- Honda CR-Z car insurance costs around $1,612 per year, $806 for a 6-month policy, or $134 per month.

- The cheapest CR-Z model to insure is the base Hybrid Hatchback trim level at an estimated $1,588 per year.

- The CR-Z Hybrid EX Hatchback is the most expensive to insure at $1,638 per year.

How much does Honda CR-Z car insurance cost?

Plan on paying an average of $1,612 a year to insure a Honda CR-Z, or around $134 a month, for full coverage. When looking at the cost of individual coverage, liability and medical coverage costs about $694 a year, comprehensive coverage will cost around $404, and the remaining collision coverage is an estimated $514.

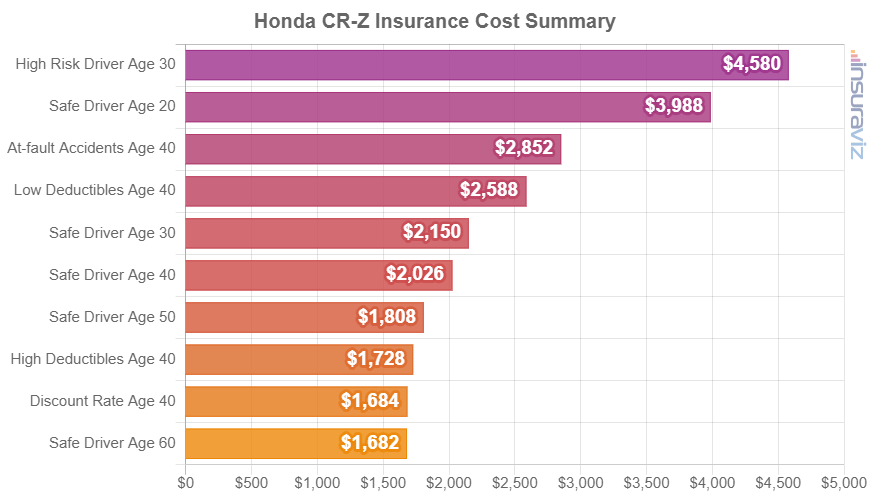

The chart below details average car insurance rates on a 2016 Honda CR-Z using different combinations of driver age and risk.

What is the cheapest Honda CR-Z car insurance?

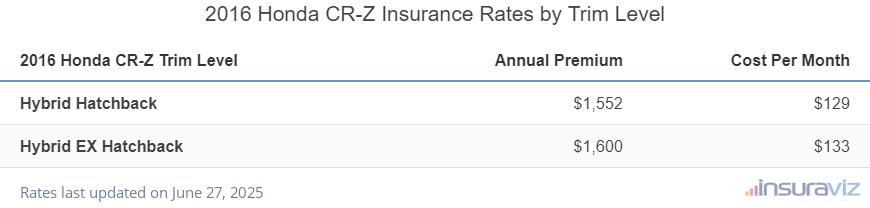

With Honda CR-Z car insurance rates ranging from $1,588 to $1,638 annually for an average driver, the cheapest model to insure is the Hybrid Hatchback. The Hybrid EX Hatchback model costs $1,638 per year, a difference of $50.

The rate table below details average yearly and semi-annual car insurance policy costs, including a monthly budget amount, for each Honda CR-Z package and trim.

| 2016 Honda CR-Z Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Hybrid Hatchback | $1,588 | $132 |

| Hybrid EX Hatchback | $1,638 | $137 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

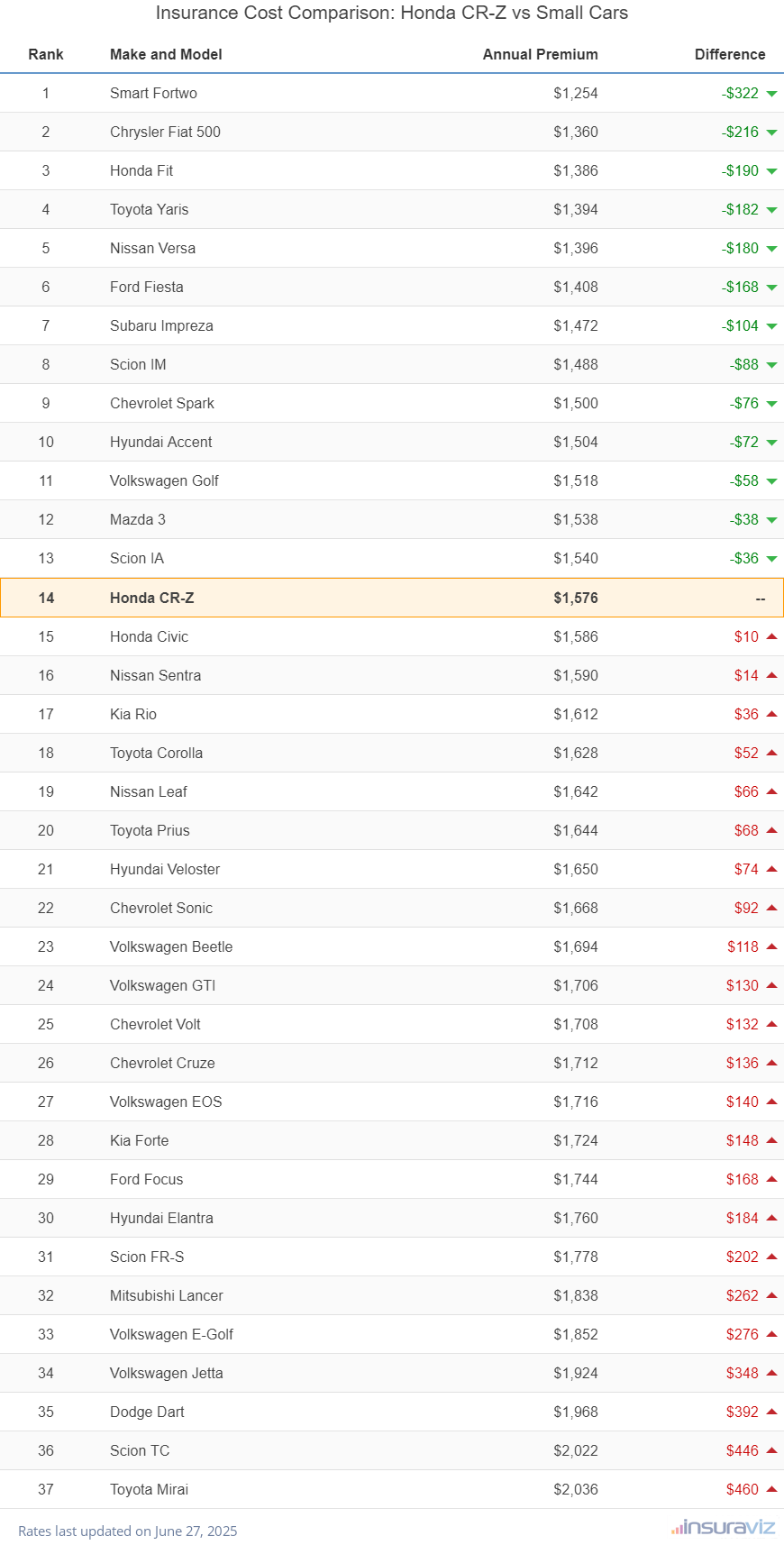

How does Honda CR-Z insurance cost compare?

When CR-Z insurance cost is compared to the top-selling vehicles in the small car segment, insurance for a Honda CR-Z costs $10 less per year than the Honda Civic, $58 less than the Toyota Corolla, $18 less than the Nissan Sentra, and $192 less than the Hyundai Elantra.

The Honda CR-Z ranks 14th out of 37 total vehicles in the small car class. The CR-Z costs an estimated $1,612 per year to insure and the segment median average cost is $1,675 per year, a difference of $63 per year. The table below shows how Honda CRZ insurance cost compares to all other models in the 2016 small car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Smart Fortwo | $1,284 | -$328 |

| 2 | Chrysler Fiat 500 | $1,396 | -$216 |

| 3 | Honda Fit | $1,420 | -$192 |

| 4 | Toyota Yaris | $1,426 | -$186 |

| 5 | Nissan Versa | $1,428 | -$184 |

| 6 | Ford Fiesta | $1,440 | -$172 |

| 7 | Subaru Impreza | $1,508 | -$104 |

| 8 | Scion IM | $1,522 | -$90 |

| 9 | Chevrolet Spark | $1,536 | -$76 |

| 10 | Hyundai Accent | $1,542 | -$70 |

| 11 | Volkswagen Golf | $1,552 | -$60 |

| 12 | Mazda 3 | $1,574 | -$38 |

| 13 | Scion IA | $1,578 | -$34 |

| 14 | Honda CR-Z | $1,612 | -- |

| 15 | Honda Civic | $1,622 | $10 |

| 16 | Nissan Sentra | $1,630 | $18 |

| 17 | Kia Rio | $1,650 | $38 |

| 18 | Toyota Corolla | $1,670 | $58 |

| 19 | Nissan Leaf | $1,678 | $66 |

| 20 | Toyota Prius | $1,682 | $70 |

| 21 | Hyundai Veloster | $1,690 | $78 |

| 22 | Chevrolet Sonic | $1,710 | $98 |

| 23 | Volkswagen Beetle | $1,732 | $120 |

| 24 | Volkswagen GTI | $1,744 | $132 |

| 25 | Chevrolet Volt | $1,746 | $134 |

| 26 | Chevrolet Cruze | $1,754 | $142 |

| 27 | Volkswagen EOS | $1,756 | $144 |

| 28 | Kia Forte | $1,766 | $154 |

| 29 | Ford Focus | $1,786 | $174 |

| 30 | Hyundai Elantra | $1,804 | $192 |

| 31 | Scion FR-S | $1,820 | $208 |

| 32 | Mitsubishi Lancer | $1,882 | $270 |

| 33 | Volkswagen E-Golf | $1,898 | $286 |

| 34 | Volkswagen Jetta | $1,970 | $358 |

| 35 | Dodge Dart | $2,016 | $404 |

| 36 | Scion TC | $2,070 | $458 |

| 37 | Toyota Mirai | $2,084 | $472 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2016 model year. Updated October 24, 2025

Some other noteworthy insights about Honda CR-Z insurance cost include:

- Be a careful driver and pay less for insurance. Having frequent at-fault accidents will raise rates, potentially by an additional $2,258 per year for a 20-year-old driver and even $414 per year for a 60-year-old driver.

- Research policy discounts to save money. Discounts may be available if the policyholders are military or federal employees, are claim-free, drive a vehicle with safety or anti-theft features, insure multiple vehicles on the same policy, are loyal customers, or many other policy discounts which could save the average driver as much as $268 per year on their insurance cost.

- Save money due to your employment. Many car insurance providers offer policy discounts for earning a living in occupations like accountants, firefighters, farmers, emergency medical technicians, architects, lawyers, and others. By qualifying for this profession discount, you could potentially save between $48 and $179 on your car insurance bill, depending on the age of the rated driver.

- Obey driving laws to keep policy cost low. A few minor traffic citations can increase policy rates as much as $428 per year so it pays to be a safe driver.

- As you age, car insurance rates tend to get cheaper. The difference in insurance cost for a Honda CR-Z between a 40-year-old driver ($1,612 per year) and a 20-year-old driver ($3,192 per year) is $1,580, or a savings of 65.8%.

- Improve your credit to save money. Having a credit score above 800 could save as much as $253 per year when compared to a decent credit rating of 670-739. On the flip side, a poor credit rating could cost up to $293 more per year.

- Rated driver gender affects the rate you pay. For a 2016 Honda CR-Z, a 20-year-old man will pay an estimated rate of $3,192 per year, while a 20-year-old female pays an estimated $2,328, a difference of $864 per year. Women get significantly cheaper rates. But by age 50, male driver rates are $1,448 and the cost for a female driver is $1,404, a difference of only $44.