- Acura Integra insurance costs an average of $1,688 per year for a full coverage policy, depending on the trim level.

- The Integra base trim level is the cheapest to insure at around $1,586 per year. The most expensive trim is the Type S at $1,858 per year.

- Ranked first out of 18 vehicles in the small luxury car segment, average car insurance rates for the Acura Integra cost $400 less per year than the segment average.

How much is insurance on a 2024 Acura Integra?

The average driver should plan on paying around $1,688 a year for a full coverage policy to insure a new 2024 Acura Integra. When compared to the 2022 Acura ILX which it replaces, the Integra costs around $94 more per year to insure.

The next chart shows average car insurance cost for a 2024 Integra using different driver ages and policy deductible amounts.

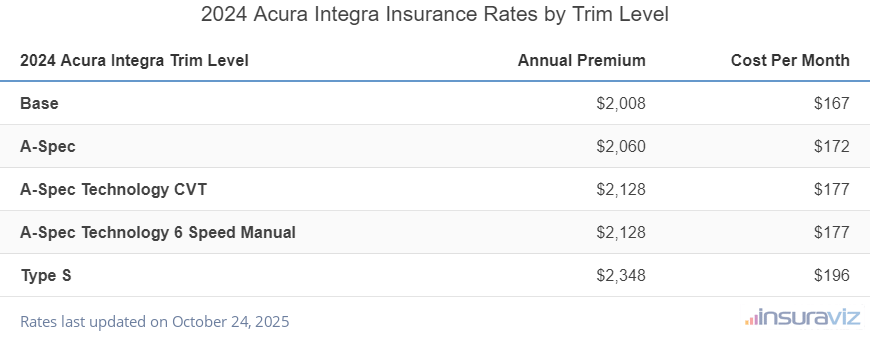

The next table shows insurance policy cost for three different terms (annual, semi-annual, and monthly) starting with the $31,500 base model and going up to the most expensive model to insure, the $50,800 Type S trim level.

| 2024 Acura Integra Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Base | $1,586 | $132 |

| A-Spec | $1,628 | $136 |

| A-Spec Technology CVT | $1,682 | $140 |

| A-Spec Technology 6 Speed Manual | $1,682 | $140 |

| Type S | $1,858 | $155 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 22, 2024

Is it expensive to insure a 2024 Acura Integra?

The Acura Integra ranks first out of 18 total comparison vehicles in the 2024 small luxury car category for car insurance affordability. The Integra costs an average of $1,688 per year to insure and the category average is $2,088 per year, a difference of $400 less per year.

When compared to the other small luxury cars, insurance rates for an Acura Integra cost $450 less per year than the Alfa Romeo Giulia, $440 less per year than the Audi S3, and $274 less per year than the Acura TLX.

The chart below shows how the average car insurance rate for an Acura Integra compares to the top-selling small luxury cars in America like the Genesis G70, Cadillac CT4, and the Acura TLX. A more comprehensive data table is included after the chart breaking down insurance rate comparisons for every vehicle in the small luxury car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura Integra | $1,688 | -- |

| 2 | BMW 330i | $1,932 | $244 |

| 3 | Acura TLX | $1,962 | $274 |

| 4 | Cadillac CT4 | $1,982 | $294 |

| 5 | Genesis G70 | $1,986 | $298 |

| 6 | Lexus IS 350 | $1,996 | $308 |

| 7 | Lexus RC 350 | $2,058 | $370 |

| 8 | BMW 330e | $2,060 | $372 |

| 9 | BMW 228i | $2,064 | $376 |

| 10 | BMW 230i | $2,080 | $392 |

| 11 | Audi S3 | $2,128 | $440 |

| 12 | Alfa Romeo Giulia | $2,138 | $450 |

| 13 | Audi A4 | $2,184 | $496 |

| 14 | BMW M235i | $2,196 | $508 |

| 15 | Volvo S60 | $2,226 | $538 |

| 16 | Audi RS 3 | $2,268 | $580 |

| 17 | BMW M240i | $2,312 | $624 |

| 18 | BMW M340i | $2,318 | $630 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated February 23, 2024

Another way to compare rates is finding out how the cost of insurance on an Acura Integra compares to other models that have similar cost. With an average MSRP of $37,760, the cost to purchase a 2024 Acura Integra ranges from $31,500 to $50,800, before delivery charges and dealer fees.

The four models most similar in price to the Integra for the 2024 model year are the BMW 228i, BMW 230i, BMW 330i, and Cadillac CT4. Here’s how they compare to a 2024 Integra by purchase price and insurance policy cost.

- Acura Integra vs. BMW 228i – The 2024 BMW 228i has an average retail price of $39,400, ranging from $38,400 to $40,400, which is $1,640 more expensive than the average sticker price for the Acura Integra. The cost to insure an Acura Integra compared to the BMW 228i is $376 less annually on average.

- Acura Integra vs. BMW 230i – The average MSRP for a 2024 Acura Integra is $2,040 cheaper than the BMW 230i, at $37,760 compared to $39,800. Insurance on a 2024 Acura Integra costs an average of $392 less each year than the BMW 230i.

- Acura Integra vs. BMW 330i – Having an average sticker price of $45,500 ($44,500 to $46,500), the BMW 330i costs $7,740 more than the average cost of the Acura Integra. Insuring the BMW 330i costs an average of $244 more annually than the Acura Integra.

- Acura Integra vs. Cadillac CT4 – The 2024 Acura Integra has an average MSRP that is $7,832 cheaper than the Cadillac CT4 ($37,760 versus $45,592). Drivers can expect to pay an average of $294 more per year to insure the Cadillac CT4 compared to an Integra.

Eight ways to save when insuring your Acura Integra

There are a lot of choices when it comes to car insurance, but if you follow the tips below you could help ensure that you’re not overpaying.

- Obey the law to get lower insurance rates. If you want the cheapest Integra insurance rates, it’s necessary to follow the law. Not surprisingly, just a couple of blemishes on your motor vehicle report could possibly raise insurance policy rates by at least $438 per year. Major misdemeanors like DUI or reckless driving could raise rates by an additional $1,530 or more.

- Gender and age are two big factors. For a 2024 Acura Integra, a 20-year-old male will pay an average rate of $3,350 per year, while a 20-year-old female driver pays an average of $2,418, a difference of $932 per year. The females get the cheaper rate by far. But by age 50, rates for male drivers are $1,498 and the rate for females is $1,460, a difference of only $38.

- Be a careful driver and save. Causing too many accidents will raise rates, as much as $2,348 per year for a 20-year-old driver and even as much as $396 per year for a 60-year-old driver.

- Find cheaper rates by qualifying for policy discounts. Discounts may be available if the insured drivers are loyal customers, take a defensive driving course, are military or federal employees, are claim-free, or many other policy discounts which could save the average driver as much as $284 per year on the cost of insuring an Integra.

- Acura Integra insurance for teen drivers is expensive. Average rates for full coverage Integra insurance costs $5,904 per year for a 16-year-old driver, $5,718 per year for a 17-year-old driver, $5,128 per year for an 18-year-old driver, and $4,676 per year for a 19-year-old driver.

- Increase physical damage deductibles to save money. Increasing deductibles from $500 to $1,000 could save around $270 per year for a 40-year-old driver and $516 per year for a 20-year-old driver.

- Low deductibles increase auto insurance cost. Lowering your policy deductibles from $500 to $250 could cost an additional $278 per year for a 40-year-old driver and $546 per year for a 20-year-old driver.

- Your employer could save you a few bucks. The vast majority of car insurance companies offer policy discounts for being employed in occupations like accountants, dentists, high school and elementary teachers, members of the military, architects, and others. If you can get this discount applied to your policy, you could potentially save between $51 and $185 on your car insurance bill, depending on the level of coverage purchased.