- Mercedes-Benz GLC350E insurance costs an average of $1,876 per year, or around $156 per month.

- The Mercedes-Benz GLC350E is one of the more expensive small luxury SUVs to insure, costing $95 more per year on average as compared to the rest of the vehicles in the segment.

How much does Mercedes GLC350E insurance cost?

Mercedes-Benz GLC350E insurance costs an average of $1,876 annually, or about $156 if paid each month. On average, expect to pay about $95 more each year to insure a Mercedes-Benz GLC350E compared to the average rate for other compact luxury SUVs, and $7 less per year than the overall national average of $1,883.

The chart below illustrates average yearly insurance rates on a 2020 Mercedes GLC350E using a range of driver ages, deductible levels, and risk profiles.

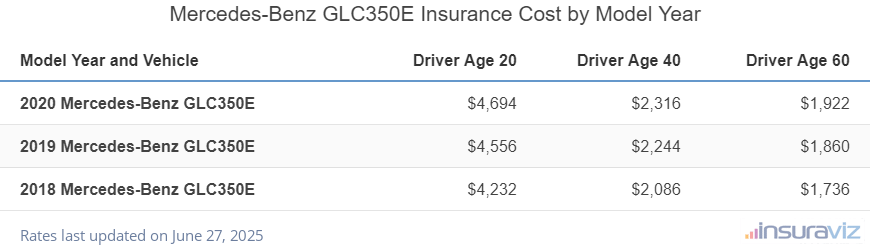

The data table below details the average insurance policy premiums for a Mercedes-Benz GLC350E from 2018 to 2020 and for different driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2020 Mercedes-Benz GLC350E | $3,806 | $1,876 | $1,556 |

| 2019 Mercedes-Benz GLC350E | $3,694 | $1,816 | $1,508 |

| 2018 Mercedes-Benz GLC350E | $3,430 | $1,692 | $1,406 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mercedes-Benz GLC350E trim levels for each model year. Updated February 22, 2024

Some other noteworthy observations as they relate to Mercedes-Benz GLC350E insurance cost include:

- Car insurance for high-risk drivers is expensive. For a 30-year-old driver, the requirement to buy a high-risk policy could increase the cost by $2,336 or more per year.

- As you get older, rates tend to drop. The difference in insurance rates for a Mercedes-Benz GLC350E between a 60-year-old driver ($1,556 per year) and a 20-year-old driver ($3,806 per year) is $2,250, or a savings of 83.9%.

- Avoid driving violations to reduce rates. If you want to pay the cheapest possible GLC350E insurance rates, it pays to follow traffic laws. Not surprisingly, just a couple of minor driving infractions have the ramification of spiking insurance policy rates by as much as $506 per year. Major convictions like driving under the influence of drugs or alcohol could raise rates by an additional $1,764 or more.

- Clean up your credit to lower your rates. Having excellent credit of 800+ may save up to $295 per year over a decent credit rating of 670-739. Conversely, a poor credit score could cost up to $341 more per year.

- Your choice of occupation could reduce your rates. Many auto insurance companies offer policy discounts for being employed in occupations like emergency medical technicians, scientists, dentists, college professors, doctors, members of the military, and others. By qualifying for this discount, you could potentially save between $56 and $170 on your annual car insurance bill, subject to policy limits.

- The cost to insure teen drivers is expensive. Average rates for full coverage GLC350E insurance costs $6,757 per year for a 16-year-old driver, $6,546 per year for a 17-year-old driver, $5,864 per year for an 18-year-old driver, and $5,333 per year for a 19-year-old driver.

How does Mercedes GLC350E insurance rank?

The Mercedes-Benz GLC350E ranks 17th out of 25 total vehicles in the small luxury SUV category for most affordable car insurance cost. The GLC350E costs an average of $1,876 per year to insure, while the class average policy cost is $1,781 annually, a difference of $95 per year.

When compared to other 2020 model year small luxury SUVs, car insurance rates for a Mercedes-Benz GLC350E cost $176 more per year than the Lexus NX 300, $172 more than the Mercedes-Benz GLC300, and $24 less than the BMW X3.

The chart displayed below shows how average GLC350E car insurance rates compare to the top 10 most popular small luxury SUVs like the Acura RDX, Audi Q5, and the Volvo XC60. We also added a more comprehensive rate table after the chart displaying average rates for every vehicle in the small luxury SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura RDX | $1,404 | -$472 |

| 2 | Cadillac XT4 | $1,450 | -$426 |

| 3 | Volvo XC40 | $1,482 | -$394 |

| 4 | Lincoln Corsair | $1,634 | -$242 |

| 5 | Lexus UX 250h | $1,648 | -$228 |

| 6 | Volvo XC60 | $1,664 | -$212 |

| 7 | Mercedes-Benz GLB 250 | $1,688 | -$188 |

| 8 | BMW X1 | $1,692 | -$184 |

| 9 | Lexus UX 200 | $1,692 | -$184 |

| 10 | Lexus NX 300 | $1,700 | -$176 |

| 11 | Mercedes-Benz GLC300 | $1,704 | -$172 |

| 12 | Mercedes-Benz GLA250 | $1,766 | -$110 |

| 13 | Land Rover Evoque | $1,768 | -$108 |

| 14 | BMW X2 | $1,802 | -$74 |

| 15 | Audi Q3 | $1,846 | -$30 |

| 16 | Audi Q5 | $1,854 | -$22 |

| 17 | Mercedes-Benz GLC350E | $1,876 | -- |

| 18 | BMW X3 | $1,900 | $24 |

| 19 | Lexus NX 300H | $1,912 | $36 |

| 20 | Mercedes-Benz GLA45 AMG | $1,936 | $60 |

| 21 | Alfa Romeo Stelvio | $1,950 | $74 |

| 22 | BMW X4 | $1,980 | $104 |

| 23 | Jaguar F-Pace | $2,004 | $128 |

| 24 | Jaguar I-Pace | $2,062 | $186 |

| 25 | Porsche Macan | $2,110 | $234 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2020 model year. Updated February 23, 2024