- BMW X6 car insurance costs an average of $3,350 per year, $1,675 for a 6-month policy, or $279 per month.

- The cheapest BMW X6 insurance is on the xDrive40i trim level at an estimated $3,036 per year. The X6 M AWD is the most expensive to insure at $3,666 per year.

- When compared to the entire midsize luxury SUV segment, the 2024 BMW X6 is one of the more expensive models to insure at 36th out of 41 total comparison vehicles.

How much does BMW X6 car insurance cost?

BMW X6 car insurance rates average $3,350 a year for full coverage, or around $279 on a monthly basis. With the average midsize luxury SUV costing $2,850 a year to insure, the BMW X6 would cost an estimated $500 more to insure each year.

The chart below demonstrates how average BMW X6 insurance costs fluctuate depending on the age of the driver and policy deductibles.

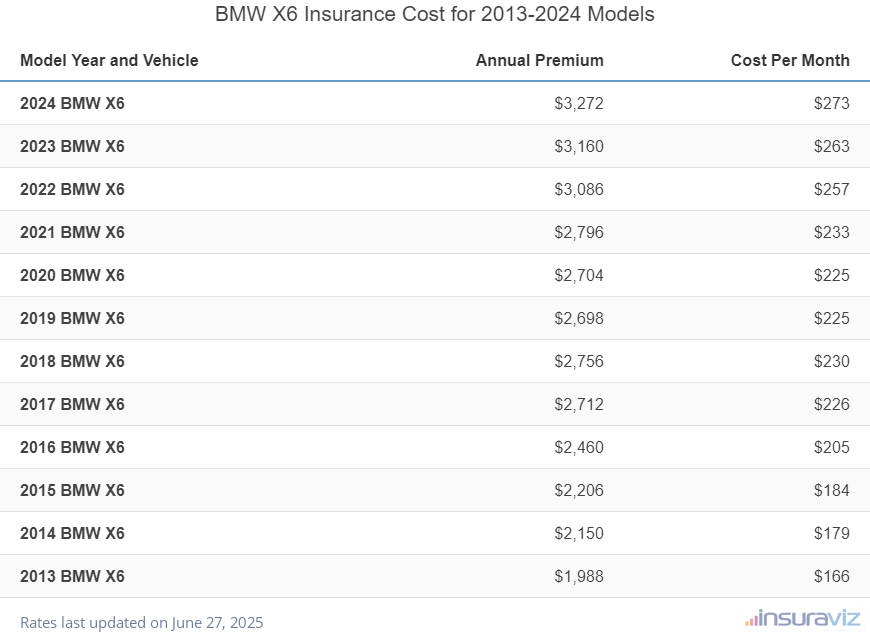

The next table breaks down average BMW X6 insurance costs for annual, semi-annual and monthly policy terms. Car insurance prices range from $2,032 to $3,350 for the 2013 to 2024 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 BMW X6 | $3,350 | $279 |

| 2023 BMW X6 | $3,236 | $270 |

| 2022 BMW X6 | $3,160 | $263 |

| 2021 BMW X6 | $2,864 | $239 |

| 2020 BMW X6 | $2,768 | $231 |

| 2019 BMW X6 | $2,764 | $230 |

| 2018 BMW X6 | $2,822 | $235 |

| 2017 BMW X6 | $2,774 | $231 |

| 2016 BMW X6 | $2,518 | $210 |

| 2015 BMW X6 | $2,256 | $188 |

| 2014 BMW X6 | $2,200 | $183 |

| 2013 BMW X6 | $2,032 | $169 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW X6 trim levels for each model year. Updated October 24, 2025

What is the cheapest BMW X6 insurance?

The BMW X6 model with the cheapest insurance rates is the base xDrive40i trim (MSRP of $73,900) costing $3,036 per year, or about $253 per month. The $127,200 M AWD trim is the most expensive to insure, costing an average of $630 more per year.

The rate table below displays the average yearly and semi-annual car insurance policy costs, in addition to a monthly insurance rate, for each BMW X6 model and trim level.

| 2024 BMW X6 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| xDrive40i | $3,036 | $253 |

| M60i xDrive | $3,352 | $279 |

| M AWD | $3,666 | $306 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How does BMW X6 car insurance cost compare?

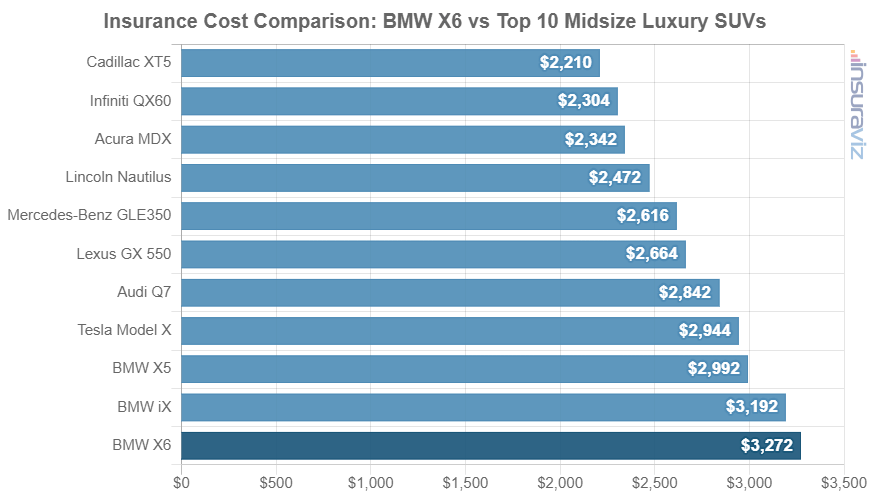

When compared directly to the most popular models in the midsize luxury SUV segment, insurance for a BMW X6 costs $944 more per year than the Lexus RX 350, $282 more than the BMW X5, $954 more than the Acura MDX, and $1,086 more than the Cadillac XT5.

The BMW X6 ranks 36th out of 41 total vehicles in the midsize luxury SUV class. The X6 costs an estimated $3,350 per year to insure and the segment average cost is $2,850 per year, a difference of $500 per year.

The chart below shows how insurance cost for a BMW X6 compares to the top 10 best-selling midsize luxury SUVs in the U.S. A table showing insurance rates for every vehicle in the 2024 midsize luxury SUV segment is included following the chart.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Jaguar E-Pace | $2,242 | -$1,108 |

| 2 | Cadillac XT5 | $2,264 | -$1,086 |

| 3 | Infiniti QX50 | $2,330 | -$1,020 |

| 4 | Cadillac XT6 | $2,348 | -$1,002 |

| 5 | Infiniti QX60 | $2,358 | -$992 |

| 6 | Mercedes-Benz AMG GLB35 | $2,364 | -$986 |

| 7 | Acura MDX | $2,396 | -$954 |

| 8 | Lexus RX 350 | $2,406 | -$944 |

| 9 | Lexus TX 350 | $2,440 | -$910 |

| 10 | Lexus RX 350h | $2,468 | -$882 |

| 11 | Lexus TX 500h | $2,506 | -$844 |

| 12 | Lexus RX 500h | $2,514 | -$836 |

| 13 | Lincoln Nautilus | $2,534 | -$816 |

| 14 | Lexus RX 450h | $2,538 | -$812 |

| 15 | Volvo V90 | $2,558 | -$792 |

| 16 | Audi SQ5 | $2,646 | -$704 |

| 17 | Mercedes-Benz GLE350 | $2,680 | -$670 |

| 18 | Lincoln Aviator | $2,698 | -$652 |

| 19 | Lexus GX 550 | $2,728 | -$622 |

| 20 | Volvo V60 | $2,808 | -$542 |

| 21 | Land Rover Discovery Sport | $2,814 | -$536 |

| 22 | Mercedes-Benz GLE450 | $2,826 | -$524 |

| 23 | Cadillac Lyriq | $2,852 | -$498 |

| 24 | Volvo EX90 | $2,876 | -$474 |

| 25 | Audi Q7 | $2,912 | -$438 |

| 26 | Genesis GV80 | $2,926 | -$424 |

| 27 | Mercedes-Benz AMG GLC43 | $2,938 | -$412 |

| 28 | Audi e-tron | $2,994 | -$356 |

| 29 | Tesla Model X | $3,016 | -$334 |

| 30 | BMW X5 | $3,068 | -$282 |

| 31 | Audi Q8 | $3,082 | -$268 |

| 32 | Land Rover Discovery | $3,100 | -$250 |

| 33 | Mercedes-Benz AMG GLE53 | $3,120 | -$230 |

| 34 | Audi SQ7 | $3,224 | -$126 |

| 35 | BMW iX | $3,272 | -$78 |

| 36 | BMW X6 | $3,350 | -- |

| 37 | Land Rover Range Rover Sport | $3,492 | $142 |

| 38 | Audi RS 6 | $3,564 | $214 |

| 39 | Porsche Cayenne | $3,594 | $244 |

| 40 | BMW XM | $3,938 | $588 |

| 41 | Mercedes-Benz AMG GLE63 | $4,046 | $696 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Below are a few additional situations that have significant impact on car insurance rates along with some ways you might be able to save a few bucks on your next policy.

- Car insurance is cheaper with higher deductibles. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $590 per year for a 40-year-old driver and $1,168 per year for a 20-year-old driver.

- Choosing a low deductible will increase insurance policy cost. Lowering your policy deductibles from $500 to $250 could cost an additional $620 per year for a 40-year-old driver and $1,242 per year for a 20-year-old driver.

- Expect to pay a lot to insure a teenager on a BMW X6. Average rates for full coverage X6 insurance costs $11,781 per year for a 16-year-old driver, $11,506 per year for a 17-year-old driver, and $10,480 per year for an 18-year-old driver.

- It’s expensive to buy high-risk insurance. For a 30-year-old driver, being required to buy a high-risk insurance policy can increase the cost by $4,134 or more per year.

- Safe drivers pay less. Multiple at-fault accidents raise rates, possibly by an extra $1,616 per year for a 30-year-old driver and as much as $968 per year for a 50-year-old driver. Save yourself some money by being a safe driver.

- Driving violations increase insurance rates. If you want the cheapest X6 car insurance rates, it’s necessary to follow traffic laws and not get pulled over. Not surprisingly, just one or two minor traffic violations can increase the cost of a policy as much as $892 per year.

- Raise your credit score for cheaper auto insurance rates. In states that give the go-ahead for credit history to be used as a policy cost factor, having a high credit score of 800+ could save as much as $526 per year compared to a credit rating between 670-739. Conversely, a diminished credit rating could cost as much as $610 more per year.

- Research discounts to save money. Discounts may be available if the insured drivers belong to certain professional organizations, are accident-free, are good students, are claim-free, or many other discounts which could save the average driver as much as $570 per year.