Debuting in 2008 to replace the original TrailBlazer and Uplander models, the Chevy Traverse is a popular midsize SUV with plenty of passenger room and cargo space.

With strong competitors like the Honda Pilot, Toyota Highlander, and Kia Telluride, how does insurance cost for a Traverse stack up?

Let’s dig in and find out how much you can expect to pay when insuring your Traverse. We detail rates for different driver ages and risk factors, explain why safe drivers and older drivers pay less, and cover in detail comparisons between the Traverse and the competition.

Chevrolet Traverse Insurance Rates Explained

Before we get into the details of insuring your Traverse, here are some quick insurance stats for the 2024 model year.

Chevrolet Traverse Insurance Quick Stats

- Average insurance cost for 2024 model: $2,238 per year or $187 per month

- Cheapest model to insure: Traverse LS 2WD at $2,116 per year

- Other affordable models to insure: Traverse LS AWD, LT 2WD, LT AWD

- Most expensive model to insure: Traverse RS AWD at $2,370 per year

- Compared to average rate for all 2024 model year vehicles ($2,572): 13.9% cheaper

Driver profile: 40-year-old male, clean driving record, full coverage, and $500 physical damage deductibles

On average, Chevrolet Traverse car insurance costs $2,238 per year, which is the equivalent of $187 a month. Depending on the trim level being insured, monthly car insurance rates for a 2024 Traverse range from $176 to $198.

Comprehensive (or other-than-collision) coverage is an estimated $574 a year, collision coverage costs approximately $920, and the remaining liability and medical payments insurance costs approximately $744.

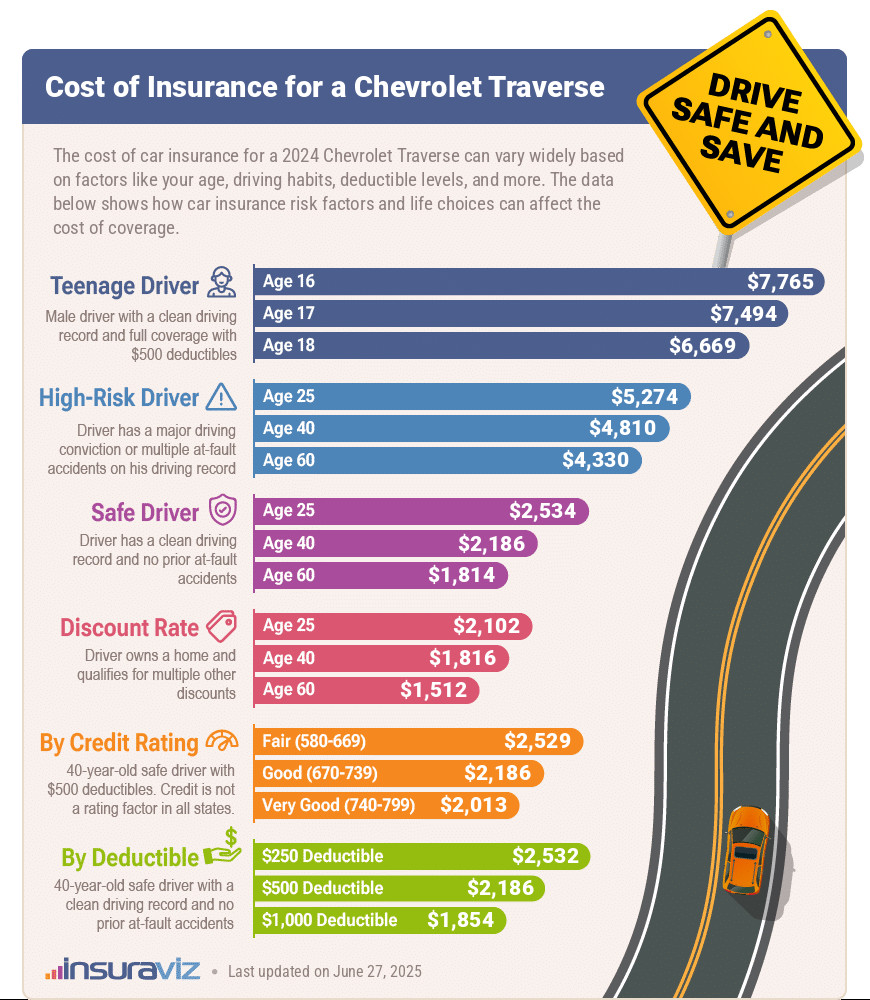

The graphic below displays average car insurance rates for a 2024 Chevy Traverse using different driver ages and risk profiles.

Each of the data groups in the infographic impact car insurance rates differently. Here’s a quick breakdown that explains why insurers charge more or less for certain driver risk profiles or coverage amounts.

Teenage Drivers

If you’re a teenager, your insurance costs will be on the high side. This is because younger drivers are seen as higher risk due to their lack of experience.

Teen drivers are statistically more likely to be involved in accidents, which leads to higher premiums. Insurance companies mitigate this risk by charging more to insure them.

For a 2024 Traverse, a 16-year-old male driver with a clean record and $500 deductibles pays an average premium of $7,957. That’s an extra $5,719 over the average rate for a 40-year-old driver.

High-Risk Drivers

Drivers with a history of major driving convictions or multiple at-fault accidents also face much higher car insurance premiums.

High-risk drivers are charged more because their driving history suggests they are more likely to file claims in the future, increasing the insurer’s risk and potential payout.

A 25-year-old high-risk driver can expect to pay about $5,406 annually to insure a 2024 Chevy Traverse with full coverage.

These rates go down with age, but they’re still higher compared to safe drivers. For example, a 60-year-old high-risk driver pays around $4,438 annually. That’s less than what a 25-year-old driver will pay, but is still $2,200 more per year than what the average 40-year-old safe driver will pay.

If you keep your driving record and claim history clean for a few years, eventually you’ll see your rates start to come back down.

Safe Drivers

Being a safe driver can really pay off especially when talking about car insurance. This group of drivers receives better rates due to their good driving record and lack of prior claims. A clean driving record indicates that a driver is less likely to be involved in accidents, which means fewer claims and lower costs for the insurer.

A 25-year-old safe driver pays an annual premium of $2,598 per year to insure a new Traverse. At 25 they are still paying inflated rates due to their relatively young age, but rates are definitely starting to come down from the highest rates paid by teen drivers.

For a 60-year-old safe driver, it’s even lower at $1,860. Insurance companies reward safe drivers because they pose less risk.

Discount Rates

Qualifying for multiple discounts, such as multi-policy or homeowner discounts, can significantly reduce your insurance costs. This group of drivers receives the best rates possible due to not only being safe drivers, but also maximizing the discounts offered by insurance companies.

A 40-year-old driver who qualifies for multiple discounts pays about $1,860 annually. This is a savings of $378 per year for taking advantage of the discounts offered by insurers.

Discounts are applied to encourage customer loyalty and reward responsible behavior. Bundling policies, such as home and auto insurance, or having multiple vehicles insured with the same company, often results in lower rates. These discounts reduce the insurer’s overall risk and administration costs, which is passed on as savings to the customer.

Impact of Credit Rating

Your credit score may also affect your insurance premiums. Why? Because insurance companies view credit scores as a measure of financial responsibility.

A higher credit score suggests that a person is more likely to manage their finances well and less likely to file claims, thus representing a lower risk to insurers. Consequently, individuals with better credit scores enjoy lower insurance premiums.

A 40-year-old driver with fair credit pays around $2,589 annually, while someone with very good credit pays less, around $2,061 annually.

It’s important to note that the impact of credit on your car insurance rates depends on the state you live in. Some states do not permit insurers to use credit as a rating factor, so this one may or may not apply to you.

Deductible Amounts

A deductible is the amount you pay out-of-pocket before insurance covers the rest of a claim.

Deductibles primarily only apply to physical damage claims under the comprehensive and collision portion of your policy coverage. Liability claims do not have a deductible.

A higher deductible means you take on more financial responsibility in the event of an accident, which lowers the insurer’s potential payout. Therefore, higher deductibles typically result in lower premiums because they reduce the insurer’s risk and potential expenses.

Choosing a higher deductible can lower your annual premium. For example, a 40-year-old driver with a $250 deductible pays about $2,592 annually, while opting for a $1,000 deductible reduces it to $1,898.

How the Traverse Stacks Up Against Competitors

The 2024 Chevy Traverse ranks 11th out of 34 total comparison vehicles in the midsize SUV segment. The Traverse costs an estimated $2,238 per year to insure for full coverage and the class average rate is $2,370 per year, a difference of $132 per year.

When compared to the top-selling other midsize SUVs in America, Chevrolet Traverse car insurance costs $160 less per year than the Jeep Grand Cherokee, $58 more than the Toyota Highlander, $62 more than the Ford Explorer, and $98 less than the Honda Pilot.

The table below shows how average Chevy Traverse insurance rates compare to the rest of the 2024 midsize SUV class like the Kia Telluride, the Honda Passport, and the Hyundai Santa Fe.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$328 |

| 2 | Nissan Murano | $2,016 | -$222 |

| 3 | Subaru Outback | $2,042 | -$196 |

| 4 | Buick Envista | $2,050 | -$188 |

| 5 | Subaru Ascent | $2,088 | -$150 |

| 6 | Volkswagen Atlas | $2,128 | -$110 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$102 |

| 8 | Ford Explorer | $2,176 | -$62 |

| 9 | Toyota Highlander | $2,180 | -$58 |

| 10 | Toyota Venza | $2,190 | -$48 |

| 11 | Chevrolet Traverse | $2,238 | -- |

| 12 | Mitsubishi Outlander Sport | $2,254 | $16 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | $24 |

| 14 | Ford Edge | $2,270 | $32 |

| 15 | Kia Sorento | $2,278 | $40 |

| 16 | GMC Acadia | $2,316 | $78 |

| 17 | Buick Enclave | $2,320 | $82 |

| 18 | Honda Pilot | $2,336 | $98 |

| 19 | Mazda CX-9 | $2,342 | $104 |

| 20 | Jeep Grand Cherokee | $2,398 | $160 |

| 21 | Hyundai Santa Fe | $2,426 | $188 |

| 22 | Nissan Pathfinder | $2,440 | $202 |

| 23 | Hyundai Palisade | $2,450 | $212 |

| 24 | Chevrolet Blazer | $2,476 | $238 |

| 25 | Kia Telluride | $2,504 | $266 |

| 26 | Toyota 4Runner | $2,572 | $334 |

| 27 | Mazda CX-90 | $2,582 | $344 |

| 28 | Toyota Grand Highlander | $2,610 | $372 |

| 29 | Kia EV9 | $2,630 | $392 |

| 30 | Tesla Model Y | $2,654 | $416 |

| 31 | Ford Bronco | $2,662 | $424 |

| 32 | Jeep Wrangler | $2,740 | $502 |

| 33 | Dodge Durango | $2,942 | $704 |

| 34 | Rivian R1S | $2,950 | $712 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

With an average MSRP of $45,857, ranging from the cheapest LS 2WD model at $39,000 to the most expensive RS AWD costing $54,500, the Traverse has a relatively affordable price tag. But how does the price of insurance compare to similarly-priced SUVs?

The vehicles in the midsize SUV segment closest in price to the Chevrolet Traverse for the 2024 model year are the Chevrolet Blazer, Kia Telluride, GMC Acadia, and Mitsubishi Outlander PHEV. Here’s how those models compare to the Traverse for overall purchase price and insurance cost.

- Chevrolet Traverse vs. Chevrolet Blazer – The 2024 Chevrolet Blazer retails for an average of $46,128, ranging from $36,795 to $65,995, which is $271 more expensive than the Chevrolet Traverse. Full-coverage insurance on the Chevrolet Blazer costs an average of $238 more every 12 months than the Chevrolet Traverse.

- Chevrolet Traverse vs. Kia Telluride – The 2024 Chevrolet Traverse has an average MSRP that is $421 cheaper than the Kia Telluride ($45,857 versus $46,278). The average insurance cost for a Chevrolet Traverse compared to the Kia Telluride is $266 less every 12 months.

- Chevrolet Traverse vs. GMC Acadia – With an average sticker price of $45,365 ($39,990 to $51,990), the GMC Acadia costs $492 less than the MSRP for the Chevrolet Traverse. Buying insurance for the GMC Acadia costs an average of $78 more each year than the Chevrolet Traverse.

- Chevrolet Traverse vs. Mitsubishi Outlander PHEV – The average MSRP for a 2024 Chevrolet Traverse is $504 more expensive than the Mitsubishi Outlander PHEV, at $45,857 compared to $45,353. Expect to pay around $24 more per year for insurance on the Mitsubishi Outlander PHEV compared to a Traverse.

Additional comparisons for other makes and models can be found on our car insurance comparisons page.

Chevy Traverse vs. Ford Explorer vs. Honda Pilot

The Traverse has a lot of competition in the midsize SUV market, so how does it compare to it’s two closest competitors: the Ford Explorer and Honda Pilot?

Here’s a breakdown showing the average cost of insurance for all three models, rates by driver age, and the cheapest and most expensive trim levels to insure for each model.

| 2024 Chevrolet Traverse | 2024 Ford Explorer | 2024 Honda Pilot | |

|---|---|---|---|

| Average Insurance Cost Per Year | $2,238 | $2,176 | $2,336 |

| Insurance Cost Per Month | $187 | $181 | $195 |

| 16-year-old Driver | $7,957 | $7,768 | $8,340 |

| 18-year-old Driver | $6,836 | $6,766 | $7,311 |

| 20-year-old Driver | $4,468 | $4,394 | $4,734 |

| 25-year-old Driver | $2,598 | $2,528 | $2,716 |

| 30-year-old Driver | $2,384 | $2,322 | $2,494 |

| 40-year-old Driver | $2,238 | $2,176 | $2,336 |

| 50-year-old Driver | $1,990 | $1,928 | $2,064 |

| 60-year-old Driver | $1,860 | $1,806 | $1,936 |

| Cheapest Model to Insure | LS 2WD | XLT 2WD | LX |

| Cheapest to Insure MSRP | $39,000 | $38,570 | $37,090 |

| Cheapest Insurance Cost | $2,116 | $1,902 | $2,186 |

| Most Expensive Model to Insure | RS AWD | King Ranch 4WD | Elite AWD |

| Most Expensive to Insure MSRP | $54,500 | $56,075 | $52,480 |

| Most Expensive Insurance Cost | $2,370 | $2,316 | $2,482 |

| Calculate Your Rates Custom rates based on your risk profile | Calculate | Calculate | Calculate |

Data Methodology: Average cost is based on a 40-year-old male driver with a clean driving record. Other driver ages also have no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle for that specific model year. Updated October 24, 2025

Chevy Traverse Insurance by Trim Level

The cheapest model of Chevy Traverse to insure is the LS 2WD at around $2,116 per year. The next cheapest trim is the LS AWD at $2,162 per year, and the third cheapest trim level to insure is the LT 2WD at $2,182 per year.

The three highest cost Traverse models to insure are the Traverse Z71 AWD, the RS 2WD, and the RS AWD trim levels at $2,284, $2,344, and $2,370 per year, respectively.

The table below shows the average annual and 6-month car insurance policy costs for each Traverse trim package, including a monthly rate.

| 2024 Chevrolet Traverse Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LS 2WD | $2,116 | $176 |

| LS AWD | $2,162 | $180 |

| LT 2WD | $2,182 | $182 |

| LT AWD | $2,218 | $185 |

| Z71 AWD | $2,284 | $190 |

| RS 2WD | $2,344 | $195 |

| RS AWD | $2,370 | $198 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Insuring a New vs. Used Traverse

Bypassing the 2024 model and instead driving a 2018 Chevrolet Traverse could cut your insurance cost by $500 or more per year at a minimum, depending on your coverage levels.

The next table shows average car insurance rates for the Traverse for 2009 to the 2024 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Chevrolet Traverse | $2,238 | $187 |

| 2023 Chevrolet Traverse | $2,226 | $186 |

| 2022 Chevrolet Traverse | $2,252 | $188 |

| 2021 Chevrolet Traverse | $2,134 | $178 |

| 2020 Chevrolet Traverse | $2,072 | $173 |

| 2019 Chevrolet Traverse | $1,826 | $152 |

| 2018 Chevrolet Traverse | $1,734 | $145 |

| 2017 Chevrolet Traverse | $1,652 | $138 |

| 2016 Chevrolet Traverse | $1,548 | $129 |

| 2015 Chevrolet Traverse | $1,590 | $133 |

| 2014 Chevrolet Traverse | $1,536 | $128 |

| 2013 Chevrolet Traverse | $1,418 | $118 |

| 2012 Chevrolet Traverse | $1,390 | $116 |

| 2011 Chevrolet Traverse | $1,362 | $113 |

| 2010 Chevrolet Traverse | $1,335 | $111 |

| 2009 Chevrolet Traverse | $1,308 | $109 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Traverse trim levels for each model year. Updated October 24, 2025

Ultimately, as the mileage creeps up, it will probably be a good idea to eliminate physical damage coverage (comprehensive and collision) from a policy. As a vehicle depreciates, the cost of maintaining physical damage coverage begins to exceed any benefits of having full coverage.

Removing comprehensive and collision coverage on an older Traverse could save around $840 annually, depending on the level of physical damage deductibles and the driver age.

The best time to drop full coverage is completely different for everyone. Eliminating the coverage means you have no recourse if your Traverse is totaled. So it’s a good idea to have some savings set aside to afford a different vehicle just in case.

10 Discounts to Maximize Your Insurance Savings

Budgeting for car insurance can be hard. So any way you can bring the cost of your insurance down is beneficial.

One of the best ways to save when insuring your Traverse is to maximize the discounts offered by your insurance company.

The table below breaks out the top 10 discounts by average savings and some of the larger companies that offer them.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $313 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $246 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $208 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $177 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $168 |

| Military Savings of 5% to 15% | Alfa, American Family, Direct General, Farmers, GEICO, Liberty Mutual, Shelter, USAA | $157 |

| Pay in Full Savings of 5% to 10% | Allstate, Nationwide, Progressive, State Farm, Travelers | $141 |

| Multiple Vehicles Savings of 4% to 15% | Allstate, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Progressive, Travelers, USAA | $134 |

| Student Away at School Savings of 4% to 25% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $130 |

| Good Student Savings of 3% to 20% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $116 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated October 24, 2025