- Toyota FJ Cruiser car insurance costs an average of $1,386 per year, or around $116 per month, depending on policy limits.

- The Toyota FJ Cruiser is one of the cheaper midsize SUVs to insure, costing $148 less per year on average as compared to the rest of the vehicles in the segment.

How much does Toyota FJ Cruiser insurance cost?

Plan on budgeting an average of $1,386 a year for a full coverage policy to insure a Toyota FJ Cruiser, which is about $116 each month. For individual policy coverages, collision coverage is around $544 a year, liability and medical coverage is around $584, and the remaining comprehensive (or other-than-collision) coverage is about $258.

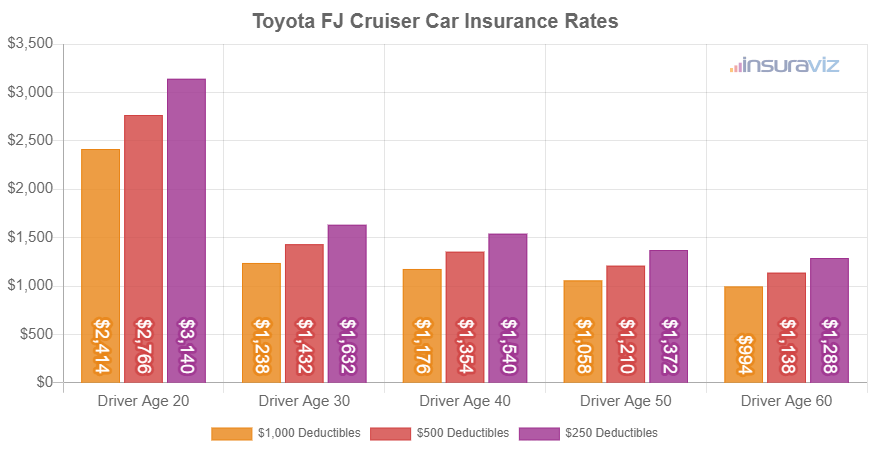

The next price chart demonstrates how average Toyota FJ Cruiser insurance cost can change with different driver ages and policy deductibles.

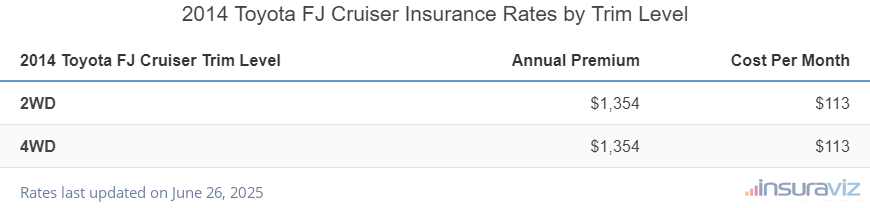

The next table details the average annual and semi-annual car insurance policy costs, in addition to a monthly budget estimate, for each Toyota FJ Cruiser package and trim.

| 2014 Toyota FJ Cruiser Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 2WD | $1,386 | $116 |

| 4WD | $1,386 | $116 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

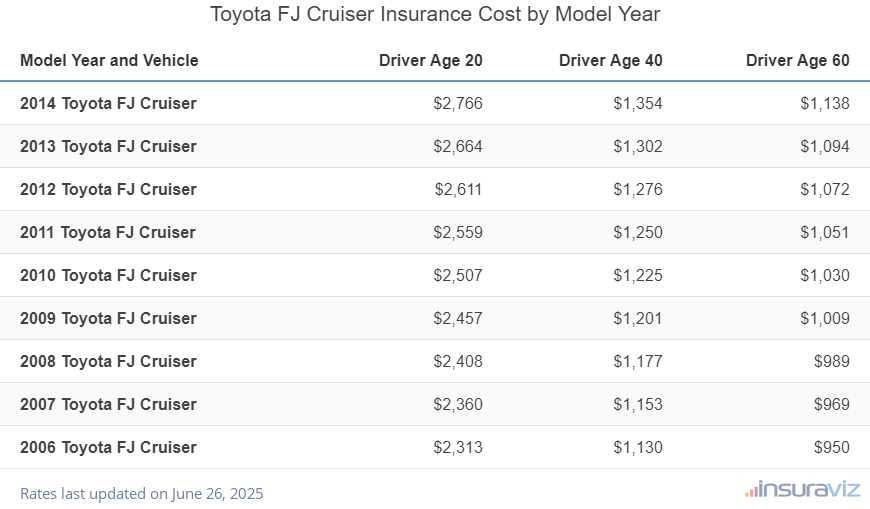

The data below shows average Toyota FJ Cruiser insurance cost for the 2006 to 2014 model years and different driver age groups.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2014 Toyota FJ Cruiser | $2,834 | $1,386 | $1,164 |

| 2013 Toyota FJ Cruiser | $2,724 | $1,334 | $1,120 |

| 2012 Toyota FJ Cruiser | $2,670 | $1,307 | $1,098 |

| 2011 Toyota FJ Cruiser | $2,616 | $1,281 | $1,076 |

| 2010 Toyota FJ Cruiser | $2,564 | $1,256 | $1,054 |

| 2009 Toyota FJ Cruiser | $2,513 | $1,230 | $1,033 |

| 2008 Toyota FJ Cruiser | $2,462 | $1,206 | $1,012 |

| 2007 Toyota FJ Cruiser | $2,413 | $1,182 | $992 |

| 2006 Toyota FJ Cruiser | $2,365 | $1,158 | $972 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Toyota FJ Cruiser trim levels for each model year. Updated October 24, 2025

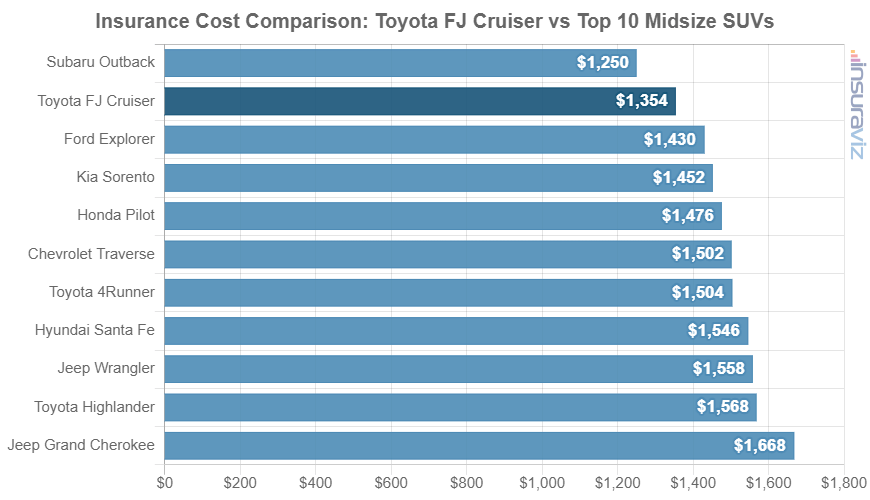

Where does FJ Cruiser insurance cost rank?

The Toyota FJ Cruiser ranks fourth out of 24 total vehicles in the midsize SUV segment for most affordable car insurance rates. The FJ Cruiser costs an average of $1,386 per year for full coverage insurance and the class average car insurance cost is $1,534 annually, a difference of $148 per year.

When average rates are compared to other midsize SUV models, auto insurance rates for a Toyota FJ Cruiser cost $320 less per year than the Jeep Grand Cherokee, $220 less than the Toyota Highlander, and $80 less than the Ford Explorer.

The following chart shows how average FJ Cruiser car insurance cost compares to the top 10 most popular midsize SUVs like the Jeep Cherokee, Subaru Outback, and the Chevrolet Traverse. A more complete table is added after the chart breaking down rates for the entire 24 vehicle midsize SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Outback | $1,282 | -$104 |

| 2 | Ford Edge | $1,310 | -$76 |

| 3 | Toyota Venza | $1,338 | -$48 |

| 4 | Toyota FJ Cruiser | $1,386 | -- |

| 5 | Nissan Xterra | $1,392 | $6 |

| 6 | Ford Flex | $1,460 | $74 |

| 7 | Ford Explorer | $1,466 | $80 |

| 8 | Kia Sorento | $1,488 | $102 |

| 9 | Dodge Journey | $1,494 | $108 |

| 10 | Jeep Cherokee | $1,500 | $114 |

| 11 | Honda Pilot | $1,510 | $124 |

| 12 | Nissan Murano | $1,520 | $134 |

| 13 | Dodge Durango | $1,534 | $148 |

| 14 | Chevrolet Traverse | $1,536 | $150 |

| 15 | Toyota 4Runner | $1,542 | $156 |

| 16 | GMC Acadia | $1,554 | $168 |

| 17 | Hyundai Santa Fe | $1,584 | $198 |

| 18 | Jeep Wrangler | $1,596 | $210 |

| 19 | Toyota Highlander | $1,606 | $220 |

| 20 | Mazda CX-9 | $1,610 | $224 |

| 21 | Jeep Grand Cherokee | $1,706 | $320 |

| 22 | Volkswagen Touareg | $1,784 | $398 |

| 23 | Nissan Pathfinder | $1,792 | $406 |

| 24 | Buick Enclave | $1,826 | $440 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2014 model year. Updated October 24, 2025

Additional rates and insights

Additional important data observations as they relate to Toyota FJ Cruiser insurance cost include:

- It’s expensive to buy high-risk insurance. For a 50-year-old driver, having enough accidents and violations to require a high-risk insurance policy could inflate rates by $1,686 or more per year.

- More mature drivers get better rates than young drivers. The difference in insurance cost on a 2014 FJ Cruiser between a 50-year-old driver ($1,242 per year) and a 20-year-old driver ($2,834 per year) is $1,592, or a savings of 78.1%.

- Tickets and violations cost money. To get the cheapest Toyota FJ Cruiser car insurance rates, it makes sense to be a safe driver. Not surprisingly, just one or two traffic tickets could result in spiking insurance policy cost as much as $380 per year.

- The higher the deductibles, the lower the cost. Raising deductibles from $500 to $1,000 could save around $180 per year for a 40-year-old driver and $362 per year for a 20-year-old driver.

- Decreasing deductibles will cost more. Lowering deductibles from $500 to $250 could cost an additional $190 per year for a 40-year-old driver and $382 per year for a 20-year-old driver.

- Get better rates due to your choice of occupation. Many auto insurance companies offer discounts for earning a living in occupations like dentists, scientists, firefighters, nurses, emergency medical technicians, and other. By qualifying for this profession discount, you may save between $42 and $153 on your yearly FJ Cruiser insurance bill, subject to the policy coverages selected.