- BMW X1 car insurance costs $1,958 per year ($163 per month) on average for a full coverage policy.

- The X1 xDrive28i trim level is the cheapest to insure at around $1,882 per year. The most expensive trim is the xDrive M35i at $2,044 per year.

- Out of 38 vehicles in the 2024 small luxury SUV segment, the X1 ranks 17th for insurance affordability.

- Insurance for the X1 costs 5% less than the average rate for similar luxury SUV models.

How much does BMW X1 insurance cost?

BMW X1 car insurance averages around $1,958 a year for full coverage, or about $163 a month. With the average small luxury SUV costing $2,058 a year to insure, the BMW X1 costs around $100 less each year.

The chart below breaks down average insurance cost on a 2024 BMW X1 using a variation of different driver ages and risk scenarios.

Which X1 model has the cheapest insurance rates?

The cheapest BMW X1 to insure is the $40,500 base xDrive28i trim at $1,882 per year, or about $157 per month. The most expensive model to insure is the $49,900 xDrive M35i model, costing an average of $162 more per year.

The rate table below breaks down average car insurance rates, plus a monthly budget estimate, for each BMW X1 trim level for the 2024 model year.

| 2024 BMW X1 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| xDrive28i | $1,882 | $157 |

| xDrive28i Technology | $1,948 | $162 |

| xDrive28i Premium | $1,960 | $163 |

| xDrive M35i | $2,044 | $170 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

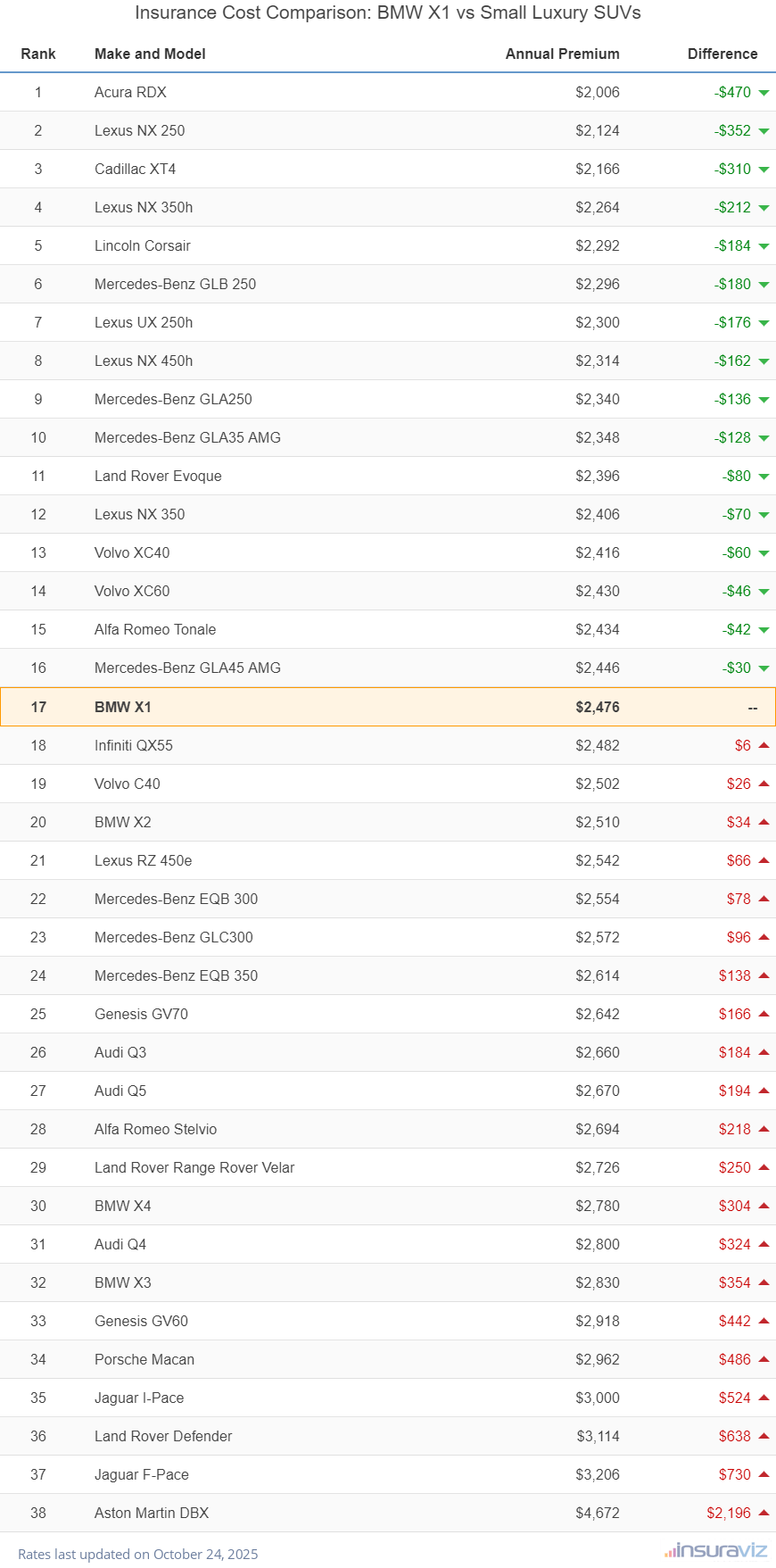

BMW X1 car insurance cost: Where does it rank?

BMW X1 insurance cost ranks 17th out of 38 vehicles in the 2024 small luxury SUV class. The X1 costs $100 less per year (or 5%) than the average rate for comparable luxury models.

The X1 costs an average of $1,958 per year to insure for full coverage and the average for all comparable small luxury SUVs is $2,058 per year.

When X1 insurance rates are compared to the most popular models in the small luxury SUV segment, insurance for a BMW X1 costs $54 more per year than the Lexus NX 350, $76 less than the Mercedes-Benz GLC300, $280 less than the BMW X3, and $372 more than the Acura RDX.

The table below shows how well BMW X1 car insurance rates fare against the rest of the small luxury SUV market.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura RDX | $1,586 | -$372 |

| 2 | Lexus NX 250 | $1,680 | -$278 |

| 3 | Cadillac XT4 | $1,712 | -$246 |

| 4 | Lexus NX 350h | $1,790 | -$168 |

| 5 | Lincoln Corsair | $1,814 | -$144 |

| 6 | Mercedes-Benz GLB 250 | $1,816 | -$142 |

| 7 | Lexus UX 250h | $1,818 | -$140 |

| 8 | Lexus NX 450h | $1,830 | -$128 |

| 9 | Mercedes-Benz GLA250 | $1,844 | -$114 |

| 10 | Mercedes-Benz GLA35 AMG | $1,856 | -$102 |

| 11 | Land Rover Evoque | $1,894 | -$64 |

| 12 | Lexus NX 350 | $1,904 | -$54 |

| 13 | Volvo XC40 | $1,910 | -$48 |

| 14 | Volvo XC60 | $1,920 | -$38 |

| 15 | Alfa Romeo Tonale | $1,926 | -$32 |

| 16 | Mercedes-Benz GLA45 AMG | $1,936 | -$22 |

| 17 | BMW X1 | $1,958 | -- |

| 18 | Infiniti QX55 | $1,964 | $6 |

| 19 | Volvo C40 | $1,978 | $20 |

| 20 | BMW X2 | $1,986 | $28 |

| 21 | Lexus RZ 450e | $2,008 | $50 |

| 22 | Mercedes-Benz EQB 300 | $2,018 | $60 |

| 23 | Mercedes-Benz GLC300 | $2,034 | $76 |

| 24 | Mercedes-Benz EQB 350 | $2,066 | $108 |

| 25 | Genesis GV70 | $2,092 | $134 |

| 26 | Audi Q3 | $2,102 | $144 |

| 27 | Audi Q5 | $2,110 | $152 |

| 28 | Alfa Romeo Stelvio | $2,130 | $172 |

| 29 | Land Rover Range Rover Velar | $2,156 | $198 |

| 30 | BMW X4 | $2,198 | $240 |

| 31 | Audi Q4 | $2,216 | $258 |

| 32 | BMW X3 | $2,238 | $280 |

| 33 | Genesis GV60 | $2,308 | $350 |

| 34 | Porsche Macan | $2,342 | $384 |

| 35 | Jaguar I-Pace | $2,370 | $412 |

| 36 | Land Rover Defender | $2,464 | $506 |

| 37 | Jaguar F-Pace | $2,536 | $578 |

| 38 | Aston Martin DBX | $3,696 | $1,738 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated February 22, 2024

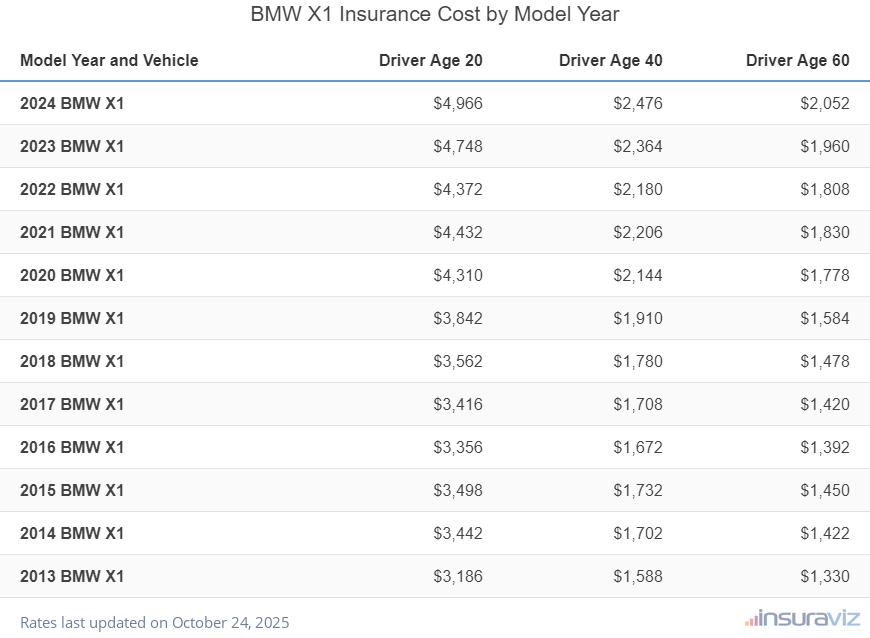

How much does a used BMW X1 cost to insure?

Choosing to drive a 2013 BMW X1 instead of a new 2024 model year may save up to $700 annually. Even insuring a 2018 model could save $552 on a yearly basis.

The following table illustrates the range of BMW X1 car insurance prices for different driver age groups and model years. Insurance costs range from the best rate of $1,054 for a 60-year-old driver rated on a 2013 BMW X1 to a high of $3,928 for a 20-year-old with a 2024 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 BMW X1 | $3,928 | $1,958 | $1,624 |

| 2023 BMW X1 | $3,756 | $1,872 | $1,554 |

| 2022 BMW X1 | $3,458 | $1,724 | $1,430 |

| 2021 BMW X1 | $3,506 | $1,746 | $1,446 |

| 2020 BMW X1 | $3,400 | $1,692 | $1,402 |

| 2019 BMW X1 | $3,040 | $1,512 | $1,252 |

| 2018 BMW X1 | $2,818 | $1,406 | $1,170 |

| 2017 BMW X1 | $2,702 | $1,350 | $1,122 |

| 2016 BMW X1 | $2,652 | $1,324 | $1,100 |

| 2015 BMW X1 | $2,766 | $1,372 | $1,146 |

| 2014 BMW X1 | $2,722 | $1,346 | $1,126 |

| 2013 BMW X1 | $2,520 | $1,258 | $1,054 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW X1 trim levels for each model year. Updated February 23, 2024

Additional Rates and Insights

Key additional insights when insuring a BMW X1, along with possible discounts are as follows:

- X1 insurance is expensive for high-risk drivers. For a 20-year-old driver, having too many accidents or violations can cause a rate increase of $3,062 or more per year.

- As you age, insurance rates get cheaper. The difference in 2024 X1 insurance cost between a 60-year-old driver ($1,624 per year) and a 30-year-old driver ($2,092 per year) is $468, or a savings of 25.2%.

- Get better rates due to your job. Just about all auto insurance providers offer policy discounts for occupations like lawyers, nurses, doctors, engineers, architects, and other occupations. By qualifying for this profession discount, you may save between $59 and $185 on your car insurance bill, depending on the age of the driver.

- Young male drivers pay the highest rates. For a 2024 BMW X1, a 20-year-old male driver pays an average price of $3,928 per year, while a 20-year-old woman will pay $2,828, a difference of $1,100 per year in the women’s favor by a large margin. But by age 50, male driver rates are $1,736 and rates for female drivers are $1,694, a difference of only $42.

- The cost to insure teenage drivers is high. Average rates for full coverage X1 insurance costs $6,943 per year for a 16-year-old driver, $6,723 per year for a 17-year-old driver, and $6,024 per year for an 18-year-old driver.

- Avoiding accidents saves money. Too frequent at-fault accidents can raise rates, as much as $942 per year for a 30-year-old driver and even $588 per year for a 50-year-old driver.

- Excellent credit equals excellent rates. Drivers who maintain a credit score over 800 could save as much as $307 per year when compared to a slightly lower credit rating between 670-739. Conversely, poor credit could cost as much as $356 more per year.