- Jeep Patriot insurance costs an average of $1,776 per year, or around $148 per month for full coverage.

- The Patriot ranks 25th out of 30 vehicles in the 2017 compact SUV segment for insurance affordability.

- The cheapest Patriot to insure is the X Sport 4WD at an average cost of $1,640 per year.

How much does Jeep Patriot insurance cost?

Jeep Patriot car insurance costs an average of $1,776 annually for a full-coverage policy, which is about $148 each month. Comprehensive costs about $334 a year, collision insurance is approximately $478, and the remaining liability/medical (or PIP) coverage costs about $964.

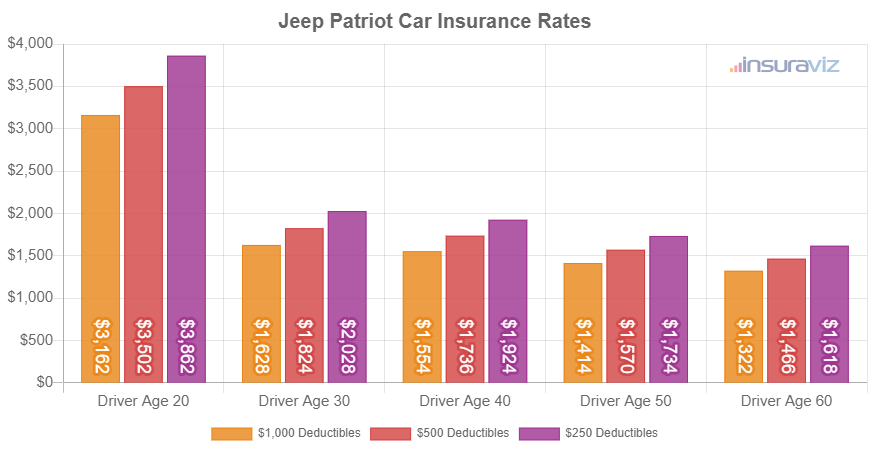

The chart below shows how average Patriot car insurance rates fluctuate based on the age of the rated driver and a range of policy deductibles. Insurance cost estimates vary from the lowest price of $1,352 per year for a 60-year-old driver with $1,000 comprehensive and collision deductibles to a high policy cost of $3,958 each year for a 20-year-old driver with $250 physical damage deductibles.

A few additional insights concerning the cost of insurance for a Patriot include:

- Better credit scores yield better car insurance rates. A high credit score of 800+ could save as much as $279 per year when compared to a rating of 670-739. Conversely, a lower credit rating could cost around $323 more per year.

- Save money due to your job. Most car insurance providers offer discounts for occupations like architects, firefighters, police officers and law enforcement, high school and elementary teachers, accountants, and other occupations. If your profession qualifies you for this discount, you may save between $53 and $188 on your annual premium, subject to the policy coverages selected.

- Careless drivers pay higher rates. Having at-fault accidents will cost you more, possibly by an extra $2,612 per year for a 20-year-old driver and even $526 per year for a 60-year-old driver.

- Auto insurance is cheaper with higher deductibles. Increasing your policy deductibles from $500 to $1,000 could save around $184 per year for a 40-year-old driver and $352 per year for a 20-year-old driver.

- Low deductibles will increase rates. Lowering the comprehensive and collision deductibles from $500 to $250 could cost an additional $194 per year for a 40-year-old driver and $368 per year for a 20-year-old driver.

- Patriot insurance rates for teenagers are high. Average rates for full coverage Patriot insurance costs $6,778 per year for a 16-year-old driver, $6,419 per year for a 17-year-old driver, and $5,480 per year for an 18-year-old driver.

- Gender affects car insurance rates. For a 2017 Jeep Patriot, a 20-year-old male driver receives an average rate of $3,590 per year, while a 20-year-old female will get a rate of $2,602, a difference of $988 per year. The females get the cheaper rate by far. But by age 50, the rate for men is $1,610 and the rate for women is $1,552, a difference of only $58.

- Avoid driving violations to reduce insurance rates. If you want to receive the best Patriot insurance rates, it pays to follow the law. Not surprisingly, just a couple of minor infractions have the potential to increase policy cost by at least $496 per year. Being convicted of a major violation like DWI/DUI and reckless driving could raise rates by an additional $1,686 or more.

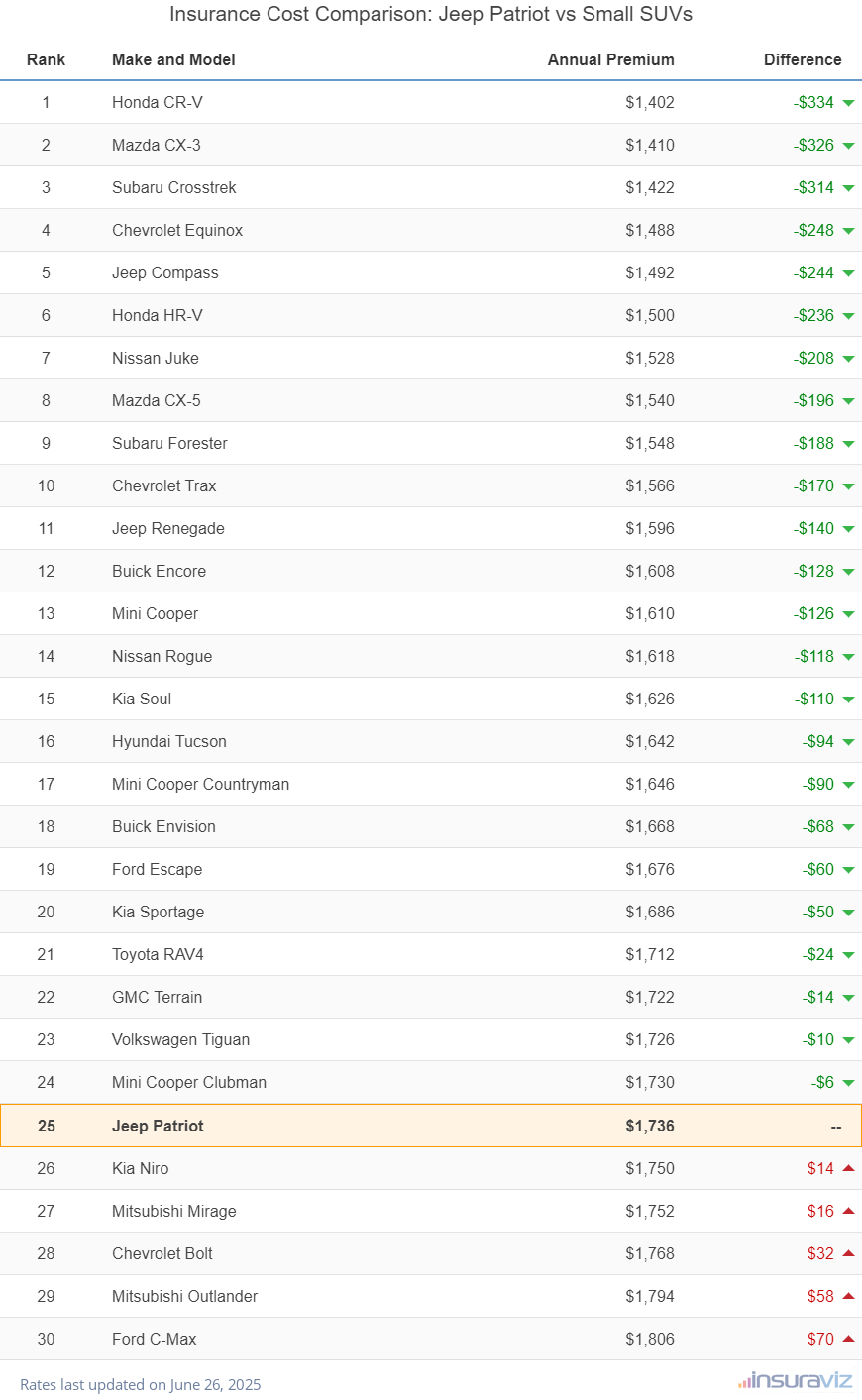

How does Jeep Patriot car insurance compare?

When rates are compared to other 2017 small SUVs, insurance for a Jeep Patriot costs $320 more per year than the Subaru Crosstrek, $338 more than the Honda CR-V, $254 more than the Chevrolet Equinox, and $118 more than the Nissan Rogue.

The Jeep Patriot ranks 25th out of 30 comparison vehicles in the compact SUV category. The Patriot costs an estimated $1,776 per year to insure for full coverage, while the category average rate is $1,664 per year, a difference of $112 per year.

The table below shows how average car insurance cost for a Jeep Patriot compares to the top-selling small SUVs like the Toyota RAV4, Honda CR-V, and the Ford Escape.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda CR-V | $1,438 | -$338 |

| 2 | Mazda CX-3 | $1,442 | -$334 |

| 3 | Subaru Crosstrek | $1,456 | -$320 |

| 4 | Chevrolet Equinox | $1,522 | -$254 |

| 5 | Jeep Compass | $1,528 | -$248 |

| 6 | Honda HR-V | $1,536 | -$240 |

| 7 | Nissan Juke | $1,562 | -$214 |

| 8 | Mazda CX-5 | $1,576 | -$200 |

| 9 | Subaru Forester | $1,590 | -$186 |

| 10 | Chevrolet Trax | $1,600 | -$176 |

| 11 | Jeep Renegade | $1,634 | -$142 |

| 12 | Buick Encore | $1,642 | -$134 |

| 13 | Mini Cooper | $1,650 | -$126 |

| 14 | Nissan Rogue | $1,658 | -$118 |

| 15 | Kia Soul | $1,662 | -$114 |

| 16 | Hyundai Tucson | $1,680 | -$96 |

| 17 | Mini Cooper Countryman | $1,686 | -$90 |

| 18 | Buick Envision | $1,706 | -$70 |

| 19 | Ford Escape | $1,714 | -$62 |

| 20 | Kia Sportage | $1,724 | -$52 |

| 21 | Toyota RAV4 | $1,754 | -$22 |

| 22 | GMC Terrain | $1,762 | -$14 |

| 23 | Volkswagen Tiguan | $1,766 | -$10 |

| 24 | Mini Cooper Clubman | $1,770 | -$6 |

| 25 | Jeep Patriot | $1,776 | -- |

| 26 | Kia Niro | $1,790 | $14 |

| 27 | Mitsubishi Mirage | $1,794 | $18 |

| 28 | Chevrolet Bolt | $1,808 | $32 |

| 29 | Mitsubishi Outlander | $1,836 | $60 |

| 30 | Ford C-Max | $1,852 | $76 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2017 model year. Updated October 24, 2025

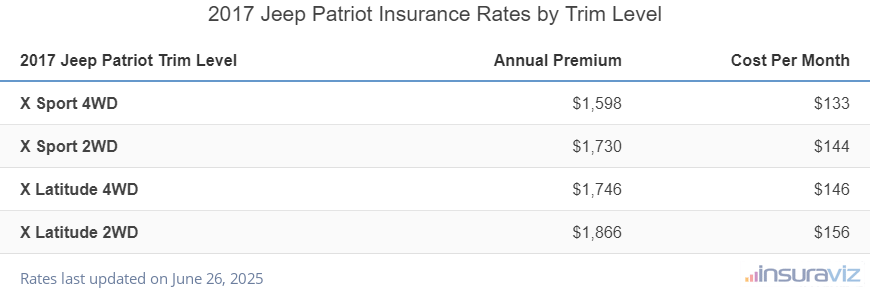

Which Patriot model has the cheapest insurance rates?

With Jeep Patriot insurance rates ranging from $1,640 to $1,912 annually for the average driver, the most affordable trim level to insure is the Patriot X Sport 4WD. The next cheapest model to insure is the X Sport 2WD at $1,772 per year.

The models of Jeep Patriot that are more expensive to insure include the X Latitude 2WD at $1,912 and the X Latitude 4WD at $1,788 per year. Those two models will cost an extra $272 and $148 per year, respectively, over the least expensive X Sport 4WD model.

The table below details average car insurance cost for each Patriot trim level, including a monthly budget estimate.

| 2017 Jeep Patriot Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| X Sport 4WD | $1,640 | $137 |

| X Sport 2WD | $1,772 | $148 |

| X Latitude 4WD | $1,788 | $149 |

| X Latitude 2WD | $1,912 | $159 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

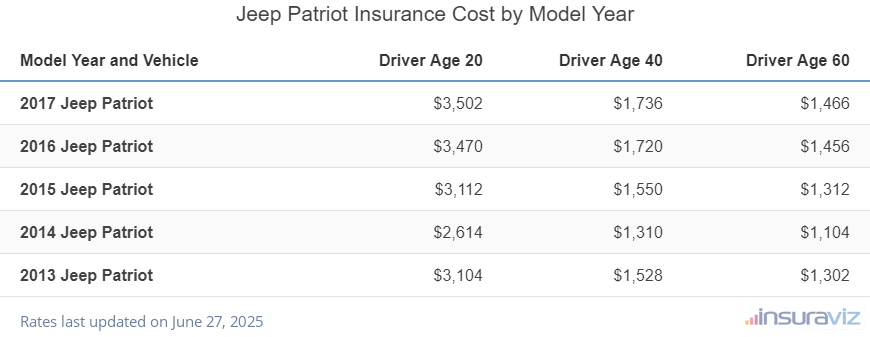

How much will an older Patriot save on insurance?

Buying insurance for a 2013 Jeep Patriot could save as much as $210 per year over the cost of insuring a 2017 model. A 2015 model could save the average driver around $186 annually.

The next table shows typical car insurance costs for a Jeep Patriot for various driver age groups for the 2013 through 2017 model years. Annual insurance cost ranges from the lowest rate of $1,130 for a 60-year-old driver rated on a 2014 Jeep Patriot to a maximum of $3,590 for a 20-year-old driving a 2017 Jeep Patriot.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2017 Jeep Patriot | $3,590 | $1,776 | $1,502 |

| 2016 Jeep Patriot | $3,554 | $1,760 | $1,492 |

| 2015 Jeep Patriot | $3,190 | $1,590 | $1,344 |

| 2014 Jeep Patriot | $2,678 | $1,338 | $1,130 |

| 2013 Jeep Patriot | $3,182 | $1,566 | $1,332 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Jeep Patriot trim levels for each model year. Updated October 24, 2025

Sooner or later, you should make the decision to drop comprehensive and collision coverage from an insurance policy. As a vehicle gets older, the cost of physical damage protection starts to outweigh any added benefit. Deleting physical damage coverage on an older Jeep Patriot may save you $584 annually, depending on how high the deductibles were and the age of the driver.