midsize sedan segment, the Honda Accord costs 10.5% less to insure than the national average rate for 2024 model year vehicles of $2,572 per year.

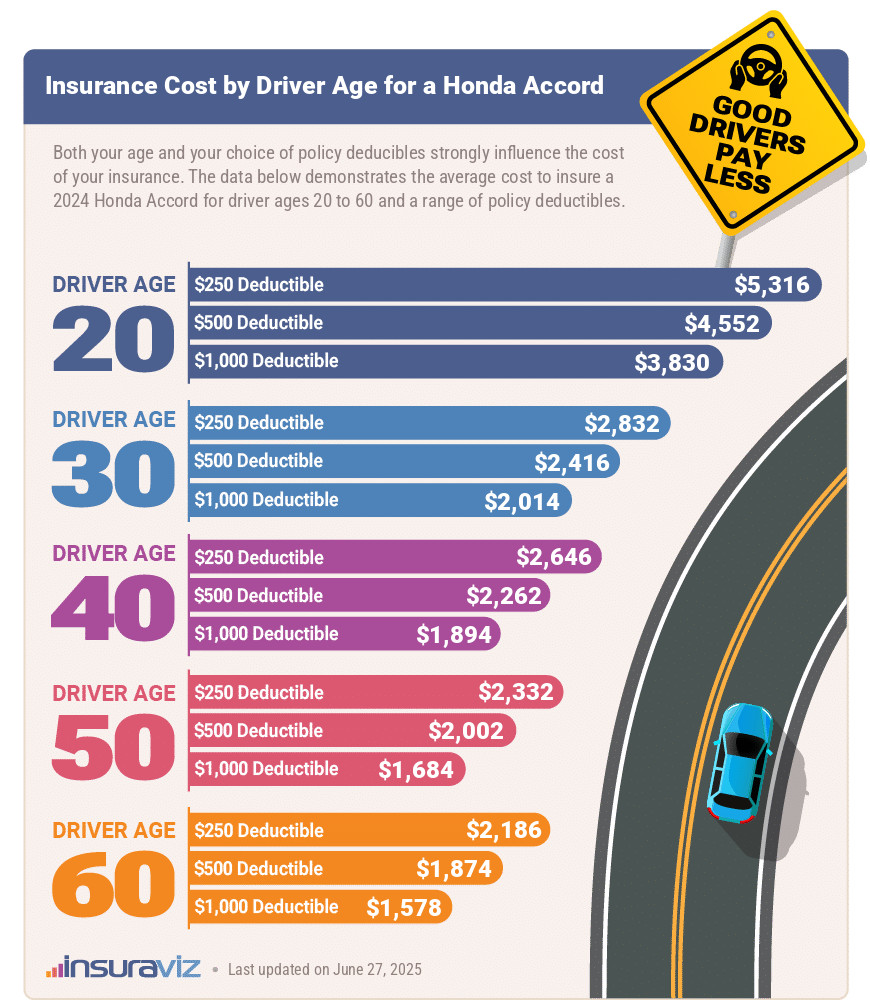

The following infographic illustrates how average Accord car insurance rates change depending on driver age and policy deductibles. The prices shown are for an annual policy, and range from $1,616 per year for a 60-year-old driver with deductibles of $1,000 to the highest cost of $5,446 per year for a 20-year-old driver with deductibles set at $250.

There are two important takeaways from this data. The first is the fact that it’s more expensive to insure younger drivers.

In this example, the younger 20-year-old can expect to pay around $2,350 per year more than the average 40-year-old driver, when comparing policies with a $500 deductible.

The second point the data illustrates is the fact that using a lower deductible on your car insurance will cost considerably more than having a higher deductible.

Using the 40-year-old driver as an example, a low $250 deductible policy on a 2024 Honda Accord costs an average of $2,708 per year. A higher $1,000 deductible policy costs an average of $1,938 per year. That’s a savings of $770 per year if you select a higher deductible.

Honda Accord insurance cost by coverage

When simplified, a car insurance policy is comprised of basically four different coverages: comprehensive, collision, liability, and medical or PIP (Personal Injury Protection).

Comprehensive covers things like damage from hail or fire, collision covers damage when you hit a tree or mailbox, liability covers injuries to other people or their vehicles, and medical coverage covers injuries to you or other occupants of your vehicle.

The table below shows how each of these coverages on a typical Honda Accord insurance policy compares to the average 2024 vehicle.

| Policy Coverage | 2024 Honda Accord | 2024 All Vehicle Average | Difference |

|---|---|---|---|

| Comprehensive | $576 | $656 | -13% |

| Collision | $1,088 | $1,216 | -11.1% |

| Liability | $456 | $492 | -7.6% |

| Med/PIP Other | $196 | $208 | -5.9% |

| Total Policy Cost | $2,316 | $2,572 | -10.5% |

Lower than average cost Higher than average cost

Data Methodology: Rated driver is a 40-year-old male with no driving violations or at-fault accidents in the prior three years. Coverage premiums are averaged for all trim levels available for the 2024 Honda Accord. Updated October 24, 2025

Based on this data, you can see that the 2024 Accord is cheaper to insure than the average 2024 model for all policy coverages, especially comprehensive coverage.

One of the best ways to pay less for auto insurance is to bundle it with your home insurance, if possible. Doing this can save an average of $255 per year when insuring a 2024 Honda Accord. See our list of the top ten discounts on Honda Accord insurance.

Additional factors that can impact the rate you pay

With so many factors going into car insurance rates, we broke out a few of them to illustrate how different profiles and lifestyle choices can make significant differences in what you’ll be paying to insure your Honda Accord.

- Expect to pay a lot for high-risk insurance. For a 50-year-old driver, the requirement to buy a high-risk policy could raise rates by $2,718 or more per year. High-risk insurance is normally only required after serious offenses like DWI/DUIs, driving with a license or insurance, or multiple at-fault accidents.

- Driver gender influences rates. For a 2024 Honda Accord, a 20-year-old man pays an estimated $4,666 per year, while a 20-year-old female driver pays $3,344, a difference of $1,322 per year. Women get significantly cheaper rates at this age due to the tendency of males to be more aggressive and risk-tolerant. But by age 50, the cost for a male driver is $2,050 and the rate for women is $2,002, a difference of only $48.

- Avoiding accidents saves money. At-fault accidents raise insurance rates, possibly by an extra $3,310 per year for a 20-year-old driver and even $690 per year for a 50-year-old driver.

- Save money by qualifying for policy discounts. Discounts may be available if the insureds drive a vehicle with safety or anti-theft features, are claim-free, belong to certain professional organizations, insure their home and car with the same company, or many other policy discounts which could save the average driver as much as $390 per year.

- Get a discount from your choice of occupation. Some auto insurance providers offer policy discounts for specific professions like college professors, architects, doctors, members of the military, scientists, farmers, and other occupations. If you can get this discount applied to your policy, you may save between $69 and $233 on your annual insurance cost, depending on the age of the rated driver.

- Accord insurance for teen drivers is expensive. Average rates for full coverage Accord insurance costs $8,220 per year for a 16-year-old driver, $7,977 per year for a 17-year-old driver, and $7,180 per year for an 18-year-old driver.

What is the cheapest Accord to insure?

With Honda Accord car insurance cost ranging from $2,232 to $2,378 per year on average, the lowest-cost model to insure is the EX-L Hybrid model. The next cheapest trim level to insure is the Sport Hybrid at $2,298 per year.

Average Honda Accord insurance cost per month ranges from $186 to $198 depending on the trim level, so plan on budgeting around that amount per month for full coverage insurance. This amount will vary depending on where you live, however.

For higher trim levels, the three most expensive Honda Accord models to insure are the EX, the Sport-L Hybrid, and the LX trim levels at an estimated $2,330, $2,350, and $2,378 per year, respectively.

The table below shows average Honda Accord insurance rates, including a monthly budget amount, for each available trim level for the 2024 model year.

| 2024 Honda Accord Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| EX-L Hybrid | $2,232 | $186 |

| Sport Hybrid | $2,298 | $192 |

| Touring Hybrid | $2,326 | $194 |

| EX | $2,330 | $194 |

| Sport-L Hybrid | $2,350 | $196 |

| LX | $2,378 | $198 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

We recommend comparing rates between at least five different car insurance companies in order to find the best price on Honda Accord insurance. Include several major companies (Progressive, GEICO, etc.) as well as smaller companies in your area.

How much is insurance on a used Honda Accord?

Insuring a 2013 Accord instead of a new 2024 model could save around $850 or more each year. A 2017 model would save around $450 over the cost of insurance for a new model.

The next table shows average Accord insurance costs for the 2013 to 2024 model years and for various driver age groups. Average policy cost ranges from $1,232 per year for a 60-year-old driver rated on a 2013 Honda Accord to the most expensive rate of $4,666 for a 20-year-old rated on a 2024 Honda Accord.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Honda Accord | $4,666 | $2,316 | $1,920 |

| 2023 Honda Accord | $4,782 | $2,360 | $1,956 |

| 2022 Honda Accord | $4,644 | $2,286 | $1,896 |

| 2021 Honda Accord | $4,444 | $2,188 | $1,816 |

| 2020 Honda Accord | $4,320 | $2,128 | $1,768 |

| 2019 Honda Accord | $4,148 | $2,040 | $1,698 |

| 2018 Honda Accord | $3,906 | $1,924 | $1,604 |

| 2017 Honda Accord | $3,752 | $1,858 | $1,550 |

| 2016 Honda Accord | $3,580 | $1,784 | $1,486 |

| 2015 Honda Accord | $3,158 | $1,576 | $1,322 |

| 2014 Honda Accord | $3,060 | $1,526 | $1,278 |

| 2013 Honda Accord | $2,936 | $1,464 | $1,232 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Honda Accord trim levels for each model year. Updated October 24, 2025

Eventually, as the vehicle gets older it will make sense to remove either comprehensive or collision or both from the insurance policy. As vehicles get older and lose value from depreciation, the extra cost of physical damage protection starts to surpass the benefits.

Vehicle ages beyond the scope of the table above may be candidates for removing full coverage. Dropping comprehensive and collision coverage could save around $828 per year, depending on how high the deductibles were and the driver age.

How does Honda Accord insurance cost compare?

When compared to other midsize cars, the Accord costs $262 less per year than the Toyota Camry, $282 less than the Nissan Altima, $502 less than the Tesla Model 3, and $10 less than the Chevrolet Malibu.

The Honda Accord ranks second out of 11 total vehicles in the 2024 midsize car segment for car insurance affordability. The Accord costs an average of $2,316 per year for full coverage insurance and the class average rate is $2,447 per year, a difference of $131 per year.

The chart below shows how average car insurance rates for an Accord compare to other popular 2024 midsize cars. The average rate for a 2024 Accord is shown in orange, while the average rate for the segment is shown in dark blue.

To see a table that ranks and compares all 11 models in the 2024 midsize sedan segment, simply click the table button in the lower-left corner of the chart.

Accord insurance compared to similarly-priced models

When sticker price is factored in, we can find out how insurance cost compares between the Accord and other models with similar average MSRPs. The 2024 Accord has an average sticker price of $32,934, before destination charges and dealer fees.

The vehicles closest in price to the Accord for the 2024 model year are the Hyundai Sonata, Toyota Camry, Subaru Legacy, and Nissan Altima. The next list shows how those models compare to the Honda Accord by purchase price and the cost to insure. See our cost comparisons index page for additional Accord comparisons plus many other makes and models.

- Honda Accord vs. Hyundai Sonata – With an average MSRP of $32,000 and ranging from $26,000 to $37,000, the Hyundai Sonata costs $934 less than the average sticker price for the Honda Accord. Full-coverage insurance on the Hyundai Sonata costs an average of $116 more each year than the Honda Accord.

- Honda Accord vs. Toyota Camry – Having an average MSRP of $31,506 ($26,420 to $36,845), the 2024 Toyota Camry costs $1,428 less than the average cost for the Honda Accord. Drivers can expect to pay an average of $262 more per year for insurance on the Toyota Camry compared to an Accord.

- Honda Accord vs. Subaru Legacy – Having an average MSRP of $31,345 and ranging from $24,895 to $38,195, the Subaru Legacy costs $1,589 less than the MSRP for the Honda Accord. Insurance on the Subaru Legacy costs an average of $52 more each year than the Honda Accord.

- Honda Accord vs. Nissan Altima – Having an average price of $29,930 and ranging from $25,730 to $35,430, the 2024 Nissan Altima costs $3,004 less than the average cost of the Honda Accord. Anticipate paying an average of $282 more each year for full-coverage insurance on the Nissan Altima compared to an Accord.

Honda Accord car insurance rates for teenagers

The Honda Accord has always been a solid choice for teenagers to drive. Reliability and safety make it a good choice for younger drivers, and insurance cost is affordable.

Regardless of the type of vehicle chosen, however, car insurance for teenagers is always going to be higher-priced than for more mature drivers. Teens are easily distracted behind the wheel and have not had the experience that only comes with time and age.

Nevertheless, the chart below shows average Honda Accord car insurance rates for teenage drivers from the age of 16 to 19. Rates are broken out for both male and female drivers due to the significant difference in gender-based rates. Prices range from a low of $5,526 to insure a 19-year-old female driver to a high of $8,220 to insure a 16-year-old male driver.

As shown by the chart above, car insurance rates are highest for 16-year-old drivers and decline slightly each year. Honda Accord insurance for a 17-year-old driver costs an average of $7,634 for females and $7,977 for males. Insuring an 18-year-old on a Honda Accord would cost an average of $7,634 for females and $7,977 for males.

Keep in mind these rates are for a new 2024 Honda Accord, and rates tend to drop as the vehicle ages. Read the next section on liability-only insurance to get an idea of how to reduce the cost of Honda Accord car insurance for teens.

Full coverage vs. liability-only insurance cost

The teen driver rates in the chart above are for a 2024 Honda Accord with full coverage, which simply means insurance includes coverage for claims such as hail damage, collisions, and vehicle theft.

A good way to reduce the cost of insurance for not only teenage drivers but any age driver is to purchase an older model Honda Accord and only insure it for liability insurance. This gives the required liability protection but saves money because you’re not paying for comprehensive and collision coverage.

The table below compares the cost of full coverage Honda Accord car insurance to the cost of only insuring for liability coverage.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Honda Accord | $1,398 | $630 |

| 2011 Honda Accord | $1,342 | $624 |

| 2010 Honda Accord | $1,278 | $618 |

| 2009 Honda Accord | $1,222 | $612 |

| 2008 Honda Accord | $1,174 | $608 |

| 2007 Honda Accord | $1,156 | $602 |

| 2006 Honda Accord | $1,132 | $596 |

| 2005 Honda Accord | $1,092 | $590 |

| 2004 Honda Accord | $1,064 | $584 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025

One thing to note about buying a liability-only car insurance policy is that if you do have an accident or incident where there is physical damage to your vehicle, you have no coverage. So if you do not have the financial means to replace the vehicle, it may not be the best idea to drop physical damage coverage entirely.

Be sure you’re getting the discounts you deserve

Qualifying for policy discounts is one of the best ways to get cheaper Honda Accord insurance. Every company offers discounts, but some offer a wider selection than others.

We assembled the top ten discounts by average savings and the larger U.S. insurance companies that offer each one.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $324 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $255 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $215 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $183 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $174 |

| Military Savings of 5% to 15% | Alfa, American Family, Direct General, Farmers, GEICO, Liberty Mutual, Shelter, USAA | $162 |

| Pay in Full Savings of 5% to 10% | Allstate, Nationwide, Progressive, State Farm, Travelers | $146 |

| Multiple Vehicles Savings of 4% to 15% | Allstate, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Progressive, Travelers, USAA | $139 |

| Student Away at School Savings of 4% to 25% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $134 |

| Good Student Savings of 3% to 20% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $120 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated October 24, 2025

Note that this is by no means a comprehensive list of the companies that offer these discounts. There are many smaller insurance companies that may also offer some or all of the discounts listed above. But for the sake of this article, we focused primarily on the larger carriers.

Also, each company may apply discounts to different coverages. For example, taking a defensive driving course may only get you a discount on the specific premiums charged for liability and/or collision insurance rather than the entire policy premium.

This makes sense if you think about it because being a better driver will not have any impact on the frequency or severity of comprehensive claims, like from a hail storm or flood.

We highly recommend asking your agent or a customer service representative if you are getting every discount you deserve. It’s an easy way to reduce the cost of your Honda Accord insurance.

During his career as an independent insurance agent,

During his career as an independent insurance agent,