- Infiniti QX30 car insurance costs an estimated $1,974 per year on average, or about $165 per month for a policy with full coverage.

- The QX30 Luxe 2WD trim level is the cheapest to insure at around $1,882 per year. The most expensive trim is the Sport 2WD at $2,078 per year.

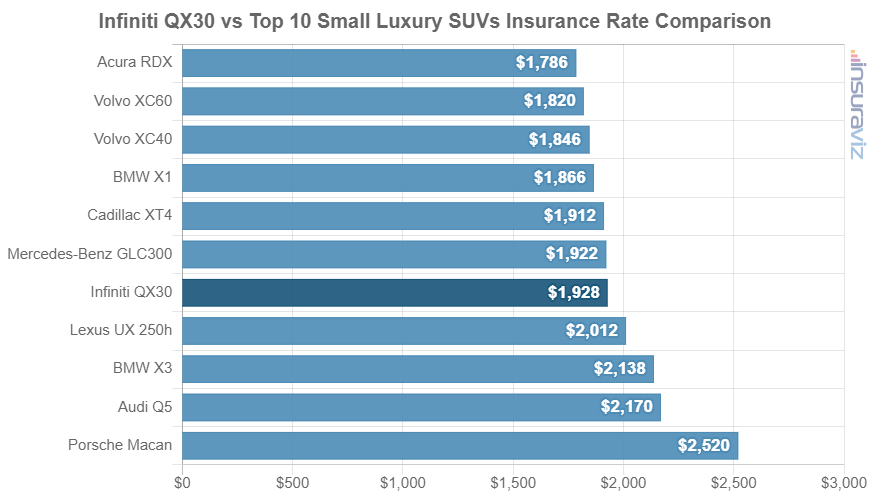

- When compared to other small luxury SUVs, the Infiniti QX30 is one of the cheaper vehicles to insure, costing $135 less per year on average.

How much does Infiniti QX30 car insurance cost?

Infiniti QX30 insurance rates average $1,974 yearly, or about $165 a month. With the average small luxury SUV costing $2,109 a year to insure, the QX30 comes in just a little bit cheaper than the segment average.

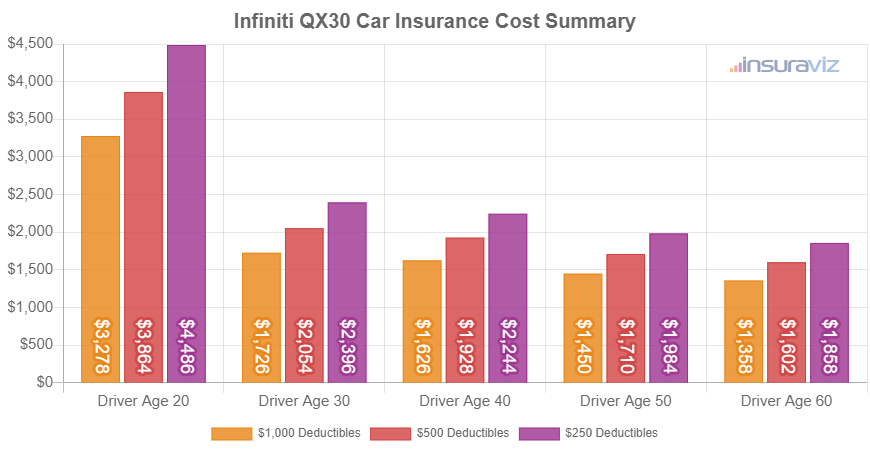

The chart below demonstrates how average 2019 Infiniti QX30 car insurance rates fluctuate with differences in driver age and insurance policy deductibles. Cost estimates vary from the cheapest price of $1,392 per year for a 60-year-old driver with $1,000 deductibles to the highest cost estimate of $4,596 each year for a driver age 20 with low physical damage deductibles.

The preceding chart displays a limited number of data points from an extremely large data set. If we displayed all rates for every conceivable data combination, including all six QX30 models and all 41,000+ zip codes in the U.S., the chart would contain around 580,608,000,000 bars.

In order to help you understand the massive variability for QX30 insurance rates, keep in mind that buying a policy with only liability coverage in some parts of Indiana or Illinois may cost as little as $228 a year.

For an identical Infiniti QX30, a newly-licensed teen driver with a propensity for speed in certain areas in Louisiana could get an insurance bill for $14,711 a year for a full coverage policy.

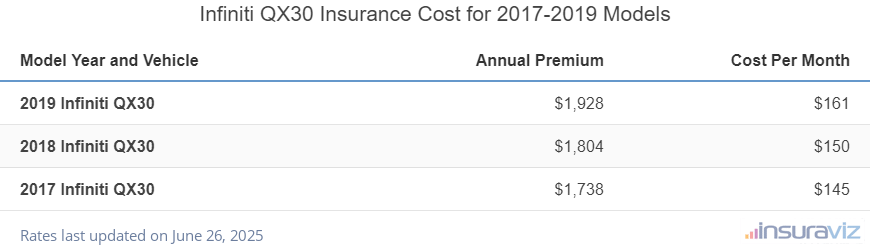

The next table shows average Infiniti QX30 car insurance rates for the 2017 to 2019 model years. For the average 40-year-old driver, rates range from $1,778 to $1,974 per year, depending on model year.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2019 Infiniti QX30 | $1,974 | $165 |

| 2018 Infiniti QX30 | $1,848 | $154 |

| 2017 Infiniti QX30 | $1,778 | $148 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Infiniti QX30 trim levels for each model year. Updated October 24, 2025

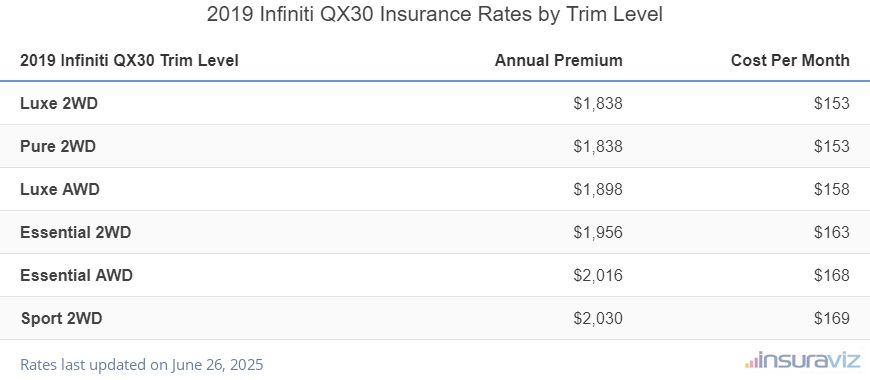

What is the cheapest Infiniti QX30 insurance?

With average Infiniti QX30 car insurance cost ranging from $1,882 to $2,078 per year for the average driver, the most affordable model to insure is the Luxe 2WD. The second cheapest trim level to insure is the Pure 2WD at $1,882 per year.

The least budget-friendly models of Infiniti QX30 to insure are the Sport 2WD and the Essential AWD at $2,066 per year. Those will cost an extra $196 per year over the lowest cost Luxe 2WD model to insure.

The rate table below displays the average auto insurance costs, including a monthly rate, for each Infiniti QX30 model trim level.

| 2019 Infiniti QX30 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Luxe 2WD | $1,882 | $157 |

| Pure 2WD | $1,882 | $157 |

| Luxe AWD | $1,944 | $162 |

| Essential 2WD | $2,004 | $167 |

| Essential AWD | $2,066 | $172 |

| Sport 2WD | $2,078 | $173 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How does Infiniti QX30 insurance cost rank?

The Infiniti QX30 ranks 11th out of 24 total vehicles in the small luxury SUV category. The QX30 costs an estimated $1,974 per year for car insurance and the segment median rate is $2,109 annually, a difference of $135 per year.

When compared directly to the best-selling models in the small luxury SUV category, insurance for a Infiniti QX30 costs $86 more per year than the Lexus NX 300, $8 more than the Mercedes-Benz GLC300, $218 less than the BMW X3, and $146 more than the Acura RDX.

The chart below shows how well average Infiniti QX30 car insurance rates compare to the top ten selling compact luxury SUVs in the U.S. Following the chart, a table is included that ranks all 24 vehicles in the small luxury SUV segment for car insurance affordability.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura RDX | $1,828 | -$146 |

| 2 | Volvo XC60 | $1,864 | -$110 |

| 3 | Lexus NX 300 | $1,888 | -$86 |

| 4 | Volvo XC40 | $1,890 | -$84 |

| 5 | Lincoln MKC | $1,894 | -$80 |

| 6 | Lexus UX 200 | $1,908 | -$66 |

| 7 | BMW X1 | $1,910 | -$64 |

| 8 | Cadillac XT4 | $1,958 | -$16 |

| 9 | Mercedes-Benz GLC300 | $1,966 | -$8 |

| 10 | Mercedes-Benz GLA250 | $1,968 | -$6 |

| 11 | Infiniti QX30 | $1,974 | -- |

| 12 | BMW X2 | $2,034 | $60 |

| 13 | Lexus UX 250h | $2,060 | $86 |

| 14 | Lexus NX 300H | $2,072 | $98 |

| 15 | Land Rover Evoque | $2,164 | $190 |

| 16 | Alfa Romeo Stelvio | $2,180 | $206 |

| 17 | BMW X3 | $2,192 | $218 |

| 18 | Audi Q5 | $2,224 | $250 |

| 19 | Mercedes-Benz GLC350E | $2,298 | $324 |

| 20 | BMW X4 | $2,342 | $368 |

| 21 | Mercedes-Benz GLA45 AMG | $2,368 | $394 |

| 22 | Jaguar F-Pace | $2,452 | $478 |

| 23 | Porsche Macan | $2,582 | $608 |

| 24 | Jaguar I-Pace | $2,600 | $626 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2019 model year. Updated October 24, 2025

Some additional rates and common car insurance policy situations include:

- The higher deductible you choose, the lower the policy cost. Raising your deductibles from $500 to $1,000 could save around $310 per year for a 40-year-old driver and $604 per year for a 20-year-old driver.

- Lower deductibles raise insurance cost. Dropping your deductibles from $500 to $250 could cost an additional $324 per year for a 40-year-old driver and $638 per year for a 20-year-old driver.

- Avoid tickets to save money. To get the cheapest QX30 car insurance rates, it can pay off to be a safe driver. In fact, just a couple traffic citations can increase insurance policy cost by at least $518 per year. Serious citations such as a DWI could raise rates by an additional $1,822 or more.

- Save money due to your job. Most auto insurance providers offer discounts for being employed in occupations such as police officers and law enforcement, nurses, scientists, engineers, and other occupations. By earning this discount, you may save between $59 and $207 on your QX30 insurance cost, depending on the policy coverages selected.

- Careful drivers have lower rates. Too many at-fault accidents will increase rates, possibly by an extra $2,804 per year for a 20-year-old driver and as much as $592 per year for a 50-year-old driver.

- Teenagers are the most expensive age group to insure. Average rates for full coverage QX30 car insurance costs $7,016 per year for a 16-year-old driver, $6,792 per year for a 17-year-old driver, and $6,077 per year for an 18-year-old driver.