- The average Mercedes-Benz AMG CLS53 insurance cost is $3,190 per year, or $266 per month for full coverage.

- The Mercedes AMG CLS53 ranks ninth out of 21 total comparison vehicles in the large luxury car segment for cheapest car insurance rates.

- The AMG CLS53 is one of the cheaper large luxury cars to insure, costing $210 less per year on average as compared to the rest of the vehicles in the segment.

How much does Mercedes AMG CLS53 insurance cost?

Average Mercedes-Benz AMG CLS53 insurance costs $3,190 annually for full coverage, or $266 per month. With the average large luxury car costing $3,400 a year to insure, the AMG CLS53 is $210 cheaper per year on average.

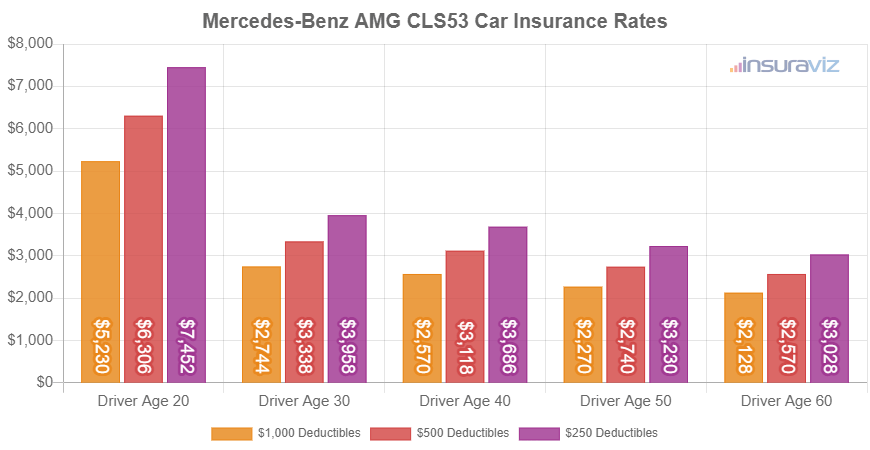

The next chart details average 2021 Mercedes AMG CLS53 car insurance rates and shows how prices can vary based on variables like driver age and policy deductible.

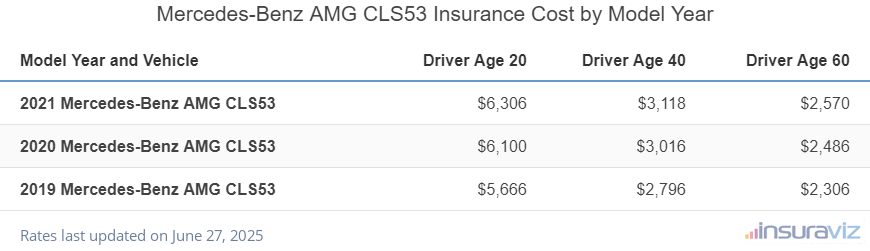

Older models generally cost less to insure, and the data table shows average Mercedes-Benz AMG CLS53 insurance policy costs from the 2019 to the 2021 model years and for different driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2021 Mercedes-Benz AMG CLS53 | $6,460 | $3,190 | $2,630 |

| 2020 Mercedes-Benz AMG CLS53 | $6,250 | $3,088 | $2,546 |

| 2019 Mercedes-Benz AMG CLS53 | $5,806 | $2,862 | $2,364 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mercedes-Benz AMG CLS53 trim levels for each model year. Updated October 24, 2025

Is Mercedes AMG CLS53 insurance expensive?

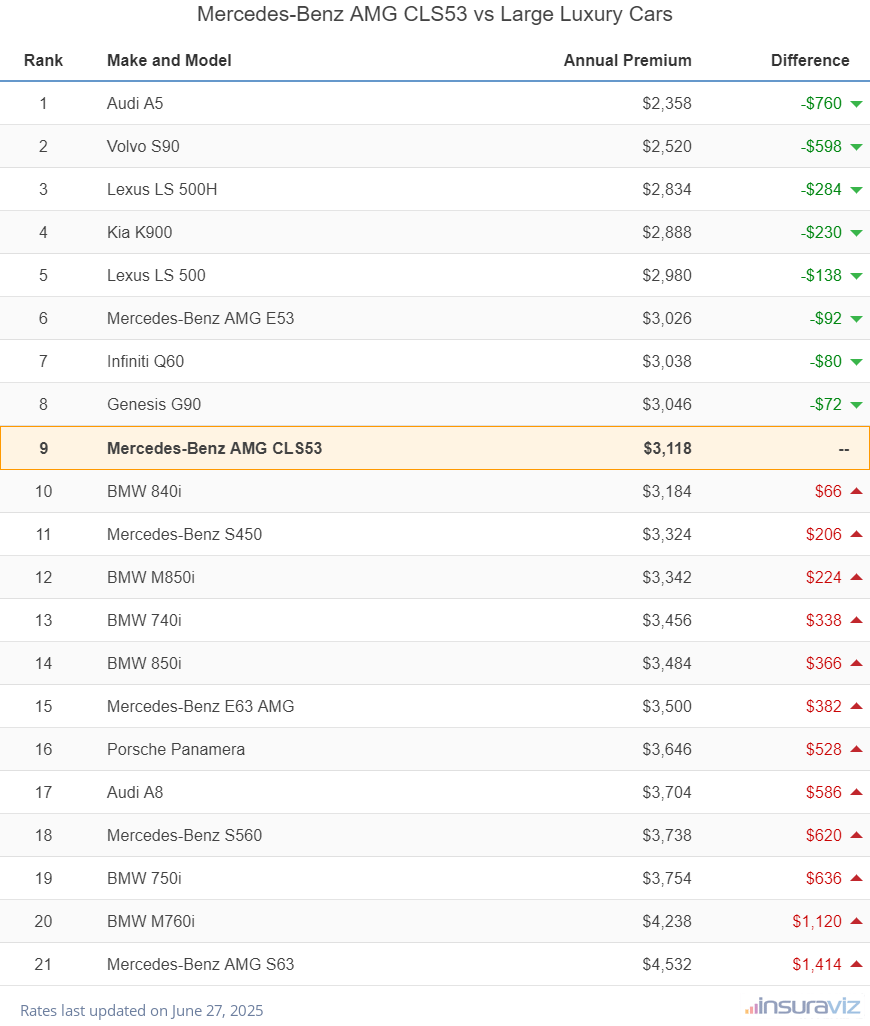

When compared to the competition, car insurance for a Mercedes-Benz AMG CLS53 costs $776 more per year than the Audi A5, $350 less than the BMW 740i, and $544 less than the Porsche Panamera.

The Mercedes-Benz AMG CLS53 ranks ninth out of 21 total comparison vehicles in the 2021 large luxury car segment for most affordable car insurance rates. The AMG CLS53 costs an average of $3,190 per year for insurance, while the segment average auto insurance cost is $3,400 annually, a difference of $210 per year.

The table displayed ranks all 2021 model year large luxury cars by average car insurance cost, from cheapest to most expensive.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Audi A5 | $2,414 | -$776 |

| 2 | Volvo S90 | $2,582 | -$608 |

| 3 | Lexus LS 500H | $2,904 | -$286 |

| 4 | Kia K900 | $2,958 | -$232 |

| 5 | Lexus LS 500 | $3,054 | -$136 |

| 6 | Mercedes-Benz AMG E53 | $3,102 | -$88 |

| 7 | Infiniti Q60 | $3,114 | -$76 |

| 8 | Genesis G90 | $3,122 | -$68 |

| 9 | Mercedes-Benz AMG CLS53 | $3,190 | -- |

| 10 | BMW 840i | $3,262 | $72 |

| 11 | Mercedes-Benz S450 | $3,404 | $214 |

| 12 | BMW M850i | $3,424 | $234 |

| 13 | BMW 740i | $3,540 | $350 |

| 14 | BMW 850i | $3,568 | $378 |

| 15 | Mercedes-Benz E63 AMG | $3,586 | $396 |

| 16 | Porsche Panamera | $3,734 | $544 |

| 17 | Audi A8 | $3,794 | $604 |

| 18 | Mercedes-Benz S560 | $3,830 | $640 |

| 19 | BMW 750i | $3,846 | $656 |

| 20 | BMW M760i | $4,340 | $1,150 |

| 21 | Mercedes-Benz AMG S63 | $4,640 | $1,450 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2021 model year. Updated October 24, 2025

Additional car insurance information

Average car insurance rates are great for comparison sakes, but there are a lot of factors that can either increase or decrease rates. The list below details some of these factors and how they can impact car insurance cost for a Mercedes AMG CLS53.

- Clean up your credit for better rates. Having a good credit rating over 800 may save $501 per year over a lower credit score of 670-739. Conversely, a weaker credit score below 579 could cost around $581 more per year.

- Car insurance for teens is expensive. Average rates for full coverage insurance on a Mercedes AMG CLS53 costs $11,232 per year for a 16-year-old driver, $10,964 per year for a 17-year-old driver, $9,974 per year for an 18-year-old driver, and $9,018 per year for a 19-year-old driver.

- Your occupation could lower your rates. Many auto insurance providers offer discounts for working in occupations like police officers and law enforcement, architects, lawyers, doctors, the military, and others. Qualifying for an occupational discount could save between $96 and $222 on your annual insurance cost, depending on the level of coverage purchased.

- Careless drivers have higher insurance rates. At-fault accidents will increase rates, as much as $1,538 per year for a 30-year-old driver and even as much as $744 per year for a 60-year-old driver.

- As age goes up, auto insurance cost tends to go down. The difference in AMG CLS53 insurance cost between a 40-year-old driver ($3,190 per year) and a 20-year-old driver ($6,460 per year) is $3,270, or a savings of 67.8%.

- Increase physical damage deductibles to save money. Raising deductibles from $500 to $1,000 could save around $556 per year for a 40-year-old driver and $1,104 per year for a 20-year-old driver.