- GMC Acadia insurance costs an average of $2,316 per year on average, or about $193 per month for a policy with full coverage.

- The Acadia Elevation trim level is the cheapest to insure at around $2,210 per year, or $184 per month.

- The model with the most expensive insurance is the Denali at $2,430 per year, or around $203 per month.

- When compared to other midsize SUVs, the 2024 GMC Acadia is one of the cheaper midsize SUVs to insure, costing $54 less per year than the segment average.

How much does GMC Acadia insurance cost?

GMC Acadia car insurance costs on average $2,316 annually for full coverage, or $193 each month. With the average midsize SUV costing $2,370 a year to insure, the GMC Acadia could save roughly $54 on an annual basis over comparable models.

When compared to all vehicles, not just midsize SUVs, insurance for an Acadia costs $40 more per year than the all-vehicle national average of $2,276.

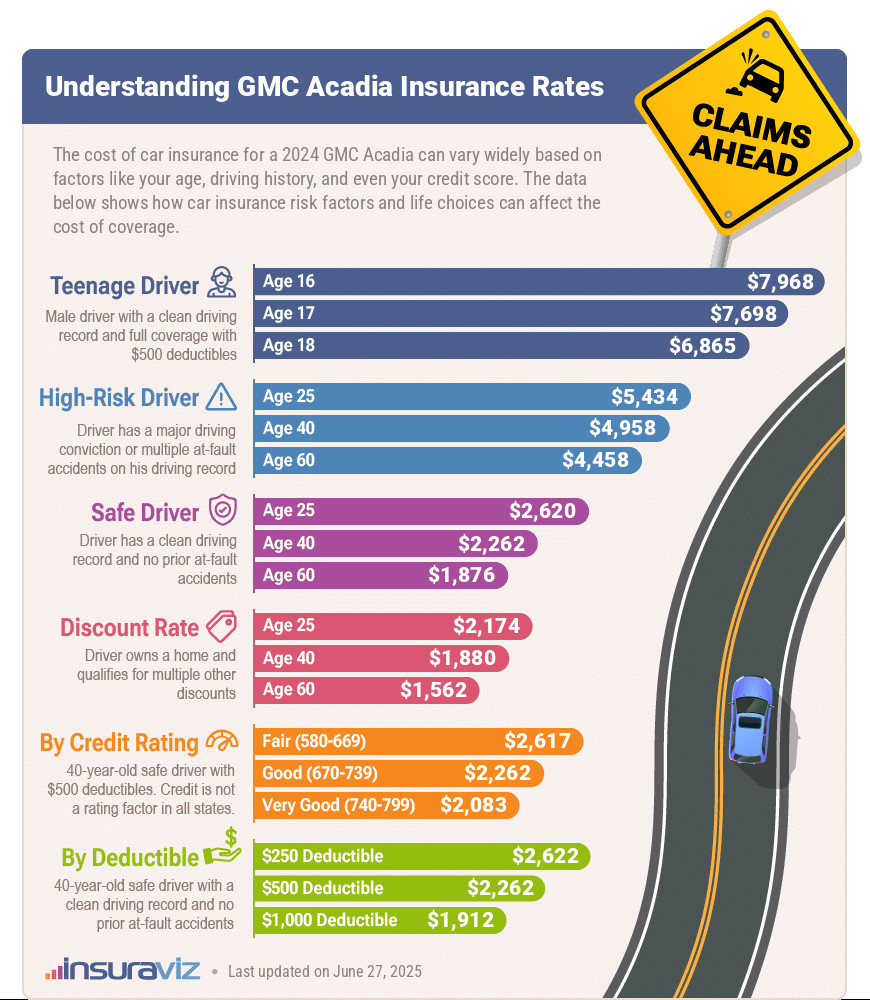

The following infographic displays the range of car insurance costs for a 2024 GMC Acadia using a variety of different risk scenarios.

This may seem like a lot of different rates for insuring the same vehicle, but honestly, it’s just a drop in the bucket.

When you factor in variables like location, marital status, financial stability, customer longevity, and a slew of other variables, there can literally be millions of different rates for the exact same vehicle.

Plus, different policy coverages make it possible to create an even wider range of rates. A liability-only insurance policy for an Acadia in some parts of Wisconsin or Iowa may be as cheap as $234 a year, while a teenager with a couple of driving violations in some high-crime zip codes in Philadelphia, could receive a car insurance bill for $16,451 a year for a policy with full coverage.

Another factor that impacts rates is the age of your Acadia. Older vehicles generally cost less to insure due to having a lower replacement value. This translates into car insurance savings when driving an older model.

The following table shows average full coverage car insurance rates for the GMC Acadia for the 2007 to 2024 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 GMC Acadia | $2,316 | $193 |

| 2023 GMC Acadia | $2,220 | $185 |

| 2022 GMC Acadia | $2,200 | $183 |

| 2021 GMC Acadia | $2,120 | $177 |

| 2020 GMC Acadia | $2,058 | $172 |

| 2019 GMC Acadia | $2,014 | $168 |

| 2018 GMC Acadia | $1,922 | $160 |

| 2017 GMC Acadia | $1,828 | $152 |

| 2016 GMC Acadia | $1,782 | $149 |

| 2015 GMC Acadia | $1,686 | $141 |

| 2014 GMC Acadia | $1,554 | $130 |

| 2013 GMC Acadia | $1,614 | $135 |

| 2012 GMC Acadia | $1,582 | $132 |

| 2011 GMC Acadia | $1,550 | $129 |

| 2010 GMC Acadia | $1,519 | $127 |

| 2009 GMC Acadia | $1,489 | $124 |

| 2008 GMC Acadia | $1,459 | $122 |

| 2007 GMC Acadia | $1,430 | $119 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all GMC Acadia trim levels for each model year. Updated October 24, 2025

This table brings up a question: Would you actually insure a 2007 Acadia with full coverage?

Probably not.

And that brings up another question: When do you drop full coverage?

That is honestly a personal decision that only you can decide. It depends on your personal financial situation and whether or not you can afford to replace your Acadia if it gets totaled in an accident or weather event.

You might read guidelines like drop full coverage when the annual cost of coverage is more than 10% of the value of the vehicle. But that doesn’t take into consideration your personal situation.

Maybe you have an extra vehicle you can drive if you do lose your Acadia. If so, then that’s great. Save the money and drop full coverage.

But maybe that vehicle is intended to be used by your 15-year-old next year when they get their driver’s license. If that’s the case, then it changes the picture completely.

There is no cut and dried answer to this question, it has to just feel right to you.

What is the cheapest GMC Acadia insurance?

With average GMC Acadia car insurance rates ranging from $2,210 to $2,430 per year on average, the cheapest model to insure is the Elevation. The next cheapest Acadia to insure is the Elevation Premium at $2,286 per year.

The most expensive models of GMC Acadia to insure are the Denali and the AT4 at $2,430 per year. Those models will cost an extra $220 per year to insure on average.

Monthly insurance cost for a GMC Acadia ranges from $184 to $203 for full coverage, depending on the exact model you’re insuring. Older models may not justify the cost of keeping full coverage, so if you’re looking to save money on insurance, liability-only coverage may be an option.

The rate table below details average annual and 6-month policy costs, plus a monthly insurance rate, for each 2024 GMC Acadia package and trim.

| 2024 GMC Acadia Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Elevation | $2,210 | $184 |

| Elevation Premium | $2,286 | $191 |

| AT4 | $2,336 | $195 |

| Denali | $2,430 | $203 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Is GMC Acadia car insurance expensive?

The GMC Acadia ranks 16th out of 34 total vehicles in the midsize SUV class. The Acadia costs an average of $2,316 per year to insure, while the segment median rate is $2,370 per year, making the Acadia $54 less per year on average.

Compared with popular models in the midsize SUV class, insurance for a GMC Acadia is:

- $274 more per year than the Subaru Outback

- $110 less per year than the Hyundai Santa Fe

- $346 less per year than the Ford Bronco

- $78 more per year than the Chevrolet Traverse

- $424 less per year than the Jeep Wrangler

When compared to all 2024 model year vehicles (not just midsize SUVs), GMC Acadia insurance costs 1.7% more than the national average car insurance rate of $2,276 per year.

The chart below shows how average insurance rates for a 2024 GMC Acadia compare against the 10 best-selling midsize SUVs. Following the chart, you will find an expanded table that illustrates insurance rankings for all 34 vehicles in the midsize SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$406 |

| 2 | Nissan Murano | $2,016 | -$300 |

| 3 | Subaru Outback | $2,042 | -$274 |

| 4 | Buick Envista | $2,050 | -$266 |

| 5 | Subaru Ascent | $2,088 | -$228 |

| 6 | Volkswagen Atlas | $2,128 | -$188 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$180 |

| 8 | Ford Explorer | $2,176 | -$140 |

| 9 | Toyota Highlander | $2,180 | -$136 |

| 10 | Toyota Venza | $2,190 | -$126 |

| 11 | Chevrolet Traverse | $2,238 | -$78 |

| 12 | Mitsubishi Outlander Sport | $2,254 | -$62 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | -$54 |

| 14 | Ford Edge | $2,270 | -$46 |

| 15 | Kia Sorento | $2,278 | -$38 |

| 16 | GMC Acadia | $2,316 | -- |

| 17 | Buick Enclave | $2,320 | $4 |

| 18 | Honda Pilot | $2,336 | $20 |

| 19 | Mazda CX-9 | $2,342 | $26 |

| 20 | Jeep Grand Cherokee | $2,398 | $82 |

| 21 | Hyundai Santa Fe | $2,426 | $110 |

| 22 | Nissan Pathfinder | $2,440 | $124 |

| 23 | Hyundai Palisade | $2,450 | $134 |

| 24 | Chevrolet Blazer | $2,476 | $160 |

| 25 | Kia Telluride | $2,504 | $188 |

| 26 | Toyota 4Runner | $2,572 | $256 |

| 27 | Mazda CX-90 | $2,582 | $266 |

| 28 | Toyota Grand Highlander | $2,610 | $294 |

| 29 | Kia EV9 | $2,630 | $314 |

| 30 | Tesla Model Y | $2,654 | $338 |

| 31 | Ford Bronco | $2,662 | $346 |

| 32 | Jeep Wrangler | $2,740 | $424 |

| 33 | Dodge Durango | $2,942 | $626 |

| 34 | Rivian R1S | $2,950 | $634 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Some closing points about Acadia insurance include:

- Policy discounts save money. Discounts may be available if the policyholders insure their home and car with the same company, work in certain occupations, are military or federal employees, sign their policy early, or many other discounts which could save the average driver as much as $392 per year on the cost of insuring an Acadia.

- Citations and violations increase insurance cost. If you want the most affordable Acadia insurance rates, it’s necessary to drive conservatively. In fact, just one or two blemishes on your motor vehicle report could result in a rate increase of up to $608 per year. Being convicted of a serious infraction such as DWI and leaving the scene of an accident could raise rates by an additional $2,112 or more.

- A good credit rating can save money. In states that have car insurance regulations that allow an insured’s credit score to be used as a policy cost factor, drivers who have credit scores over 800 may see savings of $364 per year over a credit score between 670-739. Conversely, a weaker credit score could cost up to $422 more per year.

- Older drivers tend to pay less than younger drivers. The difference in insurance cost for a GMC Acadia between a 60-year-old driver ($1,922 per year) and a 20-year-old driver ($4,606 per year) is $2,684, or a savings of 82.2%.

- Increase deductibles to save money. Increasing deductibles from $500 to $1,000 could save around $360 per year for a 40-year-old driver and $686 per year for a 20-year-old driver.

- Choosing a low deductible may not make good financial sense. Dropping your deductibles from $500 to $250 could cost an additional $370 per year for a 40-year-old driver and $718 per year for a 20-year-old driver.

- Insurance for teenage drivers is expensive. Average rates for full coverage Acadia insurance costs $8,163 per year for a 16-year-old driver, $7,888 per year for a 17-year-old driver, and $7,034 per year for an 18-year-old driver.