- BMW 428xi car insurance costs an average of $2,120 per year, or around $177 per month, for full coverage.

- Ranked 17th out of 53 other models in the 2016 midsize luxury car class, car insurance rates for the BMW 428xi cost $161 less per year than the average cost for the segment.

- The 428xi Gran Coupe trim level is the cheapest to insure at around $2,072 per year. The most expensive trim is the Convertible at $2,192 per year.

How much does BMW 428xi car insurance cost?

BMW 428xi insurance costs on average $2,120 annually for full coverage, or around $177 if paid each month. Expect to pay approximately $161 less per year to insure a BMW 428xi compared to the average rate for midsize luxury cars, and $156 less per year than the all-vehicle national average of $2,276.

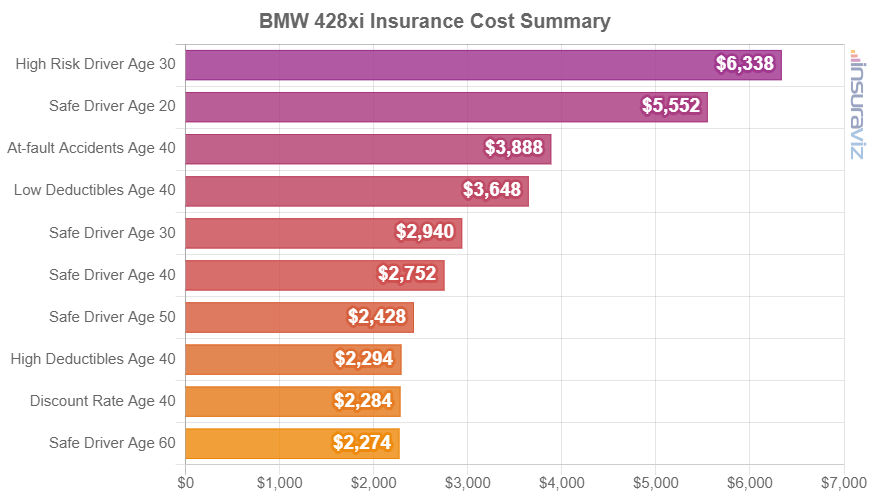

The rate chart below illustrates average insurance cost for a 2016 BMW 428xi with a variety of different policy risk scenarios.

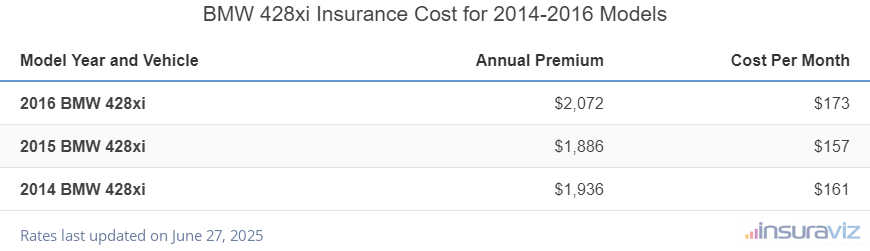

The next table shows average car insurance rates for different policy terms for a BMW 428xi from the 2014 to the 2016 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2016 BMW 428xi | $2,120 | $177 |

| 2015 BMW 428xi | $1,930 | $161 |

| 2014 BMW 428xi | $1,982 | $165 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW 428xi trim levels for each model year. Updated October 24, 2025

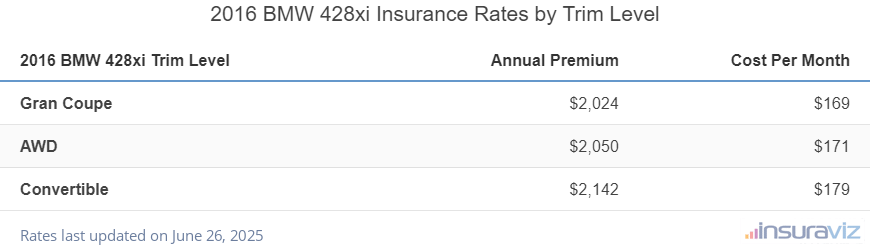

The rate table below displays average annual and 6-month policy costs, in addition to a monthly insurance rate, for each BMW 428xi package and trim.

| 2016 BMW 428xi Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Gran Coupe | $2,072 | $173 |

| AWD | $2,100 | $175 |

| Convertible | $2,192 | $183 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Below are some additional insurance rates for different scenarios, plus some tips on how you can reduce the overall cost of your next policy.

- Improve your credit for cheaper auto insurance rates. Having an excellent credit score over 800 could save as much as $333 per year when compared to a good rating of 670-739. Conversely, a credit score lower than 579 could cost around $386 more per year.

- Your employment could save you money. The vast majority of car insurance companies offer discounts for having a job in professions like lawyers, police officers and law enforcement, firefighters, doctors, college professors, members of the military, and others. Qualifying for an occupational discount could potentially save between $64 and $179 on your annual insurance cost, depending on the policy coverages selected.

- Citations and violations increase policy cost. If you want the cheapest car insurance rates, it’s necessary to be a good, safe driver. As a matter of fact, just one or two minor incidents on your driving report have the ramification of increasing insurance rates by up to $570 per year. Major misdemeanor violations such as DWI/DUI and reckless driving could raise rates by an additional $1,978 or more.

- Qualify for discounts to lower insurance cost. Discounts may be available if the insureds are loyal customers, are senior citizens, belong to certain professional organizations, are homeowners, take a defensive driving course, or many other discounts which could save the average driver as much as $358 per year on their insurance cost.

- 428xi insurance rates for teens are expensive. Average rates for full coverage 428xi insurance costs $7,640 per year for a 16-year-old driver, $7,383 per year for a 17-year-old driver, $6,579 per year for an 18-year-old driver, and $6,002 per year for a 19-year-old driver.

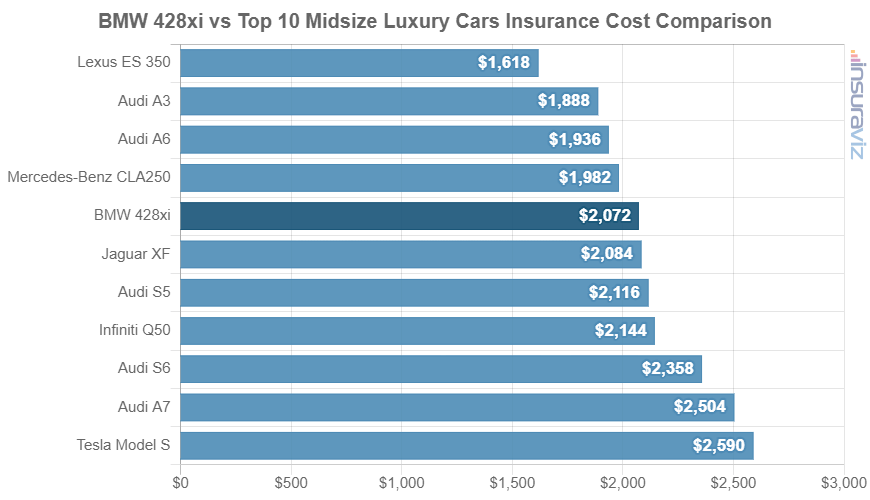

How does 428xi insurance compare to similar vehicles?

When compared side-by-side to other popular midsize luxury cars, insurance prices for a BMW 428xi cost $462 more per year than the Lexus ES 350, $76 less than the Infiniti Q50, and $162 more than the Lincoln MKZ.

The BMW 428xi ranks 17th out of 53 comparison vehicles in the midsize luxury car segment for most affordable car insurance cost. The 428xi costs an estimated $2,120 per year for full coverage auto insurance and the category median rate is $2,281 per year, a difference of $161 per year.

The chart below shows how average BMW 428xi car insurance rates compare to the top 10 most popular midsize luxury cars like the Mercedes-Benz CLA250, Audi A6, and the Lincoln MKZ. A comprehensive table is included following the chart that shows insurance rankings for the entire midsize luxury car category.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Lexus ES 350 | $1,658 | -$462 |

| 2 | Acura ILX | $1,726 | -$394 |

| 3 | Lexus IS 300 | $1,836 | -$284 |

| 4 | Volvo S80 | $1,880 | -$240 |

| 5 | Mercedes-Benz C350E | $1,886 | -$234 |

| 6 | Lexus RC 300 | $1,902 | -$218 |

| 7 | Audi A3 | $1,930 | -$190 |

| 8 | Mercedes-Benz AMG CLA45 | $1,954 | -$166 |

| 9 | Lincoln MKZ | $1,958 | -$162 |

| 10 | Lexus ES 300H | $1,972 | -$148 |

| 11 | Audi A6 | $1,984 | -$136 |

| 12 | Mercedes-Benz CLA250 | $2,028 | -$92 |

| 13 | BMW 528i | $2,070 | -$50 |

| 14 | Lexus GS 350 | $2,084 | -$36 |

| 15 | Audi S4 | $2,102 | -$18 |

| 16 | Mercedes-Benz E350 | $2,116 | -$4 |

| 17 | BMW 428xi | $2,120 | -- |

| 18 | Mercedes-Benz SLK55 AMG | $2,136 | $16 |

| 19 | Cadillac ELR | $2,142 | $22 |

| 20 | Mercedes-Benz C450 AMG | $2,150 | $30 |

| 21 | Jaguar XF | $2,152 | $32 |

| 22 | BMW 428i | $2,160 | $40 |

| 23 | Audi S5 | $2,168 | $48 |

| 24 | Hyundai Genesis | $2,184 | $64 |

| 25 | BMW 528xi | $2,188 | $68 |

| 26 | Infiniti Q50 | $2,196 | $76 |

| 27 | BMW 535xi | $2,204 | $84 |

| 28 | BMW 435xi | $2,230 | $110 |

| 29 | Mercedes-Benz E250 | $2,244 | $124 |

| 30 | Mercedes-Benz SL400 | $2,264 | $144 |

| 31 | BMW Active 5 | $2,268 | $148 |

| 32 | BMW 435i | $2,280 | $160 |

| 33 | BMW 535d | $2,302 | $182 |

| 34 | Mercedes-Benz E400 | $2,356 | $236 |

| 35 | BMW 535i | $2,360 | $240 |

| 36 | Mercedes-Benz E550 | $2,376 | $256 |

| 37 | Audi S6 | $2,398 | $278 |

| 38 | BMW 550i | $2,416 | $296 |

| 39 | Mercedes-Benz CLS400 | $2,492 | $372 |

| 40 | BMW 550xi | $2,510 | $390 |

| 41 | Mercedes-Benz SL550 | $2,516 | $396 |

| 42 | BMW 640i | $2,552 | $432 |

| 43 | Audi A7 | $2,562 | $442 |

| 44 | BMW 640xi | $2,570 | $450 |

| 45 | BMW M5 | $2,576 | $456 |

| 46 | Audi S7 | $2,584 | $464 |

| 47 | Tesla Model S | $2,650 | $530 |

| 48 | Mercedes-Benz S550E | $2,658 | $538 |

| 49 | BMW 650xi | $2,676 | $556 |

| 50 | Lexus GS F | $2,688 | $568 |

| 51 | BMW M6 | $2,866 | $746 |

| 52 | Mercedes-Benz SL63 AMG | $2,946 | $826 |

| 53 | Mercedes-Benz SL65 AMG | $3,672 | $1,552 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2016 model year. Updated October 24, 2025