- Ford C-Max car insurance costs around $1,456 per year, $728 for a 6-month policy, or around $121 per month.

- The cheapest Ford C-Max insurance is the Hybrid SE Hatchback at an estimated $1,434 per year.

- The C-Max is one of the more expensive small SUVs to insure, costing $120 more per year on average when compared to other small SUVs.

How much does Ford C-Max car insurance cost?

Ranked 27th out of 33 vehicles in the 2018 small SUV class, Ford C-Max insurance costs on average $1,456 yearly, or about $121 each month.

With the average small SUV costing $1,336 a year to insure, the Ford C-Max could cost around $120 or more every 12 months.

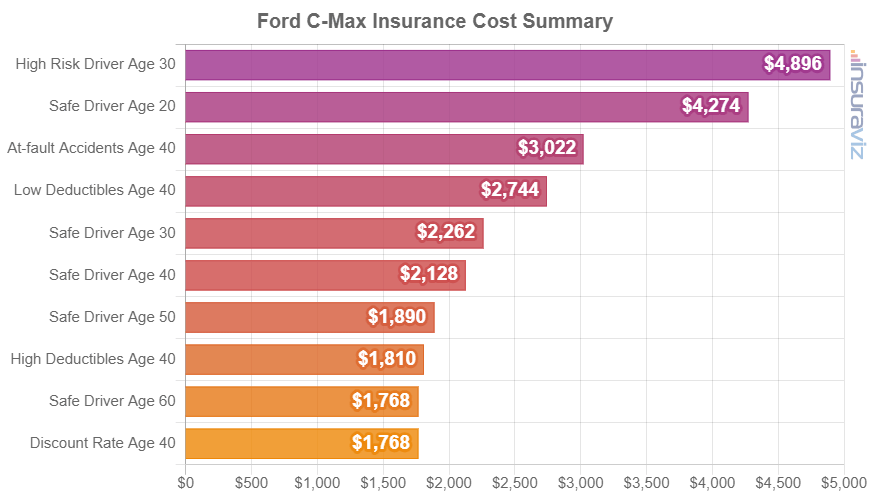

The bar chart below details average car insurance cost for a C-Max for different driver age groups and scenarios.

The table below details average annual and 6-month policy costs, in addition to a monthly budget figure, for each Ford C-Max model and trim level.

| 2018 Ford C-Max Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Hybrid SE Hatchback | $1,434 | $120 |

| Hybrid Titanium Hatchback | $1,480 | $123 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

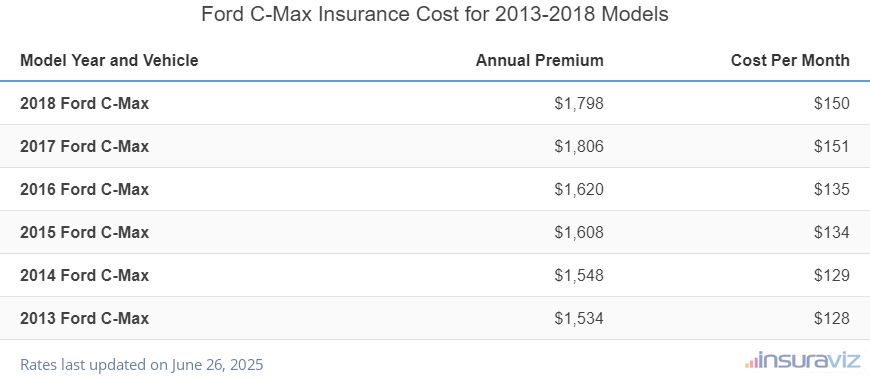

The next table breaks down average Ford C-Max full coverage insurance policy costs from the 2013 to the 2018 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2018 Ford C-Max | $1,456 | $121 |

| 2017 Ford C-Max | $1,466 | $122 |

| 2016 Ford C-Max | $1,314 | $110 |

| 2015 Ford C-Max | $1,302 | $109 |

| 2014 Ford C-Max | $1,264 | $105 |

| 2013 Ford C-Max | $1,244 | $104 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ford C-Max trim levels for each model year. Updated February 23, 2024

Does C-Max insurance cost more than similar vehicles?

When compared directly to other vehicles in the small SUV segment, auto insurance rates for a Ford C-Max cost $38 more per year than the Toyota RAV4, $270 more than the Honda CR-V, and $196 more than the Chevrolet Equinox.

The Ford C-Max ranks 27th out of 33 comparison vehicles in the small SUV category for most affordable car insurance cost. The C-Max costs an average of $1,456 per year to insure for full coverage and the class average cost is $1,336 per year, a difference of $120 per year.

The next table shows how insurance cost for a Ford C-Max compares to the rest of the models in the 2018 compact SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Ford Ecosport | $1,116 | -$340 |

| 2 | Nissan Kicks | $1,140 | -$316 |

| 3 | Toyota C-HR | $1,146 | -$310 |

| 4 | Jeep Compass | $1,156 | -$300 |

| 5 | Subaru Crosstrek | $1,170 | -$286 |

| 6 | Hyundai Kona | $1,182 | -$274 |

| 7 | Honda CR-V | $1,186 | -$270 |

| 8 | Mazda CX-3 | $1,194 | -$262 |

| 9 | Chevrolet Equinox | $1,260 | -$196 |

| 10 | Honda HR-V | $1,262 | -$194 |

| 11 | Mitsubishi Eclipse Cross | $1,276 | -$180 |

| 12 | Mazda CX-5 | $1,300 | -$156 |

| 13 | Subaru Forester | $1,316 | -$140 |

| 14 | Chevrolet Trax | $1,318 | -$138 |

| 15 | Nissan Rogue | $1,342 | -$114 |

| 16 | Jeep Renegade | $1,344 | -$112 |

| 17 | Buick Encore | $1,350 | -$106 |

| 18 | Hyundai Tucson | $1,376 | -$80 |

| 19 | Kia Soul | $1,378 | -$78 |

| 20 | Volkswagen Tiguan | $1,390 | -$66 |

| 21 | Mini Cooper | $1,392 | -$64 |

| 22 | Buick Envision | $1,410 | -$46 |

| 23 | Toyota RAV4 | $1,418 | -$38 |

| 24 | Kia Sportage | $1,420 | -$36 |

| 25 | Mini Cooper Countryman | $1,422 | -$34 |

| 26 | Ford Escape | $1,432 | -$24 |

| 27 | Ford C-Max | $1,456 | -- |

| 28 | GMC Terrain | $1,460 | $4 |

| 29 | Mini Cooper Clubman | $1,480 | $24 |

| 30 | Chevrolet Bolt | $1,484 | $28 |

| 31 | Mitsubishi Mirage | $1,486 | $30 |

| 32 | Kia Niro | $1,510 | $54 |

| 33 | Mitsubishi Outlander | $1,522 | $66 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2018 model year. Updated February 23, 2024

Other rates and observations

A few additional noteworthy conclusions as they relate to Ford C-Max insurance cost include:

- Insuring teen drivers is expensive. Average rates for full coverage C-Max insurance costs $5,338 per year for a 16-year-old driver, $5,129 per year for a 17-year-old driver, $4,519 per year for an 18-year-old driver, and $4,141 per year for a 19-year-old driver.

- As you get older, rates tend to be cheaper. The difference in insurance cost for a 2018 Ford C-Max between a 60-year-old driver ($1,216 per year) and a 20-year-old driver ($2,944 per year) is $1,728, or a savings of 83.1%.

- Your employment could save you money. The large majority of auto insurance providers offer discounts for occupations like architects, firefighters, accountants, lawyers, police officers and law enforcement, and other. Being employed in a qualifying occupation could potentially save between $44 and $156 on your annual C-Max insurance bill, depending on the age of the driver.

- Driver gender influences rates. For a 2018 Ford C-Max, a 20-year-old male will pay an estimated rate of $2,944 per year, while a 20-year-old female driver pays an average of $2,116, a difference of $828 per year. Women get significantly cheaper rates. But by age 50, the cost for a male driver is $1,300 and the cost for a female driver is $1,262, a difference of only $38.

- High-risk auto insurance costs more. For a 20-year-old driver, having enough accidents and violations to require a high-risk insurance policy increases the cost by $2,318 or more per year.

- Policy discounts mean cheaper C-Max insurance. Discounts may be available if the insured drivers are good students, insure multiple vehicles on the same policy, work in certain occupations, are claim-free, or many other discounts which could save the average driver as much as $246 per year on the cost of insuring a Ford C-Max.

- Car insurance is cheaper with higher deductibles. Increasing deductibles from $500 to $1,000 could save around $202 per year for a 40-year-old driver and $394 per year for a 20-year-old driver.

- Low deductibles increase auto insurance cost. Lowering your physical damage coverage deductibles from $500 to $250 could cost an additional $212 per year for a 40-year-old driver and $420 per year for a 20-year-old driver.