- Mercedes-Benz AMG GLE53 insurance rates average $2,466 per year or $1,233 for a semi-annual policy, depending on policy limits.

- Ranked 33rd out of 41 other models in the midsize luxury SUV class, car insurance rates for the Mercedes-Benz AMG GLE53 cost $213 more per year than the average cost for the segment.

How much does Mercedes AMG GLE53 insurance cost?

With MSRPs starting from $76,950 to $81,200 depending on the model, Mercedes-Benz AMG GLE53 insurance costs on average $2,466 a year, or $206 each month.

You can expect to pay about $213 more annually to insure a Mercedes-Benz AMG GLE53 compared to similar vehicles, and $583 more per year than the $1,883 national average for all vehicles combined.

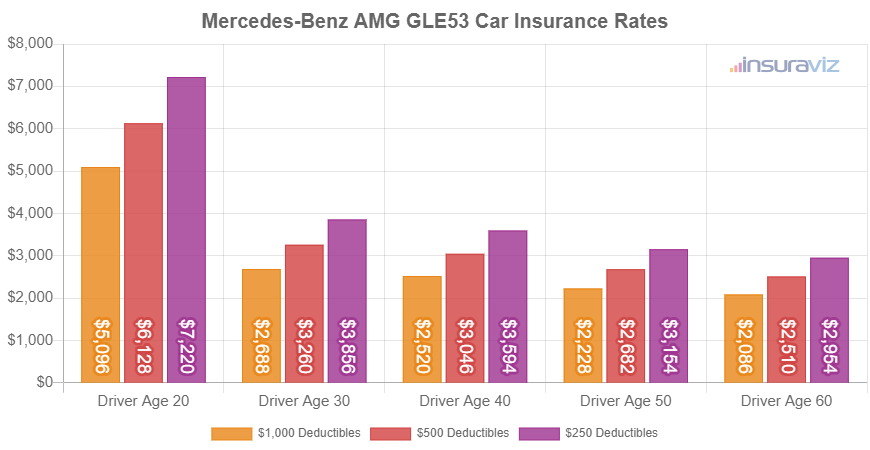

The rate summary chart below demonstrates how car insurance rates can vary with differences in driver age and coverage deductibles. Rates in the example range from $1,692 per year for a 60-year-old driver with $1,000 deductibles up to $5,854 per year for a 20-year-old with a deductible of $250.

Adding options and buying higher-level trim packages generally increase the cost of car insurance. The next table details the estimated yearly and semi-annual policy costs, including a monthly budget amount, for several Mercedes-Benz AMG GLE53 trim levels available for 2024.

| 2024 Mercedes-Benz AMG GLE53 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 4Matic+ SUV | $2,436 | $203 |

| Coupe | $2,498 | $208 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

Other AMG GLE53 insurance rates and insights

Additional data insights about Mercedes-Benz AMG GLE53 insurance cost include:

- It’s expensive to buy high-risk insurance. For a 50-year-old driver, having a tendency to get into accidents or receive violations can cause a rate increase of $2,874 or more per year.

- Better credit scores yield better car insurance rates. Having excellent credit of 800+ could save an average of $387 per year compared to a slightly lower credit score between 670-739. Conversely, a less-than-perfect credit history could cost as much as $449 more per year.

- Get cheaper rates by researching discounts. Discounts may be available if the insured drivers are homeowners, choose electronic billing, are good students, insure their home and car with the same company, or many other discounts which could save the average driver as much as $418 per year on the cost of insuring an AMG GLE53.

- Fewer accidents means cheaper Mercedes-Benz AMG GLE53 insurance. Having a few at-fault accidents can really raise rates, possibly as much as $3,508 per year for a 20-year-old driver and as much as $1,006 per year for a 40-year-old driver.

- As driver age increases, insurance rates tend to go down. The difference in insurance rates for an AMG GLE53 between a 60-year-old driver ($2,036 per year) and a 20-year-old driver ($4,970 per year) is $2,934, or a savings of 83.8%.

- Citations and violations increase rates. If you want to pay the best price on AMG GLE53 insurance rates, it pays to not be aggressive behind the wheel. As a matter of fact, just a couple blemishes on your driving record have the ramification of raising policy cost by up to $650 per year.

Mercedes-Benz AMG GLE53 vs. other luxury SUVs

When compared to other vehicles in the midsize luxury SUV segment, insurance prices for a Mercedes-Benz AMG GLE53 cost $568 more per year than the Lexus RX 350, $42 more than the BMW X5, and $570 more than the Acura MDX.

The Mercedes-Benz AMG GLE53 ranks 33rd out of 41 total comparison vehicles in the midsize luxury SUV category for most affordable auto insurance rates.

The chart displayed below shows how Mercedes-Benz AMG GLE53 insurance rates compare to the best-selling midsize luxury SUVs like the Cadillac XT5, Infiniti QX60, and the Lexus GX 460. A more comprehensive data table is included after the chart that displays car insurance rates for all 41 vehicles in the midsize luxury SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Jaguar E-Pace | $1,776 | -$690 |

| 2 | Cadillac XT5 | $1,792 | -$674 |

| 3 | Infiniti QX50 | $1,844 | -$622 |

| 4 | Cadillac XT6 | $1,856 | -$610 |

| 5 | Infiniti QX60 | $1,868 | -$598 |

| 6 | Mercedes-Benz AMG GLB35 | $1,870 | -$596 |

| 7 | Acura MDX | $1,896 | -$570 |

| 8 | Lexus RX 350 | $1,898 | -$568 |

| 9 | Lexus TX 350 | $1,928 | -$538 |

| 10 | Lexus RX 350h | $1,952 | -$514 |

| 11 | Lexus TX 500h | $1,980 | -$486 |

| 12 | Lexus RX 500h | $1,986 | -$480 |

| 13 | Lincoln Nautilus | $2,002 | -$464 |

| 14 | Lexus RX 450h | $2,008 | -$458 |

| 15 | Volvo V90 | $2,022 | -$444 |

| 16 | Audi SQ5 | $2,094 | -$372 |

| 17 | Mercedes-Benz GLE350 | $2,118 | -$348 |

| 18 | Lincoln Aviator | $2,134 | -$332 |

| 19 | Lexus GX 550 | $2,158 | -$308 |

| 20 | Volvo V60 | $2,220 | -$246 |

| 21 | Land Rover Discovery Sport | $2,226 | -$240 |

| 22 | Mercedes-Benz GLE450 | $2,236 | -$230 |

| 23 | Cadillac Lyriq | $2,254 | -$212 |

| 24 | Volvo EX90 | $2,274 | -$192 |

| 25 | Audi Q7 | $2,304 | -$162 |

| 26 | Genesis GV80 | $2,312 | -$154 |

| 27 | Mercedes-Benz AMG GLC43 | $2,324 | -$142 |

| 28 | Audi e-tron | $2,366 | -$100 |

| 29 | Tesla Model X | $2,384 | -$82 |

| 30 | BMW X5 | $2,424 | -$42 |

| 31 | Audi Q8 | $2,438 | -$28 |

| 32 | Land Rover Discovery | $2,452 | -$14 |

| 33 | Mercedes-Benz AMG GLE53 | $2,466 | -- |

| 34 | Audi SQ7 | $2,550 | $84 |

| 35 | BMW iX | $2,586 | $120 |

| 36 | BMW X6 | $2,652 | $186 |

| 37 | Land Rover Range Rover Sport | $2,762 | $296 |

| 38 | Audi RS 6 | $2,818 | $352 |

| 39 | Porsche Cayenne | $2,842 | $376 |

| 40 | BMW XM | $3,114 | $648 |

| 41 | Mercedes-Benz AMG GLE63 | $3,198 | $732 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated February 23, 2024