- BMW M6 car insurance costs an average of $3,558 per year, $1,779 for a 6-month policy, or around $297 per month.

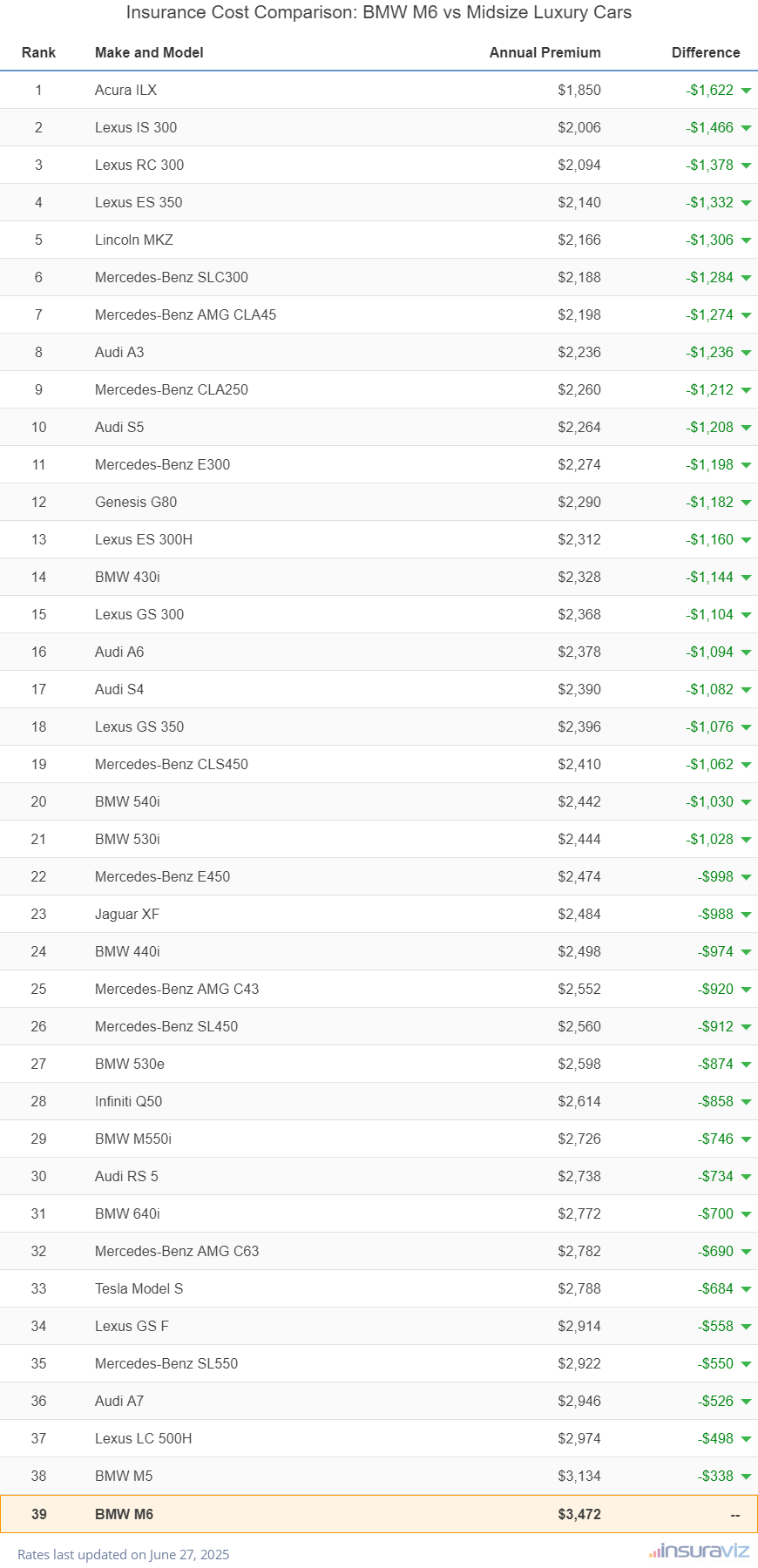

- Out of 39 models in the 2019 midsize luxury car segment, the BMW M6 ranks 39th for auto insurance affordability.

How much does BMW M6 insurance cost?

BMW M6 car insurance costs an average of $3,558 annually for full coverage, or about $297 a month. For individual coverages, collision insurance costs approximately $1,966 a year, liability and medical payments insurance will cost about $714, and the remaining comprehensive coverage is around $878.

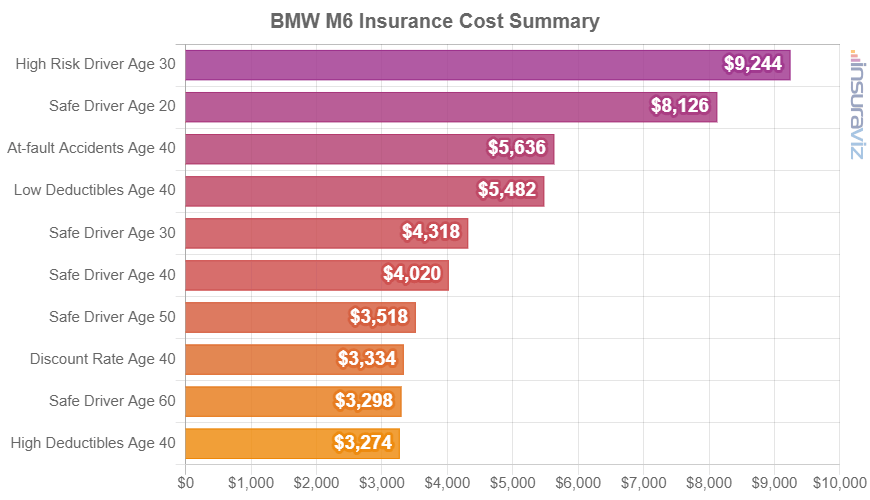

The cost summary chart below shows average auto insurance cost for a 2019 M6 using variations of risk profiles and driver ages.

The table below breaks down average car insurance rates for a BMW M6 for the 2013 to 2019 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2019 BMW M6 | $3,558 | $297 |

| 2018 BMW M6 | $3,306 | $276 |

| 2017 BMW M6 | $3,142 | $262 |

| 2016 BMW M6 | $2,866 | $239 |

| 2015 BMW M6 | $2,660 | $222 |

| 2014 BMW M6 | $2,556 | $213 |

| 2013 BMW M6 | $2,388 | $199 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW M6 trim levels for each model year. Updated October 24, 2025

Is BMW M6 car insurance expensive?

Yes, car insurance for a BMW M6 is expensive. The M6 ranks 39th out of 39 comparison vehicles in the 2019 midsize luxury car segment for the most affordable insurance cost.

The M6 costs an average of $3,558 per year for an auto insurance policy with full coverage and the segment average rate is $2,558 per year, a difference of $1,000 per year.

When rates are compared to other vehicles in the 2019 midsize luxury car class, car insurance prices for a BMW M6 cost $1,368 more per year than the Lexus ES 350, $1,054 more than the BMW 530i, and $878 more than the Infiniti Q50.

The following table shows how average M6 car insurance prices compare to other midsize luxury cars in like the Lincoln MKZ, Mercedes-Benz CLA250, and the Audi A6.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura ILX | $1,894 | -$1,664 |

| 2 | Lexus IS 300 | $2,054 | -$1,504 |

| 3 | Lexus RC 300 | $2,146 | -$1,412 |

| 4 | Lexus ES 350 | $2,190 | -$1,368 |

| 5 | Lincoln MKZ | $2,218 | -$1,340 |

| 6 | Mercedes-Benz SLC300 | $2,240 | -$1,318 |

| 7 | Mercedes-Benz AMG CLA45 | $2,252 | -$1,306 |

| 8 | Audi A3 | $2,290 | -$1,268 |

| 9 | Mercedes-Benz CLA250 | $2,316 | -$1,242 |

| 10 | Audi S5 | $2,320 | -$1,238 |

| 11 | Mercedes-Benz E300 | $2,330 | -$1,228 |

| 12 | Genesis G80 | $2,346 | -$1,212 |

| 13 | Lexus ES 300H | $2,370 | -$1,188 |

| 14 | BMW 430i | $2,384 | -$1,174 |

| 15 | Lexus GS 300 | $2,424 | -$1,134 |

| 16 | Audi A6 | $2,438 | -$1,120 |

| 17 | Audi S4 | $2,448 | -$1,110 |

| 18 | Lexus GS 350 | $2,454 | -$1,104 |

| 19 | Mercedes-Benz CLS450 | $2,468 | -$1,090 |

| 20 | BMW 540i | $2,502 | -$1,056 |

| 21 | BMW 530i | $2,504 | -$1,054 |

| 22 | Mercedes-Benz E450 | $2,536 | -$1,022 |

| 23 | Jaguar XF | $2,546 | -$1,012 |

| 24 | BMW 440i | $2,558 | -$1,000 |

| 25 | Mercedes-Benz AMG C43 | $2,612 | -$946 |

| 26 | Mercedes-Benz SL450 | $2,622 | -$936 |

| 27 | BMW 530e | $2,662 | -$896 |

| 28 | Infiniti Q50 | $2,680 | -$878 |

| 29 | BMW M550i | $2,792 | -$766 |

| 30 | Audi RS 5 | $2,806 | -$752 |

| 31 | BMW 640i | $2,838 | -$720 |

| 32 | Mercedes-Benz AMG C63 | $2,850 | -$708 |

| 33 | Tesla Model S | $2,854 | -$704 |

| 34 | Lexus GS F | $2,984 | -$574 |

| 35 | Mercedes-Benz SL550 | $2,996 | -$562 |

| 36 | Audi A7 | $3,018 | -$540 |

| 37 | Lexus LC 500H | $3,046 | -$512 |

| 38 | BMW M5 | $3,210 | -$348 |

| 39 | BMW M6 | $3,558 | -- |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2019 model year. Updated October 24, 2025

Other insurance rates and discounts

Below are some additional rates for different policy situations as well as some discounts and tips that could save you money on your next policy.

- Be a careful driver and pay less for insurance. Too many at-fault accidents can cost more, potentially as much as $1,720 per year for a 30-year-old driver and even $1,016 per year for a 50-year-old driver.

- Obey the law to get lower policy cost. If you want to pay the most economical M6 insurance rates, it makes sense to be a safe driver. Just one or two minor blemishes on your driving record could result in spiking policy cost by at least $948 per year. Major violations like DUI/DWI and leaving the scene of an accident could raise rates by an additional $3,336 or more.

- Gender and age are two big factors. For a 2019 BMW M6, a 20-year-old male will pay an average rate of $7,244 per year, while a 20-year-old female driver will pay an average of $5,142, a difference of $2,102 per year in the women’s favor by a large margin. But by age 50, rates for male drivers are $3,118 and rates for female drivers are $3,052, a difference of only $66.

- Getting older means cheaper auto insurance rates. The difference in insurance cost for a BMW M6 between a 60-year-old driver ($2,926 per year) and a 20-year-old driver ($7,244 per year) is $4,318, or a savings of 84.9%.

- Insuring teen drivers is expensive. Average rates for full coverage M6 insurance costs $12,526 per year for a 16-year-old driver, $12,262 per year for a 17-year-old driver, $11,218 per year for an 18-year-old driver, and $10,108 per year for a 19-year-old driver.

- Get better rates due to your occupation. The large majority of car insurance providers offer policy discounts for specific professions like nurses, emergency medical technicians, firefighters, scientists, accountants, and others. If your job can earn you this discount, you may save between $107 and $207 on your annual BMW M6 car insurance premium, depending on the policy coverages selected.