- Dodge Viper insurance rates average $2,684 per year or $1,342 for a semi-annual policy.

- The cheapest Viper to insure is the SRT Coupe model at around $2,506 per year, or $209 per month.

- The model with the most expensive insurance is the ACR Coupe at $2,864 per year, or around $239 per month.

- Out of 24 other sports cars for the 2017 model year, the Viper ranks 16th for insurance cost.

How much does Dodge Viper insurance cost?

Dodge Viper insurance rates average $2,684 yearly for a full-coverage policy, which is the equivalent of $224 a month. Liability/medical will cost around $598 a year, comprehensive costs around $744, and the remaining collision coverage is around $1,342.

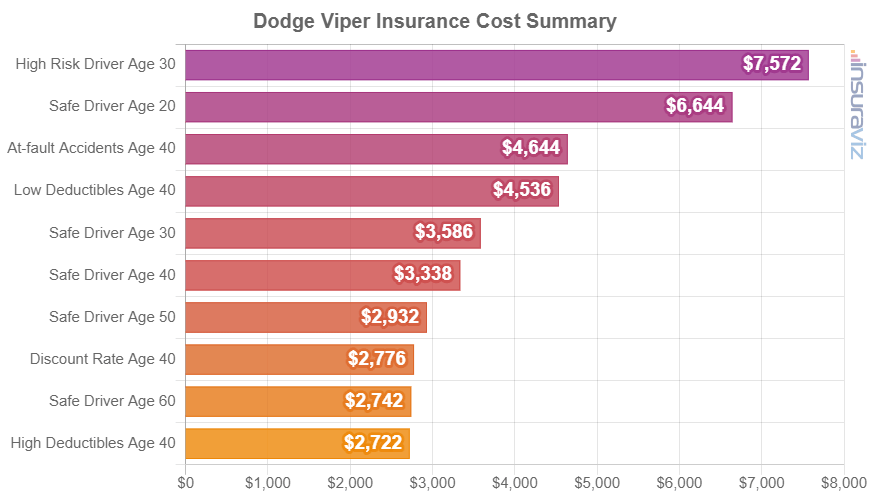

The rate summary chart below illustrates average car insurance cost on a Viper using different deductibles and driver age groups.

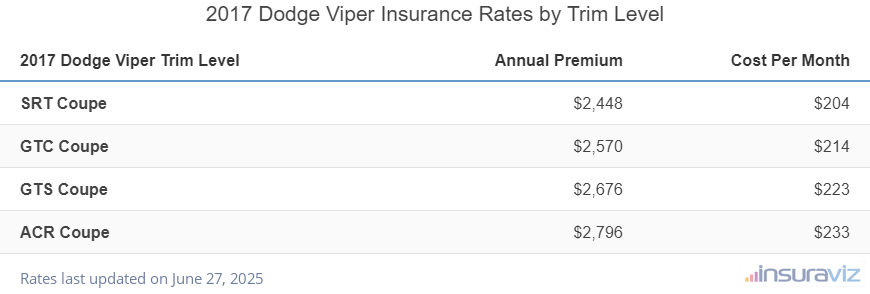

The next table displays average yearly and semi-annual policy costs, plus a monthly budget figure, for each Dodge Viper model trim level.

| 2017 Dodge Viper Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SRT Coupe | $2,506 | $209 |

| GTC Coupe | $2,632 | $219 |

| GTS Coupe | $2,738 | $228 |

| ACR Coupe | $2,864 | $239 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

The rate table below breaks down average full coverage auto insurance policy costs for a Dodge Viper from the 2013 to the 2017 model years and different driver age groups.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2017 Dodge Viper | $5,358 | $2,684 | $2,214 |

| 2016 Dodge Viper | $4,736 | $2,380 | $1,966 |

| 2015 Dodge Viper | $4,706 | $2,374 | $1,966 |

| 2014 Dodge Viper | $4,736 | $2,376 | $1,968 |

| 2013 Dodge Viper | $4,664 | $2,340 | $1,944 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Dodge Viper trim levels for each model year. Updated October 24, 2025

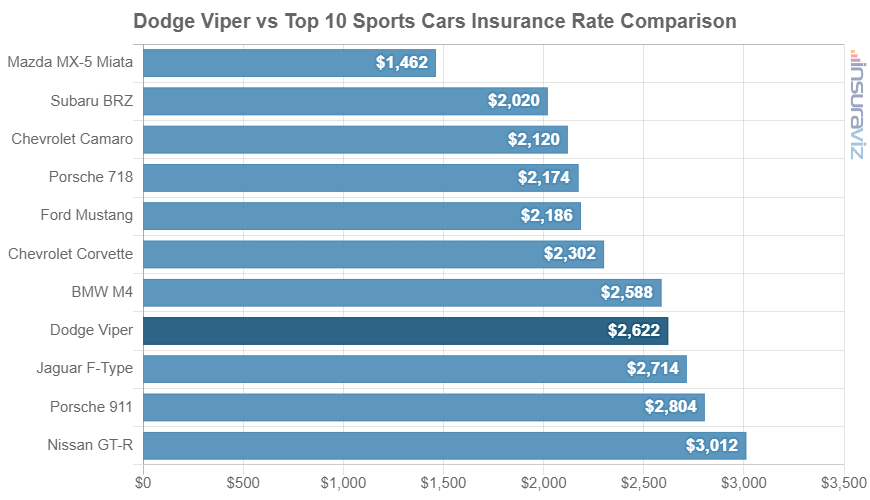

How do Dodge Viper insurance rates compare?

The Dodge Viper ranks 16th out of 24 total vehicles in the sports car category for car insurance affordability. The Viper costs an average of $2,684 per year for a car insurance policy with full coverage, while the segment average insurance cost is $2,536 per year, a difference of $148 per year.

When compared side-by-side to other sports car segment models, car insurance rates for a Dodge Viper cost $446 more per year than the Ford Mustang, $248 more than the Dodge Challenger, and $512 more than the Chevrolet Camaro.

The next chart shows how average Viper car insurance cost compares to the most popular sports cars like the Subaru WRX, Chevrolet Corvette, and the Porsche 911. We also included a more comprehensive table after the chart detailing insurance rankings for the entire sports car class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Mazda MX-5 Miata | $1,500 | -$1,184 |

| 2 | Audi TT | $1,958 | -$726 |

| 3 | Subaru WRX | $2,002 | -$682 |

| 4 | Subaru BRZ | $2,070 | -$614 |

| 5 | Nissan 370Z | $2,104 | -$580 |

| 6 | Porsche Boxster | $2,162 | -$522 |

| 7 | Chevrolet Camaro | $2,172 | -$512 |

| 8 | BMW M2 | $2,178 | -$506 |

| 9 | Porsche 718 | $2,226 | -$458 |

| 10 | Ford Mustang | $2,238 | -$446 |

| 11 | Lexus RC F | $2,328 | -$356 |

| 12 | Chevrolet Corvette | $2,358 | -$326 |

| 13 | Dodge Challenger | $2,436 | -$248 |

| 14 | Alfa Romeo 4C | $2,492 | -$192 |

| 15 | BMW M4 | $2,650 | -$34 |

| 16 | Dodge Viper | $2,684 | -- |

| 17 | BMW M3 | $2,698 | $14 |

| 18 | Jaguar F-Type | $2,780 | $96 |

| 19 | Porsche 911 | $2,872 | $188 |

| 20 | Nissan GT-R | $3,082 | $398 |

| 21 | Acura NSX | $3,216 | $532 |

| 22 | Audi R8 | $3,462 | $778 |

| 23 | BMW i8 | $3,532 | $848 |

| 24 | Maserati Granturismo | $3,674 | $990 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2017 model year. Updated October 24, 2025