- Car insurance on a Mercedes-Benz S580 costs around $4,262 per year, $2,131 for a 6-month policy, or around $355 per month.

- Out of 24 vehicles in the 2024 large luxury car segment, the S580 ranks 19th for car insurance affordability.

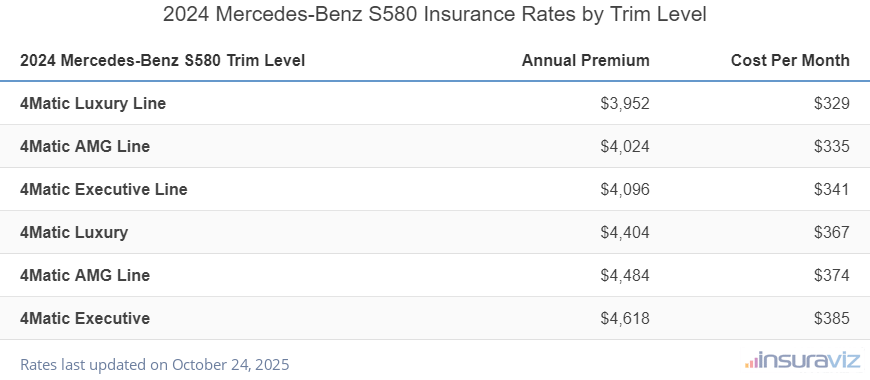

- With the cheapest insurance rates, the S580 4Matic Luxury Line model costs an average of $3,952 per year to insure.

- At the high end, the S580 4Matic Executive is the most expensive to insure at $4,618 for an annual policy.

How much does Mercedes-Benz S580 insurance cost?

Ranked 19th out of 24 vehicles in the large luxury car class, Mercedes-Benz S580 insurance rates average $4,262 a year for full coverage, or about $355 if paid each month.

Average monthly insurance cost for the S580 ranges from $329 to $385, depending on the trim level being insured. The cheapest 4Matic Luxury Line trim (MSRP of $117,700) is the cheapest model to insure, while the more expensive 4Matic Executive model (MSRP of $137,100) has the highest cost car insurance.

The rate chart below shows how the age of the driver and the policy deductibles impact the cost of Mercedes S580 car insurance rates. Average rates in the example range from $2,842 per year for a 60-year-old with $1,000 deductibles up to $10,276 each year for a low-deductible policy and a 20-year-old driver.

In addition to driver age and policy deductibles, another factor that can affect the cost of car insurance is the trim level of the vehicle being insured. The table below shows average rates for the different packages available for the 2024 model year S580.

| 2024 Mercedes-Benz S580 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 4Matic Luxury Line | $3,952 | $329 |

| 4Matic AMG Line | $4,024 | $335 |

| 4Matic Executive Line | $4,096 | $341 |

| 4Matic Luxury | $4,404 | $367 |

| 4Matic AMG Line | $4,484 | $374 |

| 4Matic Executive | $4,618 | $385 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Additional factors that can impact price are things like your driving record, your gender, and even possibly your credit rating. The list below discusses these plus goes into more detail regarding the impact of driver age.

- A good driving record pays dividends. To pay the most affordable S580 insurance rates, it pays to follow traffic laws. Not surprisingly, just one or two minor infractions on your driving record could increase insurance rates by as much as $1,110 per year.

- High-risk car insurance can get expensive. For a 50-year-old driver, having too many driving record violations or accidents could increase the cost by $4,898 or more per year.

- Insuring teen drivers is expensive. Average rates for full coverage S580 insurance costs $14,614 per year for a 16-year-old driver, $14,358 per year for a 17-year-old driver, $13,248 per year for an 18-year-old driver, and $11,920 per year for a 19-year-old driver.

- Lower policy cost by raising deductibles. Increasing your policy deductibles from $500 to $1,000 could save around $810 per year for a 40-year-old driver and $1,598 per year for a 20-year-old driver.

- Lowering deductibles results in a more expensive policy. Decreasing your policy deductibles from $500 to $250 could cost an additional $846 per year for a 40-year-old driver and $1,694 per year for a 20-year-old driver.

- Find cheaper rates by qualifying for policy discounts. Discounts may be available if the insured drivers work in certain occupations, sign their policy early, drive low annual mileage, are homeowners, or many other policy discounts which could save the average driver as much as $722 per year on their insurance cost.

- Better credit scores yield better car insurance rates. Having a credit score over 800 could save $669 per year versus a lower credit rating of 670-739. Conversely, a credit score below 579 could cost as much as $776 more per year.

- Young males pay a lot more for insurance. For a 2024 Mercedes-Benz S580, a 20-year-old male driver pays an estimated $8,582 per year, while a 20-year-old woman will get a rate of $6,116, a difference of $2,466 per year. The females get the cheaper rate by far. But by age 50, male driver rates are $3,732 and female driver rates are $3,658, a difference of only $74.

Mercedes-Benz S580 insurance cost compared

When compared to the other large luxury cars, car insurance rates for a Mercedes-Benz S580 cost $1,412 more per year than the Audi A5, $1,108 more than the Genesis G90, and $520 less than the Porsche Panamera.

The S580 ranks 19th out of 24 total comparison vehicles in the large luxury car class for most affordable insurance cost. The S580 costs an average of $4,262 per year to insure for full coverage, while the class average policy cost is $3,839 per year, a difference of $423 per year.

The chart below compares S580 insurance cost to the 10 most popular large luxury sedans in the U.S. Following the chart is a table that ranks average insurance rates for all 24 models in the 2024 full-size luxury sedan segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Audi A5 | $2,850 | -$1,412 |

| 2 | Volvo S90 | $2,940 | -$1,322 |

| 3 | Genesis G90 | $3,154 | -$1,108 |

| 4 | Mercedes-Benz AMG E53 | $3,164 | -$1,098 |

| 5 | Mercedes-Benz EQS 450 | $3,198 | -$1,064 |

| 6 | Lexus LS 500 | $3,298 | -$964 |

| 7 | Lexus LS 500h | $3,338 | -$924 |

| 8 | BMW 840i | $3,436 | -$826 |

| 9 | BMW i7 | $3,482 | -$780 |

| 10 | Audi RS 7 | $3,608 | -$654 |

| 11 | BMW M850i | $3,870 | -$392 |

| 12 | BMW 740i | $3,884 | -$378 |

| 13 | BMW 750e | $3,898 | -$364 |

| 14 | Mercedes-Benz AMG GT43 | $3,926 | -$336 |

| 15 | Audi S8 | $3,972 | -$290 |

| 16 | Mercedes-Benz S500 | $4,072 | -$190 |

| 17 | Audi A8 | $4,078 | -$184 |

| 18 | BMW 760i | $4,104 | -$158 |

| 19 | Mercedes-Benz S580 | $4,262 | -- |

| 20 | Mercedes-Benz EQS 580 | $4,334 | $72 |

| 21 | Mercedes-Benz Maybach S580 | $4,710 | $448 |

| 22 | Mercedes-Benz AMG EQS | $4,758 | $496 |

| 23 | Porsche Panamera | $4,782 | $520 |

| 24 | Mercedes-Benz Maybach S680 | $5,026 | $764 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025