- Jaguar E-Pace car insurance costs $2,242 per year on average, or around $187 per month for full coverage.

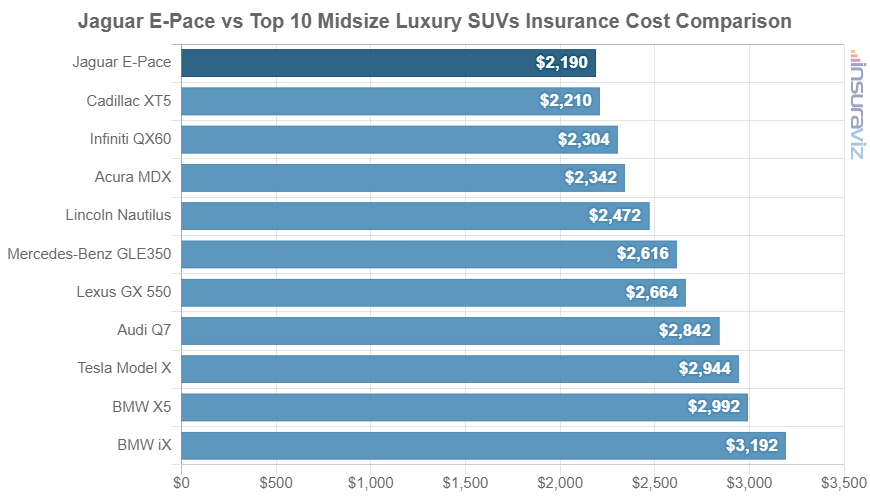

- The E-Pace is one of the cheaper midsize luxury SUVs to insure, costing $608 less per year on average as compared to the rest of the vehicles in the segment.

- The base E-Pace R-Dynamic SE trim level is the cheapest to insure at around $2,242 per year. The most expensive trim is the R-Dynamic SE at $2,242 per year.

How much does Jaguar E-Pace insurance cost?

Average Jaguar E-Pace insurance costs $2,242 yearly for full coverage, or about $187 a month. Liability/medical (or PIP) coverage costs approximately $528 a year, collision insurance costs about $1,136, and the remaining comprehensive is an estimated $578.

The following chart illustrates how average E-Pace car insurance rates change based on the age of the rated driver and policy deductibles. The rate values vary from as low as $1,538 per year for a 60-year-old driver with high physical damage deductibles to the highest rate of $5,320 annually for a 20-year-old driver with low physical damage deductibles.

Is E-Pace insurance expensive?

The Jaguar E-Pace ranks first out of 41 total vehicles in the midsize luxury SUV category. The E-Pace costs an average of $2,242 per year for full coverage insurance, while the category median cost is $2,850 annually, a difference of $608 per year.

When compared to the top-selling other midsize luxury SUVs, car insurance for a Jaguar E-Pace costs $164 less per year than the Lexus RX 350, $826 less than the BMW X5, $154 less than the Acura MDX, and $22 less than the Cadillac XT5.

The chart below shows how the insurance cost for a 2024 E-Pace compares to other best-selling midsize luxury SUVs in America. Insurance affordability rankings for all 41 vehicles in the 2024 model year segment are included in the table below the chart.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Jaguar E-Pace | $2,242 | -- |

| 2 | Cadillac XT5 | $2,264 | $22 |

| 3 | Infiniti QX50 | $2,330 | $88 |

| 4 | Cadillac XT6 | $2,348 | $106 |

| 5 | Infiniti QX60 | $2,358 | $116 |

| 6 | Mercedes-Benz AMG GLB35 | $2,364 | $122 |

| 7 | Acura MDX | $2,396 | $154 |

| 8 | Lexus RX 350 | $2,406 | $164 |

| 9 | Lexus TX 350 | $2,440 | $198 |

| 10 | Lexus RX 350h | $2,468 | $226 |

| 11 | Lexus TX 500h | $2,506 | $264 |

| 12 | Lexus RX 500h | $2,514 | $272 |

| 13 | Lincoln Nautilus | $2,534 | $292 |

| 14 | Lexus RX 450h | $2,538 | $296 |

| 15 | Volvo V90 | $2,558 | $316 |

| 16 | Audi SQ5 | $2,646 | $404 |

| 17 | Mercedes-Benz GLE350 | $2,680 | $438 |

| 18 | Lincoln Aviator | $2,698 | $456 |

| 19 | Lexus GX 550 | $2,728 | $486 |

| 20 | Volvo V60 | $2,808 | $566 |

| 21 | Land Rover Discovery Sport | $2,814 | $572 |

| 22 | Mercedes-Benz GLE450 | $2,826 | $584 |

| 23 | Cadillac Lyriq | $2,852 | $610 |

| 24 | Volvo EX90 | $2,876 | $634 |

| 25 | Audi Q7 | $2,912 | $670 |

| 26 | Genesis GV80 | $2,926 | $684 |

| 27 | Mercedes-Benz AMG GLC43 | $2,938 | $696 |

| 28 | Audi e-tron | $2,994 | $752 |

| 29 | Tesla Model X | $3,016 | $774 |

| 30 | BMW X5 | $3,068 | $826 |

| 31 | Audi Q8 | $3,082 | $840 |

| 32 | Land Rover Discovery | $3,100 | $858 |

| 33 | Mercedes-Benz AMG GLE53 | $3,120 | $878 |

| 34 | Audi SQ7 | $3,224 | $982 |

| 35 | BMW iX | $3,272 | $1,030 |

| 36 | BMW X6 | $3,350 | $1,108 |

| 37 | Land Rover Range Rover Sport | $3,492 | $1,250 |

| 38 | Audi RS 6 | $3,564 | $1,322 |

| 39 | Porsche Cayenne | $3,594 | $1,352 |

| 40 | BMW XM | $3,938 | $1,696 |

| 41 | Mercedes-Benz AMG GLE63 | $4,046 | $1,804 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

A few additional observations regarding the cost of insurance for a Jaguar E-Pace include:

- A good driving record means cheaper rates. In order to get the cheapest E-Pace insurance rates, it pays to follow traffic laws. Not surprisingly, just one or two minor lapses of judgment on your driving record have the potential to increase the cost of a policy by as much as $584 per year. Being convicted of a serious infraction like driving under the influence of drugs or alcohol could raise rates by an additional $2,064 or more.

- Be a careful driver and save. Being the cause of frequent accidents will raise rates, potentially up to $3,174 per year for a 20-year-old driver and even as much as $512 per year for a 60-year-old driver.

- Qualify for discounts to save money. Discounts may be available if the insured drivers are homeowners, work in certain occupations, drive a vehicle with safety or anti-theft features, take a defensive driving course, or other discounts which could save the average driver as much as $378 per year on the cost of insuring an E-Pace.

- Getting older pays dividends in cheaper insurance. The difference in insurance cost on an E-Pace between a 40-year-old driver ($2,242 per year) and a 20-year-old driver ($4,510 per year) is $2,268, or a savings of 67.2%.

- High-risk E-Pace insurance is expensive. For a 30-year-old driver, having too many accidents or violations increases the cost by $2,736 or more per year.

- The higher the deductibles, the lower the cost. Raising the comprehensive and collision deductibles from $500 to $1,000 could save around $388 per year for a 40-year-old driver and $766 per year for a 20-year-old driver.

- Low deductibles make insurance more expensive. Decreasing your deductibles from $500 to $250 could cost an additional $406 per year for a 40-year-old driver and $810 per year for a 20-year-old driver.