- Mercedes-Benz AMG SLC43 insurance costs an average of $2,456 per year or around $205 per month, but can vary based on the limits of the policy.

- The AMG SLC43 costs right around the average cost for other small luxury cars to insure, costing just $80 more per year.

How much does Mercedes AMG SLC43 car insurance cost?

Ranked 13th out of 18 vehicles in the small luxury car class, Mercedes AMG SLC43 insurance costs around $2,456 annually, or about $205 if paid each month. With the average small luxury car costing $2,376 a year to insure, the AMG SLC43 could cost around $80 annually.

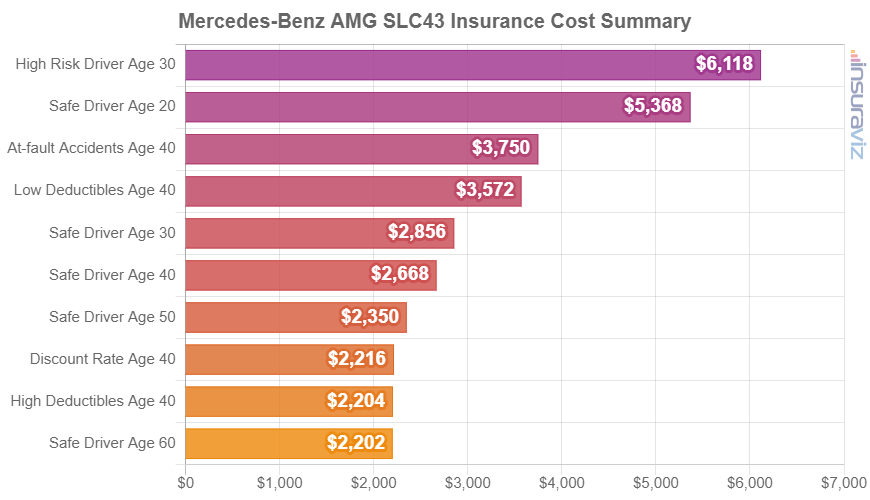

The cost summary chart below shows average insurance rates on a 2020 AMG SLC43 for some common policy risk profiles.

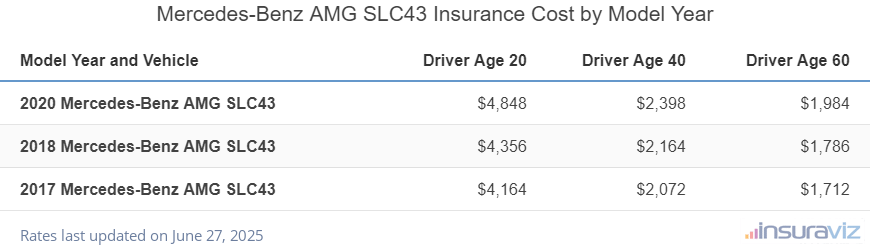

The rate table below breaks down the average car insurance cost on a Mercedes AMG SLC43 for the 2017-2020 model years for five different age groups.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2020 Mercedes-Benz AMG SLC43 | $4,968 | $2,456 | $2,032 |

| 2018 Mercedes-Benz AMG SLC43 | $4,464 | $2,218 | $1,830 |

| 2017 Mercedes-Benz AMG SLC43 | $4,270 | $2,124 | $1,754 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mercedes-Benz AMG SLC43 trim levels for each model year. Updated October 24, 2025

AMG SLC43 car insurance rates compared

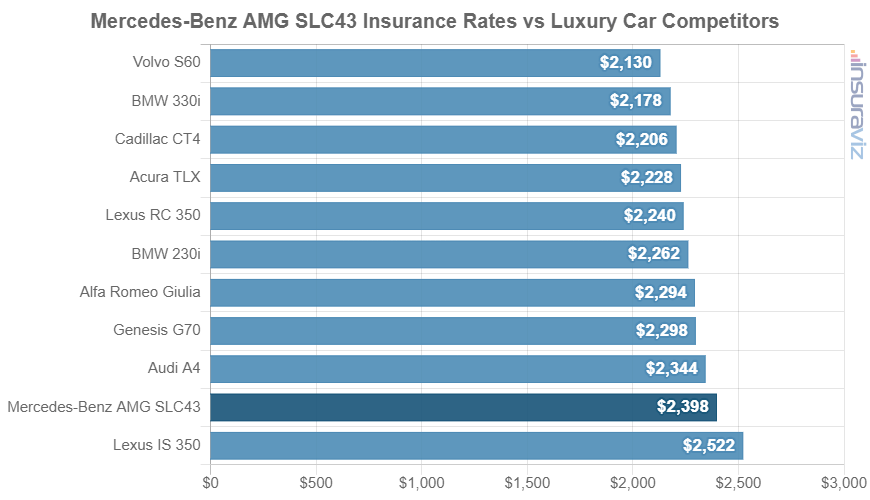

When average rates are compared to other compact luxury models, car insurance prices for the AMG SLC43 cost $224 more per year than the BMW 330i, $38 less than the Mercedes-Benz C300, and $274 more than the Volvo S60.

The Mercedes-Benz AMG SLC43 ranks 13th out of 18 total vehicles in the small luxury car class for insurance affordability. The AMG SLC43 costs an average of $2,456 per year to insure and the class average price is $2,376 annually, a difference of $80 per year.

The following chart shows how the average AMG SLC43 car insurance cost compares to the top 10 best-selling small luxury cars like the Acura TLX, Audi A4, and the Genesis G70. In addition to the chart, a larger table is included after the chart that details insurance cost comparisons and rankings for all 18 vehicles in the 2020 small luxury car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Mercedes-Benz A220 | $2,018 | -$438 |

| 2 | Volvo S60 | $2,182 | -$274 |

| 3 | BMW 330i | $2,232 | -$224 |

| 4 | Cadillac CT4 | $2,262 | -$194 |

| 5 | Acura TLX | $2,280 | -$176 |

| 6 | Lexus RC 350 | $2,292 | -$164 |

| 7 | BMW i3 | $2,306 | -$150 |

| 8 | BMW 230i | $2,318 | -$138 |

| 9 | Alfa Romeo Giulia | $2,348 | -$108 |

| 10 | Genesis G70 | $2,354 | -$102 |

| 11 | Audi S3 | $2,362 | -$94 |

| 12 | Audi A4 | $2,400 | -$56 |

| 13 | Mercedes-Benz AMG SLC43 | $2,456 | -- |

| 14 | Mercedes-Benz C300 | $2,494 | $38 |

| 15 | BMW M240i | $2,498 | $42 |

| 16 | Audi RS 3 | $2,538 | $82 |

| 17 | Lexus IS 350 | $2,582 | $126 |

| 18 | BMW 340i | $2,844 | $388 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2020 model year. Updated October 24, 2025

Additional AMG SLC43 insurance rates and insights

Included below are some additional rates and situations that could increase or decrease the cost of a car insurance policy. Also included are some tips to save money and possible discounts that may be available.

- High-risk AMG SLC43 insurance is expensive. For a 30-year-old driver, having too many accidents or violations can potentially increase rates by $3,030 or more per year.

- Lots of policy discounts equal cheaper AMG SLC43 insurance. Discounts may be available if the insureds are senior citizens, insure their home and car with the same company, sign their policy early, drive low annual mileage, or other policy discounts which could save the average driver as much as $414 per year on their insurance cost.

- As you get older, Mercedes-Benz AMG SLC43 car insurance rates tend to be cheaper. The difference in AMG SLC43 insurance cost between a 50-year-old driver ($2,166 per year) and a 20-year-old driver ($4,968 per year) is $2,802, or a savings of 78.6%.

- Credit scores can influence insurance rates. Having a credit score above 800 could save around $386 per year compared to a good credit rating of 670-739. Conversely, a subpar credit score could cost around $447 more per year.

- Raising physical damage deductibles lowers costs. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $418 per year for a 40-year-old driver and $824 per year for a 20-year-old driver.

- Low physical damage deductibles increase policy costs. Lowering your policy deductibles from $500 to $250 could cost an additional $436 per year for a 40-year-old driver and $874 per year for a 20-year-old driver.

- Avoid driving violations to reduce insurance rates. To get the cheapest Mercedes AMG SLC43 insurance, you have to be a good driver. As few as two minor moving violations could raise the cost of a policy as much as $650 per year.

- Careless drivers pay more. Too frequent at-fault accidents can raise rates, potentially by an extra $3,524 per year for a 20-year-old driver and even as much as $580 per year for a 60-year-old driver.