- Toyota Supra car insurance rates average $1,930 per year (about $161 per month) for full coverage, but can vary based on deductibles and limits.

- The cheapest Supra to insure is the 2.0 Coupe model at an estimated $1,876 per year. The most expensive is the 3.0 Premium Coupe at $1,980 annually.

- Ranked fifth out of 24 vehicles in the sports car segment, average car insurance rates for the 2021 Toyota Supra cost $486 less per year than the segment average.

- For the 2022 and 2023 model years, see our Toyota GR Supra insurance page.

How much does Toyota Supra insurance cost?

Ranked fifth out of 24 vehicles in the sports car class, Toyota Supra insurance costs an average of $1,930 a year, or $161 if paid each month. With the average sports car costing $2,416 a year to insure, the Toyota Supra would save around $486 or more every 12 months.

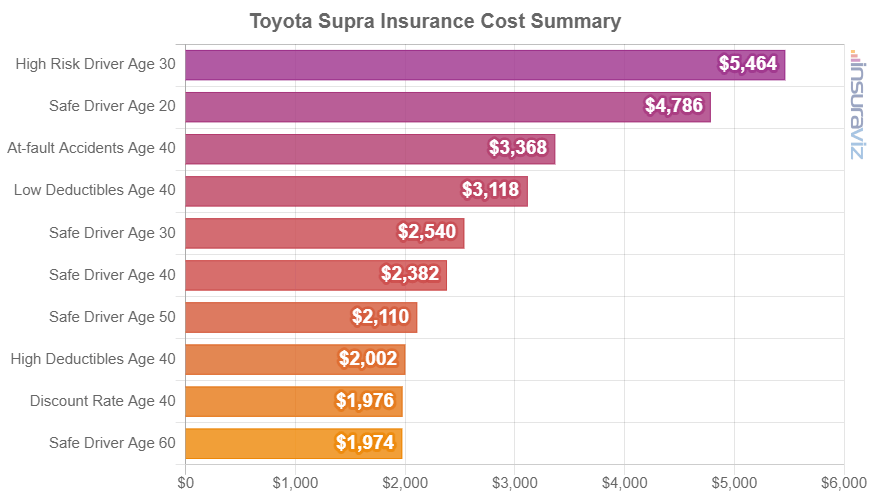

The next chart illustrates average insurance cost for a 2021 Toyota Supra rated for different driver ages and risk profiles.

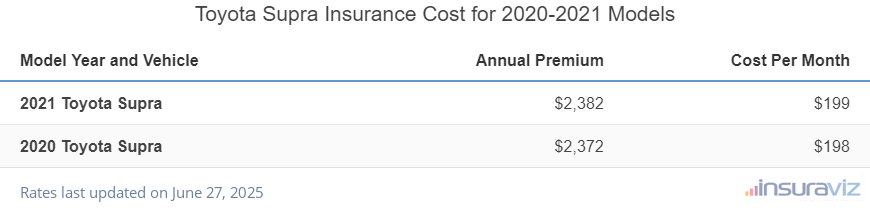

The table below shows average insurance policy costs for a Toyota Supra for the 2020-2021 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2021 Toyota Supra | $1,930 | $161 |

| 2020 Toyota Supra | $1,922 | $160 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Toyota Supra trim levels for each model year. Updated February 23, 2024

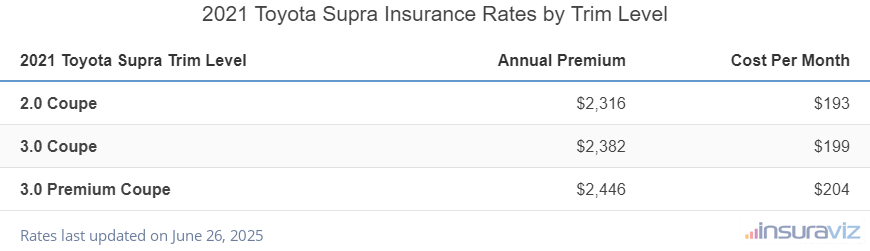

The next table details the estimated annual and semi-annual policy costs, in addition to a monthly amount for budgeting, for each Toyota Supra model trim level.

| 2021 Toyota Supra Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 2.0 Coupe | $1,876 | $156 |

| 3.0 Coupe | $1,930 | $161 |

| 3.0 Premium Coupe | $1,980 | $165 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

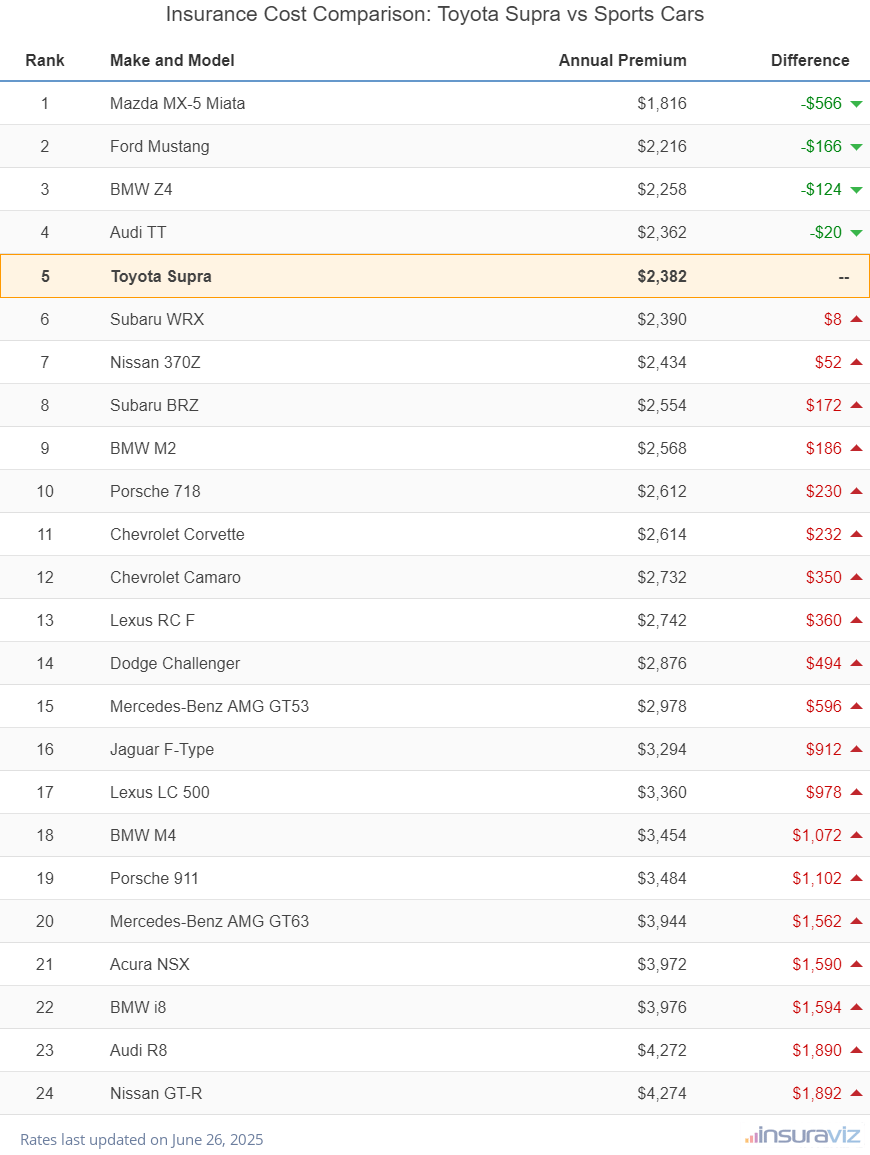

How do Supra insurance prices compare?

When insurance prices are compared to the best-selling models in the sports car category, Toyota Supra insurance costs $132 more per year than the Ford Mustang, $398 less than the Dodge Challenger, and $282 less than the Chevrolet Camaro.

The Toyota Supra ranks fifth out of 24 comparison vehicles in the sports car class for most affordable car insurance rates. The Supra costs an estimated $1,930 per year for full coverage auto insurance, while the category average insurance cost is $2,416 per year, a difference of $486 per year.

The table below shows how average insurance cost for a Toyota Supra compares to the top 10 most popular sports cars in America like the Subaru WRX, Chevrolet Corvette, and the Porsche 911.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Mazda MX-5 Miata | $1,472 | -$458 |

| 2 | Ford Mustang | $1,798 | -$132 |

| 3 | BMW Z4 | $1,830 | -$100 |

| 4 | Audi TT | $1,916 | -$14 |

| 5 | Toyota Supra | $1,930 | -- |

| 6 | Subaru WRX | $1,934 | $4 |

| 7 | Nissan 370Z | $1,972 | $42 |

| 8 | Subaru BRZ | $2,070 | $140 |

| 9 | BMW M2 | $2,080 | $150 |

| 10 | Chevrolet Corvette | $2,116 | $186 |

| 11 | Porsche 718 | $2,116 | $186 |

| 12 | Chevrolet Camaro | $2,212 | $282 |

| 13 | Lexus RC F | $2,220 | $290 |

| 14 | Dodge Challenger | $2,328 | $398 |

| 15 | Mercedes-Benz AMG GT53 | $2,412 | $482 |

| 16 | Jaguar F-Type | $2,670 | $740 |

| 17 | Lexus LC 500 | $2,722 | $792 |

| 18 | BMW M4 | $2,798 | $868 |

| 19 | Porsche 911 | $2,824 | $894 |

| 20 | Mercedes-Benz AMG GT63 | $3,194 | $1,264 |

| 21 | Acura NSX | $3,218 | $1,288 |

| 22 | BMW i8 | $3,222 | $1,292 |

| 23 | Audi R8 | $3,462 | $1,532 |

| 24 | Nissan GT-R | $3,464 | $1,534 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2021 model year. Updated February 23, 2024

Other Supra insurance rates and insights

A few additional rates and highlights concerning the cost of insurance for a Supra include:

- Be a safe driver and save on insurance. Being the cause of frequent accidents will raise rates, potentially as much as $926 per year for a 30-year-old driver and as much as $576 per year for a 50-year-old driver.

- Expect to pay a lot to insure a teenager. Average rates for full coverage Supra insurance costs $6,856 per year for a 16-year-old driver, $6,643 per year for a 17-year-old driver, $5,957 per year for an 18-year-old driver, and $5,424 per year for a 19-year-old driver.

- Good credit equals better rates. Having a credit score above 800 may save up to $303 per year compared to a slightly lower credit rating between 670-739. Conversely, a not-so-perfect credit rating could cost as much as $351 more per year.

- Your choice of occupation could lower your rates. Some insurance companies offer discounts for being employed in occupations like emergency medical technicians, firefighters, high school and elementary teachers, architects, scientists, and others. If your occupation qualifies you for this discount, you could save between $58 and $176 on your annual auto insurance bill, depending on the policy coverages.

- Gender and age are two big factors. For a 2021 Toyota Supra, a 20-year-old male driver will pay an average rate of $3,878 per year, while a 20-year-old woman will pay an average of $2,784, a difference of $1,094 per year in favor of the women by a long shot. But by age 50, the cost for men is $1,710 and the female rate is $1,666, a difference of only $44.