- Ford Flex insurance costs an average of $1,532 per year, or around $128 per month for full coverage.

- Flex insurance cost ranges from $1,446 to $1,600 annually on average, depending on trim level.

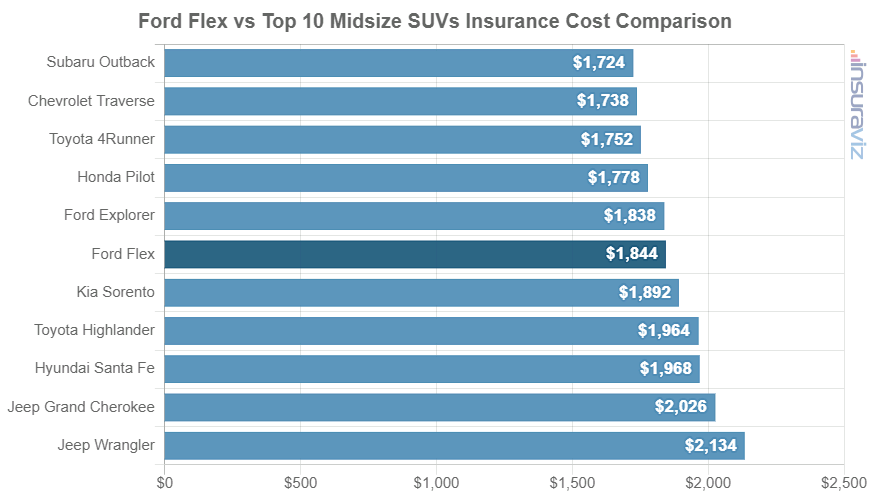

- The 2019 Ford Flex ranks 11th out of 24 vehicles for insurance affordability when compared to other midsize SUVs

How much does Ford Flex car insurance cost?

Ford Flex insurance averages around $1,532 yearly, or about $128 monthly. With the average midsize SUV costing $1,562 a year to insure, the Ford Flex compares favorably, being $30 cheaper.

Average monthly payments to insure a 2019 Ford Flex for full coverage cost from $121 per month on the Flex SE 2WD model to $133 per month on the Limited Ecoboost AWD Turbo model.

The chart below details car insurance cost for a 2019 Ford Flex using different driver ages and policy limits.

In the chart above, 2019 Ford Flex car insurance rates range from a discount rate for a 40-year-old driver of $1,270 to the high-risk average rate for a 30-year-old driver of $3,544 per year.

Not shown in the chart are rates for teenage drivers. A 16-year-old male driver with a clean driving record would pay around $5,606 while a 16-year-old female would pay about $5,230. At age 17, males would pay around $5,397 and females $5,192.

Is Ford Flex insurance cheap?

The cheapest trim level of Ford Flex to insure is the SE 2WD at around $1,446 per year. The second cheapest trim is the SEL 2WD at $1,494 per year, and the third cheapest trim to insure is the SEL AWD, also at $1,504 per year.

The highest cost models of Ford Flex to insure are the Limited Ecoboost AWD Turbo at $1,600 and the Limited AWD at $1,590 per year. Those models will cost an extra $154 per year over the cheapest SE 2WD model.

The table below displays average car insurance rates, including a monthly budget estimate, for each Ford Flex package and trim level.

| 2019 Ford Flex Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE 2WD | $1,446 | $121 |

| SEL 2WD | $1,494 | $125 |

| SEL AWD | $1,504 | $125 |

| Limited 2WD | $1,548 | $129 |

| Limited AWD | $1,590 | $133 |

| Limited Ecoboost AWD Turbo | $1,600 | $133 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

How does Flex insurance rank?

The Ford Flex ranks 11th out of 24 total vehicles in the 2019 midsize SUV segment. The Flex costs an average of $1,532 per year for full coverage insurance and the segment average is $1,562 annually, a difference of only $30 per year.

When compared directly to the top-selling other midsize SUVs, Ford Flex car insurance costs $150 less per year than the Jeep Grand Cherokee, $100 less than the Toyota Highlander, $34 more than the Honda Pilot, and $168 less than the Jeep Cherokee.

The chart below shows how insurance cost for a Ford Flex compares to the top-selling midsize SUVs for the 2019 model year. Additionally, you can find a more comprehensive table after the chart displaying insurance cost comparisons and rankings for all 24 models in the midsize SUV category.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Volkswagen Atlas | $1,404 | -$128 |

| 2 | Subaru Outback | $1,434 | -$98 |

| 3 | Chevrolet Traverse | $1,444 | -$88 |

| 4 | Ford Edge | $1,444 | -$88 |

| 5 | Toyota 4Runner | $1,452 | -$80 |

| 6 | Subaru Ascent | $1,494 | -$38 |

| 7 | Honda Pilot | $1,498 | -$34 |

| 8 | Nissan Murano | $1,502 | -$30 |

| 9 | Mazda CX-9 | $1,522 | -$10 |

| 10 | Ford Explorer | $1,526 | -$6 |

| 11 | Ford Flex | $1,532 | -- |

| 12 | Honda Passport | $1,548 | $16 |

| 13 | Chevrolet Blazer | $1,562 | $30 |

| 14 | Kia Sorento | $1,570 | $38 |

| 15 | Dodge Journey | $1,572 | $40 |

| 16 | GMC Acadia | $1,594 | $62 |

| 17 | Toyota Highlander | $1,632 | $100 |

| 18 | Hyundai Santa Fe | $1,636 | $104 |

| 19 | Dodge Durango | $1,636 | $104 |

| 20 | Buick Enclave | $1,652 | $120 |

| 21 | Nissan Pathfinder | $1,670 | $138 |

| 22 | Jeep Grand Cherokee | $1,682 | $150 |

| 23 | Jeep Cherokee | $1,700 | $168 |

| 24 | Jeep Wrangler | $1,772 | $240 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2019 model year. Updated February 23, 2024

How much will older Flex models save on insurance?

Driving a 2013 Flex in place of a 2019 model year could save an average of $474 each year. Older models have a lower replacement cost value, which results in lower insurance costs.

The data table below shows average Ford Flex car insurance rates for the 2013 to 2019 model years and different driver ages. Insurance cost ranges from the best rate of $880 for a 60-year-old driver rated on a 2013 Ford Flex to the highest rate of $3,104 for a 20-year-old driving a 2019 Ford Flex.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2019 Ford Flex | $3,104 | $1,532 | $1,276 |

| 2018 Ford Flex | $3,012 | $1,484 | $1,236 |

| 2017 Ford Flex | $2,884 | $1,424 | $1,186 |

| 2016 Ford Flex | $2,510 | $1,254 | $1,042 |

| 2015 Ford Flex | $2,516 | $1,260 | $1,054 |

| 2014 Ford Flex | $2,310 | $1,156 | $966 |

| 2013 Ford Flex | $2,096 | $1,058 | $880 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ford Flex trim levels for each model year. Updated February 23, 2024

At some point with older models, vehicle owners will have to decide when to remove comprehensive and/or collision coverage from the insurance policy. As vehicles get older and lose value from depreciation, the extra cost of physical damage coverage is more than the benefits provided by having it. Removing full coverage on an older Ford Flex could potentially save $752 per year, depending on the policy deductibles and the age of the rated driver.