The Honda CR-V is a great compact SUV and it’s one of the most affordable vehicles to insure as well.

In this article, you’ll learn how much it costs the average driver to insure a 2019 CR-V. We also break out rates for each of the trim levels available on the 2019 model.

We compare the CR-V to every other 2019 compact SUV model, address the cost of insuring teenagers on the CR-V, and also look at how your credit score can impact rates.

How much does it cost to insure a 2019 Honda CR-V?

2019 Honda CR-V insurance rates average $1,560 a year for full coverage, or $130 a month.

If you are a middle-aged driver with a good driving record, you can expect to pay approximately $237 less each year to insure a Honda CR-V as compared to the average rate for all 2019 compact sport utility vehicles, which is $1,797 per year.

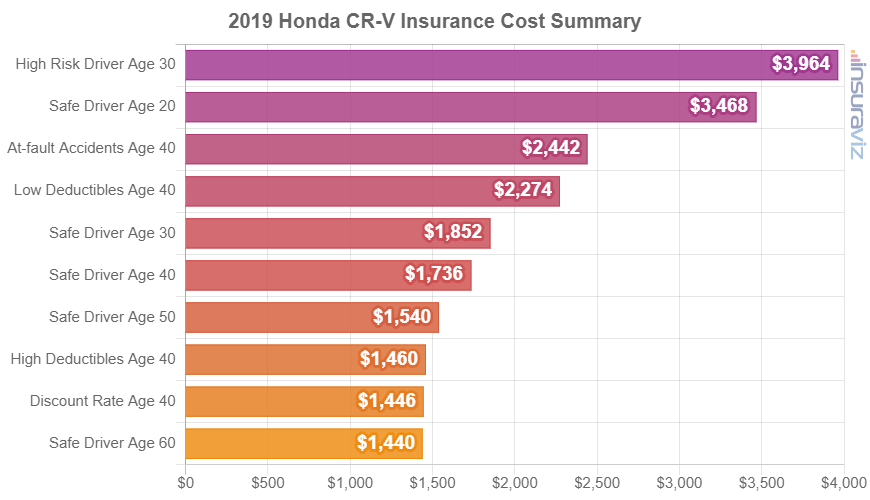

The following rate chart illustrates some of the variability possible for auto insurance rates for a 2019 Honda CR-V with a variety of policy scenarios.

The chart shows how variable insurance rates can be for the CR-V. High-risk and younger drivers pay considerably higher insurance rates than more mature and careful drivers.

The average rate we use for the next section which compares the 2019 CR-V to all other compact SUV models is the ‘Safe Driver Age 40’ rate in the chart above.

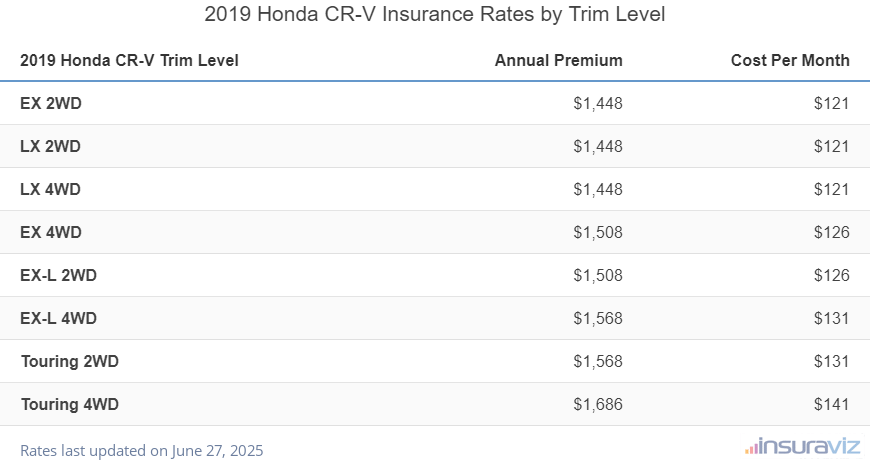

The cheapest 2019 Honda CR-V trim level to insure

The previous chart shows how factors like driver age and deductible level can affect insurance rates on a 2019 Honda CR-V. But another factor that has a considerable impact on the amount you’ll have to pay to insure a 2019 CR-V is the options that are included on the vehicle.

For the most part, the more a vehicle costs, the higher insurance will also cost. This is due to the fact that if your vehicle is totaled, your car insurance company will have to pay more for a higher trim level than a cheaper model.

The 2019 CR-V model with the overall least expensive insurance is the EX 2WD model, costing an average of $1,482 per year.

The most expensive trim to insure is the Touring 4WD at $1,726 per year. The rate difference between those two CR-V trim levels is $244.

For adolescent drivers or drivers with a bad driving record, the trim level variance is much greater. As an example, if prices are adjusted for a sixteen-year-old driver, the price range increases to $808.

The following table breaks down average car insurance rates for all 2019 Honda CR-V models. Average rates are shown for both annual and semi-annual coverage terms, also including the expected hit on your monthly budget.

| 2019 Honda CR-V Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| EX 2WD | $1,482 | $124 |

| LX 2WD | $1,482 | $124 |

| LX 4WD | $1,482 | $124 |

| EX 4WD | $1,544 | $129 |

| EX-L 2WD | $1,544 | $129 |

| EX-L 4WD | $1,604 | $134 |

| Touring 2WD | $1,604 | $134 |

| Touring 4WD | $1,726 | $144 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

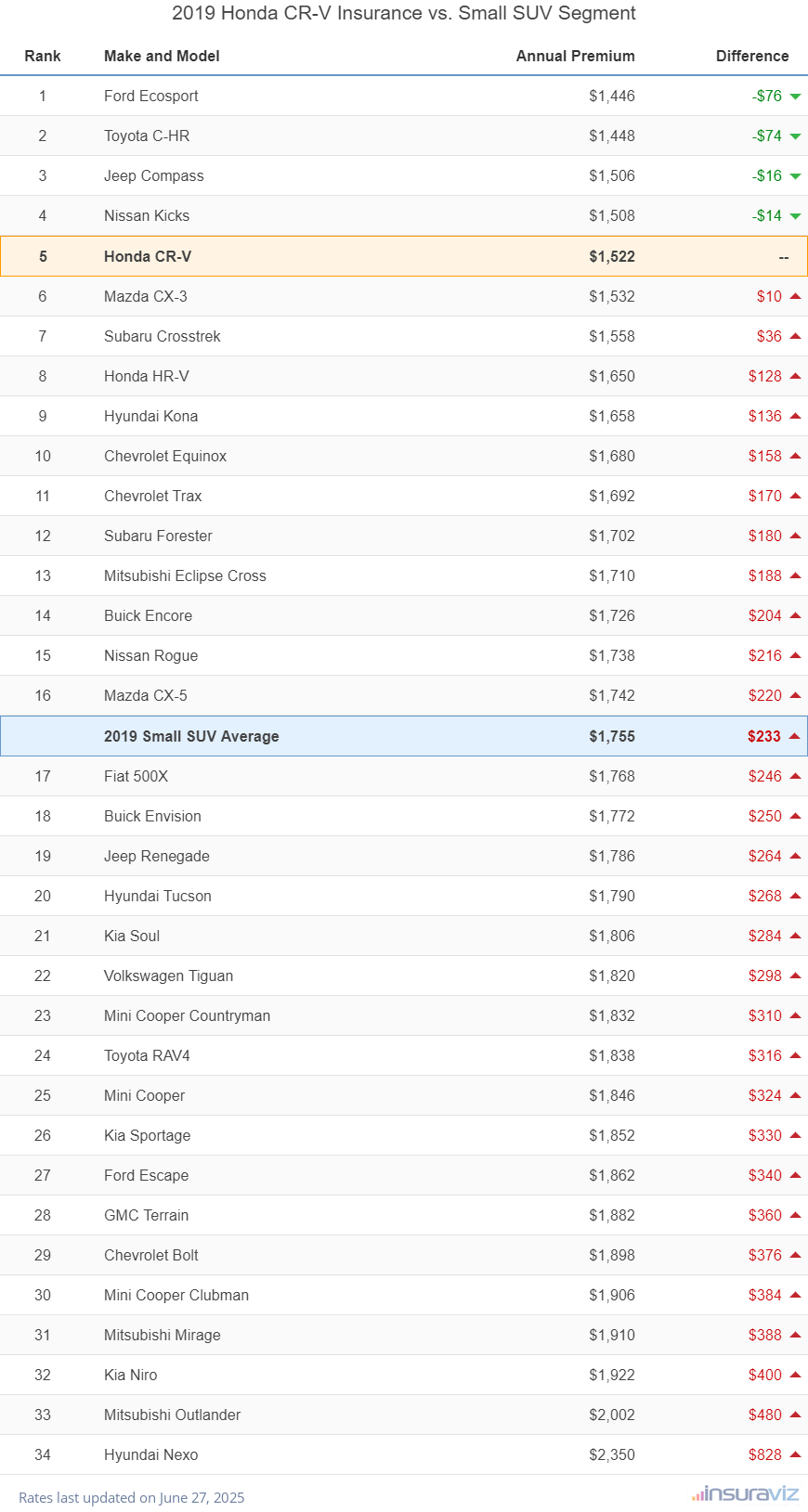

2019 CR-V insurance rates vs. the competition

When Honda CR-V car insurance rates are compared directly to other vehicles in the 2019 model year compact SUV class, the CR-V costs $334 less per year to insure than the Kia Sportage (view comparison), $272 less than the Hyundai Tucson (view comparison), and $222 less than the Mazda CX-5 (view comparison).

The 2019 CR-V is an excellent choice when it comes to auto insurance since it is one of the cheapest vehicles to insure when compared to other compact sport utility vehicles. When compared side-by-side to similar models, the 2019 Honda CR-V ranks fifth for least expensive auto insurance rates.

The following table displays how the CR-V compares to other 2019 model year compact SUVs. The average rate for the Honda CR-V is displayed in a light orange color, while the overall segment rate is highlighted in light blue.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Ford Ecosport | $1,480 | -$80 |

| 2 | Toyota C-HR | $1,482 | -$78 |

| 3 | Jeep Compass | $1,542 | -$18 |

| 4 | Nissan Kicks | $1,544 | -$16 |

| 5 | Honda CR-V | $1,560 | -- |

| 6 | Mazda CX-3 | $1,570 | $10 |

| 7 | Subaru Crosstrek | $1,598 | $38 |

| 8 | Honda HR-V | $1,690 | $130 |

| 9 | Hyundai Kona | $1,696 | $136 |

| 10 | Chevrolet Equinox | $1,720 | $160 |

| 11 | Chevrolet Trax | $1,734 | $174 |

| 12 | Subaru Forester | $1,744 | $184 |

| 13 | Mitsubishi Eclipse Cross | $1,752 | $192 |

| 14 | Buick Encore | $1,766 | $206 |

| 15 | Mazda CX-5 | $1,782 | $222 |

| 2019 Small SUV Average | $1,797 | $237 | |

| 16 | Nissan Rogue | $1,802 | $242 |

| 17 | Fiat 500X | $1,808 | $248 |

| 18 | Buick Envision | $1,814 | $254 |

| 19 | Jeep Renegade | $1,828 | $268 |

| 20 | Hyundai Tucson | $1,832 | $272 |

| 21 | Kia Soul | $1,850 | $290 |

| 22 | Volkswagen Tiguan | $1,864 | $304 |

| 23 | Mini Cooper Countryman | $1,876 | $316 |

| 24 | Toyota RAV4 | $1,886 | $326 |

| 25 | Mini Cooper | $1,888 | $328 |

| 26 | Kia Sportage | $1,894 | $334 |

| 27 | Ford Escape | $1,906 | $346 |

| 28 | GMC Terrain | $1,926 | $366 |

| 29 | Chevrolet Bolt | $1,942 | $382 |

| 30 | Mini Cooper Clubman | $1,950 | $390 |

| 31 | Mitsubishi Mirage | $1,958 | $398 |

| 32 | Kia Niro | $1,970 | $410 |

| 33 | Mitsubishi Outlander | $2,050 | $490 |

| 34 | Hyundai Nexo | $2,406 | $846 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each model. Updated October 24, 2025

Shown in the rightmost column in the table above, the ‘Difference’ column displays the difference in average insurance cost for each model when compared to the rate for the Honda CR-V. Green values indicate a cheaper average rate for that particular model, while red indicates a higher price.

Here is a quick example to illustrate this. The Kia Sportage places 26th in the comparison table with an average annual rate of $1,894. When this value is compared to the cost for the Honda CR-V, with an average price of $1,560, the average rate for the Kia Sportage costs $334 more per year, therefore the color is red.

Insuring a teen driver on a 2019 Honda CR-V

Teenagers are the most expensive driver class to insure and with good reason. They cause more accidents than any other age group due to their inexperience.

The CR-V is a great vehicle to put your teen in due to its excellent reputation for safety. The Touring trim level earned a 2019 Top Safety Pick award from the Insurance Institute for Highway Safety.

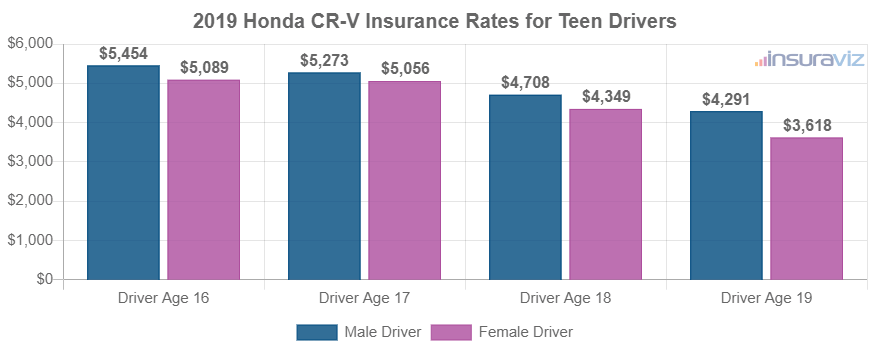

The table below shows average rates for a 2019 Honda CR-V for both male and female drivers aged 16 to 19. Rates range from a low of $3,706 to insure a 19-year-old female driver to a high of $5,587 to insure a 16-year-old male driver.

Newly-licensed 16-year-old drivers are the most expensive in the chart above. Insuring a 17-year-old driver on a 2019 Honda CR-V costs an average of $5,181 for females and $5,401 for males. Insuring an 18-year-old on a 2019 CR-V would cost an average of $4,453 for females and $4,820 for males.

Despite having some of the best insurance rates around, it is still expensive to insure a teenager with full coverage insurance on a 2019 CR-V. You may consider raising deductibles to save money. The 2019 model isn’t a candidate for dropping full coverage altogether, however.

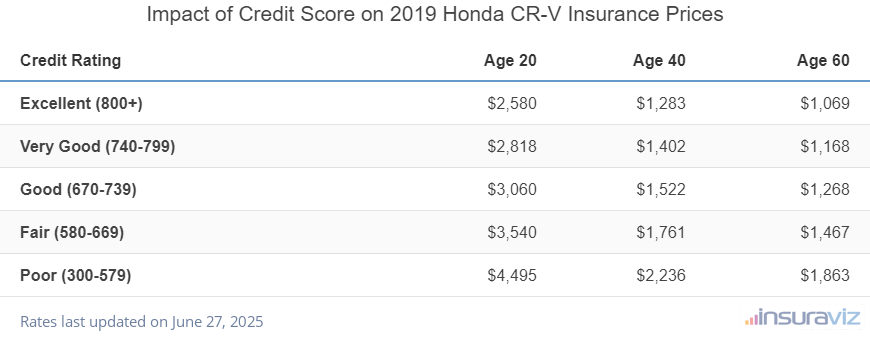

How does your credit score affect insurance rates?

Many states allow car insurance companies to use your credit score to help them compute the rate you pay.

Research has shown that drivers with better credit tend to file fewer and less severe car insurance claims.

The table below shows how different credit levels can potentially impact the cost you pay to insure your 2019 Honda CR-V.

| Credit Rating | Age 20 | Age 40 | Age 60 |

|---|---|---|---|

| Excellent (800+) | $2,642 | $1,315 | $1,096 |

| Very Good (740-799) | $2,886 | $1,437 | $1,197 |

| Good (670-739) | $3,134 | $1,560 | $1,300 |

| Fair (580-669) | $3,626 | $1,805 | $1,504 |

| Poor (300-579) | $4,604 | $2,292 | $1,910 |

Data Methodology: Rated drivers have no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all 2019 Honda CR-V trim levels. Updated October 24, 2025

Even if your credit isn’t great, there are some things you can do to improve it.

- Pay your bills on time. One of the best ways to improve your credit is to not be late when paying your bills. If possible, set up an automatic payment through your bank to facilitate on-time payments.

- Limit the number of credit cards you use. Having too many credit cards is a big red flag on your credit score. Limit the number of credit cards you use to a maximum of three or four.

- Keep your credit balances low. Try to pay off your full credit card bill every month and resist the temptation to only pay the minimum. Maxed-out credit is a big red flag.

- Check your credit report every year. Consumers are entitled to one free credit report from each of the three reporting agencies once a year. Take advantage of this to make sure there are no errors or false issues on your report.