- The average Range Rover Sport insurance cost is $3,492 per year, or $291 per month for full coverage.

- The Range Rover Sport P360 SE trim level is the cheapest to insure at around $3,058 per year. The most expensive trim is the SV Edition One Obsidian/Flux at $3,866 per year.

- Out of 41 models in the 2024 midsize luxury SUV segment, the Range Rover Sport ranks 37th for most affordable insurance.

How much does Range Rover Sport insurance cost?

Ranked 37th out of 41 vehicles in the midsize luxury SUV class, Range Rover Sport insurance averages around $3,492 annually, or about $291 monthly. With the average midsize luxury SUV costing $2,850 a year to insure, the Sport costs $642 more than the average rate.

The next chart illustrates how Range Rover Sport insurance rates can change based on the age of the rated driver and the chosen policy deductibles.

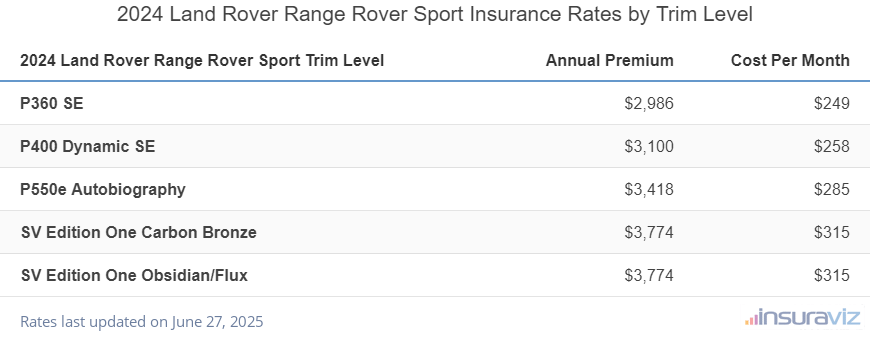

Driver age and policy limits are two of the larger factors that determine the cost of car insurance, but the trim level of the vehicle being insured is also an important factor.

At a MSRP of $85,075, the cheapest model to insure is the P360 SE. At the high end, with a MSRP of $181,775, the SV Edition One Obsidian/Flux model costs the most to insure.

The table below breaks down average Range Rover Sport insurance cost by trim level for the 2024 model year.

| 2024 Land Rover Range Rover Sport Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| P360 SE | $3,058 | $255 |

| P400 Dynamic SE | $3,172 | $264 |

| P550e Autobiography | $3,500 | $292 |

| SV Edition One Carbon Bronze | $3,866 | $322 |

| SV Edition One Obsidian/Flux | $3,866 | $322 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How do Range Rover Sport insurance rates compare?

Car insurance prices for a Range Rover Sport cost $1,086 more per year than the Lexus RX 350, $424 more than the BMW X5, and $1,096 more than the Acura MDX.

The Range Rover Sport ranks 37th out of 41 total vehicles in the 2024 midsize luxury SUV class for auto insurance affordability.

The table below ranks car insurance cost for all midsize luxury SUVs in the United States, and compares Range Rover Sport insurance rates to popular models like the Cadillac XT5, Infiniti QX60, and the Lexus GX 460.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Jaguar E-Pace | $2,242 | -$1,250 |

| 2 | Cadillac XT5 | $2,264 | -$1,228 |

| 3 | Infiniti QX50 | $2,330 | -$1,162 |

| 4 | Cadillac XT6 | $2,348 | -$1,144 |

| 5 | Infiniti QX60 | $2,358 | -$1,134 |

| 6 | Mercedes-Benz AMG GLB35 | $2,364 | -$1,128 |

| 7 | Acura MDX | $2,396 | -$1,096 |

| 8 | Lexus RX 350 | $2,406 | -$1,086 |

| 9 | Lexus TX 350 | $2,440 | -$1,052 |

| 10 | Lexus RX 350h | $2,468 | -$1,024 |

| 11 | Lexus TX 500h | $2,506 | -$986 |

| 12 | Lexus RX 500h | $2,514 | -$978 |

| 13 | Lincoln Nautilus | $2,534 | -$958 |

| 14 | Lexus RX 450h | $2,538 | -$954 |

| 15 | Volvo V90 | $2,558 | -$934 |

| 16 | Audi SQ5 | $2,646 | -$846 |

| 17 | Mercedes-Benz GLE350 | $2,680 | -$812 |

| 18 | Lincoln Aviator | $2,698 | -$794 |

| 19 | Lexus GX 550 | $2,728 | -$764 |

| 20 | Volvo V60 | $2,808 | -$684 |

| 21 | Land Rover Discovery Sport | $2,814 | -$678 |

| 22 | Mercedes-Benz GLE450 | $2,826 | -$666 |

| 23 | Cadillac Lyriq | $2,852 | -$640 |

| 24 | Volvo EX90 | $2,876 | -$616 |

| 25 | Audi Q7 | $2,912 | -$580 |

| 26 | Genesis GV80 | $2,926 | -$566 |

| 27 | Mercedes-Benz AMG GLC43 | $2,938 | -$554 |

| 28 | Audi e-tron | $2,994 | -$498 |

| 29 | Tesla Model X | $3,016 | -$476 |

| 30 | BMW X5 | $3,068 | -$424 |

| 31 | Audi Q8 | $3,082 | -$410 |

| 32 | Land Rover Discovery | $3,100 | -$392 |

| 33 | Mercedes-Benz AMG GLE53 | $3,120 | -$372 |

| 34 | Audi SQ7 | $3,224 | -$268 |

| 35 | BMW iX | $3,272 | -$220 |

| 36 | BMW X6 | $3,350 | -$142 |

| 37 | Land Rover Range Rover Sport | $3,492 | -- |

| 38 | Audi RS 6 | $3,564 | $72 |

| 39 | Porsche Cayenne | $3,594 | $102 |

| 40 | BMW XM | $3,938 | $446 |

| 41 | Mercedes-Benz AMG GLE63 | $4,046 | $554 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Additional rates and insights

We covered rates for different driver ages, different policy deductibles, and different trim levels. There are a lot more things that factor into car insurance premiums, however, and some of those are discussed in the list below.

- Policyholder gender affects insurance cost. For a 2024 Land Rover Range Rover Sport, a 20-year-old male driver will pay an estimated rate of $7,052 per year, while a 20-year-old woman pays an average of $5,032, a difference of $2,020 per year. Women get significantly cheaper rates. But by age 50, the cost for male drivers is $3,068 and the cost for a female driver is $3,002, a difference of only $66.

- Find cheaper rates by qualifying for discounts. Discounts may be available if the insured drivers take a defensive driving course, are military or federal employees, insure their home and car with the same company, are homeowners, or many other discounts which could save the average driver as much as $594 per year.

- Teen drivers cost a lot to insure. Average rates for full coverage Range Rover Sport insurance costs $12,202 per year for a 16-year-old driver, $11,927 per year for a 17-year-old driver, $10,884 per year for an 18-year-old driver, and $9,834 per year for a 19-year-old driver.

- As you get older, rates tend to drop. The difference in 2024 Land Rover Range Rover Sport insurance cost between a 60-year-old driver ($2,876 per year) and a 20-year-old driver ($7,052 per year) is $4,176, or a savings of 84.1%.

- A good driving record pays dividends. In order to get the lowest Range Rover Sport insurance rates, it’s necessary to to be a conservative driver. In fact, just a few minor incidents on your driving report can potentially raise policy rates as much as $922 per year. Serious infractions like a DUI could raise rates by an additional $3,240 or more.