- BMW 535i insurance costs an average of $2,470 per year for a full coverage policy, but can vary a lot based on the policy limits.

- When compared to the entire 2017 midsize luxury car segment, the BMW 535i ranks 32nd out of 47 total comparison vehicles for car insurance affordability.

How much does BMW 535i insurance cost?

The average BMW 535i insurance cost is $2,470 a year for a full coverage policy. When separated by coverage type, comprehensive (or other-than-collision) coverage costs around $578 a year, collision coverage will cost around $1,192, and the remaining liability/medical is an estimated $700.

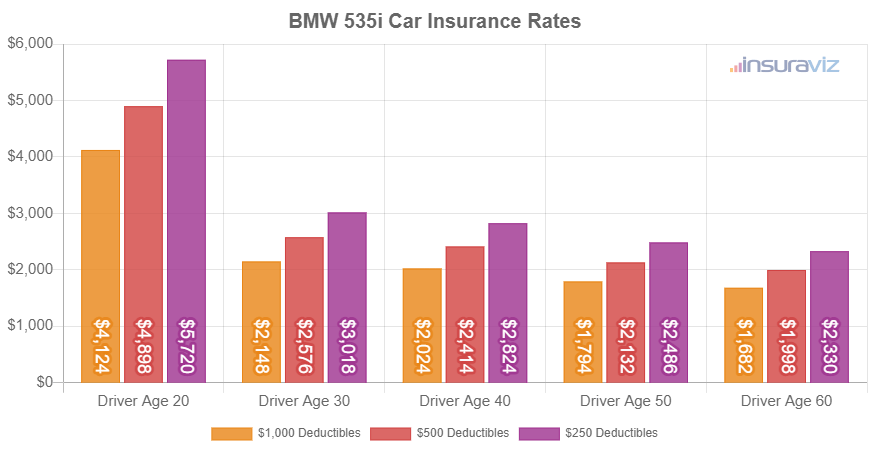

The cost summary chart below demonstrates how average BMW 535i car insurance rates can change based on driver age group and the choice of physical damage coverage deductibles. Car insurance rates are generally higher for younger drivers, and low deductibles cost more than higher deductibles.

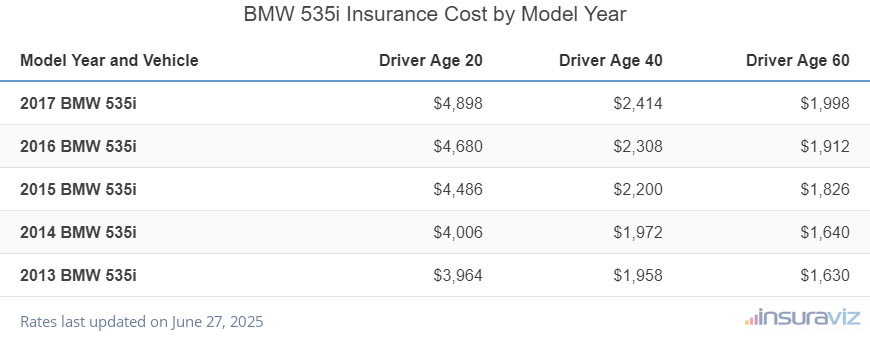

The following data table breaks down average BMW 535i car insurance rates for the 2013 to 2017 model years and different driver age groups.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2017 BMW 535i | $5,020 | $2,470 | $2,048 |

| 2016 BMW 535i | $4,796 | $2,360 | $1,958 |

| 2015 BMW 535i | $4,594 | $2,252 | $1,870 |

| 2014 BMW 535i | $4,104 | $2,020 | $1,680 |

| 2013 BMW 535i | $4,060 | $2,004 | $1,666 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW 535i trim levels for each model year. Updated October 24, 2025

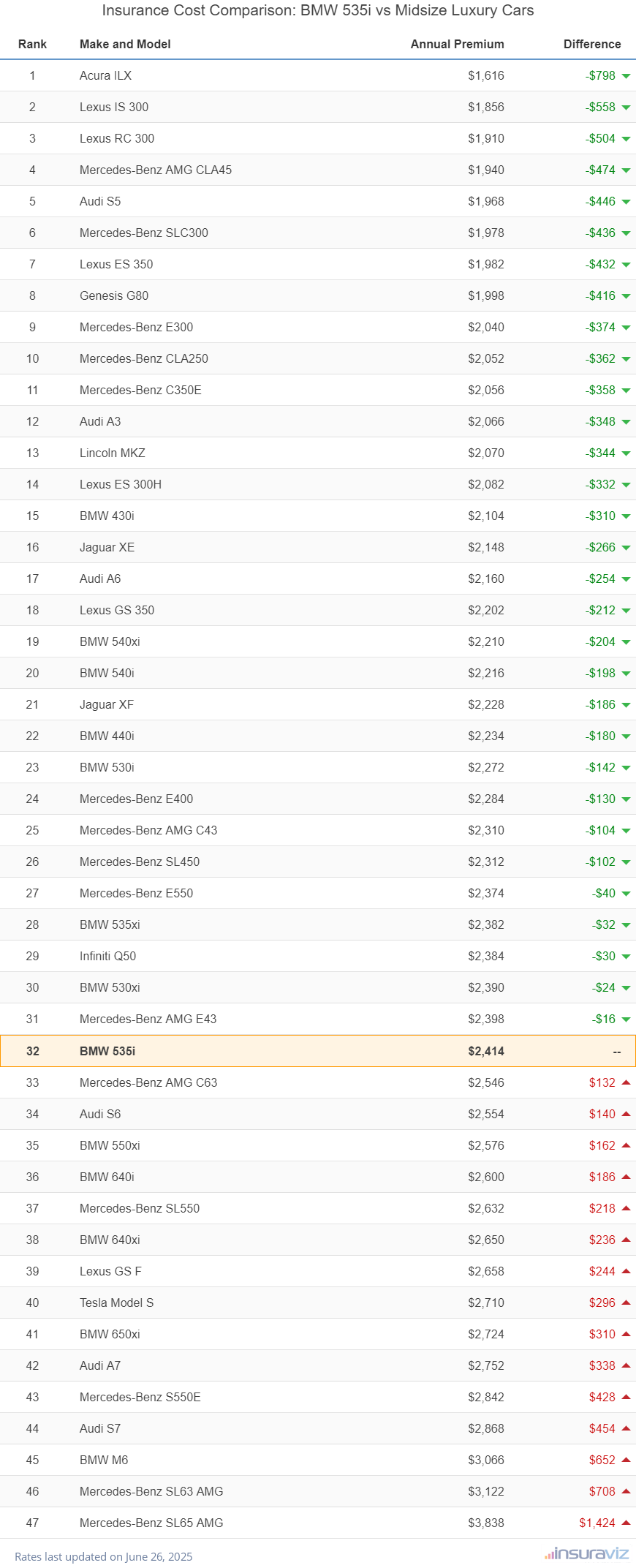

How do 535i insurance rates compare to similar vehicles?

When insurance prices are compared to other models in the midsize luxury car category, the BMW 535i costs $440 more per year than the Lexus ES 350, $144 more than the BMW 530i, and $28 more than the Infiniti Q50.

The BMW 535i ranks 32nd out of 47 comparison vehicles in the midsize luxury car class for auto insurance affordability. The 535i costs an average of $2,470 per year for a car insurance policy with full coverage and the segment average insurance cost is $2,413 per year, a difference of $57 per year.

The next table shows how average BMW 535i car insurance rates compare to models in the rest of the midsize luxury car segment like the Lincoln MKZ, Mercedes-Benz CLA250, and the Audi A6.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura ILX | $1,654 | -$816 |

| 2 | Lexus IS 300 | $1,902 | -$568 |

| 3 | Lexus RC 300 | $1,958 | -$512 |

| 4 | Mercedes-Benz AMG CLA45 | $1,986 | -$484 |

| 5 | Audi S5 | $2,014 | -$456 |

| 6 | Mercedes-Benz SLC300 | $2,024 | -$446 |

| 7 | Lexus ES 350 | $2,030 | -$440 |

| 8 | Genesis G80 | $2,048 | -$422 |

| 9 | Mercedes-Benz E300 | $2,090 | -$380 |

| 10 | Mercedes-Benz CLA250 | $2,100 | -$370 |

| 11 | Mercedes-Benz C350E | $2,104 | -$366 |

| 12 | Audi A3 | $2,112 | -$358 |

| 13 | Lincoln MKZ | $2,118 | -$352 |

| 14 | Lexus ES 300H | $2,132 | -$338 |

| 15 | BMW 430i | $2,152 | -$318 |

| 16 | Jaguar XE | $2,198 | -$272 |

| 17 | Audi A6 | $2,210 | -$260 |

| 18 | Lexus GS 350 | $2,254 | -$216 |

| 19 | BMW 540xi | $2,264 | -$206 |

| 20 | BMW 540i | $2,272 | -$198 |

| 21 | Jaguar XF | $2,280 | -$190 |

| 22 | BMW 440i | $2,286 | -$184 |

| 23 | BMW 530i | $2,326 | -$144 |

| 24 | Mercedes-Benz E400 | $2,340 | -$130 |

| 25 | Mercedes-Benz AMG C43 | $2,366 | -$104 |

| 26 | Mercedes-Benz SL450 | $2,368 | -$102 |

| 27 | Mercedes-Benz E550 | $2,432 | -$38 |

| 28 | BMW 535xi | $2,438 | -$32 |

| 29 | Infiniti Q50 | $2,442 | -$28 |

| 30 | BMW 530xi | $2,448 | -$22 |

| 31 | Mercedes-Benz AMG E43 | $2,454 | -$16 |

| 32 | BMW 535i | $2,470 | -- |

| 33 | Mercedes-Benz AMG C63 | $2,606 | $136 |

| 34 | Audi S6 | $2,612 | $142 |

| 35 | BMW 550xi | $2,638 | $168 |

| 36 | BMW 640i | $2,664 | $194 |

| 37 | Mercedes-Benz SL550 | $2,698 | $228 |

| 38 | BMW 640xi | $2,714 | $244 |

| 39 | Lexus GS F | $2,720 | $250 |

| 40 | Tesla Model S | $2,774 | $304 |

| 41 | BMW 650xi | $2,788 | $318 |

| 42 | Audi A7 | $2,818 | $348 |

| 43 | Mercedes-Benz S550E | $2,908 | $438 |

| 44 | Audi S7 | $2,936 | $466 |

| 45 | BMW M6 | $3,142 | $672 |

| 46 | Mercedes-Benz SL63 AMG | $3,202 | $732 |

| 47 | Mercedes-Benz SL65 AMG | $3,932 | $1,462 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2017 model year. Updated October 24, 2025

Additional BMW 535i car insurance rates and information

- Improve your credit rating to save on insurance. Insureds with excellent credit scores of 800+ could save around $388 per year compared to a credit rating of 670-739. Conversely, a below-average credit score could cost as much as $450 more per year.

- Car insurance for high-risk drivers is expensive. For a 40-year-old driver, having too many accidents or violations could trigger a rate increase of $3,028 or more per year.

- Gender affects car insurance rates. For a 2017 BMW 535i, a 20-year-old man pays an estimated $5,020 per year, while a 20-year-old woman will pay an average of $3,584, a difference of $1,436 per year in favor of the women by a long shot. But by age 50, the cost for a male driver is $2,186 and the rate for women is $2,132, a difference of only $54.

- Increasing deductibles makes car insurance cheaper. Boosting your deductibles from $500 to $1,000 could save around $400 per year for a 40-year-old driver and $794 per year for a 20-year-old driver.

- The lower the deductibles, the higher the cost. Lowering your policy deductibles from $500 to $250 could cost an additional $420 per year for a 40-year-old driver and $842 per year for a 20-year-old driver.

- Teenage drivers are expensive to insure. Average rates for full coverage 535i insurance costs $8,873 per year for a 16-year-old driver, $8,614 per year for a 17-year-old driver, $7,747 per year for an 18-year-old driver, and $7,033 per year for a 19-year-old driver.

- Get better rates due to your job. The large majority of auto insurance companies offer discounts for being employed in occupations like members of the military, lawyers, police officers and law enforcement, architects, accountants, and others. Working in a qualifying occupation could potentially save between $74 and $188 on your yearly insurance cost, subject to policy limits.

- Avoid tickets to save money. If you want to get the lowest-priced 535i insurance rates, it pays to drive safely. Not surprisingly, just one or two minor infractions on your driving record could result in increasing the cost of a policy as much as $666 per year.