- Lexus GS 450 insurance rates average $2,548 per year, or $1,274 for a semi-annual policy, but can vary based on deductibles and limits.

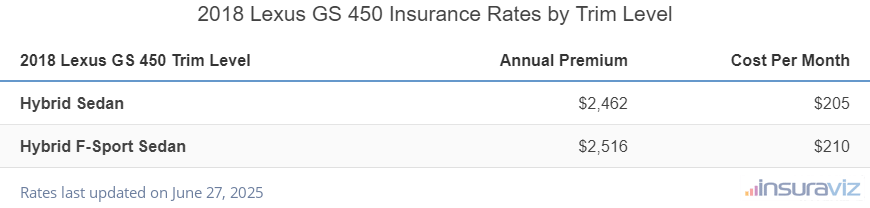

- The cheapest GS 450 model to insure is the Hybrid Sedan at around $2,520 per year, with the Hybrid F-Sport Sedan being slightly higher at $2,576 annually.

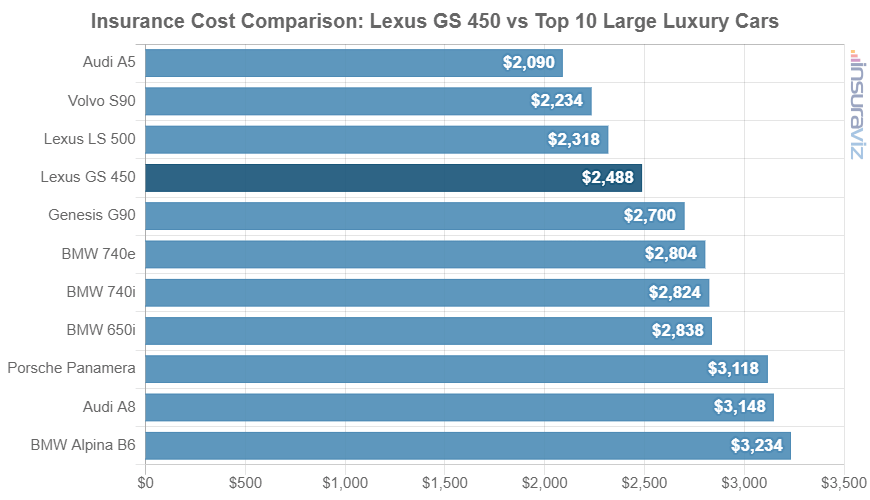

- The Lexus GS 450 is one of the cheaper 2018 model year large luxury cars to insure, costing $303 less per year on average when compared to other large luxury cars.

How much does Lexus GS 450 car insurance cost?

Ranked 12th out of 36 vehicles in the 2018 large luxury car class, Lexus GS 450 insurance costs an average of $2,548 annually for full coverage, or $212 each month. With the average large luxury car costing $2,851 a year to insure, the Lexus GS 450 may save around $303 or more each year.

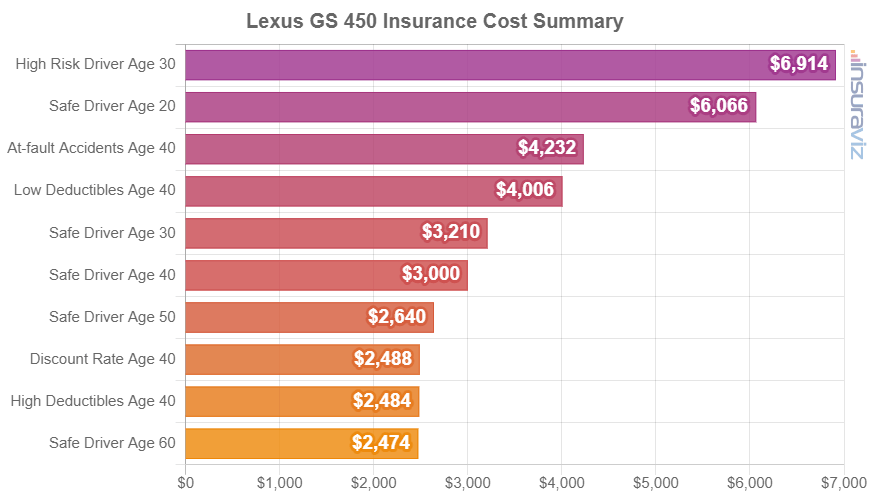

The rate chart below shows average car insurance cost for a Lexus GS 450 using a variety of different risk scenarios and driver age groups.

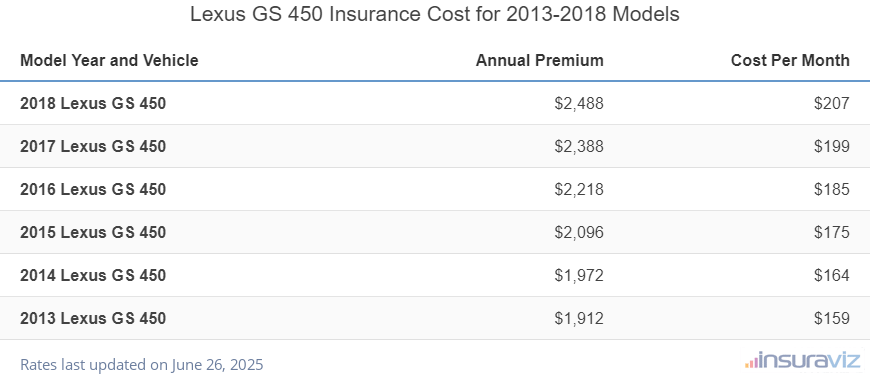

The following table breaks down average Lexus GS 450 car insurance rates for the 2013 to 2018 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2018 Lexus GS 450 | $2,548 | $212 |

| 2017 Lexus GS 450 | $2,444 | $204 |

| 2016 Lexus GS 450 | $2,268 | $189 |

| 2015 Lexus GS 450 | $2,144 | $179 |

| 2014 Lexus GS 450 | $2,018 | $168 |

| 2013 Lexus GS 450 | $1,956 | $163 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Lexus GS 450 trim levels for each model year. Updated October 24, 2025

The table below shows the average insurance rates for annual and semi-annual policies, plus a monthly budget figure, for each Lexus GS 450 model trim level.

| 2018 Lexus GS 450 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Hybrid Sedan | $2,520 | $210 |

| Hybrid F-Sport Sedan | $2,576 | $215 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Where do Lexus GS 450 insurance prices rank?

The Lexus GS 450 ranks 12th out of 36 comparison vehicles in the 2018 model year large luxury car segment for car insurance affordability. The GS 450 costs an average of $2,548 per year to insure for full coverage and the class median rate is $2,851 annually, a difference of $303 per year.

When compared directly to other full-size luxury sedans, car insurance rates for a Lexus GS 450 cost $408 more per year than the Audi A5, $344 less than the BMW 740i, and $366 more than the Cadillac XTS.

The chart below shows how GS 450 insurance rates compare to the top 10 selling large luxury cars in the U.S. like the Audi A8, Infiniti Q60, and the Porsche Panamera. A more comprehensive data table is included following the chart that ranks insurance rate affordability for the entire 36 vehicle large luxury car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Lincoln Continental | $1,996 | -$552 |

| 2 | Cadillac CTS | $2,060 | -$488 |

| 3 | Audi A5 | $2,140 | -$408 |

| 4 | Cadillac XTS | $2,182 | -$366 |

| 5 | Cadillac CT6 | $2,206 | -$342 |

| 6 | Volvo S90 | $2,288 | -$260 |

| 7 | Lexus LS 500 | $2,374 | -$174 |

| 8 | Infiniti Q70 | $2,382 | -$166 |

| 9 | Acura RLX | $2,420 | -$128 |

| 10 | Lexus LS 500H | $2,466 | -$82 |

| 11 | Mercedes-Benz CLS550 | $2,524 | -$24 |

| 12 | Lexus GS 450 | $2,548 | -- |

| 13 | Infiniti Q60 | $2,596 | $48 |

| 14 | Mercedes-Benz C63 AMG | $2,644 | $96 |

| 15 | Cadillac CTS-V | $2,718 | $170 |

| 16 | Mercedes-Benz S450 | $2,748 | $200 |

| 17 | Jaguar XJ | $2,758 | $210 |

| 18 | Genesis G90 | $2,766 | $218 |

| 19 | BMW 740e | $2,872 | $324 |

| 20 | BMW 740i | $2,892 | $344 |

| 21 | Mercedes-Benz S560 | $2,902 | $354 |

| 22 | BMW 650i | $2,908 | $360 |

| 23 | Audi RS 7 | $3,012 | $464 |

| 24 | Mercedes-Benz E63 AMG | $3,092 | $544 |

| 25 | Mercedes-Benz CLS63 AMG | $3,120 | $572 |

| 26 | BMW 750i | $3,128 | $580 |

| 27 | Maserati Ghibli | $3,134 | $586 |

| 28 | Porsche Panamera | $3,196 | $648 |

| 29 | Audi A8 | $3,224 | $676 |

| 30 | BMW Alpina B6 | $3,312 | $764 |

| 31 | Maserati Quattroporte | $3,328 | $780 |

| 32 | Audi S8 | $3,426 | $878 |

| 33 | Mercedes-Benz AMG | $3,452 | $904 |

| 34 | Mercedes-Benz AMG S63 | $3,522 | $974 |

| 35 | BMW M760i | $3,758 | $1,210 |

| 36 | Mercedes-Benz S65 AMG | $4,538 | $1,990 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2018 model year. Updated October 24, 2025

Additional rates and insights

Some other relevant observations about Lexus GS 450 insurance rates include:

- The cost to insure teenage drivers is high. Average rates for full coverage GS 450 insurance costs $9,141 per year for a 16-year-old driver, insurance cost for a 17-year-old averages $8,879 per year, 18-year-old car insurance rates average $7,998 per year, and car insurance for a 19-year-old costs an average of $7,255 per year.

- Cheaper rates come with better credit scores. Having a credit score over 800 could save $400 per year versus a credit rating of 670-739. Conversely, a subpar credit score could cost around $464 more per year.

- Age and gender affect car insurance rates. For a 2018 Lexus GS 450, a 20-year-old man will have an average rate of $5,180 per year, while a 20-year-old woman will pay an average of $3,696, a difference of $1,484 per year. The females get much better rates. But by age 50, the cost for a male driver is $2,250 and the cost for female drivers is $2,196, a difference of only $54.

- Auto insurance is cheaper with higher deductibles. Increasing your deductibles from $500 to $1,000 could save around $416 per year for a 40-year-old driver and $826 per year for a 20-year-old driver.

- Low physical damage deductibles increases cost. Lowering the comprehensive and collision deductibles from $500 to $250 could cost an additional $436 per year for a 40-year-old driver and $876 per year for a 20-year-old driver.

- Get better rates due to your job. Most auto insurance providers offer discounts for specific occupations like accountants, nurses, lawyers, high school and elementary teachers, dentists, firefighters, and others. Qualifying for an occupational discount could save between $76 and $195 on your insurance premium, depending on the age of the rated driver.

- More mature drivers get better rates than young drivers. The difference in 2018 GS 450 insurance rates between a 50-year-old driver ($2,250 per year) and a 20-year-old driver ($5,180 per year) is $2,930, or a savings of 78.9%.

- Policy discounts equal cheaper GS 450 insurance rates. Discounts may be available if the insureds belong to certain professional organizations, work in certain occupations, choose electronic billing, are homeowners, are good students, or many other discounts which could save the average driver as much as $434 per year.