- Acura TSX insurance rates average $1,202 per year or around $100 per month, but vary considerably based on driver age.

- As one of the cheaper midsize luxury cars to insure, the Acura TSX costs $491 less per year on average to insure when compared to the other midsize luxury cars.

- The cheapest TSX to insure is the Sport Station Wagon trim level, costing an average of $1,166 per year. The most expensive is the Technology Package Sedan at $1,250 annually.

How much does Acura TSX car insurance cost?

Ranked first out of 52 vehicles in the 2014 midsize luxury car class, Acura TSX insurance rates average $1,202 annually, or $100 a month. With the average midsize luxury car costing $1,693 a year to insure, the Acura TSX could potentially save around $491 or more on an annual basis.

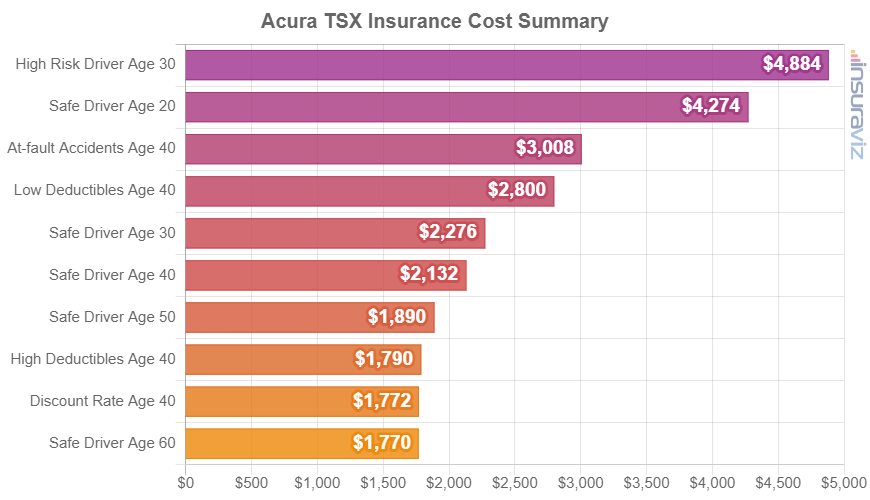

The following rate chart displays average car insurance rates for a 2014 Acura TSX using different combinations of risk and driver age.

The table below shows which trim levels have the cheapest car insurance for the Acura TSX. Average annual and 6-month Acura TSX insurance rates are shown, including a monthly budget amount, for each 2014 model year trim level.

| 2014 Acura TSX Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sport Station Wagon | $1,166 | $97 |

| Sedan | $1,198 | $100 |

| Special Edition Sedan | $1,198 | $100 |

| Technology Package Station Wagon | $1,198 | $100 |

| Technology Package Sedan | $1,250 | $104 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

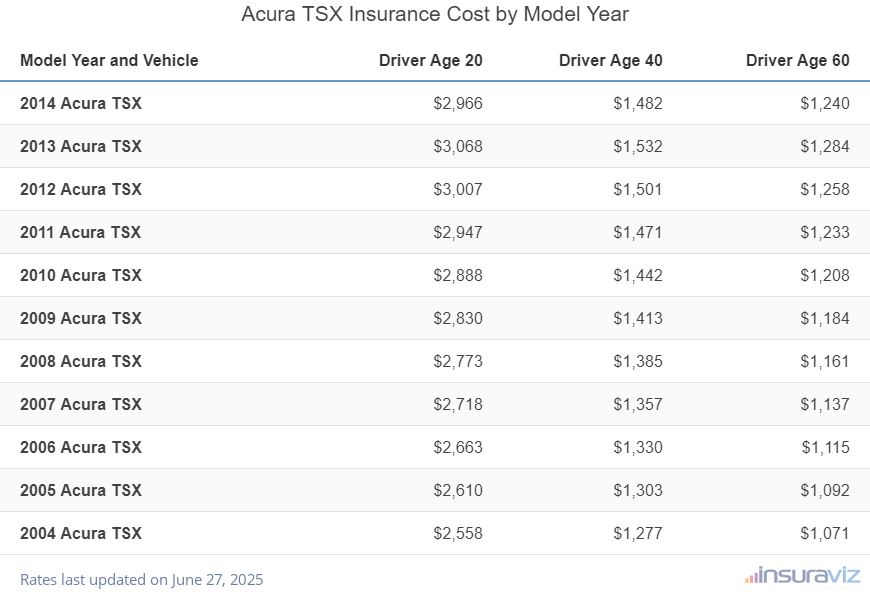

The following table shows average full coverage auto insurance policy costs for an Acura TSX for the 2004 to 2014 model years and different driver age groups.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2014 Acura TSX | $2,406 | $1,202 | $1,006 |

| 2013 Acura TSX | $2,486 | $1,242 | $1,040 |

| 2012 Acura TSX | $2,436 | $1,217 | $1,019 |

| 2011 Acura TSX | $2,388 | $1,193 | $999 |

| 2010 Acura TSX | $2,340 | $1,169 | $979 |

| 2009 Acura TSX | $2,293 | $1,146 | $959 |

| 2008 Acura TSX | $2,247 | $1,123 | $940 |

| 2007 Acura TSX | $2,202 | $1,100 | $921 |

| 2006 Acura TSX | $2,158 | $1,078 | $903 |

| 2005 Acura TSX | $2,115 | $1,057 | $885 |

| 2004 Acura TSX | $2,073 | $1,036 | $867 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Acura TSX trim levels for each model year. Updated February 22, 2024

A few additional noteworthy additions about Acura TSX insurance rates include:

- Avoiding accidents keeps insurance rates low. Having frequent at-fault accidents will raise rates, possibly by an additional $578 per year for a 30-year-old driver and as much as $372 per year for a 50-year-old driver.

- Policy discounts save money. Discounts may be available if the policyholders are claim-free, drive a vehicle with safety or anti-theft features, are good students, belong to certain professional organizations, work in certain occupations, or many other discounts which could save the average driver as much as $202 per year on their insurance cost.

- Get cheaper rates because of your job. The large majority of auto insurance companies offer discounts for earning a living in occupations like architects, lawyers, doctors, accountants, police officers and law enforcement, college professors, and others. If your occupation qualifies you for this discount, you could potentially save between $36 and $122 on your annual TSX insurance bill, subject to the policy coverages selected.

- Bring up your credit score and save. Having a credit score over 800 could save $189 per year compared to a slightly lower credit score between 670-739. Conversely, a diminished credit rating could cost as much as $219 more per year.

- As you get older, Acura TSX car insurance rates tend to be cheaper. The difference in Acura TSX insurance rates between a 50-year-old driver ($1,074 per year) and a 20-year-old driver ($2,406 per year) is $1,332, or a savings of 76.6%.

How do Acura TSX car insurance prices compare?

When compared directly to some other models in the midsize luxury car category, auto insurance rates for an Acura TSX cost $190 less per year than the Lexus ES 350, $380 less than the Infiniti Q50, and $42 less than the Lincoln MKZ.

The Acura TSX ranks first out of 52 total vehicles in the 2014 midsize luxury car class for insurance affordability. The TSX costs an estimated $1,202 per year for an auto insurance policy with full coverage and the class average policy cost is $1,693 annually, a difference of $491 per year.

The chart below shows how the average car insurance rate for an Acura TSX compares to the top 10 best-selling midsize luxury cars in America like the Mercedes-Benz CLA250, Audi A6, and the Tesla Model S. A more comprehensive data table is included following the chart that displays insurance rate comparisons for all 52 models in the midsize luxury car class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura TSX | $1,202 | -- |

| 2 | Acura ILX | $1,236 | $34 |

| 3 | Lincoln MKZ | $1,244 | $42 |

| 4 | Acura TL | $1,284 | $82 |

| 5 | Lexus ES 350 | $1,392 | $190 |

| 6 | Mercedes-Benz CLA250 | $1,432 | $230 |

| 7 | Audi A6 | $1,460 | $258 |

| 8 | Audi S5 | $1,466 | $264 |

| 9 | Mercedes-Benz SLK55 AMG | $1,474 | $272 |

| 10 | Mercedes-Benz C350 | $1,530 | $328 |

| 11 | Lexus ES 300H | $1,542 | $340 |

| 12 | BMW 435i | $1,562 | $360 |

| 13 | Mercedes-Benz E250 | $1,566 | $364 |

| 14 | BMW 428xi | $1,568 | $366 |

| 15 | Mercedes-Benz E350 | $1,578 | $376 |

| 16 | Mercedes-Benz E400 | $1,580 | $378 |

| 17 | Infiniti Q50 | $1,582 | $380 |

| 18 | Lexus GS 350 | $1,586 | $384 |

| 19 | BMW 528xi | $1,590 | $388 |

| 20 | BMW 428i | $1,596 | $394 |

| 21 | BMW 535i | $1,596 | $394 |

| 22 | Audi RS 5 | $1,602 | $400 |

| 23 | Mercedes-Benz CLA45 AMG | $1,608 | $406 |

| 24 | Hyundai Genesis | $1,614 | $412 |

| 25 | Volvo S80 | $1,618 | $416 |

| 26 | BMW 435xi | $1,622 | $420 |

| 27 | BMW 535xi | $1,626 | $424 |

| 28 | BMW Activehybrid 5 | $1,652 | $450 |

| 29 | Mercedes-Benz E550 | $1,654 | $452 |

| 30 | Jaguar XF | $1,658 | $456 |

| 31 | Audi S6 | $1,680 | $478 |

| 32 | Cadillac ELR | $1,682 | $480 |

| 33 | Jaguar XK | $1,686 | $484 |

| 34 | Audi S4 | $1,690 | $488 |

| 35 | BMW 535d | $1,690 | $488 |

| 36 | BMW 528i | $1,692 | $490 |

| 37 | BMW 550i | $1,698 | $496 |

| 38 | BMW 550xi | $1,728 | $526 |

| 39 | Audi A7 | $1,776 | $574 |

| 40 | BMW 640i | $1,778 | $576 |

| 41 | BMW 640xi | $1,802 | $600 |

| 42 | Mercedes-Benz SL550 | $1,830 | $628 |

| 43 | Audi S7 | $1,870 | $668 |

| 44 | BMW 650xi | $1,936 | $734 |

| 45 | BMW M5 | $1,938 | $736 |

| 46 | Jaguar XKR | $2,000 | $798 |

| 47 | BMW M6 | $2,024 | $822 |

| 48 | Tesla Model S | $2,038 | $836 |

| 49 | Mercedes-Benz SL63 AMG | $2,104 | $902 |

| 50 | Mercedes-Benz CL63 AMG | $2,316 | $1,114 |

| 51 | Mercedes-Benz SL65 AMG | $2,602 | $1,400 |

| 52 | Mercedes-Benz SLS AMG | $2,744 | $1,542 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2014 model year. Updated February 22, 2024