- Average Hyundai Tucson insurance cost is $1,764 per year, or $147 per month for full coverage.

- The cheapest Hyundai Tucson insurance can be found on the SE trim level, costing around $1,608 per year. The most expensive model to insure is the Plug-in Hybrid Limited at $1,894 per year.

- The Hyundai Tucson is one of the more expensive small SUVs to insure, costing $19 more per year on average as compared to other small SUVs.

How much does Hyundai Tucson insurance cost?

Hyundai Tucson insurance costs an average of $1,764 per year for the 2024 model year. Average cost per month ranges from $134 to $158 depending on the trim level.

When policy cost is broken down by coverage type, collision coverage costs about $810 a year, liability and medical (or PIP) coverage costs an estimated $502, and the remaining comprehensive (or other-than-collision) coverage will cost around $452.

The chart below demonstrates average Hyundai Tucson car insurance rates using different policy scenarios. More mature drivers tend to have cheaper rates, whereas drivers with more risk or a tendency to have accidents and claims will pay higher rates.

The preceding insurance cost chart shows a fairly small set of insurance rate estimates for a Hyundai Tucson. If we included the entire data set including all rates for every possible combination of risk factors, including all 10 Hyundai Tucson trim levels and every zip code in the U.S., the chart would have 967,680,000,000 different rate possibilities.

Additional observations include:

- Young males pay a lot more for insurance. For a 2024 Hyundai Tucson, a 20-year-old male driver pays an estimated $3,534 per year, while a 20-year-old woman will get a rate of $2,538, a difference of $996 per year. Women get significantly cheaper rates. But by age 50, male driver rates are $1,564 and female driver rates are $1,526, a difference of only $38.

- Improve your credit rating to save on insurance. In states that allow a driver’s credit rating to be used as a rate factor, drivers with high 800+ credit scores may see savings of $277 per year over a lower credit rating of 670-739. Conversely, a less-than-perfect credit score could cost as much as $321 more per year.

- Find cheap Tucson car insurance rates by qualifying for policy discounts. Discounts may be available if the insured drivers work in certain occupations, sign their policy early, are military or federal employees, are claim-free, are homeowners, or many other policy discounts which could save the average driver as much as $298 per year on their insurance cost.

- Lower the cost of your policy by increasing deductibles. Jacking up your deductibles from $500 to $1,000 could save around $286 per year for a 40-year-old driver and $556 per year for a 20-year-old driver.

- Low physical damage deductibles increase costs. Decreasing your policy deductibles from $500 to $250 could cost an additional $298 per year for a 40-year-old driver and $590 per year for a 20-year-old driver.

- Obey driving laws to save money. To pay the cheapest price for Tucson insurance rates, it’s necessary to drive safely. Not surprisingly, just a couple of minor lapses of judgment on your driving record could possibly raise the price of a policy as much as $462 per year. Serious citations like DUI and hit-and-run could raise rates by an additional $1,624 or more.

Is a Hyundai Tucson cheap to insure?

The cheapest model of Hyundai Tucson to insure is the SE at $1,608 per year. The next cheapest trim is the SEL at $1,660 per year, and the third cheapest model to insure is the Hybrid Blue also at $1,722 per year.

For the pricier trim levels, the two most expensive Tucson trim levels to insure are the Hyundai Tucson Hybrid Limited and the Plug-in Hybrid Limited models at around $1,830 and $1,894 per year, respectively.

The table below illustrates the average car insurance cost by trim level for the Tucson for different policy terms.

| 2024 Hyundai Tucson Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE | $1,608 | $134 |

| SEL | $1,660 | $138 |

| Hybrid Blue | $1,722 | $144 |

| XRT | $1,750 | $146 |

| Hybrid SEL Convenience | $1,768 | $147 |

| Limited | $1,790 | $149 |

| N Line | $1,790 | $149 |

| Plug-in Hybrid SEL | $1,820 | $152 |

| Hybrid Limited | $1,830 | $153 |

| Plug-in Hybrid Limited | $1,894 | $158 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

Hyundai Tucson versus the competition

The Hyundai Tucson ranks 27th out of 47 total comparison vehicles in the small SUV segment. The Tucson costs an estimated $1,764 per year for insurance, while the segment average is $1,745 annually, a difference of $19 per year.

When compared to the most popular models in the small SUV segment, Tucson car insurance rates cost $16 more per year than the Toyota RAV4, $146 more than the Honda CR-V, $18 more than the Chevrolet Equinox, and $60 more than the Nissan Rogue.

The table below shows all 47 models in the 2024 small SUV class ranked by insurance cost and compared to the Hyundai Tucson rate.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,402 | -$362 |

| 2 | Chevrolet Trailblazer | $1,424 | -$340 |

| 3 | Kia Soul | $1,482 | -$282 |

| 4 | Nissan Kicks | $1,494 | -$270 |

| 5 | Buick Envision | $1,520 | -$244 |

| 6 | Toyota Corolla Cross | $1,530 | -$234 |

| 7 | Hyundai Venue | $1,540 | -$224 |

| 8 | Mazda CX-5 | $1,548 | -$216 |

| 9 | Ford Bronco Sport | $1,554 | -$210 |

| 10 | Volkswagen Tiguan | $1,570 | -$194 |

| 11 | Buick Encore | $1,612 | -$152 |

| 12 | Honda CR-V | $1,618 | -$146 |

| 13 | Volkswagen Taos | $1,624 | -$140 |

| 14 | Kia Niro | $1,626 | -$138 |

| 15 | Honda HR-V | $1,650 | -$114 |

| 16 | Subaru Forester | $1,692 | -$72 |

| 17 | Kia Seltos | $1,694 | -$70 |

| 18 | GMC Terrain | $1,698 | -$66 |

| 19 | Nissan Rogue | $1,704 | -$60 |

| 20 | Hyundai Kona | $1,706 | -$58 |

| 21 | Mazda CX-30 | $1,710 | -$54 |

| 22 | Volkswagen ID4 | $1,720 | -$44 |

| 23 | Ford Escape | $1,730 | -$34 |

| 24 | Chevrolet Equinox | $1,746 | -$18 |

| 25 | Toyota RAV4 | $1,748 | -$16 |

| 26 | Mazda MX-30 | $1,760 | -$4 |

| 27 | Hyundai Tucson | $1,764 | -- |

| 28 | Chevrolet Trax | $1,794 | $30 |

| 29 | Mini Cooper Clubman | $1,798 | $34 |

| 30 | Mini Cooper | $1,800 | $36 |

| 31 | Mitsubishi Eclipse Cross | $1,820 | $56 |

| 32 | Jeep Renegade | $1,824 | $60 |

| 33 | Mitsubishi Outlander | $1,848 | $84 |

| 34 | Nissan Ariya | $1,856 | $92 |

| 35 | Kia Sportage | $1,858 | $94 |

| 36 | Hyundai Ioniq 5 | $1,864 | $100 |

| 37 | Fiat 500X | $1,870 | $106 |

| 38 | Mazda CX-50 | $1,884 | $120 |

| 39 | Toyota bz4X | $1,890 | $126 |

| 40 | Mini Cooper Countryman | $1,892 | $128 |

| 41 | Subaru Solterra | $1,898 | $134 |

| 42 | Mitsubishi Mirage | $1,900 | $136 |

| 43 | Kia EV6 | $1,958 | $194 |

| 44 | Dodge Hornet | $2,018 | $254 |

| 45 | Jeep Compass | $2,054 | $290 |

| 46 | Hyundai Nexo | $2,094 | $330 |

| 47 | Ford Mustang Mach-E | $2,220 | $456 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated February 22, 2024

How much less does a used Hyundai Tucson cost to insure?

Insuring a 2013 model Tucson rather than a new 2024 model could save around $810 each year, depending on policy coverage levels.

Insuring a vehicle that is old enough to justify dropping full coverage completely could save an additional $492 annually, depending on what the comprehensive and collision deductibles were set to and the age of the driver.

The data below illustrates typical Hyundai Tucson auto insurance costs for the 2013 through 2024 model years. Annual policy costs range from the most affordable rate of $950 for a 2013 Hyundai Tucson to the most expensive yearly cost of $1,764 for a 2024 model.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Hyundai Tucson | $1,764 | $147 |

| 2023 Hyundai Tucson | $1,686 | $141 |

| 2022 Hyundai Tucson | $1,608 | $134 |

| 2021 Hyundai Tucson | $1,432 | $119 |

| 2020 Hyundai Tucson | $1,392 | $116 |

| 2019 Hyundai Tucson | $1,450 | $121 |

| 2018 Hyundai Tucson | $1,376 | $115 |

| 2017 Hyundai Tucson | $1,328 | $111 |

| 2016 Hyundai Tucson | $1,262 | $105 |

| 2015 Hyundai Tucson | $1,146 | $96 |

| 2014 Hyundai Tucson | $1,132 | $94 |

| 2013 Hyundai Tucson | $950 | $79 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Hyundai Tucson trim levels for each model year. Updated February 23, 2024

Hyundai Tucson full coverage vs. liability only

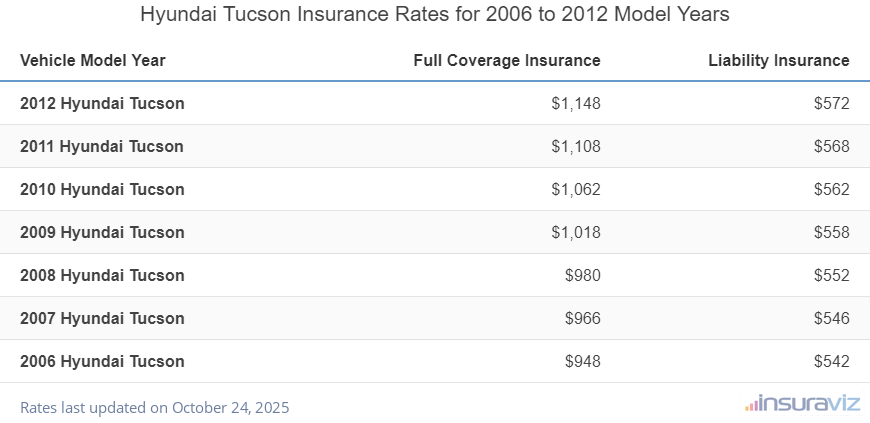

Insuring an older model year Tucson for only liability insurance is a good way to reduce the cost of insurance. The table below shows liability-only car insurance rates for the 2006 to 2012 Tucson model years.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Hyundai Tucson | $910 | $454 |

| 2011 Hyundai Tucson | $878 | $450 |

| 2010 Hyundai Tucson | $838 | $444 |

| 2009 Hyundai Tucson | $804 | $440 |

| 2008 Hyundai Tucson | $774 | $436 |

| 2007 Hyundai Tucson | $764 | $432 |

| 2006 Hyundai Tucson | $748 | $428 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated February 23, 2024