The Toyota Highlander is a popular midsize SUV for good reason. Toyota reliability is well known and the Highlander is a very safe vehicle.

But how much will it cost to insure a 2019 Highlander? We’re glad you asked!

First, we will show you how Highlander insurance rates compare to the rest of the midsize sports utility vehicle segment, then we will go into detail on what you can expect when insuring yours.

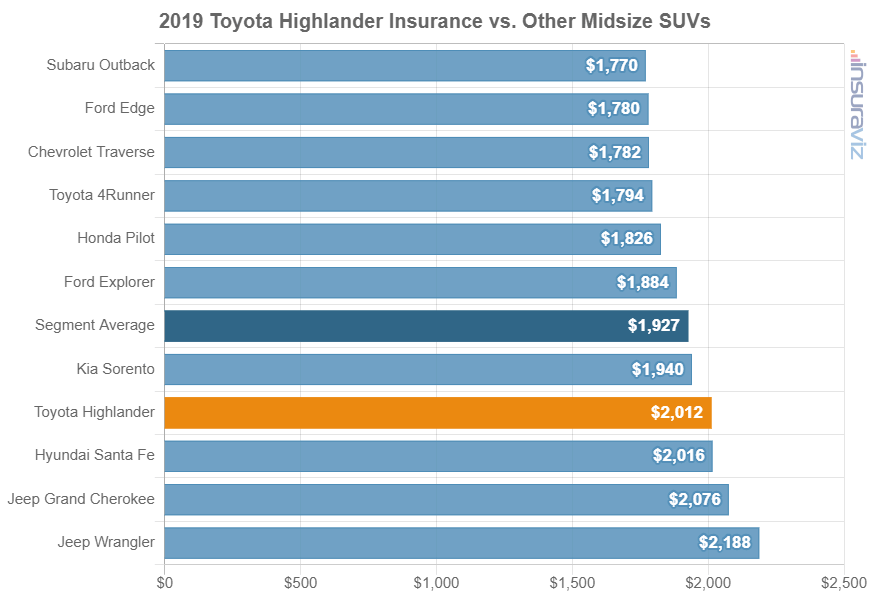

The 2019 Highlander is not the best choice if you’re looking for dirt cheap auto insurance, as it’s one of the more expensive models to insure when compared to all other 2019 model year midsize SUVs.

It ranks below average in our same-class comparison, at 17th place out of 24 total vehicles in the 2019 midsize SUV segment.

The next chart examines how the Highlander compares to other popular 2019 model year midsize SUVs. The average rate for a Toyota Highlander is shown in orange and the average rate for the segment is displayed in dark blue.

To see the full comparison of all 24 models in the 2019 midsize SUV segment, click or tap the middle button in the lower-left corner of the chart. To get insurance quotes for your Toyota Highlander, enter your Zip Code in the field above and click the GO button.

If you can afford to pay your entire 2019 Highlander insurance bill at once, rather than in monthly payments, you could save anywhere from $82 to $163 per year, depending on the company.

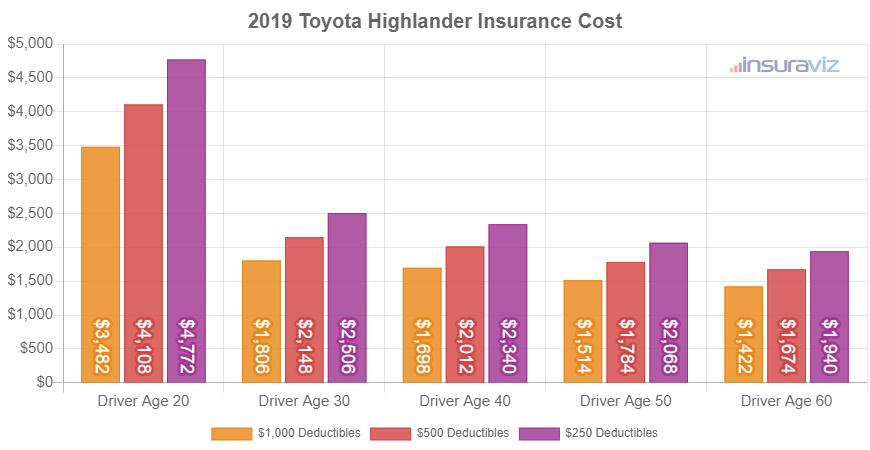

As shown in the chart above, the average driver can expect to pay somewhere around $1,632 a year for full coverage to insure a 2019 Toyota Highlander.

The average cost assumes a forty-year-old driver, a clean driving record, and $500 deductibles. Driver age and the deductible amount are two critical rating factors that can significantly change the cost of insurance on a Highlander.

The chart below demonstrates how these two important factors can impact the price of Highlander insurance.

As shown above, you can see that for the average middle-aged driver, choosing the lower $250 policy deductible over the $1,000 deductible can cost $522 more per year ($1,376 versus $1,898).

The cost difference gets even larger for drivers in younger age groups. If the driver is closer to twenty, the extra cost for the $250 deductible policy is $1,044 per year ($2,822 versus $3,866).

There are some car insurance companies that sell policies with even lower deductibles than $250. It’s not shown on the chart, but insurance on a 2019 Highlander with $100 deductibles would cost around $756 more per year than a $1,000 deductible for a forty-year-old driver, and $1,544 per year more for a twenty-year-old.

The difference in prices in the example proves why you really need to compare apples-to-apples price quotes, mainly due to the significant price differences that seemingly minor discrepancies in policy coverages can cause.

Make sure you compare identical coverages when shopping your coverage around. Identical policy deductibles, liability limits, and optional coverages help ensure you find the best deal.

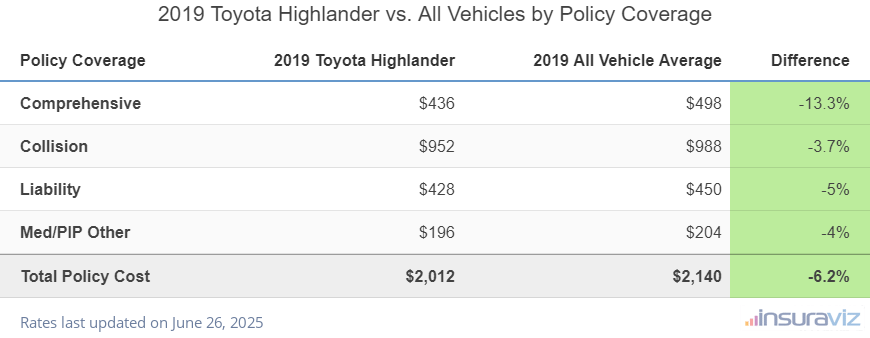

This next table goes into even more detail by showing how each individual coverage on the 2019 Highlander compares to the average for all 2019 models.

| Policy Coverage | 2019 Toyota Highlander | 2019 All Vehicle Average | Difference |

|---|---|---|---|

| Comprehensive | $354 | $404 | -13.2% |

| Collision | $772 | $800 | -3.6% |

| Liability | $348 | $364 | -4.5% |

| Med/PIP Other | $158 | $166 | -4.9% |

| Total Policy Cost | $1,632 | $1,734 | -6.1% |

Lower than average cost Higher than average cost

Data Methodology: Rated driver is a 40-year-old male with no driving violations or at-fault accidents in the prior three years. Coverage premiums are averaged for all trim levels available for the 2019 Toyota Highlander. Updated February 23, 2024

To interpret this table, green values in the ‘Difference’ column indicate that the 2019 Highlander has more favorable rates than the average for all vehicles. Overall, the cost of Highlander insurance is 6.1% less than the average cost for all 2019 models combined.

The cheapest 2019 Toyota Highlander insurance

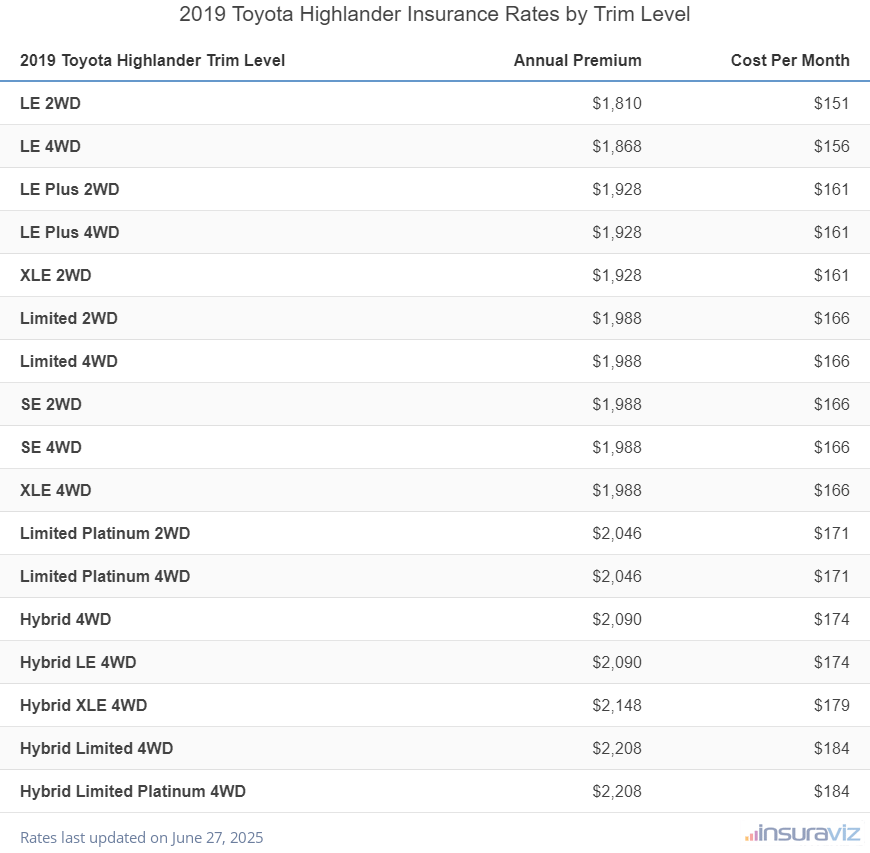

The prices analyzed to this point in the article take each different Highlander trim level and combine them into one price for simplicity’s sake.

But the exact trim level of the vehicle is one of many things that have a pretty big effect in determining the amount you pay to insure a 2019 Toyota Highlander.

More often than not, as the price of the vehicle goes up, the more it will also cost to insure, and the 2019 Highlander is no exception.

The 2019 Highlander trim with the overall cheapest insurance is the base LE 2WD trim, with an average rate of $1,466 per year.

The most expensive trim level to insure is the Hybrid Limited Platinum 4WD at $1,788 per year. The cost difference between those two trims is $322, which is pretty significant.

Because of this possible trim level price difference, it’s important to get quotes for the exact model you own or are thinking about purchasing.

The following table illustrates insurance prices for all 2019 Toyota Highlander models. Rates are included for both annual and semi-annual insurance policies, as well as a monthly budgeting amount.

| 2019 Toyota Highlander Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LE 2WD | $1,466 | $122 |

| LE 4WD | $1,514 | $126 |

| LE Plus 2WD | $1,562 | $130 |

| LE Plus 4WD | $1,562 | $130 |

| XLE 2WD | $1,562 | $130 |

| Limited 2WD | $1,610 | $134 |

| Limited 4WD | $1,610 | $134 |

| SE 2WD | $1,610 | $134 |

| SE 4WD | $1,610 | $134 |

| XLE 4WD | $1,610 | $134 |

| Limited Platinum 2WD | $1,658 | $138 |

| Limited Platinum 4WD | $1,658 | $138 |

| Hybrid 4WD | $1,692 | $141 |

| Hybrid LE 4WD | $1,692 | $141 |

| Hybrid XLE 4WD | $1,740 | $145 |

| Hybrid Limited 4WD | $1,788 | $149 |

| Hybrid Limited Platinum 4WD | $1,788 | $149 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

How can bad credit impact Highlander insurance?

If you live in a state that allows insurance companies to use your credit score as a factor in determining your car insurance rate, then having poor credit can significantly hurt your chances of finding cheap coverage.

Even a lack of credit can hurt you in some states. Not all states allow insurers to penalize you for not having a credit history, however.

The table below shows how different credit scores can potentially impact the cost you pay to insure your 2019 Highlander.

| Credit Rating | Age 20 | Age 40 | Age 60 |

|---|---|---|---|

| Excellent (800+) | $2,806 | $1,376 | $1,143 |

| Very Good (740-799) | $3,065 | $1,503 | $1,249 |

| Good (670-739) | $3,328 | $1,632 | $1,356 |

| Fair (580-669) | $3,850 | $1,888 | $1,569 |

| Poor (300-579) | $4,889 | $2,397 | $1,992 |

Data Methodology: Rated drivers have no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all 2019 Toyota Highlander trim levels. Updated February 23, 2024

The Fair Credit Reporting Act (FCRA) requires each of the nationwide consumer reporting companies, Equifax, Experian, and TransUnion, to provide you with a free copy of your credit report, at your request, once per year. For more information, go to the Federal Trade Commission’s website on credit.

How much can you save with policy discounts?

Discounts are one of the best ways to score cheaper car insurance for your Highlander. But often, drivers are not aware of potential discounts and they miss out on the savings.

Every car insurer has a slightly different set of discounts, so don’t assume every discount shown below is offered by your company. Simply inquire with your agent or company and have them run through their discounts to see if you qualify.

The table below breaks out the top 10 discounts by average savings when insuring a 2019 Toyota Highlander, and some of the companies that offer them.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $228 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $180 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $152 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $129 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $122 |

| Military Savings of 5% to 15% | Alfa, American Family, Direct General, Farmers, GEICO, Liberty Mutual, Shelter, USAA | $114 |

| Pay in Full Savings of 5% to 10% | Allstate, Nationwide, Progressive, State Farm, Travelers | $103 |

| Multiple Vehicles Savings of 4% to 15% | Allstate, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Progressive, Travelers, USAA | $98 |

| Student Away at School Savings of 4% to 25% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $95 |

| Good Student Savings of 3% to 20% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $85 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated February 23, 2024

Additional smaller discounts include things like having driver education that can save around $82, being a homeowner can save an average of $65, occupational discounts can save around $62, and a customer loyalty discount could save $49.

One thing to point out is that you can’t necessarily stack all the discounts together to get a free policy. Each company has a limit at which discounts max out, so we’re sorry we had to burst that bubble.

In 1896, a London resident was the first driver to receive a speeding ticket. He was going eight miles an hour and was pulled over by an officer on a bicycle.

Five ways to get cheaper 2019 Toyota Highlander insurance

Nobody wants to pay more than absolutely necessary to insure their vehicles. Good insurance does not have to cost an arm and a leg (unless you’re a high-risk driver, but that’s on you).

The list below shows some things you can do to potentially cut the cost of your Highlander policy.

- Remove unneeded coverage on older vehicles. Removing physical damage coverage from vehicles that are older can lead to significant savings. Just make sure you can financially cover the cost of the vehicle to replace it if it gets totaled.

- Shop around often. Setting aside 5-10 minutes to get free car insurance quotes could save a pile of cash. Companies change rates often and switching companies is very easy to do. We recommend shopping around once a year to ensure you’re not overpaying.

- Remain claim free. Auto insurance companies offer a significant discount if you can remain claim-free. Insurance is intended to be used for larger losses, so don’t use it as your piggy bank or you’ll end up paying more in the end.

- Compare car insurance quotes before buying a car. Different cars can have very different insurance premiums, and car insurance companies can charge very different rates. Check prices before you buy a new vehicle so you can avoid price shock when you see your first bill.

- Do you really need a $100 deductible? If it makes you sleep better at night knowing you’ll only have to pay $100 out-of-pocket at claim time, then by all means go with a low deductible. But for the majority of drivers, a higher deductible works just fine and ends up saving money in the end.