- Lexus LS 600H car insurance costs $2,330 per year (about $194 per month) for a full coverage policy.

- Ranked 25th out of 38 vehicles in the 2016 large luxury car segment, average car insurance rates for the Lexus LS 600H cost $132 more per year than the segment average.

How much does Lexus LS 600H car insurance cost?

Ranked 25th out of 38 vehicles in the large luxury car class, 2016 Lexus LS 600H insurance averages $2,330 annually, or about $194 a month. With the average large luxury car costing $2,198 a year to insure, the Lexus LS 600H may cost an estimated $132 or more each year.

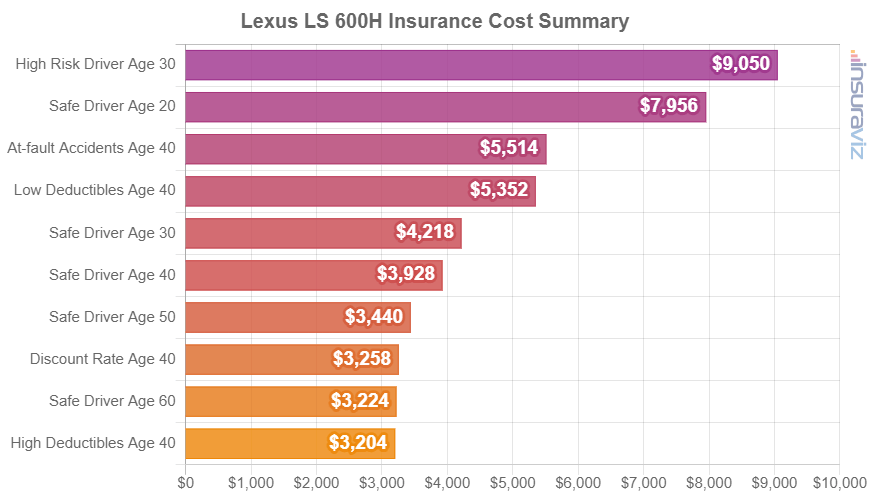

The chart below details average car insurance rates for a 2016 Lexus LS 600H with a variety of different policy risk scenarios.

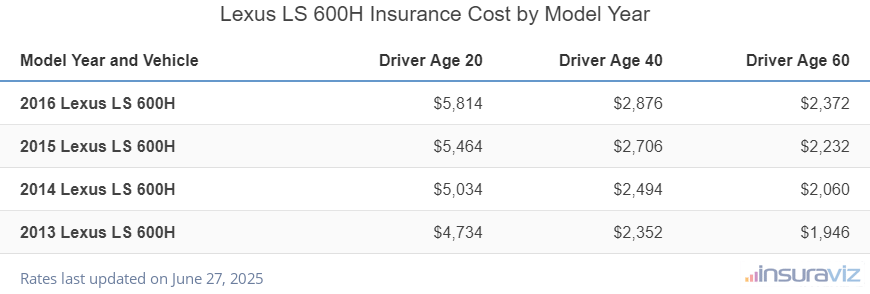

The data table below illustrates average Lexus LS 600H insurance rates from the 2013 to 2016 model years and for different driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2016 Lexus LS 600H | $4,714 | $2,330 | $1,924 |

| 2015 Lexus LS 600H | $4,428 | $2,192 | $1,810 |

| 2014 Lexus LS 600H | $4,082 | $2,020 | $1,670 |

| 2013 Lexus LS 600H | $3,838 | $1,904 | $1,578 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Lexus LS 600H trim levels for each model year. Updated February 23, 2024

Some additional observations regarding LS 600H insurance include:

- Getting older pays dividends in cheaper insurance. The difference in insurance rates for a 2016 LS 600H between a 60-year-old driver ($1,924 per year) and a 30-year-old driver ($2,498 per year) is $574, or a savings of 26%.

- Driver gender influences rates. For a 2016 Lexus LS 600H, a 20-year-old man receives an average rate of $4,714 per year, while a 20-year-old female pays an average of $3,364, a difference of $1,350 per year. Women get significantly cheaper rates. But by age 50, male driver rates are $2,052 and the cost for women is $2,006, a difference of only $46.

- Obey driving laws to keep insurance costs low. To pay the most budget-friendly LS 600H insurance rates, it pays to avoid traffic tickets. A few minor infractions on your driving record could result in raising policy costs as much as $620 per year. Serious misdemeanor violations such as a DUI could raise rates by an additional $2,162 or more.

- Save money due to your choice of occupation. Some car insurance companies offer policy discounts for working in professions like police officers and law enforcement, nurses, lawyers, doctors, college professors, and others. If you qualify for this occupational discount, you could save between $70 and $142 on your car insurance premium, depending on the level of coverage purchased.

- Policy discounts mean cheaper LS 600H insurance. Discounts may be available if the insured drivers are senior citizens, choose electronic billing, insure multiple vehicles on the same policy, insure their home and car with the same company, or other policy discounts which could save the average driver as much as $396 per year on Lexus LS 600H insurance.

- Safe drivers have cheaper LS 600H insurance. Having a few at-fault accidents can really raise rates, possibly by an additional $3,336 per year for a 20-year-old driver and even $544 per year for a 60-year-old driver.

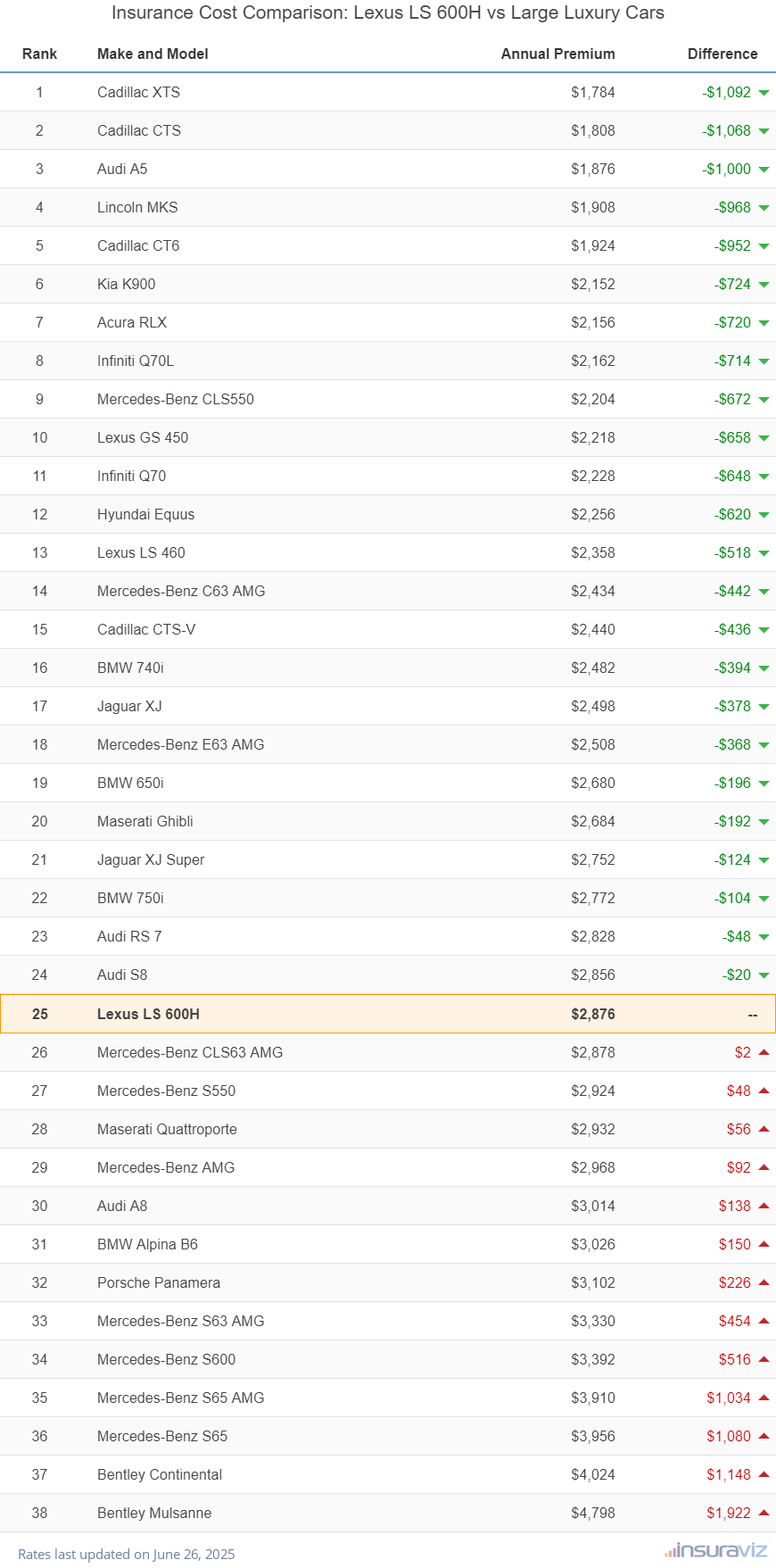

Is Lexus LS 600H insurance expensive?

When rates are compared to popular vehicles in the 2016 large luxury car segment, car insurance prices for a Lexus LS 600H cost $808 more per year than the Audi A5, $40 less than the Mercedes-Benz S550, and $318 more than the BMW 740i.

The Lexus LS 600H ranks 25th out of 38 comparison vehicles in the 2016 model year large luxury car class for the most affordable insurance cost. The LS 600H costs an average of $2,330 per year for an auto insurance policy with full coverage, while the class average auto insurance cost is $2,198 annually, a difference of $132 per year.

The table displayed below shows how average 2016 Lexus LS 600H car insurance rates rank against other large luxury cars like the Cadillac XTS, Infiniti Q70, and the Lexus LS 460.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Cadillac XTS | $1,448 | -$882 |

| 2 | Cadillac CTS | $1,466 | -$864 |

| 3 | Audi A5 | $1,522 | -$808 |

| 4 | Lincoln MKS | $1,546 | -$784 |

| 5 | Cadillac CT6 | $1,560 | -$770 |

| 6 | Kia K900 | $1,744 | -$586 |

| 7 | Acura RLX | $1,748 | -$582 |

| 8 | Infiniti Q70L | $1,752 | -$578 |

| 9 | Mercedes-Benz CLS550 | $1,784 | -$546 |

| 10 | Lexus GS 450 | $1,796 | -$534 |

| 11 | Infiniti Q70 | $1,804 | -$526 |

| 12 | Hyundai Equus | $1,826 | -$504 |

| 13 | Lexus LS 460 | $1,910 | -$420 |

| 14 | Mercedes-Benz C63 AMG | $1,972 | -$358 |

| 15 | Cadillac CTS-V | $1,976 | -$354 |

| 16 | BMW 740i | $2,012 | -$318 |

| 17 | Jaguar XJ | $2,024 | -$306 |

| 18 | Mercedes-Benz E63 AMG | $2,034 | -$296 |

| 19 | BMW 650i | $2,170 | -$160 |

| 20 | Maserati Ghibli | $2,176 | -$154 |

| 21 | Jaguar XJ Super | $2,230 | -$100 |

| 22 | BMW 750i | $2,246 | -$84 |

| 23 | Audi RS 7 | $2,292 | -$38 |

| 24 | Audi S8 | $2,314 | -$16 |

| 25 | Lexus LS 600H | $2,330 | -- |

| 26 | Mercedes-Benz CLS63 AMG | $2,332 | $2 |

| 27 | Maserati Quattroporte | $2,370 | $40 |

| 28 | Mercedes-Benz S550 | $2,370 | $40 |

| 29 | Mercedes-Benz AMG | $2,404 | $74 |

| 30 | Audi A8 | $2,440 | $110 |

| 31 | BMW Alpina B6 | $2,452 | $122 |

| 32 | Porsche Panamera | $2,512 | $182 |

| 33 | Mercedes-Benz S63 AMG | $2,696 | $366 |

| 34 | Mercedes-Benz S600 | $2,746 | $416 |

| 35 | Mercedes-Benz S65 AMG | $3,166 | $836 |

| 36 | Mercedes-Benz S65 | $3,204 | $874 |

| 37 | Bentley Continental | $3,260 | $930 |

| 38 | Bentley Mulsanne | $3,888 | $1,558 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2016 model year. Updated February 23, 2024