- The average cost of Corvette insurance is $3,322 per year for the 2024 model, or $277 per month, for full coverage.

- The Corvette ranks 14th out of 23 vehicles in the 2024 sports car class for car insurance affordability.

- The cheapest Corvette to insure is the Stingray 1LT Coupe trim level at an average of $2,752 per year. The most expensive is the Z06 1LT Convertible at $3,688 annually.

How much does Corvette insurance cost?

The average Corvette insurance cost per year is $3,322 for a policy with full coverage. Monthly insurance rates range from $229 to $307, depending on the trim level.

With the average sports car costing $3,300 a year to insure, drivers can expect to pay around $22 more per year for insurance on a Corvette when compared to the segment average.

Comprehensive (or other-than-collision) coverage costs approximately $976 a year, collision insurance will cost approximately $1,780, and the remaining liability and medical costs when combined average $566.

The table below shows the cost of each individual policy coverage on a 2024 Corvette and compares them to the average cost for all 2024 model year vehicles.

| Policy Coverage | 2024 Chevrolet Corvette | 2024 All Vehicle Average | Difference |

|---|---|---|---|

| Comprehensive | $976 | $656 | 39.2% |

| Collision | $1,780 | $1,216 | 37.7% |

| Liability | $392 | $492 | -22.6% |

| Med/PIP Other | $174 | $208 | -17.8% |

| Total Policy Cost | $3,322 | $2,572 | 25.4% |

Lower than average cost Higher than average cost

Data Methodology: Rated driver is a 40-year-old male with no driving violations or at-fault accidents in the prior three years. Coverage premiums are averaged for all trim levels available for the 2024 Chevrolet Corvette. Updated October 24, 2025

If we just look at the bottom line figure, insurance rates on a 2024 Corvette average 25.4% more than the national average rate for all 2024 model year vehicles of $2,572 per year.

But when looking at the individual coverages, comprehensive and collision are higher, which is understandable. The cost to repair body damage on a Corvette, whether from a collision or from mother nature, is not cheap.

However, the interesting thing is the low liability insurance rates on a Corvette. Historically, Corvettes tend to have much better than average losses for property damage liability, personal injury, medical payments, and bodily injury.

So despite being a high-performance vehicle, the low liability insurance rates on a Corvette actually make it fairly affordable to insure, as long as the rated driver is not under the age of 25.

Speaking of younger drivers, the age of the rated driver is one of the biggest factors that will impact the cost of insurance on any vehicle, not just a Corvette.

The chart below details how 2024 Corvette insurance cost changes with different driver ages and policy deductibles. Rates range from $2,220 per year for a 60-year-old driver with high policy deductibles to $7,906 per year for a 20-year-old driver with low deductibles.

The chart clearly illustrates how younger drivers pay higher car insurance rates on a Corvette, especially with a policy that has a low physical damage insurance deductible.

Corvette insurance rates for teenage drivers

If you think Corvette insurance for a 20-year-old is expensive, wait until you see Corvette insurance rates for teen drivers aged 16 to 19.

This chart below breaks out the average cost to insure both male and female drivers aged 16 to 19 when rated on a 2024 Corvette.

Average Corvette car insurance rates for teenage drivers range from $7,840 per year for a 19-year-old female driver to $11,238 per year for a 16-year-old male driver. Higher policy deductibles can help bring down the price, as will insuring your teen on an older model-year Corvette.

Insurance on a Corvette for a 17-year-old driver ranges from $10,482 to $11,029, and Corvette insurance for an 18-year-old driver ranges from $9,290 to $10,161 per year.

If a teenager does in fact get a new 2024 Corvette, first, they are very lucky. Second, we sincerely hope their parents are paying their car insurance bill.

Putting an inexperienced driver behind the wheel of a high-performance vehicle like the Corvette is the perfect recipe for expensive car insurance rates.

Older models will cost less to insure than a new model, but even so, don’t expect insurance on any model year Corvette to be considered “affordable” for a driver under the age of 25.

If your teenager has good grades, check to see if you can get a good student discount on your policy. That could save anywhere from 3% to 20% per year, depending on the company you use.

Corvette insurance compared to the competition

The Chevy Corvette ranks 14th out of 23 total vehicles in the 2024 sports car segment for car insurance affordability.

A 2024 Corvette costs an average of $3,322 per year to insure, while the sports car segment average cost is $3,300 per year, a difference of $22 per year in favor of the Vette.

When compared to the top-selling other sports cars, insurance for a Corvette costs $454 more per year than the Subaru BRZ, $1,102 more per year than the Mazda MX-5 Miata, $792 more per year than the Toyota GR86, and $116 less per year than the Porsche 911.

The table below shows how the average C8 Corvette insurance cost compares to other sports cars for insurance affordability. The average rate for the Corvette is shown in orange, while the average rate for the segment is shown in blue.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Mazda MX-5 Miata | $2,220 | -$1,102 |

| 2 | Toyota GR86 | $2,530 | -$792 |

| 3 | Ford Mustang | $2,634 | -$688 |

| 4 | BMW Z4 | $2,650 | -$672 |

| 5 | Subaru WRX | $2,690 | -$632 |

| 6 | Toyota GR Supra | $2,694 | -$628 |

| 7 | BMW M2 | $2,772 | -$550 |

| 8 | Nissan Z | $2,778 | -$544 |

| 9 | Lexus RC F | $2,838 | -$484 |

| 10 | Subaru BRZ | $2,868 | -$454 |

| 11 | BMW M3 | $3,030 | -$292 |

| 12 | Porsche 718 | $3,090 | -$232 |

| 13 | Chevrolet Camaro | $3,118 | -$204 |

| 2024 Sports Car Average | $3,300 | -$22 | |

| 14 | Chevrolet Corvette | $3,322 | -- |

| 15 | Porsche 911 | $3,438 | $116 |

| 16 | BMW M4 | $3,580 | $258 |

| 17 | Lexus LC 500 | $3,600 | $278 |

| 18 | Jaguar F-Type | $3,786 | $464 |

| 19 | Mercedes-Benz AMG GT53 | $3,972 | $650 |

| 20 | Porsche Taycan | $4,062 | $740 |

| 21 | Mercedes-Benz SL 55 | $4,632 | $1,310 |

| 22 | Nissan GT-R | $4,670 | $1,348 |

| 23 | Mercedes-Benz SL 63 | $4,930 | $1,608 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each model. Updated October 24, 2025

The red and green values in the ‘Difference’ column in the table indicate whether each comparison model is cheaper to insure or more expensive to insure than the Corvette, and by how much.

Green values mean that model is cheaper to insure on average than a 2024 Corvette, while red values mean that model has more expensive average insurance rates.

The chart below compares the average insurance cost on a 2024 Corvette to the top luxury performance competitors.

When compared to other performance luxury models from nameplates like BMW, Porsche, and Mercedes-Benz, insuring a Corvette starts to look pretty affordable in comparison.

The original 1953 Corvette model only offered two additional options: a heater or an AM radio. If you added both, you would have paid $3,749, which is the equivalent of $42,007 today!

What is the cheapest Corvette insurance?

With Chevy Corvette insurance rates ranging from $2,752 to $3,688 per year for the average driver, the cheapest model to insure is the Stingray 1LT Coupe. The next cheapest trim level to insure is the Stingray 2LT Coupe at $2,892 per year.

For monthly budgeters, expect the cost of full coverage car insurance on a Corvette to start at around $229 per month. But this value is an average rate, so depending on the trim level you’re insuring and where you live, it could be significantly different.

At the high end, the three most expensive C8 Corvette trim levels to insure are the Z06 3LT Coupe, the Z06 1LT Convertible, and the Z06 1LT Convertible trim levels at an average cost of $3,642, $3,656, and $3,688 per year, respectively.

Average auto insurance prices for annual and semi-annual policy terms are shown in the table below, including a monthly budget figure, for each available Corvette trim level.

| 2024 Chevrolet Corvette Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Stingray 1LT Coupe | $2,752 | $229 |

| Stingray 2LT Coupe | $2,892 | $241 |

| Stingray 3LT Coupe | $2,976 | $248 |

| Stingray 1LT Convertible | $2,998 | $250 |

| Stingray 2LT Convertible | $3,116 | $260 |

| Stingray 3LT Convertible | $3,184 | $265 |

| E-Ray Coupe | $3,404 | $284 |

| E-Ray Convertible | $3,476 | $290 |

| Z06 1LT Coupe | $3,538 | $295 |

| Z06 1LT Convertible | $3,596 | $300 |

| Z06 2LT Coupe | $3,610 | $301 |

| Z06 3LT Coupe | $3,642 | $304 |

| Z06 1LT Convertible | $3,656 | $305 |

| Z06 1LT Convertible | $3,688 | $307 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

New versus used Corvette insurance rates

Opting to insure a 2013 C6 Chevy Corvette instead of a new 2024 C8 Corvette could save around $1,544 each year depending on policy coverages and where you live.

Even a 2017 model could save the average driver around $964 per year when compared to the cost of insuring a new Corvette.

The table below shows the average cost of full coverage insurance for a Corvette for 2013 through 2024 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Chevrolet Corvette | $3,322 | $277 |

| 2023 Chevrolet Corvette | $2,886 | $241 |

| 2022 Chevrolet Corvette | $2,760 | $230 |

| 2021 Chevrolet Corvette | $2,678 | $223 |

| 2020 Chevrolet Corvette | $2,584 | $215 |

| 2019 Chevrolet Corvette | $2,718 | $227 |

| 2018 Chevrolet Corvette | $2,462 | $205 |

| 2017 Chevrolet Corvette | $2,358 | $197 |

| 2016 Chevrolet Corvette | $2,372 | $198 |

| 2015 Chevrolet Corvette | $2,184 | $182 |

| 2014 Chevrolet Corvette | $1,630 | $136 |

| 2013 Chevrolet Corvette | $1,778 | $148 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Corvette trim levels for each model year. Updated October 24, 2025

Sooner or later, it will probably be a good financial move to drop comprehensive and/or collision coverage from the insurance policy. As vehicles get older and lose value, the cost of having physical damage protection begins to exceed the benefit of having it on the policy.

Deleting physical damage coverage on an older Chevrolet Corvette could save around $1,370 annually, depending on the policy deductibles and the age of the rated driver.

Another option for reducing the cost of insurance is to look at purchasing Corvette classic car insurance rather than a standard policy. If your miles are low enough, and the car is over 20 years old, it may qualify for cheaper coverage.

How to find the best insurance for a Corvette

Corvette owners are particular, not only with their cars but also with their car insurance.

So how do you find the best Corvette insurance? That just depends on what you prioritize as most important for your coverage.

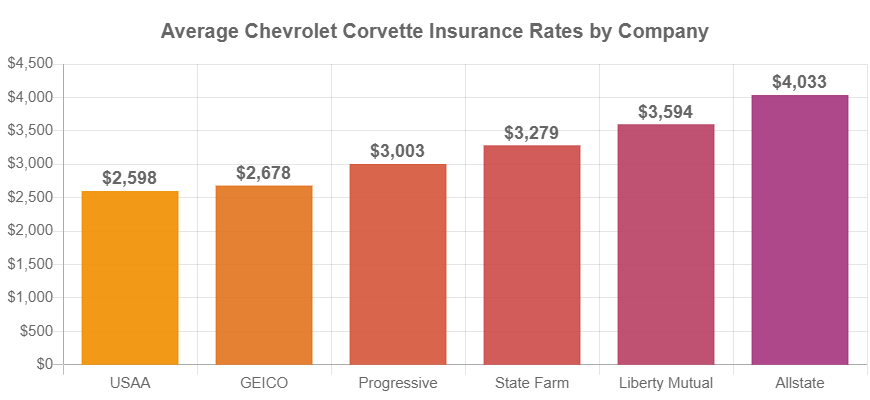

If price is your top priority, see the chart below that shows the larger U.S. car insurance companies that have come of the best Corvette insurance rates. USAA, GEICO, and Progressive ranked as the companies with the cheapest average rates.

How a company handles and settles claims is often a top priority for people who value their cars. A recent claims satisfaction study performed by J.D. Power has Allstate, Farmers, and State Farm as the top large U.S. insurance companies for claims satisfaction.

Top five large U.S. car insurance companies with above-average claims satisfaction

- Allstate

- Farmers Insurance

- State Farm

- American Family

- GEICO

Smaller companies like Amica Mutual, Erie Insurance, and AAA of California fared even better than those five, but they only sell car insurance in specific regions or states rather than nationwide.

And not every company ranks above average.

Five large U.S. car insurance companies with below-average claims satisfaction

- Liberty Mutual

- The Hartford

- Nationwide

- Progressive

- Travelers

Other smaller companies ranking below average included Auto-Owners Insurance, Safeco, National General, Mercury, and Kemper.

Just because a company ranked below average doesn’t mean you will have a bad experience if you file a claim, however. And conversely, don’t expect a flawless experience with companies who rank above average.

The chart below shows estimated car insurance rates for a 2024 Corvette for some of the larger car insurance companies in the U.S.

In this comparison, USAA tended to have the best Corvette insurance rates out of the other large insurers. The average USAA rate on a 2024 Chevy Corvette was $2,598 per year.

One caveat about USAA, however, is that unless you’re active military, a veteran, or a family member, you can’t buy car insurance from them. And that’s a real bummer because USAA often has very competitive car insurance rates.

GEICO ranked a close second at $2,678 per year, with Progressive coming in third at $3,003.

State Farm, Liberty Mutual, and Allstate rounded out the comparison with average rates of $3,279, $3,594, and $4,033 per year, respectively.

It’s recommended you compare rates between at least five different car insurance companies in order to find an affordable price. Include smaller regional or mutual companies as well as large nationwide carriers.

Despite each company’s different rates, we highly recommend you get a free car insurance quote from the majority of them, even the more expensive companies. Why? Because as we discussed earlier in this article, there are a lot of variables that affect the rate you pay.

Where you live can cause a major rate shuffle, with some companies giving preferential rates based on your address and Zip Code.

And the only way to know which insurance company is best for Corvette insurance is to get quotes based on the exact model of your Corvette, your age, your location, and the coverages you need. In addition, compare apples-to-apples insurance quotes in order to have a level playing field to find the best rates.