- Mazda 2 insurance costs an average of $1,092 per year, or around $91 per month.

- The cheapest trim level to insure is the Sport Hatchback at around $1,072 per year, and the most expensive trim to insure is the Touring Hatchback at $1,112 annually.

How much does Mazda 2 insurance cost?

Mazda 2 car insurance rates average $1,092 annually for full coverage, or around $91 a month. When splitting out the cost of individual coverages, collision coverage will cost around $238 a year, liability/medical (or PIP) coverage costs approximately $622, and the remaining comprehensive coverage is approximately $232.

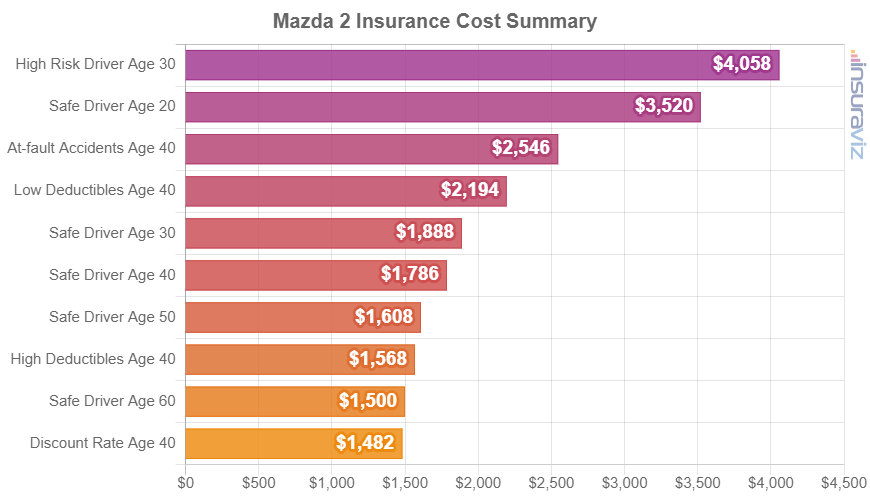

The following chart details average car insurance rates for a 2014 Mazda 2 using some common driver age and risk scenarios.

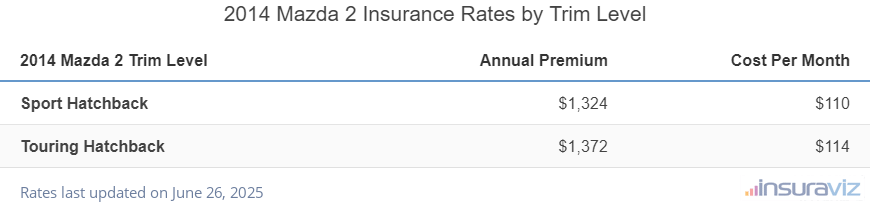

The table below details the average annual and 6-month policy costs, in addition to a monthly budget figure, for each Mazda 2 model trim level.

| 2014 Mazda 2 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sport Hatchback | $1,072 | $89 |

| Touring Hatchback | $1,112 | $93 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

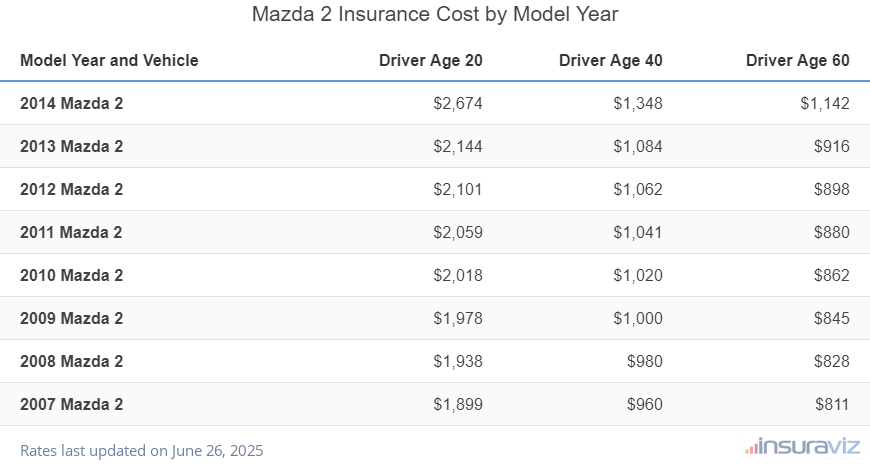

The table below shows average insurance policy costs for a Mazda 2 for the 2007 to 2014 model years for five different age groups.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2014 Mazda 2 | $2,166 | $1,092 | $924 |

| 2013 Mazda 2 | $1,736 | $878 | $744 |

| 2012 Mazda 2 | $1,701 | $860 | $729 |

| 2011 Mazda 2 | $1,667 | $843 | $715 |

| 2010 Mazda 2 | $1,634 | $826 | $700 |

| 2009 Mazda 2 | $1,601 | $810 | $686 |

| 2008 Mazda 2 | $1,569 | $794 | $673 |

| 2007 Mazda 2 | $1,538 | $778 | $659 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mazda 2 trim levels for each model year. Updated February 23, 2024

The Mazda 2 was rebadged and sold initially as the Scion iA for the 2016 model year. After the Scion name was discontinued, it was named the Toyota Yaris iA for 2017 and 2018. Then in 2019, the iA was dropped and it was then just marketed as the Toyota Yaris sedan for the 2019 and 2020 model years.

How do Mazda 2 car insurance rates rank?

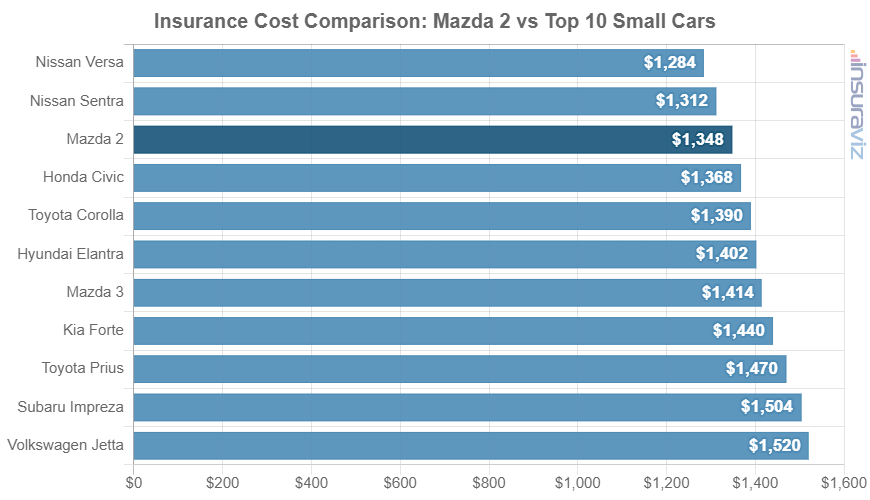

The Mazda 2 ranks 12th out of 36 total comparison vehicles in the 2014 small car class for insurance affordability. The Mazda 2 costs an average of $1,092 per year to insure and the segment median rate is $1,160 annually, a difference of $68 per year.

When average rates are compared to other vehicles in the small car class, insurance prices for a Mazda 2 cost $14 less per year than the Honda Civic, $34 less than the Toyota Corolla, and $30 more than the Nissan Sentra.

The chart below shows how average Mazda 2 car insurance rates compare to the top 10 selling small cars like the Hyundai Elantra, Volkswagen Jetta, and the Kia Forte. We also included a more comprehensive table following the chart that displays average car insurance rates for all 36 models in the 2014 small car class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Scion IQ | $864 | -$228 |

| 2 | Kia Rio5 | $1,034 | -$58 |

| 3 | Nissan Versa | $1,038 | -$54 |

| 4 | Ford Fiesta | $1,042 | -$50 |

| 5 | Hyundai Accent | $1,050 | -$42 |

| 6 | Toyota Yaris | $1,054 | -$38 |

| 7 | Smart Fortwo | $1,056 | -$36 |

| 8 | Nissan Sentra | $1,062 | -$30 |

| 9 | Chevrolet Sonic | $1,064 | -$28 |

| 10 | Chevrolet Spark | $1,070 | -$22 |

| 11 | Kia Rio | $1,078 | -$14 |

| 12 | Mazda 2 | $1,092 | -- |

| 13 | Honda Civic | $1,106 | $14 |

| 14 | Chrysler Fiat 500 | $1,108 | $16 |

| 15 | Hyundai Veloster | $1,116 | $24 |

| 16 | Toyota Corolla | $1,126 | $34 |

| 17 | Nissan Leaf | $1,130 | $38 |

| 18 | Hyundai Elantra | $1,134 | $42 |

| 19 | Mazda 3 | $1,144 | $52 |

| 20 | Volkswagen Golf | $1,156 | $64 |

| 21 | Honda CR-Z | $1,158 | $66 |

| 22 | Kia Forte | $1,164 | $72 |

| 23 | Ford Focus | $1,180 | $88 |

| 24 | Toyota Prius | $1,190 | $98 |

| 25 | Volkswagen GTI | $1,208 | $116 |

| 26 | Volkswagen Beetle | $1,214 | $122 |

| 27 | Subaru Impreza | $1,218 | $126 |

| 28 | Volkswagen Jetta | $1,226 | $134 |

| 29 | Scion FR-S | $1,228 | $136 |

| 30 | Chevrolet Volt | $1,240 | $148 |

| 31 | Chevrolet Cruze | $1,336 | $244 |

| 32 | Honda Fit | $1,342 | $250 |

| 33 | Volkswagen EOS | $1,346 | $254 |

| 34 | Mitsubishi Lancer | $1,386 | $294 |

| 35 | Dodge Dart | $1,396 | $304 |

| 36 | Scion TC | $1,402 | $310 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2014 model year. Updated February 22, 2024