- Average Mercedes S550 insurance cost is $3,262 per year, or $272 per month for full coverage.

- The S550 base Sedan trim level is the cheapest to insure at around $3,202 per year. The most expensive trim is the Convertible at $3,344 per year.

- The Mercedes-Benz S550 costs slightly more than the class average to insure, at $237 more per year when compared to the rest of the vehicles in the segment.

How much does Mercedes S550 insurance cost?

Mercedes-Benz S550 car insurance averages $3,262 annually, or $272 on a monthly basis. With the average large luxury car costing $3,025 a year to insure, the Mercedes-Benz S550 costs around $237 more per year to insure when compared to the segment average.

Depending on the trim level being insured, monthly car insurance cost for a Mercedes S550 ranges from $267 to $279, with the base Sedan being cheapest and the Convertible costing the most to insure.

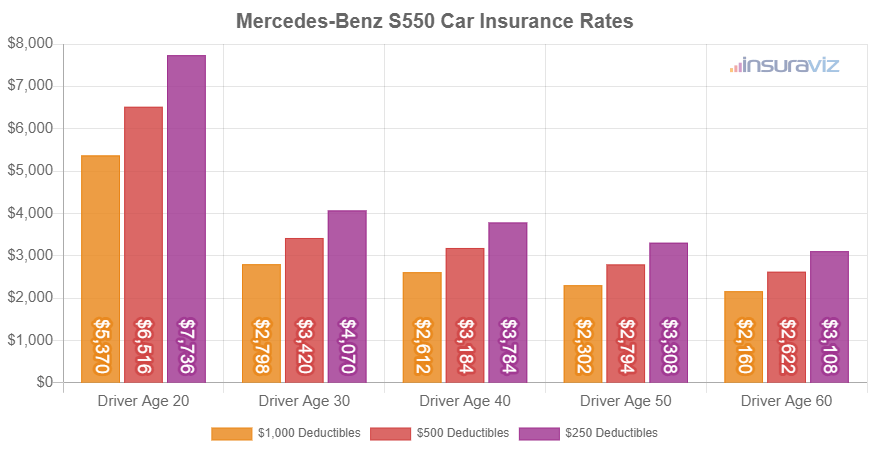

The following chart shows how average Mercedes S550 car insurance rates change based on driver age and policy deductibles.

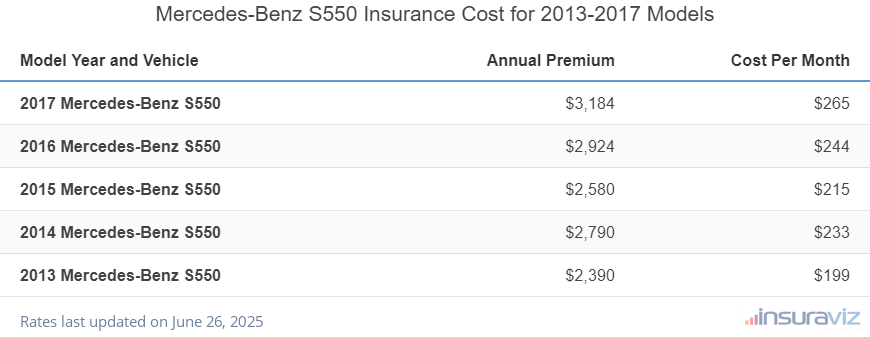

The following table shows average Mercedes S550 car insurance rates for the 2013 to 2017 model years. Average insurance prices range from $2,446 for a 2013 model to the most expensive cost of $3,262 for a 2017 S550.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2017 Mercedes-Benz S550 | $3,262 | $272 |

| 2016 Mercedes-Benz S550 | $2,992 | $249 |

| 2015 Mercedes-Benz S550 | $2,642 | $220 |

| 2014 Mercedes-Benz S550 | $2,862 | $239 |

| 2013 Mercedes-Benz S550 | $2,446 | $204 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mercedes-Benz S550 trim levels for each model year. Updated October 24, 2025

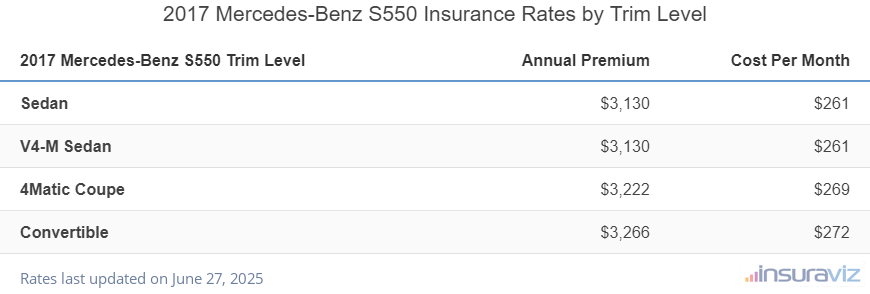

Which S550 trim level is cheapest to insure?

With Mercedes-Benz S550 insurance rates ranging from $3,202 to $3,344 annually for the average driver, the cheapest trim level to insure is the base Sedan model. The next cheapest trim level to insure is the V4-M Sedan at $3,202 per year. Expect to pay at least $267 per month for a policy with full coverage.

For the more appointed S550 models, the two most expensive S550 trim levels to insure are the Mercedes-Benz S550 4Matic Coupe, and the Convertible trim levels at an estimated $3,298, and $3,344 per year, respectively.

The table below displays average yearly and semi-annual policy costs, including a monthly budget estimate, for each Mercedes S550 trim level.

| 2017 Mercedes-Benz S550 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sedan | $3,202 | $267 |

| V4-M Sedan | $3,202 | $267 |

| 4Matic Coupe | $3,298 | $275 |

| Convertible | $3,344 | $279 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How does S550 insurance cost compare?

When S550 insurance rates are compared to the most popular models in the 2017 large luxury car segment, insurance for a Mercedes-Benz S550 costs $1,364 more per year than the Audi A5, $530 more than the BMW 740i, $1,322 more than the Cadillac XTS, and $1,158 more than the Cadillac CT6.

The Mercedes-Benz S550 ranks 31st out of 43 total vehicles in the large luxury car class. The S550 costs an estimated $3,262 per year to insure for full coverage, while the category median rate is $3,025 annually, a difference of $237 per year.

The table below shows how car insurance cost for a Mercedes S550 compares to the top-selling large luxury cars like the Audi A5, BMW 740i, and the Cadillac CT6.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Lincoln Continental | $1,894 | -$1,368 |

| 2 | Audi A5 | $1,898 | -$1,364 |

| 3 | Cadillac XTS | $1,940 | -$1,322 |

| 4 | Cadillac CTS | $1,968 | -$1,294 |

| 5 | Cadillac CT6 | $2,104 | -$1,158 |

| 6 | Volvo S90 | $2,202 | -$1,060 |

| 7 | Infiniti Q70 | $2,284 | -$978 |

| 8 | Acura RLX | $2,350 | -$912 |

| 9 | Mercedes-Benz CLS550 | $2,392 | -$870 |

| 10 | Lexus GS 450 | $2,444 | -$818 |

| 11 | Mercedes-Benz C63 AMG | $2,492 | -$770 |

| 12 | Jaguar XJ | $2,512 | -$750 |

| 13 | Infiniti Q60 | $2,542 | -$720 |

| 14 | Kia K900 | $2,552 | -$710 |

| 15 | Mercedes-Benz E63 AMG | $2,580 | -$682 |

| 16 | Cadillac CTS-V | $2,602 | -$660 |

| 17 | Genesis G90 | $2,628 | -$634 |

| 18 | Lexus LS 460 | $2,668 | -$594 |

| 19 | BMW 740e | $2,678 | -$584 |

| 20 | BMW 740i | $2,732 | -$530 |

| 21 | BMW 650i | $2,810 | -$452 |

| 22 | Maserati Ghibli | $2,922 | -$340 |

| 23 | Porsche Panamera | $2,966 | -$296 |

| 24 | Jaguar XJ Super | $2,978 | -$284 |

| 25 | Mercedes-Benz CLS63 AMG | $2,986 | -$276 |

| 26 | Audi A8 | $3,084 | -$178 |

| 27 | BMW 750i | $3,154 | -$108 |

| 28 | BMW Alpina B6 | $3,168 | -$94 |

| 29 | Maserati Quattroporte | $3,178 | -$84 |

| 30 | Audi RS 7 | $3,182 | -$80 |

| 31 | Mercedes-Benz S550 | $3,262 | -- |

| 32 | Audi S8 | $3,278 | $16 |

| 33 | Mercedes-Benz AMG | $3,282 | $20 |

| 34 | BMW M760xi | $3,572 | $310 |

| 35 | Mercedes-Benz S63 AMG | $3,700 | $438 |

| 36 | Mercedes-Benz S600 | $3,714 | $452 |

| 37 | Mercedes-Benz AMG S63 | $3,836 | $574 |

| 38 | Bentley Flying Spur | $4,196 | $934 |

| 39 | Mercedes-Benz S65 AMG | $4,330 | $1,068 |

| 40 | Mercedes-Benz S65 | $4,416 | $1,154 |

| 41 | Mercedes-Benz AMG S65 | $4,520 | $1,258 |

| 42 | Bentley Continental | $4,522 | $1,260 |

| 43 | Bentley Mulsanne | $5,556 | $2,294 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2017 model year. Updated October 24, 2025

Additional Rates and Information

A few additional insights concerning S550 insurance cost include:

- S550 insurance for teenagers is expensive. Average rates for full coverage S550 insurance costs $11,580 per year for a 16-year-old driver, $11,329 per year for a 17-year-old driver, and $10,358 per year for an 18-year-old driver.

- Avoiding accidents saves money. Having multiple accidents could cost you more, possibly by an additional $4,764 per year for a 20-year-old driver and even $1,352 per year for a 40-year-old driver.

- Driver age and gender matter. For a 2017 Mercedes-Benz S550, a 20-year-old male driver pays an estimated $6,674 per year, while a 20-year-old female driver pays $4,728, a difference of $1,946 per year in favor of the women by a long shot. But by age 50, male rates are $2,862 and female rates are $2,802, a difference of only $60.

- Qualify for discounts to save money. Discounts on S550 car insurance may be available if the insureds are claim-free, are homeowners, belong to certain professional organizations, take a defensive driving course, or many other discounts which could save the average driver as much as $556 per year.

- Expect to pay a lot for high risk insurance. For a 50-year-old driver, the need to buy a high-risk policy can increase the cost by $3,868 or more per year.

- Your employer could save you a few bucks. Just about all auto insurance companies offer discounts for certain professions like college professors, nurses, accountants, scientists, engineers, members of the military, and other occupations. Being employed in a qualifying profession may save between $98 and $188 on your annual car insurance cost, depending on the policy coverages selected.