- Mercedes C63 AMG insurance rates cost $2,644 per year on average, or about $220 per month, for a policy with full coverage.

- The cheapest C63 AMG insurance is on the base Coupe model, costing an average of $2,524 per year, or $210 per month.

- The model with the most expensive insurance is the S Sedan at $2,788 per year, or around $232 per month.

- When compared to other 2018 large luxury cars, the Mercedes-Benz C63 AMG is one of the cheaper large luxury cars to insure, costing $207 less per year on average.

How much does Mercedes C63 AMG insurance cost?

Mercedes-Benz C63 AMG insurance costs an average of $2,644 per year, which is equal to $220 a month. Collision coverage costs around $1,346 a year, liability and medical payments insurance will cost about $636, and the remaining comprehensive will cost around $662.

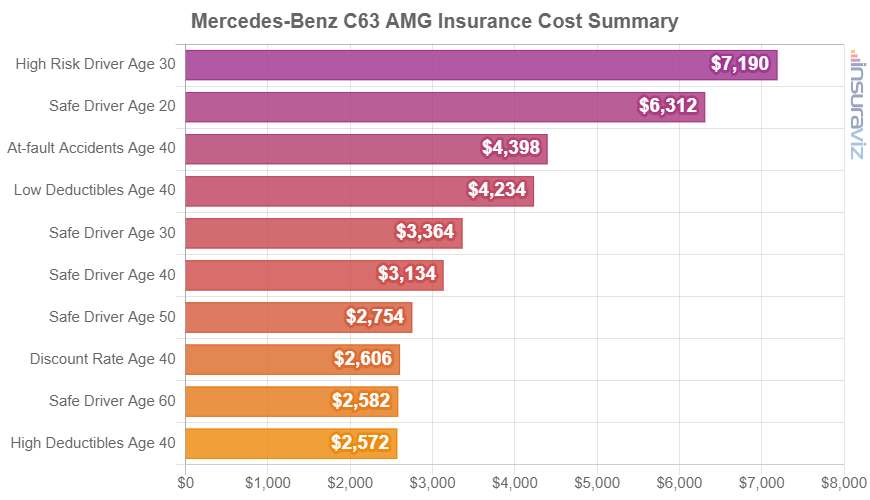

The following rate chart breaks down average annual car insurance cost for a 2018 Mercedes-Benz C63 AMG for different driver age groups and scenarios.

The next table displays the average cost for annual and 6-month car insurance policies for each Mercedes-Benz C63 AMG trim level.

| 2018 Mercedes-Benz C63 AMG Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Coupe | $2,524 | $210 |

| Convertible | $2,564 | $214 |

| S Convertible | $2,638 | $220 |

| S Coupe | $2,638 | $220 |

| Sedan | $2,732 | $228 |

| S Sedan | $2,788 | $232 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

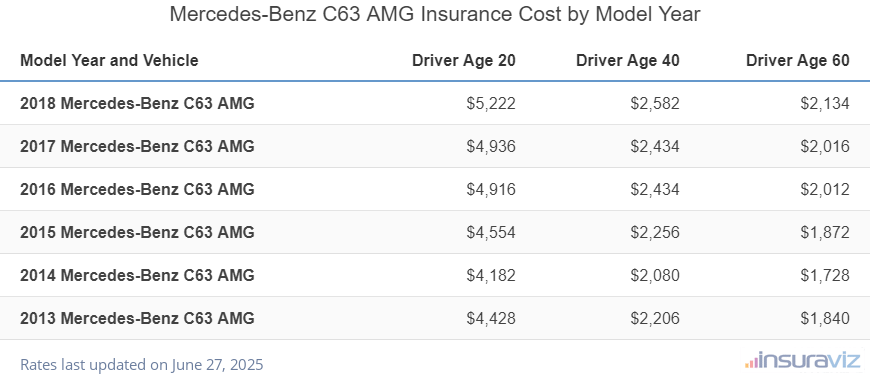

The data table below shows average car insurance rates for a Mercedes-Benz C63 AMG for the 2013 to 2018 model years.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2018 Mercedes-Benz C63 AMG | $5,350 | $2,644 | $2,186 |

| 2017 Mercedes-Benz C63 AMG | $5,054 | $2,492 | $2,064 |

| 2016 Mercedes-Benz C63 AMG | $5,036 | $2,492 | $2,062 |

| 2015 Mercedes-Benz C63 AMG | $4,664 | $2,312 | $1,918 |

| 2014 Mercedes-Benz C63 AMG | $4,284 | $2,132 | $1,772 |

| 2013 Mercedes-Benz C63 AMG | $4,538 | $2,264 | $1,882 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mercedes-Benz C63 AMG trim levels for each model year. Updated October 24, 2025

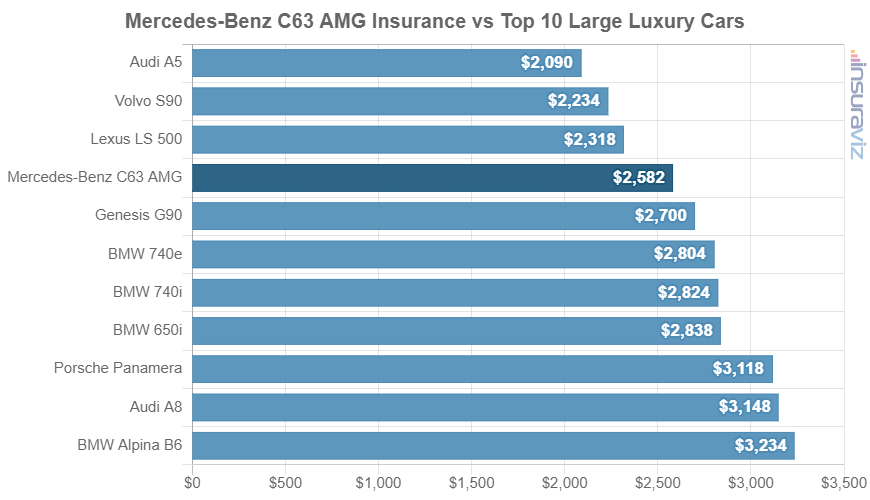

How does Mercedes Benz C63 AMG insurance cost compare?

When compared directly to some other models in the large luxury car category, car insurance prices for a Mercedes-Benz C63 AMG cost $504 more per year than the Audi A5, $248 less than the BMW 740i, and $462 more than the Cadillac XTS.

The C63 AMG ranks 14th out of 36 total comparison vehicles in the 2018 large luxury car category for most affordable car insurance prices. The C63 AMG costs an average of $2,644 per year to insure, while the class average is $2,851 annually, a savings of $207 per year.

The next chart shows how C63 AMG insurance compares to other luxury models like the Cadillac CT6, Lincoln Continental, and the Porsche Panamera. We also included a more comprehensive table after the chart detailing insurance cost rankings for every vehicle in the 2018 large luxury car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Lincoln Continental | $1,996 | -$648 |

| 2 | Cadillac CTS | $2,060 | -$584 |

| 3 | Audi A5 | $2,140 | -$504 |

| 4 | Cadillac XTS | $2,182 | -$462 |

| 5 | Cadillac CT6 | $2,206 | -$438 |

| 6 | Volvo S90 | $2,288 | -$356 |

| 7 | Lexus LS 500 | $2,374 | -$270 |

| 8 | Infiniti Q70 | $2,382 | -$262 |

| 9 | Acura RLX | $2,420 | -$224 |

| 10 | Lexus LS 500H | $2,466 | -$178 |

| 11 | Mercedes-Benz CLS550 | $2,524 | -$120 |

| 12 | Lexus GS 450 | $2,548 | -$96 |

| 13 | Infiniti Q60 | $2,596 | -$48 |

| 14 | Mercedes-Benz C63 AMG | $2,644 | -- |

| 15 | Cadillac CTS-V | $2,718 | $74 |

| 16 | Mercedes-Benz S450 | $2,748 | $104 |

| 17 | Jaguar XJ | $2,758 | $114 |

| 18 | Genesis G90 | $2,766 | $122 |

| 19 | BMW 740e | $2,872 | $228 |

| 20 | BMW 740i | $2,892 | $248 |

| 21 | Mercedes-Benz S560 | $2,902 | $258 |

| 22 | BMW 650i | $2,908 | $264 |

| 23 | Audi RS 7 | $3,012 | $368 |

| 24 | Mercedes-Benz E63 AMG | $3,092 | $448 |

| 25 | Mercedes-Benz CLS63 AMG | $3,120 | $476 |

| 26 | BMW 750i | $3,128 | $484 |

| 27 | Maserati Ghibli | $3,134 | $490 |

| 28 | Porsche Panamera | $3,196 | $552 |

| 29 | Audi A8 | $3,224 | $580 |

| 30 | BMW Alpina B6 | $3,312 | $668 |

| 31 | Maserati Quattroporte | $3,328 | $684 |

| 32 | Audi S8 | $3,426 | $782 |

| 33 | Mercedes-Benz AMG | $3,452 | $808 |

| 34 | Mercedes-Benz AMG S63 | $3,522 | $878 |

| 35 | BMW M760i | $3,758 | $1,114 |

| 36 | Mercedes-Benz S65 AMG | $4,538 | $1,894 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2018 model year. Updated October 24, 2025

Additional rates and policy discounts

Some other rates and discounts to watch for on your next policy are detailed below.

- As driver age increases, insurance rates tend to go down. The difference in 2018 Mercedes-Benz C63 AMG insurance rates between a 60-year-old driver ($2,186 per year) and a 30-year-old driver ($2,834 per year) is $648, or a savings of 25.8%.

- Policy discounts save money. Discounts may be available if the policyholders drive low annual mileage, take a defensive driving course, are good students, are senior citizens, or many other discounts which could save the average driver as much as $446 per year.

- Safe drivers have lower car insurance rates. At-fault accidents raise insurance rates, potentially as much as $1,274 per year for a 30-year-old driver and even as much as $622 per year for a 60-year-old driver.

- Raising deductibles makes insurance more affordable. Increasing your deductibles from $500 to $1,000 could save around $454 per year for a 40-year-old driver and $898 per year for a 20-year-old driver.

- Decreasing deductibles costs more money. Decreasing your policy deductibles from $500 to $250 could cost an additional $478 per year for a 40-year-old driver and $952 per year for a 20-year-old driver.

- Your choice of occupation could save you a few bucks. Many car insurance providers offer discounts for being employed in occupations like firefighters, accountants, lawyers, members of the military, doctors, emergency medical technicians, and others. If you’re employed in a qualifying profession, you may save between $79 and $195 on your annual C63 AMG insurance bill, depending on your age.

- Young males pay a lot more for insurance. For a 2018 Mercedes C63 AMG, a 20-year-old man pays an average price of $5,350 per year, while a 20-year-old female driver will pay an average of $3,820, a difference of $1,530 per year in the women’s favor by a large margin. But by age 50, the rate for men is $2,332 and the cost for female drivers is $2,280, a difference of only $52.

- Bring up your credit score to save money. Having an excellent credit rating above 800 could save up to $415 per year versus a good credit rating of 670-739. Conversely, a mediocre credit rating could cost up to $481 more per year.