- Lexus GS F car insurance costs an average of $2,444 per year, or around $204 per month for full coverage.

- Out of 41 vehicles in the 2020 midsize luxury car segment, the GS F ranks 32nd for car insurance affordability.

How much does Lexus GS F insurance cost?

Lexus GS F car insurance rates average $2,444 a year, or around $204 monthly. On average, expect to pay about $253 more each year to insure a Lexus GS F when compared to the average rate for all midsize luxury cars, and $561 more per year than the all-vehicle national average of $1,883.

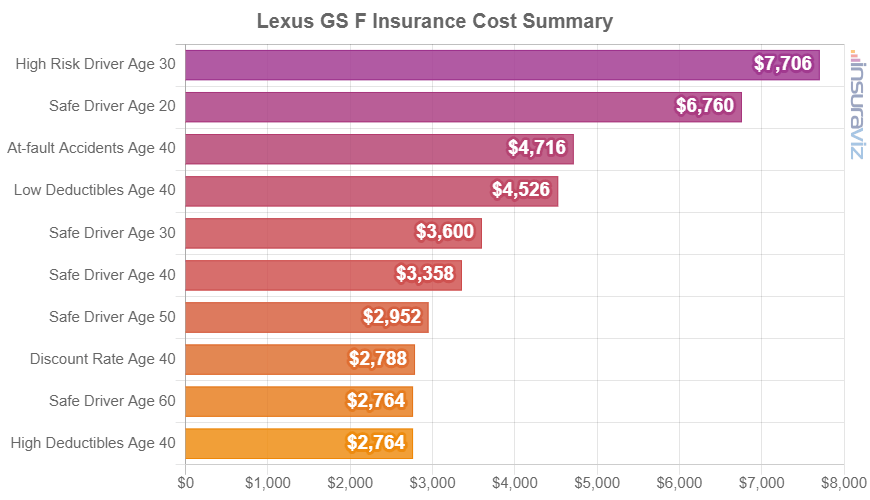

The rate chart below displays average insurance rates on a 2020 GS F rated for different driver ages and risk profiles.

The next table breaks down average Lexus GS F car insurance rates for the 2016-2020 model years and for various driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2020 Lexus GS F | $4,944 | $2,444 | $2,016 |

| 2019 Lexus GS F | $4,788 | $2,360 | $1,946 |

| 2018 Lexus GS F | $4,544 | $2,246 | $1,856 |

| 2017 Lexus GS F | $4,352 | $2,152 | $1,780 |

| 2016 Lexus GS F | $4,290 | $2,126 | $1,762 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Lexus GS F trim levels for each model year. Updated February 23, 2024

A few additional key observations regarding the cost to insure a Lexus GS F include:

- Raise your credit score for cheaper insurance rates. Drivers with high 800+ credit scores could save $384 per year versus a credit rating of 670-739. Conversely, a less-than-good credit score could cost as much as $445 more per year.

- High-risk auto insurance costs more. For a 20-year-old driver, being required to buy a high-risk insurance policy could end up with a rate increase of $3,856 or more per year.

- Research discounts to lower the cost. Discounts may be available if the insureds work in certain occupations, are accident-free, insure their home and car with the same company, are claim-free, or many other discounts which could save the average driver as much as $416 per year on the cost of insuring a GS F.

- Gender affects car insurance rates. For a 2020 Lexus GS F, a 20-year-old male driver will have an average rate of $4,944 per year, while a 20-year-old woman pays $3,528, a difference of $1,416 per year. The females get the cheaper rate by far. But by age 50, rates for male drivers are $2,152 and female driver rates are $2,102, a difference of only $50.

- Avoiding accidents saves money. Having frequent at-fault accidents will raise rates, possibly up to $1,172 per year for a 30-year-old driver and as much as $704 per year for a 50-year-old driver.

Is Lexus GS F car insurance expensive?

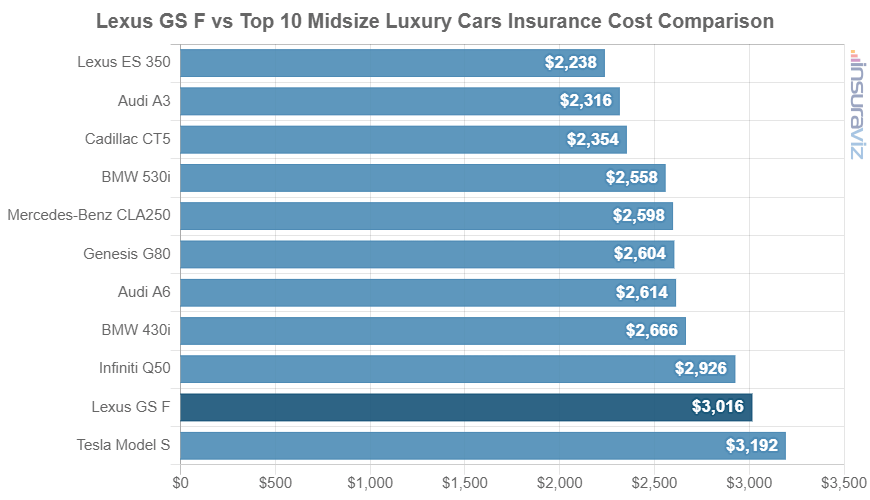

When compared to other models in the midsize luxury car segment, auto insurance rates for a Lexus GS F cost $628 more per year than the Lexus ES 350, $372 more than the BMW 530i, and $70 more than the Infiniti Q50.

The Lexus GS F ranks 32nd out of 41 total comparison vehicles in the 2020 midsize luxury car class for car insurance affordability. The GS F costs an estimated $2,444 per year for a car insurance policy with full coverage and the category average insurance cost is $2,191 annually, a difference of $253 per year.

The next chart shows how average Lexus GS F car insurance rates compare to the top-selling midsize luxury cars in America like the Lincoln MKZ, Mercedes-Benz CLA250, and the Audi A6. In addition to the chart, a larger table is included that displays car insurance affordability rankings for all 41 models in the 2020 midsize luxury car class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura ILX | $1,528 | -$916 |

| 2 | Lexus RC 300 | $1,758 | -$686 |

| 3 | Mercedes-Benz SLC300 | $1,808 | -$636 |

| 4 | Lexus ES 350 | $1,816 | -$628 |

| 5 | Lincoln MKZ | $1,820 | -$624 |

| 6 | Mercedes-Benz AMG CLA45 | $1,836 | -$608 |

| 7 | Jaguar XE | $1,840 | -$604 |

| 8 | Lexus IS 300 | $1,844 | -$600 |

| 9 | Audi A3 | $1,876 | -$568 |

| 10 | Cadillac CT5 | $1,908 | -$536 |

| 11 | Audi S5 | $1,956 | -$488 |

| 12 | Lexus GS 350 | $2,008 | -$436 |

| 13 | Mercedes-Benz E350 | $2,018 | -$426 |

| 14 | Lexus ES 300H | $2,046 | -$398 |

| 15 | Audi S4 | $2,066 | -$378 |

| 16 | BMW 530i | $2,072 | -$372 |

| 17 | BMW 540i | $2,094 | -$350 |

| 18 | Mercedes-Benz CLA250 | $2,106 | -$338 |

| 19 | Genesis G80 | $2,110 | -$334 |

| 20 | Audi A6 | $2,116 | -$328 |

| 21 | Mercedes-Benz E450 | $2,142 | -$302 |

| 22 | BMW 430i | $2,160 | -$284 |

| 23 | Mercedes-Benz CLS450 | $2,186 | -$258 |

| 24 | Jaguar XF | $2,188 | -$256 |

| 25 | Mercedes-Benz AMG C43 | $2,272 | -$172 |

| 26 | BMW 440i | $2,274 | -$170 |

| 27 | Mercedes-Benz SL450 | $2,288 | -$156 |

| 28 | Audi RS 5 | $2,298 | -$146 |

| 29 | Audi S6 | $2,348 | -$96 |

| 30 | Infiniti Q50 | $2,374 | -$70 |

| 31 | BMW 530e | $2,384 | -$60 |

| 32 | Lexus GS F | $2,444 | -- |

| 33 | Mercedes-Benz AMG C63 | $2,476 | $32 |

| 34 | BMW M550i | $2,522 | $78 |

| 35 | Mercedes-Benz SL550 | $2,544 | $100 |

| 36 | Tesla Model S | $2,586 | $142 |

| 37 | Audi A7 | $2,622 | $178 |

| 38 | Lexus LC 500H | $2,690 | $246 |

| 39 | Audi S7 | $2,790 | $346 |

| 40 | BMW M8 | $2,794 | $350 |

| 41 | BMW M5 | $2,832 | $388 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2020 model year. Updated February 23, 2024