- BMW 330i insurance costs an average of $2,444 per year or around $204 per month, depending on the trim level.

- The cheapest BMW 330i insurance is the base Sedan trim level at an average of $2,416 per year, while the xDrive Sedan is the most expensive to insure at an average cost of $2,470 per year.

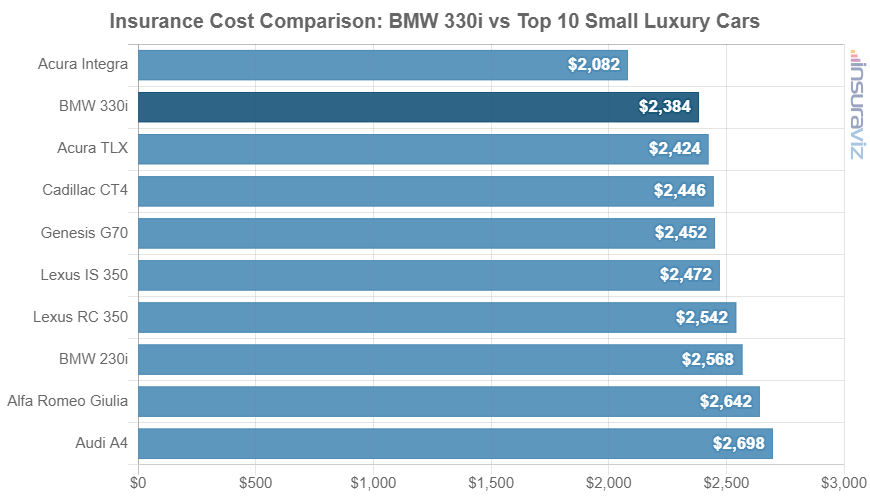

- The BMW 330i is one of the cheaper small luxury cars to insure, costing $197 less per year on average as compared to other small luxury cars

How much does BMW 330i insurance cost?

Ranked second out of 18 vehicles in the 2024 small luxury car class, BMW 330i insurance costs an average of $2,444 annually for full coverage, or about $204 per month.

The average small luxury car costs $2,641 per year to insure, so the BMW 330i would save around $197 each year when compared to the average insurance cost for the entire segment.

Depending on the trim level being insured, average monthly payments for full-coverage insurance on a 2024 BMW 330i range from $201 to $206. These rates can vary significantly based on your age, driving record, and where you live.

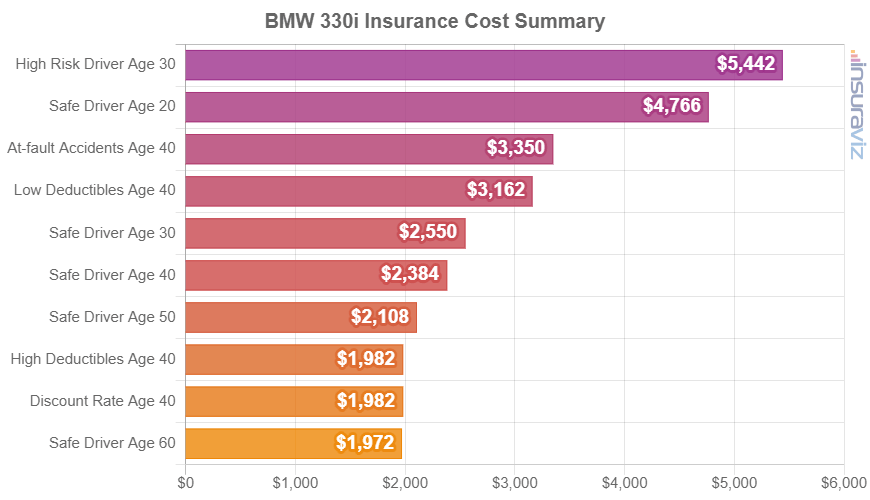

The chart below helps illustrate how much average car insurance cost can vary on a 2024 BMW 330i.

What is the cheapest BMW 330i insurance?

The cheapest BMW 330i insurance is on the base Sedan at $2,416 per year, or about $201 per month. The most expensive model to insure is the xDrive Sedan, costing an average of $54 more per year.

The next table shows the average auto insurance costs, plus a monthly amount for budgeting, for each trim level for the 2024 model year.

| 2024 BMW 330i Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sedan | $2,416 | $201 |

| xDrive Sedan | $2,470 | $206 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How does 330i insurance compare to the competition?

When compared to a few of the more popular models in the compact luxury car segment, insurance for a BMW 330i costs $40 less per year than the Acura TLX, $310 more per year than the Acura Integra, and $62 less per year than the Cadillac CT4.

The BMW 330i ranks second out of 18 total vehicles in the small luxury car segment. The 330i costs an average of $2,444 per year to insure for full coverage and the class median rate is $2,641 annually, a difference of $197 per year.

The chart below shows how well the average BMW 330i insurance cost compares to the most popular small luxury cars in America. An additional rate table is included that breaks down insurance rate rankings for all 18 models in the 2024 small luxury car category.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura Integra | $2,134 | -$310 |

| 2 | BMW 330i | $2,444 | -- |

| 3 | Acura TLX | $2,484 | $40 |

| 4 | Cadillac CT4 | $2,506 | $62 |

| 5 | Genesis G70 | $2,512 | $68 |

| 6 | Lexus IS 350 | $2,534 | $90 |

| 7 | Lexus RC 350 | $2,604 | $160 |

| 8 | BMW 330e | $2,606 | $162 |

| 9 | BMW 228i | $2,608 | $164 |

| 10 | BMW 230i | $2,630 | $186 |

| 11 | Audi S3 | $2,690 | $246 |

| 12 | Alfa Romeo Giulia | $2,704 | $260 |

| 13 | Audi A4 | $2,762 | $318 |

| 14 | BMW M235i | $2,776 | $332 |

| 15 | Volvo S60 | $2,814 | $370 |

| 16 | Audi RS 3 | $2,868 | $424 |

| 17 | BMW M240i | $2,924 | $480 |

| 18 | BMW M340i | $2,932 | $488 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Another useful way to compare the cost of insurance is to look at models that are most similar in price to the BMW 330i, and see if insurance is more or less expensive for those models.

A 2024 BMW 330i has an average purchase price of $45,500, ranging from $44,500 to $46,500, depending on the trim level being purchased (primarily the xDrive option).

The four compact luxury car models closest in price for the 2024 model year are the Cadillac CT4, Lexus IS 350, BMW 330e, and Genesis G70. Here’s how the average MSRP and insurance cost for those models compare to a BMW 330i.

- BMW 330i vs. Cadillac CT4 – The 2024 Cadillac CT4 has an average retail price of $45,592, ranging from $35,990 to $61,495, which is $92 more expensive than the average cost of the 330i. The cost to insure a BMW 330i compared to the Cadillac CT4 is $62 less every 12 months on average.

- BMW 330i vs. Lexus IS 350 – The 2024 Lexus IS 350 has an average MSRP of $46,035 ($44,410 to $47,660), which is $535 more expensive than the average MSRP for the 330i. The average insurance cost for the BMW 330i compared to the Lexus IS 350 is $90 less each year.

- BMW 330i vs. BMW 330e – The average MSRP for a 2024 BMW 330i is $1,100 cheaper than the BMW 330e, at $45,500 compared to $46,600. The cost to insure a BMW 330i compared to the BMW 330e is $162 less per year on average.

- BMW 330i vs. Genesis G70 – The average MSRP for a 2024 BMW 330i is $1,614 cheaper than the Genesis G70, at $45,500 compared to $47,114. Insurance on the BMW 330i costs an average of $68 less per year than the Genesis G70.

BMW 330i full coverage insurance rates

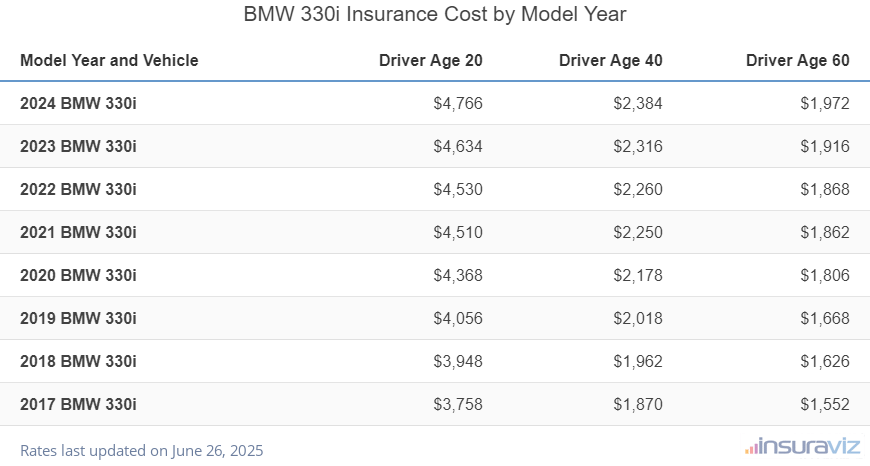

The following table shows average full coverage car insurance rates for the 2017 through 2024 330i models for rated drivers aged 20 through 60.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 BMW 330i | $4,880 | $2,444 | $2,020 |

| 2023 BMW 330i | $4,744 | $2,370 | $1,962 |

| 2022 BMW 330i | $4,640 | $2,314 | $1,916 |

| 2021 BMW 330i | $4,618 | $2,304 | $1,908 |

| 2020 BMW 330i | $4,474 | $2,232 | $1,848 |

| 2019 BMW 330i | $4,158 | $2,070 | $1,710 |

| 2018 BMW 330i | $4,040 | $2,012 | $1,666 |

| 2017 BMW 330i | $3,848 | $1,916 | $1,592 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW 330i trim levels for each model year. Updated October 24, 2025

Additional Rates and Information

Since it’s difficult to show all possible rates for every driver age, every risk profile, etc., here are some additional rates and also some policy discounts to keep an eye out for.

- Improve your credit to save money. In states that have laws that do not prevent an insured’s credit score from being used as a factor in determining insurance rates, drivers who have credit scores over 800 may save $384 per year over a credit score between 670-739. Conversely, a below-average credit rating could cost around $445 more per year.

- Make your policy cheaper by raising deductibles. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $412 per year for a 40-year-old driver and $798 per year for a 20-year-old driver.

- Low physical damage deductibles increase costs. Dropping your physical damage deductibles from $500 to $250 could cost an additional $428 per year for a 40-year-old driver and $842 per year for a 20-year-old driver.

- Getting older means cheaper auto insurance rates. The difference in 2024 330i insurance rates between a 50-year-old driver ($2,158 per year) and a 20-year-old driver ($4,880 per year) is $2,722, or a savings of 77.4%.

- Policy discounts save money. Discounts may be available if the insureds are good students, are homeowners, belong to certain professional organizations, are away-from-home students, or other discounts which could save the average driver as much as $412 per year on BMW 330i insurance.

- Car insurance for teenagers on a BMW 330i is expensive. Average rates for full coverage BMW 330i insurance costs $8,522 per year for a 16-year-old driver, $8,289 per year for a 17-year-old driver, and $7,490 per year for an 18-year-old driver.

- Don’t be a careless driver. Having at-fault accidents will cost you more, possibly as much as $3,428 per year for a 20-year-old driver and as much as $560 per year for a 60-year-old driver.

- Save money due to your occupation. Most insurance companies offer discounts for earning a living in occupations like scientists, lawyers, high school and elementary teachers, college professors, members of the military, and other occupations. Having this discount applied to your policy could potentially save between $73 and $233 on your car insurance premium, depending on the coverage levels.