- Mercedes C63 AMG insurance rates cost $2,094 per year on average, or about $175 per month, for a policy with full coverage.

- The cheapest C63 AMG insurance is on the base Coupe model, costing an average of $1,998 per year, or $167 per month.

- The model with the most expensive insurance is the S Sedan at $2,206 per year, or around $184 per month.

- When compared to other 2018 large luxury cars, the Mercedes-Benz C63 AMG is one of the cheaper large luxury cars to insure, costing $161 less per year on average.

How much does Mercedes C63 AMG insurance cost?

Mercedes-Benz C63 AMG insurance costs an average of $2,094 per year, which is equal to $175 a month. Collision coverage costs around $1,064 a year, liability and medical payments insurance will cost about $506, and the remaining comprehensive will cost around $524.

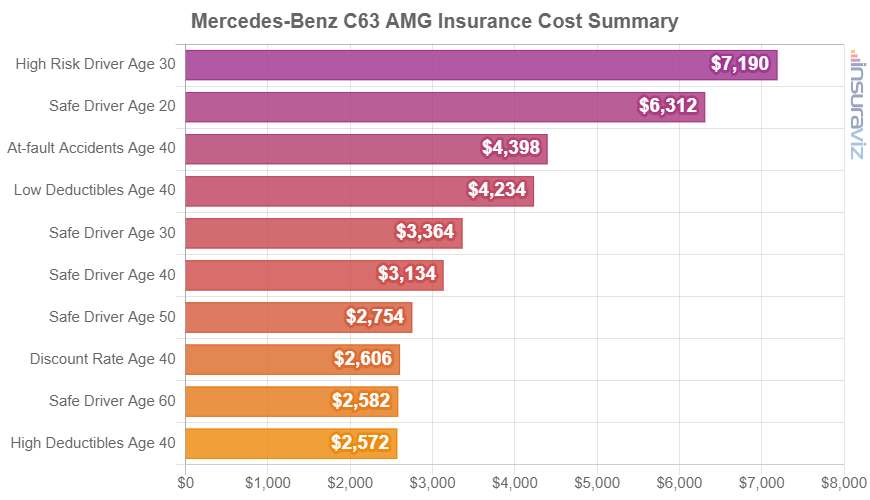

The following rate chart breaks down average annual car insurance cost for a 2018 Mercedes-Benz C63 AMG for different driver age groups and scenarios.

The next table displays the average cost for annual and 6-month car insurance policies for each Mercedes-Benz C63 AMG trim level.

| 2018 Mercedes-Benz C63 AMG Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Coupe | $1,998 | $167 |

| Convertible | $2,030 | $169 |

| S Convertible | $2,086 | $174 |

| S Coupe | $2,086 | $174 |

| Sedan | $2,160 | $180 |

| S Sedan | $2,206 | $184 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

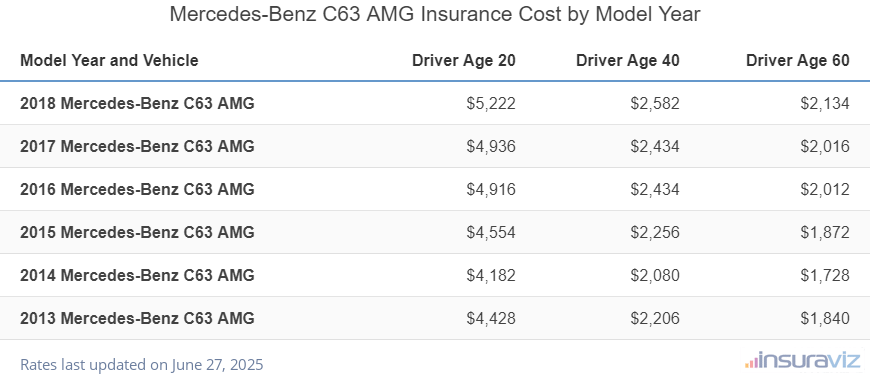

The data table below shows average car insurance rates for a Mercedes-Benz C63 AMG for the 2013 to 2018 model years.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2018 Mercedes-Benz C63 AMG | $4,232 | $2,094 | $1,730 |

| 2017 Mercedes-Benz C63 AMG | $4,000 | $1,974 | $1,632 |

| 2016 Mercedes-Benz C63 AMG | $3,984 | $1,972 | $1,632 |

| 2015 Mercedes-Benz C63 AMG | $3,690 | $1,828 | $1,518 |

| 2014 Mercedes-Benz C63 AMG | $3,388 | $1,686 | $1,402 |

| 2013 Mercedes-Benz C63 AMG | $3,588 | $1,790 | $1,490 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mercedes-Benz C63 AMG trim levels for each model year. Updated February 22, 2024

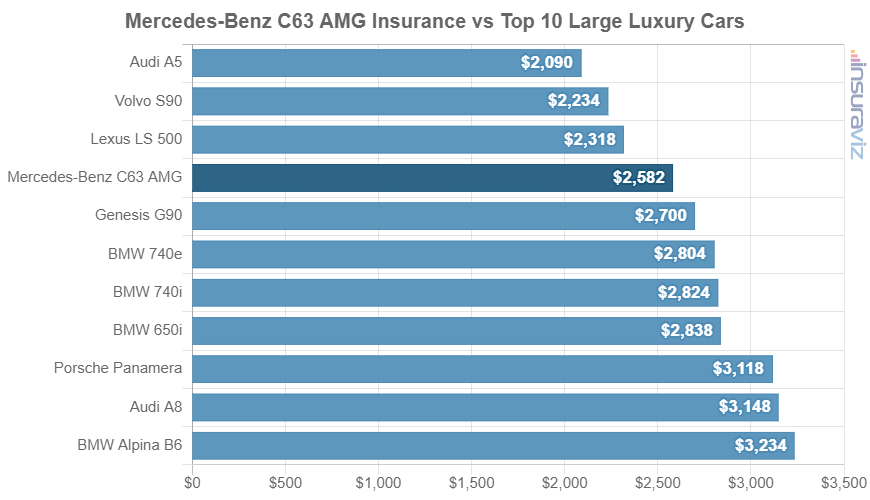

How does Mercedes Benz C63 AMG insurance cost compare?

When compared directly to some other models in the large luxury car category, car insurance prices for a Mercedes-Benz C63 AMG cost $402 more per year than the Audi A5, $194 less than the BMW 740i, and $368 more than the Cadillac XTS.

The C63 AMG ranks 14th out of 36 total comparison vehicles in the 2018 large luxury car category for most affordable car insurance prices. The C63 AMG costs an average of $2,094 per year to insure, while the class average is $2,255 annually, a savings of $161 per year.

The next chart shows how C63 AMG insurance compares to other luxury models like the Cadillac CT6, Lincoln Continental, and the Porsche Panamera. We also included a more comprehensive table after the chart detailing insurance cost rankings for every vehicle in the 2018 large luxury car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Lincoln Continental | $1,578 | -$516 |

| 2 | Cadillac CTS | $1,630 | -$464 |

| 3 | Audi A5 | $1,692 | -$402 |

| 4 | Cadillac XTS | $1,726 | -$368 |

| 5 | Cadillac CT6 | $1,748 | -$346 |

| 6 | Volvo S90 | $1,812 | -$282 |

| 7 | Lexus LS 500 | $1,880 | -$214 |

| 8 | Infiniti Q70 | $1,884 | -$210 |

| 9 | Acura RLX | $1,914 | -$180 |

| 10 | Lexus LS 500H | $1,950 | -$144 |

| 11 | Mercedes-Benz CLS550 | $1,998 | -$96 |

| 12 | Lexus GS 450 | $2,016 | -$78 |

| 13 | Infiniti Q60 | $2,054 | -$40 |

| 14 | Mercedes-Benz C63 AMG | $2,094 | -- |

| 15 | Cadillac CTS-V | $2,150 | $56 |

| 16 | Mercedes-Benz S450 | $2,174 | $80 |

| 17 | Genesis G90 | $2,180 | $86 |

| 18 | Jaguar XJ | $2,182 | $88 |

| 19 | BMW 740e | $2,272 | $178 |

| 20 | BMW 740i | $2,288 | $194 |

| 21 | Mercedes-Benz S560 | $2,294 | $200 |

| 22 | BMW 650i | $2,298 | $204 |

| 23 | Audi RS 7 | $2,382 | $288 |

| 24 | Mercedes-Benz E63 AMG | $2,448 | $354 |

| 25 | Mercedes-Benz CLS63 AMG | $2,468 | $374 |

| 26 | Maserati Ghibli | $2,474 | $380 |

| 27 | BMW 750i | $2,476 | $382 |

| 28 | Porsche Panamera | $2,526 | $432 |

| 29 | Audi A8 | $2,550 | $456 |

| 30 | BMW Alpina B6 | $2,620 | $526 |

| 31 | Maserati Quattroporte | $2,632 | $538 |

| 32 | Audi S8 | $2,710 | $616 |

| 33 | Mercedes-Benz AMG | $2,732 | $638 |

| 34 | Mercedes-Benz AMG S63 | $2,786 | $692 |

| 35 | BMW M760i | $2,972 | $878 |

| 36 | Mercedes-Benz S65 AMG | $3,590 | $1,496 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2018 model year. Updated February 23, 2024

Additional rates and policy discounts

Some other rates and discounts to watch for on your next policy are detailed below.

- As driver age increases, insurance rates tend to go down. The difference in 2018 Mercedes-Benz C63 AMG insurance rates between a 60-year-old driver ($1,730 per year) and a 30-year-old driver ($2,242 per year) is $512, or a savings of 25.8%.

- Policy discounts save money. Discounts may be available if the policyholders drive low annual mileage, take a defensive driving course, are good students, are senior citizens, or many other discounts which could save the average driver as much as $354 per year.

- Safe drivers have lower car insurance rates. At-fault accidents raise insurance rates, potentially as much as $1,006 per year for a 30-year-old driver and even as much as $492 per year for a 60-year-old driver.

- Raising deductibles makes insurance more affordable. Increasing your deductibles from $500 to $1,000 could save around $360 per year for a 40-year-old driver and $710 per year for a 20-year-old driver.

- Decreasing deductibles costs more money. Decreasing your policy deductibles from $500 to $250 could cost an additional $376 per year for a 40-year-old driver and $754 per year for a 20-year-old driver.

- Your choice of occupation could save you a few bucks. Many car insurance providers offer discounts for being employed in occupations like firefighters, accountants, lawyers, members of the military, doctors, emergency medical technicians, and others. If you’re employed in a qualifying profession, you may save between $63 and $156 on your annual C63 AMG insurance bill, depending on your age.

- Young males pay a lot more for insurance. For a 2018 Mercedes C63 AMG, a 20-year-old man pays an average price of $4,232 per year, while a 20-year-old female driver will pay an average of $3,020, a difference of $1,212 per year in the women’s favor by a large margin. But by age 50, the rate for men is $1,846 and the cost for female drivers is $1,804, a difference of only $42.

- Bring up your credit score to save money. Having an excellent credit rating above 800 could save up to $329 per year versus a good credit rating of 670-739. Conversely, a mediocre credit rating could cost up to $381 more per year.