- BMW 650i insurance costs an average of $3,074 per year for a full coverage policy, but can vary based on the vehicle trim level.

- The cheapest BMW 650i insurance is on the Gran Coupe trim at $3,046 per year.

- The 650i Gran Coupe xDrive has the most expensive insurance rates at $3,106 per year.

- Out of 31 competing large luxury cars for 2019, the 650i ranks 21st for insurance cost.

How much does BMW 650i insurance cost?

Ranked 21st out of 31 vehicles in the large luxury car class, BMW 650i insurance rates are approximately $3,074 yearly, or $256 each month. With the average large luxury car costing $3,053 a year to insure, the BMW 650i would cost around $21 or more annually.

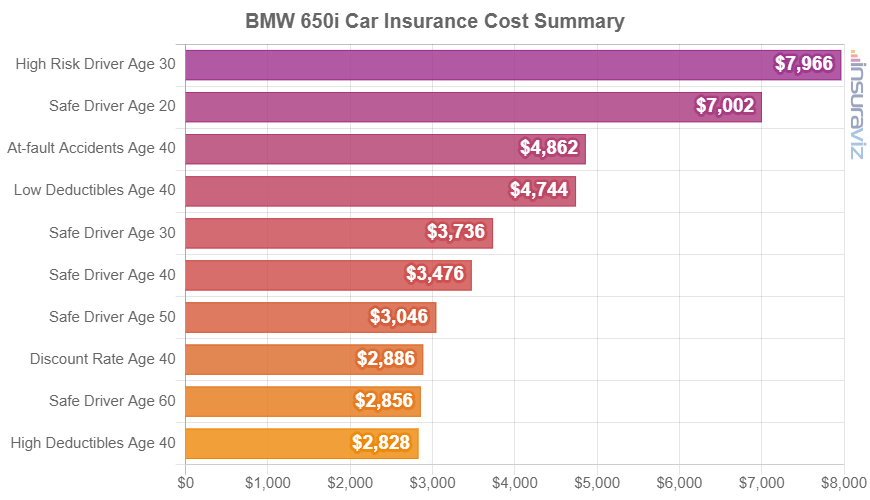

The bar chart below breaks down average car insurance rates for a 2019 BMW 650i with a variety of different driver ages and risk profiles.

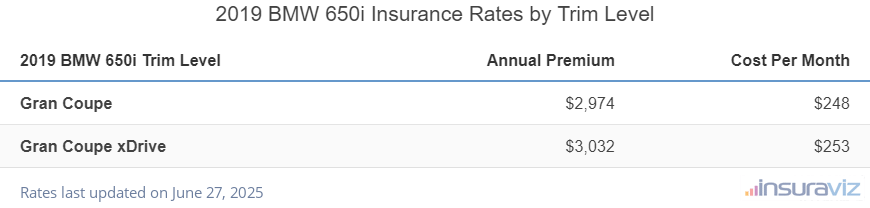

The table below shows annual and 6-month car insurance policy costs, including a monthly budget figure, for each BMW 650i model and trim level.

| 2019 BMW 650i Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Gran Coupe | $3,046 | $254 |

| Gran Coupe xDrive | $3,106 | $259 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

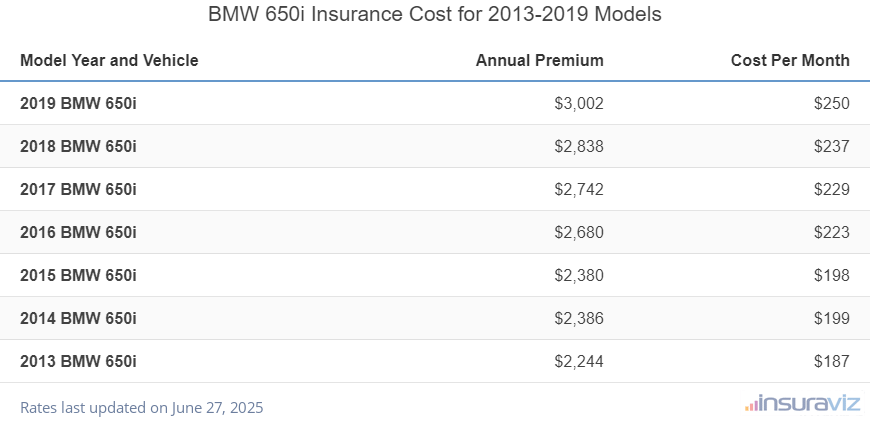

The table below illustrates average BMW 650i insurance rates for the 2013 to 2019 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2019 BMW 650i | $3,074 | $256 |

| 2018 BMW 650i | $2,908 | $242 |

| 2017 BMW 650i | $2,810 | $234 |

| 2016 BMW 650i | $2,746 | $229 |

| 2015 BMW 650i | $2,438 | $203 |

| 2014 BMW 650i | $2,442 | $204 |

| 2013 BMW 650i | $2,296 | $191 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW 650i trim levels for each model year. Updated October 24, 2025

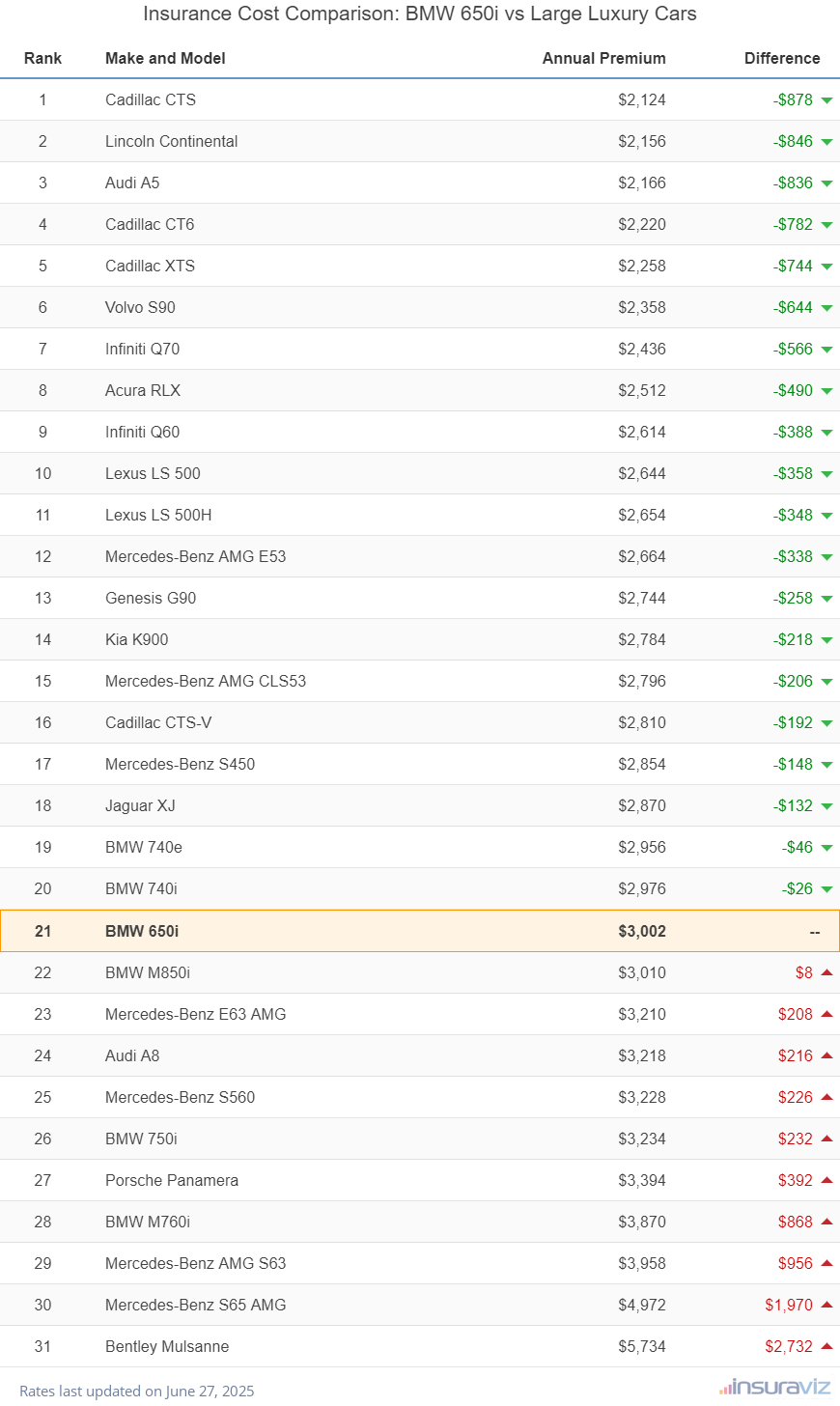

How do 650i car insurance rates compare?

When the BMW 650i is compared to popular vehicles in the large luxury car segment, insurance costs $856 more per year than the Audi A5, $26 more than the BMW 740i, and $760 more than the Cadillac XTS.

The BMW 650i ranks 21st out of 31 total vehicles in the large luxury car class for car insurance affordability. The 650i costs an estimated $3,074 per year for an auto insurance policy with full coverage and the segment median rate is $3,053 per year, a difference of $21 per year.

The table displayed below shows how well average BMW 650i car insurance rates compare to the rest of the U.S. large luxury car market like the Cadillac CT6, Lincoln Continental, and the Porsche Panamera.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Cadillac CTS | $2,174 | -$900 |

| 2 | Lincoln Continental | $2,208 | -$866 |

| 3 | Audi A5 | $2,218 | -$856 |

| 4 | Cadillac CT6 | $2,272 | -$802 |

| 5 | Cadillac XTS | $2,314 | -$760 |

| 6 | Volvo S90 | $2,416 | -$658 |

| 7 | Infiniti Q70 | $2,496 | -$578 |

| 8 | Acura RLX | $2,574 | -$500 |

| 9 | Infiniti Q60 | $2,678 | -$396 |

| 10 | Lexus LS 500 | $2,708 | -$366 |

| 11 | Lexus LS 500H | $2,718 | -$356 |

| 12 | Mercedes-Benz AMG E53 | $2,728 | -$346 |

| 13 | Genesis G90 | $2,808 | -$266 |

| 14 | Kia K900 | $2,850 | -$224 |

| 15 | Mercedes-Benz AMG CLS53 | $2,862 | -$212 |

| 16 | Cadillac CTS-V | $2,880 | -$194 |

| 17 | Mercedes-Benz S450 | $2,924 | -$150 |

| 18 | Jaguar XJ | $2,938 | -$136 |

| 19 | BMW 740e | $3,028 | -$46 |

| 20 | BMW 740i | $3,048 | -$26 |

| 21 | BMW 650i | $3,074 | -- |

| 22 | BMW M850i | $3,082 | $8 |

| 23 | Mercedes-Benz E63 AMG | $3,286 | $212 |

| 24 | Audi A8 | $3,296 | $222 |

| 25 | Mercedes-Benz S560 | $3,304 | $230 |

| 26 | BMW 750i | $3,312 | $238 |

| 27 | Porsche Panamera | $3,476 | $402 |

| 28 | BMW M760i | $3,964 | $890 |

| 29 | Mercedes-Benz AMG S63 | $4,054 | $980 |

| 30 | Mercedes-Benz S65 AMG | $5,092 | $2,018 |

| 31 | Bentley Mulsanne | $5,874 | $2,800 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2019 model year. Updated October 24, 2025

Additional rates and insights

A few additional rates and observations about 650i insurance include:

- Driving citations can increase insurance rates. In order to have the cheapest BMW 650i insurance rates, it pays to be a cautious driver and not get traffic citations. A few minor blemishes on your driving record could result in increasing insurance policy cost as much as $810 per year. Major convictions like hit-and-run, DUI or reckless driving could raise rates by an additional $2,864 or more.

- High-risk auto insurance costs more. For a 40-year-old driver, having a high frequency of accidents or violations could trigger a rate increase of $3,716 or more per year.

- Age and gender affect car insurance rates. For a 2019 BMW 650i, a 20-year-old man will have an average rate of $6,234 per year, while a 20-year-old female will get a rate of $4,434, a difference of $1,800 per year. The females get the cheaper rate by far. But by age 50, male rates are $2,698 and the rate for women is $2,642, a difference of only $56.

- The older you get, the cheaper insurance rates become. The difference in insurance rates for a BMW 650i between a 60-year-old driver ($2,532 per year) and a 30-year-old driver ($3,300 per year) is $768, or a savings of 26.3%.

- Get a discount from your employment. Many auto insurance companies offer discounts for working in professions like police officers and law enforcement, accountants, college professors, nurses, lawyers, and others. Having this discount applied to your policy could potentially save between $92 and $207 on your annual 650i insurance premium, subject to the policy coverages selected.

- Make your policy cheaper by raising deductibles. Raising deductibles from $500 to $1,000 could save around $556 per year for a 40-year-old driver and $1,110 per year for a 20-year-old driver.

- Choosing a low deductible will increase insurance policy cost. Dropping your deductibles from $500 to $250 could cost an additional $586 per year for a 40-year-old driver and $1,178 per year for a 20-year-old driver.