- Volkswagen Beetle insurance costs an average of $1,538 per year, $769 for a 6-month policy, or $128 per month.

- The Volkswagen Beetle only differs from the compact car segment average insurance rate by $32 per year.

- The cheapest Volkswagen Beetle insurance is on the S Hatchback at $1,460 per year, or about $122 per month.

- Insuring an older model of Beetle may reduce your insurance bill by $418 each year.

How much does VW Beetle insurance cost?

Volkswagen Beetle car insurance costs an average of $1,538 per year, depending on location, driver age, and other factors. Collision insurance costs around $612 a year, comprehensive (or other-than-collision) coverage is approximately $340, and the remaining liability/medical (or PIP) coverage will cost an estimated $586.

The chart below details average insurance cost for a 2019 VW Beetle using an assortment of different driver ages and risk profiles.

To help you understand the full range of possible rates, consider that an insurance policy with just liability coverage for a Beetle in some parts of Indiana or North Carolina may be as low as $225 a year.

For the same model year of Volkswagen Beetle, a newly-licensed teen driver with an accident and a violation in specific New York City zip codes could receive a car insurance bill for $13,269 a year for a policy that provides full coverage.

Some additional example rates, policy discounts, and ways to keep costs down are listed below.

- Bring up your credit score to save money. Having a good credit rating over 800 could earn savings of $241 per year versus a decent credit rating of 670-739. Conversely, a poor credit rating could cost as much as $280 more per year.

- Make your policy cheaper by raising deductibles. Raising deductibles from $500 to $1,000 could save around $216 per year for a 40-year-old driver and $422 per year for a 20-year-old driver.

- Low physical damage deductibles increase policy cost. Lowering the comprehensive and collision deductibles from $500 to $250 could cost an additional $226 per year for a 40-year-old driver and $446 per year for a 20-year-old driver.

- Expect to pay a lot to insure a teenager. Average rates for full coverage Beetle insurance costs $5,632 per year for a 16-year-old driver, $5,414 per year for a 17-year-old driver, and $4,776 per year for an 18-year-old driver.

- Beetle insurance is expensive for high-risk drivers. For a 30-year-old driver, having a high frequency of accidents or violations could end up with a rate increase of $1,920 or more per year.

- As you get older, rates tend to drop. The difference in insurance cost for a Volkswagen Beetle between a 60-year-old driver ($1,286 per year) and a 20-year-old driver ($3,110 per year) is $1,824, or a savings of 83%.

Beetle vs. other small cars: Which insurance is cheaper?

When compared to the best-selling models in the small car category, VW Beetle insurance costs $66 more per year than the Honda Civic, $280 more than the Toyota Corolla, $48 more than the Nissan Sentra, and $160 less than the Hyundai Elantra.

Volkswagen Beetle insurance ranks 20th out of 33 comparison vehicles in the small car category. The Beetle costs an estimated $1,538 per year for insurance, while the category average is $1,506 annually, a difference of only $32 per year.

The chart below shows how Volkswagen Beetle insurance rates compare to the best-selling small cars in the U.S. for the 2019 model year. Also included is a table that breaks down average insurance cost for all 33 models in the small car class, and the cost difference between each model and the VW Beetle.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Ford Fiesta | $1,250 | -$288 |

| 2 | Honda Fit | $1,254 | -$284 |

| 3 | Toyota Corolla | $1,258 | -$280 |

| 4 | Fiat 500 | $1,264 | -$274 |

| 5 | Fiat 500L | $1,336 | -$202 |

| 6 | Chevrolet Spark | $1,348 | -$190 |

| 7 | Volkswagen Golf | $1,358 | -$180 |

| 8 | Fiat 124 Spider | $1,364 | -$174 |

| 9 | Toyota Yaris | $1,366 | -$172 |

| 10 | Hyundai Accent | $1,368 | -$170 |

| 11 | Smart Fortwo | $1,372 | -$166 |

| 12 | Subaru Impreza | $1,380 | -$158 |

| 13 | Mazda 3 | $1,396 | -$142 |

| 14 | Honda Civic | $1,472 | -$66 |

| 15 | Fiat 500E | $1,474 | -$64 |

| 16 | Nissan Sentra | $1,490 | -$48 |

| 17 | Nissan Versa | $1,504 | -$34 |

| 18 | Kia Forte | $1,508 | -$30 |

| 19 | Hyundai Veloster | $1,512 | -$26 |

| 20 | Volkswagen Beetle | $1,538 | -- |

| 21 | Toyota Prius | $1,580 | $42 |

| 22 | Kia Rio | $1,584 | $46 |

| 23 | Honda Clarity | $1,598 | $60 |

| 24 | Chevrolet Sonic | $1,616 | $78 |

| 25 | Volkswagen GTI | $1,618 | $80 |

| 26 | Hyundai Ioniq | $1,634 | $96 |

| 27 | Chevrolet Cruze | $1,650 | $112 |

| 28 | Chevrolet Volt | $1,664 | $126 |

| 29 | Hyundai Elantra | $1,698 | $160 |

| 30 | Volkswagen Jetta | $1,736 | $198 |

| 31 | Volkswagen E-Golf | $1,742 | $204 |

| 32 | Toyota 86 | $1,836 | $298 |

| 33 | Toyota Mirai | $1,928 | $390 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2019 model year. Updated February 22, 2024

What is the cheapest VW Beetle insurance?

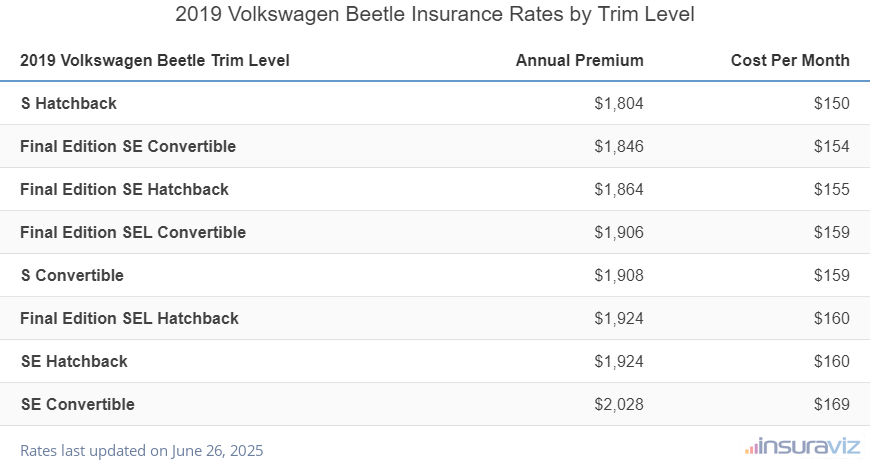

The cheapest model of Volkswagen Beetle to insure is the S Hatchback at $1,460 per year. The second cheapest model is the Final Edition SE Convertible, also at $1,494 per year, and the third cheapest trim level to insure is the Final Edition SE Hatchback at $1,508 per year.

For higher Beetle trim levels, the three most expensive Beetle models to insure are the Volkswagen Beetle Final Edition SEL Hatchback, the SE Hatchback, and the SE Convertible trim levels at $1,556, $1,556, and $1,640 per year, respectively.

The next table displays the estimated annual and 6-month policy costs, including a monthly budget amount, for each Volkswagen Beetle model and trim level.

| 2019 Volkswagen Beetle Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S Hatchback | $1,460 | $122 |

| Final Edition SE Convertible | $1,494 | $125 |

| Final Edition SE Hatchback | $1,508 | $126 |

| Final Edition SEL Convertible | $1,542 | $129 |

| S Convertible | $1,544 | $129 |

| Final Edition SEL Hatchback | $1,556 | $130 |

| SE Hatchback | $1,556 | $130 |

| SE Convertible | $1,640 | $137 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

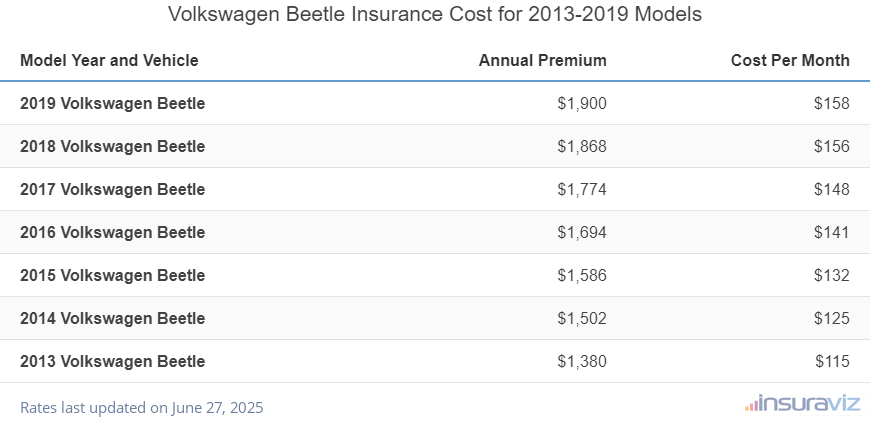

How much cheaper are older Beetle models to insure?

Insuring a 2013 Volkswagen Beetle will save an estimated $418 per year over the cost of insuring a 2019 model. In general, the older the vehicle, the more you will save on insurance compared to a newer model.

The following data table illustrates typical Volkswagen Beetle insurance rates for the 2013 to 2019 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2019 Volkswagen Beetle | $1,538 | $128 |

| 2018 Volkswagen Beetle | $1,514 | $126 |

| 2017 Volkswagen Beetle | $1,440 | $120 |

| 2016 Volkswagen Beetle | $1,370 | $114 |

| 2015 Volkswagen Beetle | $1,286 | $107 |

| 2014 Volkswagen Beetle | $1,214 | $101 |

| 2013 Volkswagen Beetle | $1,120 | $93 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Volkswagen Beetle trim levels for each model year. Updated February 23, 2024

As a VW Beetle drops in value over time, the cost required to keep physical damage protection is more than the added benefit. At some point, dropping physical damage coverage (comprehensive and collision) will make financial sense, and will also drastically lower the cost of insurance.

Dropping physical damage insurance coverage on an older Volkswagen Beetle may save $662 per year, depending on where the physical damage deductibles were set and the driver age.