- Ford Fiesta insurance averages $1,582 per year or around $132 per month, depending on the trim level.

- Out of 33 vehicles in the 2019 small car segment, the Fiesta ranks first for insurance affordability.

- The cheapest Fiesta to insure is the S Hatchback trim level at an estimated $1,534 per year. The most expensive is the ST Hatchback at $1,736 annually.

- Dropping full coverage on an older Ford Fiesta could save you around $614 per year, depending on the deductible level and the age of the rated driver.

How much does Ford Fiesta insurance cost?

Ford Fiesta car insurance costs an average of $1,582 per year. Average monthly insurance cost for the Fiesta ranges from $128 to $145, depending on the trim level.

If the average policy is broken down into individual coverages, comprehensive will cost approximately $376 a year, collision coverage costs around $492, and the remaining liability and medical payments insurance will cost about $714.

The following chart details how Ford Fiesta car insurance cost varies based on the age of the rated driver and $250, $500, and $1,000 deductibles. Insurance rates for a 2019 Ford Fiesta are used in the example.

The overall average rate in the chart above is the $500 deductible policy for a 40-year-old driver which costs $1,582 per year, or $132 per month.

Depending on the Fiesta trim level being insured, monthly car insurance rates range from $128 to $145, with the Fiesta S Hatchback being cheapest and the Fiesta ST Hatchback costing the most to insure.

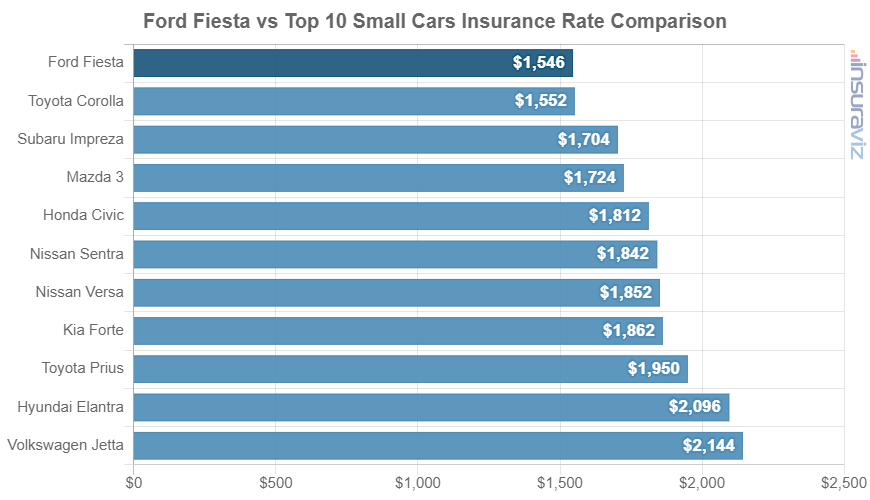

Is Ford Fiesta insurance cheap compared to similar cars?

The Ford Fiesta ranks first out of 33 total vehicles in the small car category for 2019. The Fiesta costs an estimated $1,582 per year to insure and the class median cost is $1,904 annually, a difference of $322 per year.

When Fiesta insurance cost is compared to the top-selling vehicles in the small car segment, insurance for a Ford Fiesta costs $274 less per year than the Honda Civic, $8 less than the Toyota Corolla, $306 less than the Nissan Sentra, and $566 less than the Hyundai Elantra.

The chart below shows how 2019 Ford Fiesta car insurance rates compare to other top-selling small cars for the 2019 model year. We also included a more comprehensive table after the chart that displays typical insurance rates for all 33 vehicles in the small car category for 2019.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Ford Fiesta | $1,582 | -- |

| 2 | Honda Fit | $1,584 | $2 |

| 3 | Toyota Corolla | $1,590 | $8 |

| 4 | Fiat 500 | $1,598 | $16 |

| 5 | Fiat 500L | $1,688 | $106 |

| 6 | Chevrolet Spark | $1,706 | $124 |

| 7 | Volkswagen Golf | $1,718 | $136 |

| 8 | Hyundai Accent | $1,730 | $148 |

| 9 | Toyota Yaris | $1,736 | $154 |

| 10 | Fiat 124 Spider | $1,738 | $156 |

| 11 | Smart Fortwo | $1,740 | $158 |

| 12 | Subaru Impreza | $1,746 | $164 |

| 13 | Mazda 3 | $1,766 | $184 |

| 14 | Honda Civic | $1,856 | $274 |

| 15 | Fiat 500E | $1,864 | $282 |

| 16 | Nissan Sentra | $1,888 | $306 |

| 17 | Nissan Versa | $1,898 | $316 |

| 18 | Kia Forte | $1,908 | $326 |

| 19 | Hyundai Veloster | $1,912 | $330 |

| 20 | Volkswagen Beetle | $1,944 | $362 |

| 21 | Kia Rio | $1,980 | $398 |

| 22 | Toyota Prius | $1,998 | $416 |

| 23 | Honda Clarity | $2,020 | $438 |

| 24 | Chevrolet Sonic | $2,040 | $458 |

| 25 | Volkswagen GTI | $2,046 | $464 |

| 26 | Hyundai Ioniq | $2,064 | $482 |

| 27 | Chevrolet Cruze | $2,086 | $504 |

| 28 | Chevrolet Volt | $2,106 | $524 |

| 29 | Hyundai Elantra | $2,148 | $566 |

| 30 | Volkswagen Jetta | $2,194 | $612 |

| 31 | Volkswagen E-Golf | $2,206 | $624 |

| 32 | Toyota 86 | $2,324 | $742 |

| 33 | Toyota Mirai | $2,438 | $856 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2019 model year. Updated October 24, 2025

What is the cheapest Ford Fiesta insurance?

With car insurance costs ranging from $1,534 to $1,736 per year for the average driver, the cheapest Ford Fiesta insurance is on the S Hatchback. The second cheapest trim level to insure is the Fiesta S Sedan also at $1,534 per year. Plan on budgeting at least $128 per month to insure a Fiesta for full coverage.

For higher trim levels, the three highest cost trim levels to insure are the Fiesta SE Sedan, the ST Line Hatchback, and the ST Hatchback trim levels at around $1,534, $1,614, and $1,736 per year, respectively.

The next table details the estimated yearly and 6-month policy costs, in addition to a monthly budget figure, for each 2019 Ford Fiesta model package and trim level.

| 2019 Ford Fiesta Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S Hatchback | $1,534 | $128 |

| S Sedan | $1,534 | $128 |

| SE Hatchback | $1,534 | $128 |

| SE Sedan | $1,534 | $128 |

| ST Line Hatchback | $1,614 | $135 |

| ST Hatchback | $1,736 | $145 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

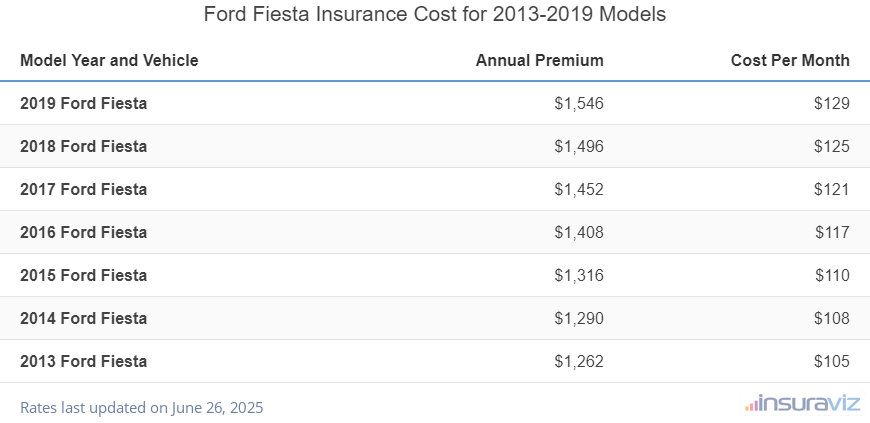

Will an older Fiesta cost less to insure?

If you are looking to purchase an older used Fiesta, insuring a 2013 model could save around $292 over the cost of a 2019 model. Older models have a lower value due to depreciation, which results in car insurance savings.

The table below details average insurance policy premiums for a Ford Fiesta for the 2013 to 2019 model years. The policy costs range from a minimum value of $1,290 for a 2013 Fiesta to the highest rate of $1,582 for a 2019 model.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2019 Ford Fiesta | $1,582 | $132 |

| 2018 Ford Fiesta | $1,530 | $128 |

| 2017 Ford Fiesta | $1,486 | $124 |

| 2016 Ford Fiesta | $1,440 | $120 |

| 2015 Ford Fiesta | $1,354 | $113 |

| 2014 Ford Fiesta | $1,318 | $110 |

| 2013 Ford Fiesta | $1,290 | $108 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ford Fiesta trim levels for each model year. Updated October 24, 2025

Eventually, after the vehicle has depreciated considerably, you should make the decision to delete coverage for physical damage claims from the policy. As a vehicle ages, the expense required to maintain full coverage starts to exceed the added benefit.

Removing physical damage insurance coverage on an older Ford Fiesta could save in the ballpark of $614 a year, depending on the deductibles and the age of the driver.

Ford Fiesta Insurance Rates for Teen Drivers

Full coverage car insurance rates for teenagers on a 2019 Ford Fiesta range from a low of $3,702 for a 19-year-old female driver to a high of $5,771 for a 16-year-old male driver.

The average Ford Fiesta insurance cost for 17-year-old drivers is $5,508 for males and $5,334 for females. Add another year to the rated driver age and Fiesta insurance for 18-year-olds costs $4,779 for males and $4,469 for females.

The chart below shows the average full coverage insurance cost for male and female teenage drivers aged 16 to 19 on a 2019 Ford Fiesta.

Since full coverage car insurance for teens is so expensive, parents often buy an older model that has a lower value so that it does not have to be insured for physical damage coverage (comprehensive and collision insurance).

Liability insurance for teens is still expensive, but dropping coverage for claims like hail damage and parking lot fender benders can save a big chunk of the average car insurance bill.