- Ford EcoSport insurance costs an average of $1,570 per year, or around $131 per month, for full coverage.

- The cheapest model to insure is the EcoSport S AWD at an estimated $1,486 per year, while the EcoSport Titanium AWD is the most expensive to insure at $1,620 per year.

- The Ford EcoSport is one of the cheaper small SUVs to insure for the 2022 model year, costing $36 less per year on average as compared to the rest of the vehicles in the segment.

How much does Ford EcoSport insurance cost?

Ford EcoSport insurance costs an average of $1,570 a year for a full coverage policy. Average cost per month ranges from $124 to $135 depending on the trim level.

When a policy is broken down into individual coverages, liability and medical (or PIP) coverage is around $580 a year, comprehensive coverage costs approximately $388, and the remaining collision coverage is approximately $602.

The chart below demonstrates average car insurance rates on a 2022 EcoSport using different driver ages and risk profiles.

In the chart above rates range from a discount rate for a 40-year-old driver of $1,302 to the high-risk average rate for a 30-year-old driver of $3,588 per year.

Not shown in the chart are rates for teenage drivers. A 16-year-old male driver with a clean driving record would pay around $5,630 while a 16-year-old female would pay about $5,255. At age 17, males would pay around $5,414 and females $5,218.

A few additional important insights about insuring a Ford EcoSport include:

- A good driving record means cheaper insurance costs. To get the cheapest EcoSport insurance rates, it pays to avoid traffic tickets. As a matter of fact, just a couple of minor infractions on your driving record can increase EcoSport insurance cost as much as $414 per year. Serious convictions like reckless driving and leaving the scene of an accident, DUI, or driving on a revoked license could raise rates by an additional $1,440 or more.

- EcoSport insurance rates for teenagers are high. Average rates for full coverage EcoSport insurance costs $5,630 per year for a 16-year-old driver, $5,414 per year for a 17-year-old driver, and $4,782 per year for an 18-year-old driver.

- High-risk insurance is expensive. For a 50-year-old driver, the requirement to buy a high-risk policy could raise rates by $1,840 or more per year.

- As you age, insurance rates get cheaper. The difference in insurance rates for a Ford EcoSport between a 60-year-old driver ($1,308 per year) and a 20-year-old driver ($3,130 per year) is $1,822, or a savings of 82.1%.

- Safe drivers have cheaper EcoSport insurance. Causing frequent accidents will increase insurance costs, possibly as much as $2,216 per year for a 20-year-old driver and as much as $394 per year for a 60-year-old driver.

What is the cheapest Ford EcoSport car insurance?

The cheapest model to insure is the Ecosport S AWD at $1,486 per year, or about $124 per month. The second cheapest trim is the SE AWD at $1,556 per year, and the third cheapest model to insure is the SES AWD also at $1,614 per year.

In the upper range of insurance cost, the three most expensive models to insure are the EcoSport SE AWD, the SES AWD, and the Titanium AWD trim levels at an estimated $1,620 per year.

The average monthly cost to insure a Ford EcoSport ranges between $124 to $135 per month for a full-coverage policy. Keep in mind that these are average rates, which can vary a lot based on the age of the driver, location, policy limits, and in some states, even the insured’s credit rating.

The next table displays average Ford EcoSport insurance rates for annual, semi-annual, and monthly terms, for each 2022 model year trim level.

| 2022 Ford Ecosport Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S AWD | $1,486 | $124 |

| SE AWD | $1,556 | $130 |

| SES AWD | $1,614 | $135 |

| Titanium AWD | $1,620 | $135 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

Is Ford EcoSport insurance cheaper than other small SUVs?

The Ford EcoSport ranks 19th out of 45 comparison vehicles in the 2022 compact SUV segment. It costs an estimated $1,570 per year to insure, while the class average is $1,606 annually, a difference of $36 per year.

When rates are compared to the most popular models in the small SUV category, insurance for a Ford EcoSport costs $66 less per year than the Toyota RAV4, $54 more than the Honda CR-V, $50 less than the Chevrolet Equinox, and $126 less than the Nissan Rogue.

When compared to all vehicles, average Ford EcoSport insurance costs 18.1% less than the national average car insurance rate of $1,883 per year.

The table below shows how the average car insurance cost for a Ford EcoSport compares to all other small SUVs (excluding small luxury SUVs).

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Mazda CX-5 | $1,318 | -$252 |

| 2 | Nissan Kicks | $1,350 | -$220 |

| 3 | Chevrolet Trailblazer | $1,358 | -$212 |

| 4 | Subaru Crosstrek | $1,392 | -$178 |

| 5 | Buick Encore | $1,434 | -$136 |

| 6 | Toyota C-HR | $1,438 | -$132 |

| 7 | Nissan Rogue Sport | $1,444 | -$126 |

| 8 | Hyundai Venue | $1,470 | -$100 |

| 9 | Buick Envision | $1,474 | -$96 |

| 10 | Kia Seltos | $1,476 | -$94 |

| 11 | Ford Bronco Sport | $1,482 | -$88 |

| 12 | Toyota Corolla Cross | $1,486 | -$84 |

| 13 | Hyundai Kona | $1,498 | -$72 |

| 14 | Volkswagen Tiguan | $1,502 | -$68 |

| 15 | Subaru Forester | $1,504 | -$66 |

| 16 | Honda CR-V | $1,516 | -$54 |

| 17 | Mazda CX-30 | $1,532 | -$38 |

| 18 | Honda HR-V | $1,554 | -$16 |

| 19 | Ford Ecosport | $1,570 | -- |

| 20 | Chevrolet Trax | $1,586 | $16 |

| 21 | GMC Terrain | $1,594 | $24 |

| 22 | Mitsubishi Eclipse Cross | $1,598 | $28 |

| 23 | Hyundai Tucson | $1,608 | $38 |

| 24 | Chevrolet Bolt | $1,616 | $46 |

| 25 | Chevrolet Equinox | $1,620 | $50 |

| 26 | Volkswagen Taos | $1,624 | $54 |

| 27 | Fiat 500X | $1,628 | $58 |

| 28 | Toyota RAV4 | $1,636 | $66 |

| 29 | Kia Soul | $1,636 | $66 |

| 30 | Mazda MX-30 | $1,670 | $100 |

| 31 | Jeep Compass | $1,676 | $106 |

| 32 | Kia Niro | $1,682 | $112 |

| 33 | Nissan Rogue | $1,696 | $126 |

| 34 | Ford Escape | $1,704 | $134 |

| 35 | Hyundai Ioniq 5 | $1,720 | $150 |

| 36 | Jeep Renegade | $1,722 | $152 |

| 37 | Mini Cooper Clubman | $1,722 | $152 |

| 38 | Kia Sportage | $1,730 | $160 |

| 39 | Volkswagen ID4 | $1,766 | $196 |

| 40 | Mini Cooper | $1,772 | $202 |

| 41 | Mini Cooper Countryman | $1,800 | $230 |

| 42 | Mitsubishi Outlander | $1,864 | $294 |

| 43 | Mitsubishi Mirage | $1,880 | $310 |

| 44 | Ford Mustang Mach-E | $1,958 | $388 |

| 45 | Hyundai Nexo | $1,982 | $412 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2022 model year. Updated February 23, 2024

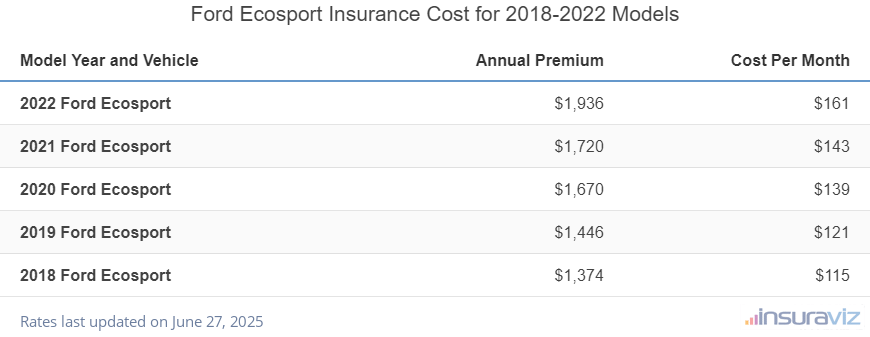

Will buying a newer EcoSport cost more for insurance?

Buying a new 2022 Ford EcoSport instead of a used 2018 model will cost around $454 a year more for insurance. Even buying an almost new 2019 model could save you $398 annually over the cost of buying new.

The data table below details average full coverage car insurance rates for various Ford EcoSport model years. Insurance prices range from a low of $1,116 for a 2018 Ford EcoSport to the most expensive yearly cost of $1,570 for a 2022 model year.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2022 Ford Ecosport | $1,570 | $131 |

| 2021 Ford Ecosport | $1,394 | $116 |

| 2020 Ford Ecosport | $1,354 | $113 |

| 2019 Ford Ecosport | $1,172 | $98 |

| 2018 Ford Ecosport | $1,116 | $93 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ford Ecosport trim levels for each model year. Updated February 22, 2024