- Kia Sorento insurance costs an average of $1,800 per year or around $150 per month, depending on the trim level.

- With the cheapest insurance rates, the Sorento LX trim level costs an average of $1,648 per year to insure. At the high end, the Sorento SX Prestige Plug-in Hybrid is the most expensive to insure at $1,934 for an annual policy.

- Sorento insurance costs about the same as the average cost for the 2024 midsize SUV class.

- Insuring a used Sorento could save $630 per year by only requiring a liability-only policy.

How much does Kia Sorento car insurance cost?

Kia Sorento insurance averages $1,800 per year for a full-coverage policy, or around $150 on a monthly basis. Drivers can plan on paying around $74 less per year to insure a Kia Sorento compared to similar vehicles, and $83 less per year than the $1,883 average for all vehicles.

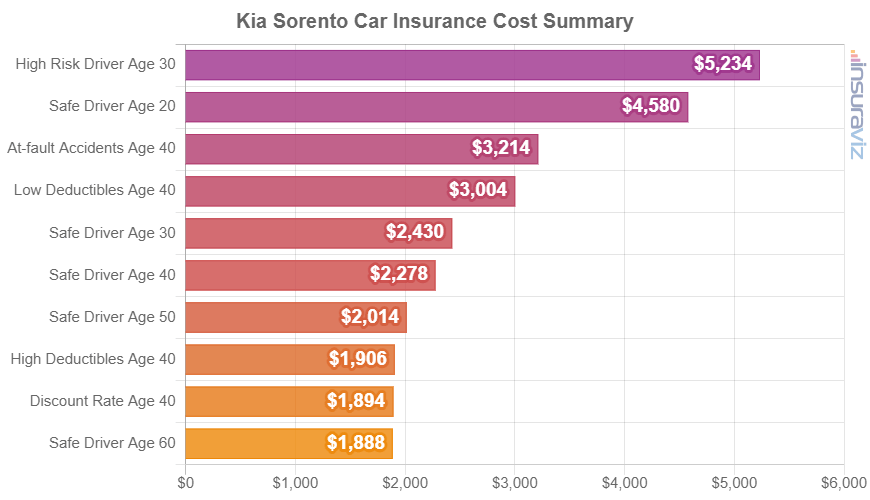

The chart below details average 2024 Kia Sorento car insurance rates with a variety of different driver ages and risk profiles.

In the chart above, Sorento insurance rates range from a discount rate for a 40-year-old driver of $1,496 to the high-risk average rate for a 30-year-old driver of $3,366 per year.

Auto insurance rates on a Sorento for teen drivers are not included in the data above. A 16-year-old male driver with a good driving record would pay approximately $6,375 on average, while a 16-year-old female would pay about $5,956. At the age of 18, males would pay around $5,573 and females $5,132.

Below are some additional key points regarding insurance for a Sorento.

- Driver gender influences rates. For a 2024 Kia Sorento, a 20-year-old man will pay an estimated rate of $3,620 per year, while a 20-year-old female pays an estimated $2,594, a difference of $1,026 per year. The females get the cheaper rate by far. But by age 50, male driver rates are $1,592 and female driver rates are $1,556, a difference of only $36.

- Your choice of occupation could reduce your rates. Many auto insurance companies offer policy discounts for earning a living in occupations like police officers and law enforcement, members of the military, college professors, firefighters, engineers, and others. If you qualify for this occupational discount, you may save between $54 and $185 on your yearly car insurance bill, depending on the coverage levels.

- Policy discounts mean cheaper Sorento car insurance. Discounts may be available if the insureds are accident-free, drive a vehicle with safety or anti-theft features, insure their home and car with the same company, work in certain occupations, or other policy discounts which could save the average driver as much as $304 per year.

- The higher the deductibles, the lower the cost. Raising deductibles from $500 to $1,000 could save around $294 per year for a 40-year-old driver and $576 per year for a 20-year-old driver.

- Low deductibles will increase rates. Dropping your physical damage deductibles from $500 to $250 could cost an additional $306 per year for a 40-year-old driver and $612 per year for a 20-year-old driver.

- High risk Sorento insurance is expensive. For a 40-year-old driver, the need to buy a high-risk policy could trigger a rate increase of $2,176 or more per year.

- Be a careful driver and save. Causing frequent accidents will increase insurance costs, potentially by an extra $864 per year for a 30-year-old driver and as much as $432 per year for a 60-year-old driver.

- Excellent credit scores get the best rates. Drivers who have credit scores over 800 could save $283 per year compared to a decent credit rating of 670-739. Conversely, a lower credit score could cost around $328 more per year.

What is the cheapest Kia Sorento to insure?

The cheapest Kia Sorento insurance can be found on the LX at $1,648 per year, or about $137 per month. The next cheapest model is the S also at $1,690 per year, and the third cheapest model to insure is the X-Line S AWD at $1,732 per year.

At the high end of the Sorento insurance cost range, the three most expensive Sorento trim levels to insure are the Kia Sorento SX Prestige AWD, the X-Line SX Prestige AWD, and the SX Prestige Plug-in Hybrid trim levels at an estimated $1,868, $1,878, and $1,934 per year, respectively.

The table below shows the different trim levels available for the 2024 Kia Sorento and the average car insurance cost for each.

| 2024 Kia Sorento Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LX | $1,648 | $137 |

| S | $1,690 | $141 |

| X-Line S AWD | $1,732 | $144 |

| EX | $1,766 | $147 |

| EX Hybrid | $1,782 | $149 |

| SX | $1,812 | $151 |

| X-Line EX AWD | $1,828 | $152 |

| SX Prestige Hybrid | $1,852 | $154 |

| SX Prestige AWD | $1,868 | $156 |

| X-Line SX Prestige AWD | $1,878 | $157 |

| SX Prestige Plug-in Hybrid | $1,934 | $161 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

Where does Sorento car insurance cost rank?

The Kia Sorento ranks 14th out of 34 total vehicles in the midsize SUV category for 2024. The Sorento costs an average of $1,800 per year for insurance, while the category average cost is $1,874 annually, a difference of $74 per year.

When compared directly to popular vehicles in the midsize SUV segment, insurance for a Kia Sorento costs $130 less per year than the Hyundai Santa Fe, $30 more per year than the Chevrolet Traverse, $78 more per year than the Ford Explorer, and $182 more per year than the Subaru Outback.

The table below shows how well the Sorento fares against the entire 2024 midsize SUV segment for insurance affordability. The difference column indicates how much cheaper or more expensive each model is than the Kia Sorento on a yearly basis.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,512 | -$288 |

| 2 | Nissan Murano | $1,594 | -$206 |

| 3 | Subaru Outback | $1,618 | -$182 |

| 4 | Buick Envista | $1,622 | -$178 |

| 5 | Subaru Ascent | $1,652 | -$148 |

| 6 | Volkswagen Atlas | $1,684 | -$116 |

| 7 | Volkswagen Atlas Cross Sport | $1,690 | -$110 |

| 8 | Ford Explorer | $1,722 | -$78 |

| 9 | Toyota Highlander | $1,728 | -$72 |

| 10 | Toyota Venza | $1,732 | -$68 |

| 11 | Chevrolet Traverse | $1,770 | -$30 |

| 12 | Mitsubishi Outlander Sport | $1,782 | -$18 |

| 13 | Mitsubishi Outlander PHEV | $1,784 | -$16 |

| 14 | Kia Sorento | $1,800 | -- |

| 15 | Ford Edge | $1,802 | $2 |

| 16 | Buick Enclave | $1,828 | $28 |

| 17 | GMC Acadia | $1,832 | $32 |

| 18 | Honda Pilot | $1,848 | $48 |

| 19 | Mazda CX-9 | $1,852 | $52 |

| 20 | Jeep Grand Cherokee | $1,898 | $98 |

| 21 | Nissan Pathfinder | $1,928 | $128 |

| 22 | Hyundai Santa Fe | $1,930 | $130 |

| 23 | Hyundai Palisade | $1,932 | $132 |

| 24 | Chevrolet Blazer | $1,958 | $158 |

| 25 | Kia Telluride | $1,978 | $178 |

| 26 | Toyota 4Runner | $2,036 | $236 |

| 27 | Mazda CX-90 | $2,044 | $244 |

| 28 | Toyota Grand Highlander | $2,066 | $266 |

| 29 | Kia EV9 | $2,080 | $280 |

| 30 | Tesla Model Y | $2,100 | $300 |

| 31 | Ford Bronco | $2,104 | $304 |

| 32 | Jeep Wrangler | $2,168 | $368 |

| 33 | Rivian R1S | $2,328 | $528 |

| 34 | Dodge Durango | $2,330 | $530 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated February 22, 2024

Comparing average insurance quotes for a Kia Sorento to midsize non-luxury SUVs with similar sticker prices can give us an additional metric for comparison.

The 2024 Sorento has an average MSRP of $40,818, which ranges from $32,000 to $52,000, depending upon the exact model purchased.

The vehicles closest in average purchase price to the Kia Sorento are the Subaru Ascent, Nissan Murano, Toyota Venza, and Nissan Pathfinder. The list below shows how those models compare to the Sorento for overall insurance affordability.

- Compared to the Subaru Ascent – The average MSRP for a 2024 Kia Sorento is $777 cheaper than the Subaru Ascent, at $40,818 compared to $41,595. Drivers can expect to pay an average of $148 less every 12 months to insure the Subaru Ascent compared to a Sorento.

- Compared to the Nissan Murano – With an average sticker price of $42,160 and ranging from $37,920 to $47,630, the 2024 Nissan Murano costs $1,342 more than the average cost of the Sorento. The cost to insure a Kia Sorento compared to the Nissan Murano is $206 more annually on average.

- Compared to the Toyota Venza – The purchase price for the Toyota Venza averages $1,476 less than the average cost for the Sorento ($39,343 compared to $40,818). The average insurance cost for the Sorento compared to the Toyota Venza is $68 more per year.

- Compared to the Nissan Pathfinder – The average MSRP for a 2024 Kia Sorento is $1,670 cheaper than the Nissan Pathfinder, at $40,818 compared to $42,488. Insurance on a Sorento costs an average of $128 less each year than the Nissan Pathfinder.

Will a used Sorento cost less to insure?

Resisting the showroom glitz for an older model of Kia Sorento could save $634 or more each year on insurance. New 2024 models have much higher replacement value than older models like the 2013 Sorento.

The data below details average insurance rates for a Kia Sorento for the 2013 through 2024 model years and various driver age groups. The range of insurance prices goes from the cheapest rate of $980 for a 60-year-old driver rated on a 2013 Kia Sorento to a high of $3,620 for a 20-year-old driving a 2024 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Kia Sorento | $3,620 | $1,800 | $1,490 |

| 2023 Kia Sorento | $3,414 | $1,694 | $1,404 |

| 2022 Kia Sorento | $3,308 | $1,640 | $1,362 |

| 2021 Kia Sorento | $3,440 | $1,696 | $1,412 |

| 2020 Kia Sorento | $3,340 | $1,648 | $1,372 |

| 2019 Kia Sorento | $3,194 | $1,570 | $1,308 |

| 2018 Kia Sorento | $3,060 | $1,508 | $1,256 |

| 2017 Kia Sorento | $2,974 | $1,466 | $1,224 |

| 2016 Kia Sorento | $2,988 | $1,472 | $1,234 |

| 2015 Kia Sorento | $2,840 | $1,398 | $1,172 |

| 2014 Kia Sorento | $2,368 | $1,176 | $984 |

| 2013 Kia Sorento | $2,354 | $1,166 | $980 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Kia Sorento trim levels for each model year. Updated February 23, 2024

At some point in the life of every vehicle, vehicle owners will have to decide when to delete comprehensive and collision coverage from a policy. As a vehicle loses value over time, the cost of carrying full coverage begins to exceed the added benefit.

Eliminating physical damage coverage on an older Kia Sorento may save the average driver $630 a year (based on 2013 and 2024 model year rates), depending on the policy deductibles and the driver age.

Kia Sorento insurance rates by location

Where you live definitely impacts insurance rates. For the Sorento, average rates for some larger cities include Dallas, TX, averaging $1,850 per year, Minneapolis, MN, at $1,826, Omaha, NE, costing $1,644, and Indianapolis, IN, at an estimated $1,488.

The chart data below illustrates average car insurance premiums on a Kia Sorento in the largest cities in America.

How much does it cost to insure a Kia Sorento in my state?

From a state perspective, states like Ohio ($1,310), Virginia ($1,256), and Iowa ($1,262) have the cheapest car insurance rates, while states like Michigan ($2,362), Louisiana ($2,092), and Florida ($2,186) tend to have more expensive Sorento insurance rates.

The next table breaks down average insurance rates on a 2024 Kia Sorento for all fifty U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $1,644 | $137 |

| Alaska | $1,408 | $117 |

| Arizona | $1,674 | $140 |

| Arkansas | $1,888 | $157 |

| California | $2,158 | $180 |

| Colorado | $1,930 | $161 |

| Connecticut | $1,996 | $166 |

| Delaware | $2,036 | $170 |

| Florida | $2,186 | $182 |

| Georgia | $1,846 | $154 |

| Hawaii | $1,282 | $107 |

| Idaho | $1,336 | $111 |

| Illinois | $1,608 | $134 |

| Indiana | $1,394 | $116 |

| Iowa | $1,262 | $105 |

| Kansas | $1,786 | $149 |

| Kentucky | $1,930 | $161 |

| Louisiana | $2,092 | $174 |

| Maine | $1,150 | $96 |

| Maryland | $1,690 | $141 |

| Massachusetts | $1,958 | $163 |

| Michigan | $2,362 | $197 |

| Minnesota | $1,574 | $131 |

| Mississippi | $1,770 | $148 |

| Missouri | $2,022 | $169 |

| Montana | $1,674 | $140 |

| Nebraska | $1,538 | $128 |

| Nevada | $2,132 | $178 |

| New Hampshire | $1,264 | $105 |

| New Jersey | $2,160 | $180 |

| New Mexico | $1,516 | $126 |

| New York | $2,074 | $173 |

| North Carolina | $1,192 | $99 |

| North Dakota | $1,526 | $127 |

| Ohio | $1,310 | $109 |

| Oklahoma | $1,978 | $165 |

| Oregon | $1,700 | $142 |

| Pennsylvania | $1,746 | $146 |

| Rhode Island | $2,204 | $184 |

| South Carolina | $1,542 | $129 |

| South Dakota | $1,856 | $155 |

| Tennessee | $1,728 | $144 |

| Texas | $1,690 | $141 |

| Utah | $1,604 | $134 |

| Vermont | $1,360 | $113 |

| Virginia | $1,256 | $105 |

| Washington | $1,650 | $138 |

| West Virginia | $1,632 | $136 |

| Wisconsin | $1,338 | $112 |

| Wyoming | $1,626 | $136 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated February 22, 2024