- Kia K900 car insurance costs an average of $2,338 per year or around $195 per month, depending on the trim level.

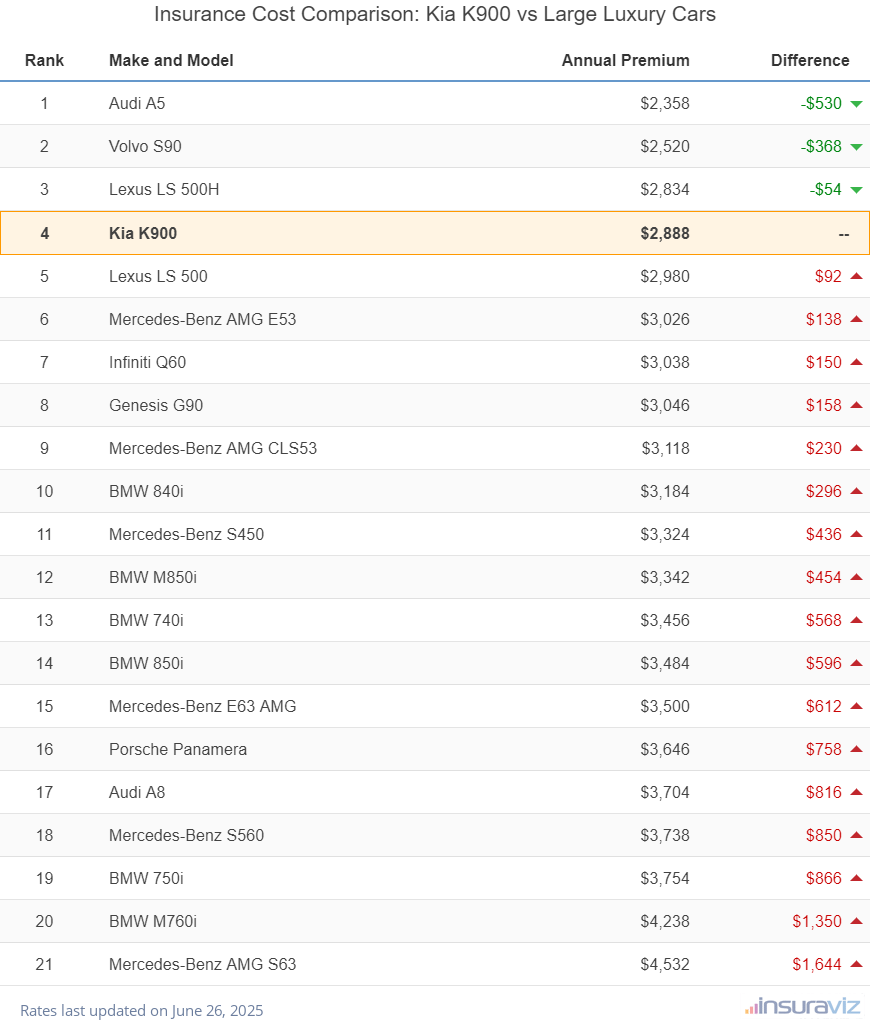

- When compared to the entire 2021 large luxury car segment, the K900 ranks very well at fourth out of 21 total comparison vehicles.

How much does Kia K900 car insurance cost?

Kia K900 car insurance rates average $2,338 yearly, or $195 each month. With the average full-size luxury sedan costing $2,689 a year to insure, the Kia K900 could save an estimated $351 or more every 12 months.

The chart below details how average 2021 Kia K900 car insurance cost varies based on the age of the rated driver and $250, $500, and $1,000 deductibles.

Where does K900 insurance cost rank?

The Kia K900 ranks fourth out of 21 total comparison vehicles in the large luxury car category. The K900 costs an average of $2,338 per year to insure, while the segment average rate is $2,689 annually, a difference of $351 per year.

When compared to the more popular vehicles in the large luxury car segment, insurance for a Kia K900 costs $428 more per year than the Audi A5, $460 less than the BMW 740i, $616 less than the Porsche Panamera, and $126 less than the Infiniti Q60.

The table below shows how average insurance rates for a 2021 Kia K900 fare against the rest of the large luxury sedan segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Audi A5 | $1,910 | -$428 |

| 2 | Volvo S90 | $2,042 | -$296 |

| 3 | Lexus LS 500H | $2,298 | -$40 |

| 4 | Kia K900 | $2,338 | -- |

| 5 | Lexus LS 500 | $2,414 | $76 |

| 6 | Mercedes-Benz AMG E53 | $2,450 | $112 |

| 7 | Infiniti Q60 | $2,464 | $126 |

| 8 | Genesis G90 | $2,470 | $132 |

| 9 | Mercedes-Benz AMG CLS53 | $2,524 | $186 |

| 10 | BMW 840i | $2,578 | $240 |

| 11 | Mercedes-Benz S450 | $2,692 | $354 |

| 12 | BMW M850i | $2,706 | $368 |

| 13 | BMW 740i | $2,798 | $460 |

| 14 | BMW 850i | $2,822 | $484 |

| 15 | Mercedes-Benz E63 AMG | $2,834 | $496 |

| 16 | Porsche Panamera | $2,954 | $616 |

| 17 | Audi A8 | $3,000 | $662 |

| 18 | Mercedes-Benz S560 | $3,028 | $690 |

| 19 | BMW 750i | $3,042 | $704 |

| 20 | BMW M760i | $3,432 | $1,094 |

| 21 | Mercedes-Benz AMG S63 | $3,670 | $1,332 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2021 model year. Updated February 23, 2024

Some other noteworthy insights about insuring a Kia K900 include:

- Earn policy discounts to save money. Discounts may be available if the insureds are claim-free, insure their home and car with the same company, are good students, drive low annual mileage, sign their policy early, or other policy discounts which could save the average driver as much as $398 per year on Kia K900 insurance.

- Clean up your credit to lower your rates. Having a high credit rating of over 800 could save as much as $367 per year versus a lower credit rating of 670-739. Conversely, a poor credit rating could cost as much as $426 more per year.

- Higher physical damage deductibles lower policy costs. Increasing your policy deductibles from $500 to $1,000 could save around $380 per year for a 40-year-old driver and $748 per year for a 20-year-old driver.

- The lower deductible you choose, the higher the policy cost. Decreasing deductibles from $500 to $250 could cost an additional $398 per year for a 40-year-old driver and $796 per year for a 20-year-old driver.

- High-risk insurance is expensive. For a 30-year-old driver, being required to buy a high-risk insurance policy could inflate rates by $2,898 or more per year.

- Earn a discount from your job. Many car insurance providers offer policy discounts for being employed in occupations like firefighters, lawyers, police officers and law enforcement, emergency medical technicians, and others. Getting this discount could save between $70 and $176 on your yearly insurance cost, subject to the policy coverages selected.

- The cost to insure teenage drivers is high. Average rates for full coverage K900 insurance costs $8,344 per year for a 16-year-old driver, $8,102 per year for a 17-year-old driver, and $7,288 per year for an 18-year-old driver.