- Jeep Grand Cherokee insurance rates average $2,398 per year, $1,199 for a 6-month policy, or $200 per month for full coverage, depending on the trim level.

- The cheapest Jeep Grand Cherokee insurance is on the Laredo A trim level costing an average of $2,100 per year. The most expensive is the Summit Reserve 4xe at $2,650 annually.

- The Jeep Grand Cherokee is one of the more expensive midsize SUVs to insure, costing $28 more per year on average as compared to the rest of the segment.

- The Grand Cherokee ranks 20th out of 34 vehicles in the 2024 midsize SUV class for car insurance affordability.

How much are Jeep Grand Cherokee insurance rates?

Jeep Grand Cherokee insurance costs around $2,398 a year, or around $200 if paid each month. With the average midsize SUV costing $2,370 a year to insure, the Jeep Grand Cherokee would cost about $28 more to insure each year.

When compared to all 2024 model year vehicles, insurance on a Grand Cherokee costs 7% less than the overall 2024 model average rate of $2,572 per year.

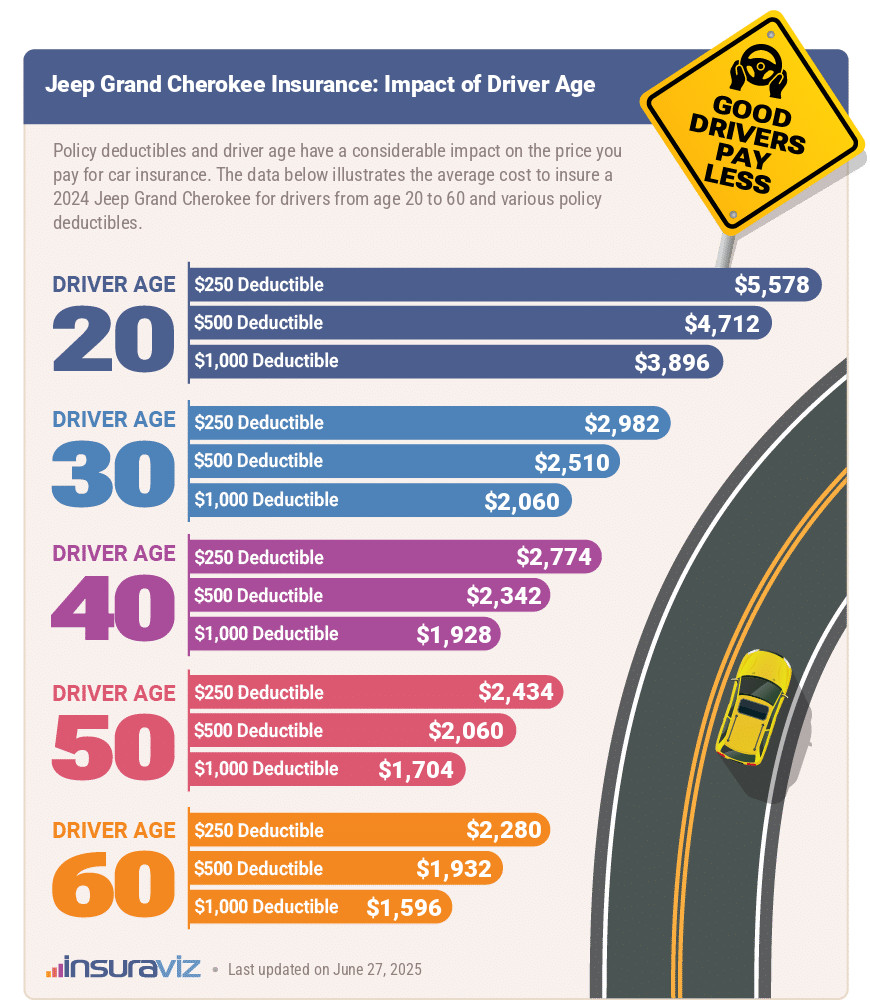

The graphic below illustrates how average Jeep Grand Cherokee car insurance rates drop with driver age, and also the effect that different deductible amounts can have on policy cost. Our average rate is obtained from the data for a 40-year-old driver with $500 physical damage deductibles.

As illustrated in the infographic above, insurance rates drop as drivers mature with all other factors held constant. Conversely, insurance rates tend to increase as the MSRP of the vehicle increases. This can be illustrated by looking at the insurance rates for the different trim levels offered for the Grand Cherokee.

When we look at the individual coverages on a car insurance policy and compare the cost of those to the average costs for all 2024 models, we get the data shown in the table below.

| Policy Coverage | 2024 Jeep Grand Cherokee | 2024 All Vehicle Average | Difference |

|---|---|---|---|

| Comprehensive | $620 | $656 | -5.6% |

| Collision | $1,250 | $1,216 | 2.8% |

| Liability | $364 | $492 | -29.9% |

| Med/PIP Other | $164 | $208 | -23.7% |

| Total Policy Cost | $2,398 | $2,572 | -7% |

Lower than average cost Higher than average cost

Data Methodology: Rated driver is a 40-year-old male with no driving violations or at-fault accidents in the prior three years. Coverage premiums are averaged for all trim levels available for the 2024 Jeep Grand Cherokee. Updated October 24, 2025

Overall, insurance on the Grand Cherokee runs pretty similar to the 2024 model year averages. It’s a little cheaper for physical damage coverages but gives a little back in the liability and medical coverages.

Jeep Grand Cherokee insurance rates by trim level

The average cost to insure a Grand Cherokee is $2,398 per year, with trim level cost ranging from the cheapest Laredo A at $2,100 per year up to the most expensive Summit Reserve 4xe at $2,650 per year.

That’s a difference of $550 between the cheapest and most expensive versions of the Grand Cherokee to insure, as is shown by the table below.

| 2024 Jeep Grand Cherokee Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Laredo A | $2,100 | $175 |

| Laredo | $2,190 | $183 |

| Laredo X | $2,208 | $184 |

| Laredo 4X4 | $2,238 | $187 |

| Laredo X 4X4 | $2,252 | $188 |

| Altitude | $2,274 | $190 |

| Altitude X | $2,296 | $191 |

| Altitude 4X4 | $2,316 | $193 |

| Altitude X 4X4 | $2,330 | $194 |

| Limited | $2,366 | $197 |

| Limited 4X4 | $2,394 | $200 |

| 4xe | $2,498 | $208 |

| Overland | $2,528 | $211 |

| Summit | $2,560 | $213 |

| Trailhawk 4xe | $2,560 | $213 |

| Summit Reserve | $2,590 | $216 |

| Overland 4xe | $2,598 | $217 |

| Summit 4xe | $2,624 | $219 |

| Summit Reserve 4xe | $2,650 | $221 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

The table above does a good job illustrating the fact that the more expensive Grand Cherokee models have more expensive car insurance rates. In general, anytime the cost of a vehicle increases with added options or packages, it’s going to bump up the cost of insurance.

The insurance cost range of $550 from the cheapest to most expensive Grand Cherokee model is a pretty large range for a single vehicle model. But that variation should reinforce the importance of getting actual insurance quotes for your vehicle before making a purchasing decision since the rate can vary quite a bit depending on the exact model.

If you can afford to pay your entire 2024 Grand Cherokee insurance bill at once, rather than in monthly or quarterly payments, you could save anywhere from $120 to $240 per year, depending on the company.

How much is insurance on a used Grand Cherokee?

In most cases, insurance on a used model will cost less than buying a new one. For example, when comparing insurance rates for a new 2024 model to a used 2017 model, the 2017 Grand Cherokee will cost around $486 less per year. A 2013 model will cost around $890 less per year than insuring a 2024 model.

Car insurance tends to be more expensive when the value of the vehicle is higher. As a Grand Cherokee ages, it has a lower Actual Cash Value (ACV), which simply means your insurance company will pay less if the vehicle is totaled in an accident or weather-related incident. This lower ACV results in cheaper insurance rates for you.

The table below demonstrates how insurance rates are generally cheaper for older Grand Cherokee models, and also how rates drop for more mature drivers.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Jeep Grand Cherokee | $4,828 | $2,398 | $1,980 |

| 2023 Jeep Grand Cherokee | $4,994 | $2,480 | $2,054 |

| 2022 Jeep Grand Cherokee | $4,874 | $2,414 | $2,002 |

| 2021 Jeep Grand Cherokee | $4,874 | $2,406 | $1,994 |

| 2020 Jeep Grand Cherokee | $4,686 | $2,314 | $1,920 |

| 2019 Jeep Grand Cherokee | $4,326 | $2,126 | $1,770 |

| 2018 Jeep Grand Cherokee | $4,056 | $2,000 | $1,664 |

| 2017 Jeep Grand Cherokee | $3,878 | $1,912 | $1,596 |

| 2016 Jeep Grand Cherokee | $3,462 | $1,722 | $1,434 |

| 2015 Jeep Grand Cherokee | $3,518 | $1,742 | $1,456 |

| 2014 Jeep Grand Cherokee | $3,452 | $1,706 | $1,426 |

| 2013 Jeep Grand Cherokee | $3,006 | $1,502 | $1,256 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Jeep Grand Cherokee trim levels for each model year. Updated October 24, 2025

The exception to the generality that car insurance rates increase with each new model year would be if a new model arrives at the dealership with enough new safety features that the liability rates drop enough to offset the higher physical damage rates due to the higher ACV for the newer model year.

It often takes a year or two to collect enough real-world data to make rate adjustments for improvements or detriments to vehicle safety. Simulations and crash test dummies cannot predict or take the place of personal injury data extracted from actual claims and accidents.

How do Grand Cherokee insurance prices compare?

Unfortunately, Jeep Grand Cherokee insurance prices tend to fall on the more expensive end of the midsize SUV insurance cost range. At $2,398 per year, it ranks 20th out of 34 total comparison vehicles, and costs $488 more per year to insure than the Honda Passport, which ranks in first place.

The chart below shows how the Grand Cherokee compares to the rest of the top 10 selling midsize SUVs in America, and the table below the chart shows the rankings for the entire midsize SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$488 |

| 2 | Nissan Murano | $2,016 | -$382 |

| 3 | Subaru Outback | $2,042 | -$356 |

| 4 | Buick Envista | $2,050 | -$348 |

| 5 | Subaru Ascent | $2,088 | -$310 |

| 6 | Volkswagen Atlas | $2,128 | -$270 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$262 |

| 8 | Ford Explorer | $2,176 | -$222 |

| 9 | Toyota Highlander | $2,180 | -$218 |

| 10 | Toyota Venza | $2,190 | -$208 |

| 11 | Chevrolet Traverse | $2,238 | -$160 |

| 12 | Mitsubishi Outlander Sport | $2,254 | -$144 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | -$136 |

| 14 | Ford Edge | $2,270 | -$128 |

| 15 | Kia Sorento | $2,278 | -$120 |

| 16 | GMC Acadia | $2,316 | -$82 |

| 17 | Buick Enclave | $2,320 | -$78 |

| 18 | Honda Pilot | $2,336 | -$62 |

| 19 | Mazda CX-9 | $2,342 | -$56 |

| 20 | Jeep Grand Cherokee | $2,398 | -- |

| 21 | Hyundai Santa Fe | $2,426 | $28 |

| 22 | Nissan Pathfinder | $2,440 | $42 |

| 23 | Hyundai Palisade | $2,450 | $52 |

| 24 | Chevrolet Blazer | $2,476 | $78 |

| 25 | Kia Telluride | $2,504 | $106 |

| 26 | Toyota 4Runner | $2,572 | $174 |

| 27 | Mazda CX-90 | $2,582 | $184 |

| 28 | Toyota Grand Highlander | $2,610 | $212 |

| 29 | Kia EV9 | $2,630 | $232 |

| 30 | Tesla Model Y | $2,654 | $256 |

| 31 | Ford Bronco | $2,662 | $264 |

| 32 | Jeep Wrangler | $2,740 | $342 |

| 33 | Dodge Durango | $2,942 | $544 |

| 34 | Rivian R1S | $2,950 | $552 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Another useful metric is to see how the cost of insurance on a Jeep Grand Cherokee compares to the most similarly priced midsize SUV models. A 2024 model year Grand Cherokee has an average sticker price of $54,456 and ranges from $36,495 to $78,525.

The vehicles in the 2024 midsize SUV segment that have the most similar cost to the Jeep Grand Cherokee are the Buick Enclave, Ford Bronco, Jeep Wrangler, and Mazda CX-90.

The list below shows how those models compare to a Grand Cherokee for MSRP and average full-coverage insurance cost. See our insurance comparisons page for a complete list of car insurance comparisons.

- Jeep Grand Cherokee vs. Buick Enclave – With an average price of $53,642 and ranging from $45,940 to $60,895, the 2024 Buick Enclave costs $814 less than the average cost for the Jeep Grand Cherokee. Drivers can expect to pay an average of $78 less annually for insurance on the Buick Enclave compared to a Grand Cherokee.

- Jeep Grand Cherokee vs. Ford Bronco – The Ford Bronco has an average sticker price of $55,779 ($45,940 to $89,835), which is $1,323 more expensive than the Jeep Grand Cherokee. The cost to insure a Jeep Grand Cherokee compared to the Ford Bronco is $264 less per year on average.

- Jeep Grand Cherokee vs. Jeep Wrangler – With an average price of $52,852 ($32,095 to $90,590), the Jeep Wrangler costs $1,604 less than the average MSRP for the Jeep Grand Cherokee. Insurance on the Jeep Wrangler costs an average of $342 more per year than the Jeep Grand Cherokee.

- Jeep Grand Cherokee vs. Mazda CX-90 – With an average MSRP of $50,976 and ranging from $39,595 to $59,950, the Mazda CX-90 costs $3,480 less than the average MSRP for the Jeep Grand Cherokee. Expect to pay approximately $184 more annually for insurance on the Mazda CX-90 compared to a Grand Cherokee.

Full coverage versus liability-only insurance

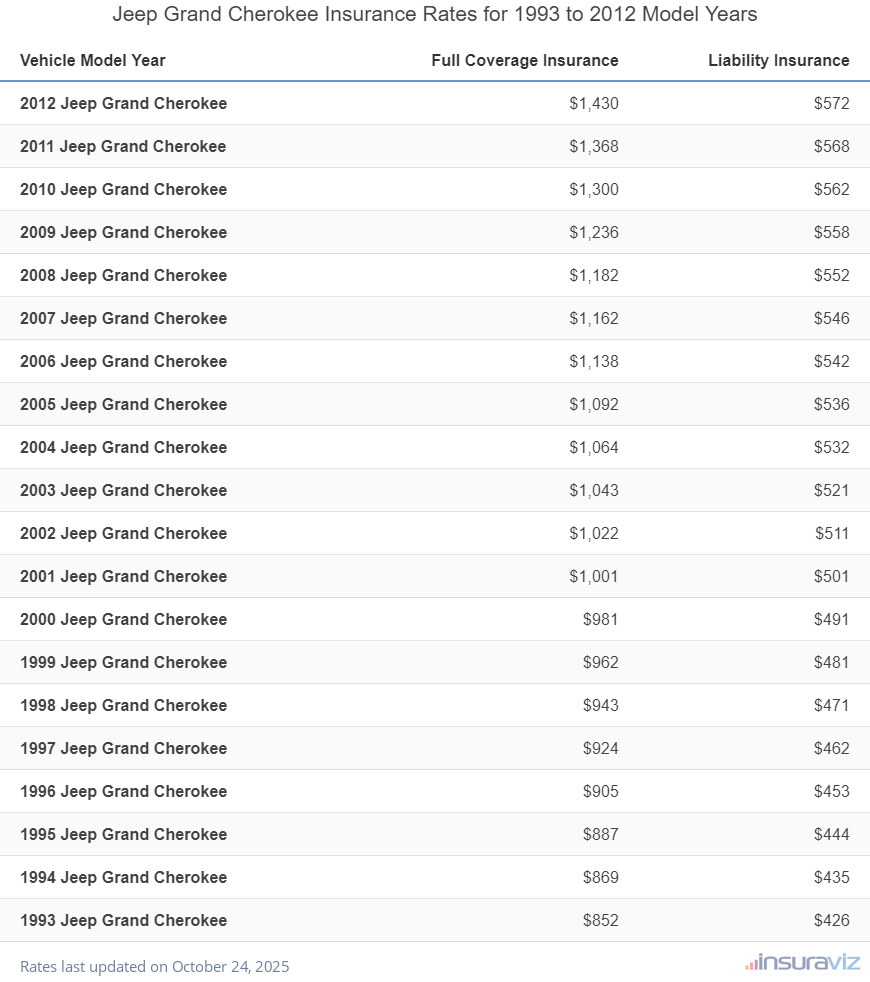

On older Grand Cherokee models, sometimes it doesn’t make sense to insure them for full coverage.

The rule of thumb is when the cost of physical damage coverage is more than ten percent of the value of the vehicle, it may be time to consider removing those coverages.

Liability insurance is all that is required to license a Jeep, and the table below shows the difference between average full coverage and liability-only rates for 1993 to 2012 Grand Cherokee models.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Jeep Grand Cherokee | $1,430 | $572 |

| 2011 Jeep Grand Cherokee | $1,368 | $568 |

| 2010 Jeep Grand Cherokee | $1,300 | $562 |

| 2009 Jeep Grand Cherokee | $1,236 | $558 |

| 2008 Jeep Grand Cherokee | $1,182 | $552 |

| 2007 Jeep Grand Cherokee | $1,162 | $546 |

| 2006 Jeep Grand Cherokee | $1,138 | $542 |

| 2005 Jeep Grand Cherokee | $1,092 | $536 |

| 2004 Jeep Grand Cherokee | $1,064 | $532 |

| 2003 Jeep Grand Cherokee | $1,043 | $521 |

| 2002 Jeep Grand Cherokee | $1,022 | $511 |

| 2001 Jeep Grand Cherokee | $1,001 | $501 |

| 2000 Jeep Grand Cherokee | $981 | $491 |

| 1999 Jeep Grand Cherokee | $962 | $481 |

| 1998 Jeep Grand Cherokee | $943 | $471 |

| 1997 Jeep Grand Cherokee | $924 | $462 |

| 1996 Jeep Grand Cherokee | $905 | $453 |

| 1995 Jeep Grand Cherokee | $887 | $444 |

| 1994 Jeep Grand Cherokee | $869 | $435 |

| 1993 Jeep Grand Cherokee | $852 | $426 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025

Companies to consider

Finding affordable car insurance can be challenging, especially considering how many companies there are to choose from.

We’re all familiar with the big names like Progressive, GEICO, State Farm, and Liberty Mutual. But for every large company, there are dozens of smaller companies that you may not have even heard of.

That’s where the services of an independent insurance agent may be useful. They have the ability to compare Jeep Grand Cherokee insurance quotes with many different companies, including the smaller ones.

So keep that in mind when shopping around for a deal on car insurance. Often the best price is with a regional carrier or a small mutual insurance company.

Make sure you compare apples-to-apples coverages when shopping your coverage around. Identical policy deductibles, liability limits, and optional coverages help ensure you find the best deal.

As far as the big boys go, we assembled a list of some of the top companies and some of the pros and cons of each.

Every large company now gives you the ability to easily manage your policy online or through a mobile app, but they each offer slightly different coverages and policy perks.

1. Progressive

Estimated Progressive car insurance rate on a 2024 Jeep Grand Cherokee: $2,206 per year

Pros

- Very easy to manage your policy, file a claim, or pay your bill either online or via their app

- Progressive offers optional coverage for ridesharing for drivers who are employed by companies like Uber or Lyft

- Coverages are available like accident forgiveness and a vanishing deductible

Cons

- Have a below-average claim satisfaction rating in J.D. Power surveys

- Somewhat expensive prices for teenage and early twenties drivers

Get a Quote Or read more about auto insurance coverages offered at Progressive.com

2. State Farm

Estimated State Farm car insurance rate on a 2024 Jeep Grand Cherokee: $2,278 per year

Pros

- Nice renewal discount of around 14% if you have been with them for three years or more

- Competitive prices for drivers with speeding tickets on their records

- Good rates when adding a teenage driver to a policy

Cons

- High average rates if you have bad credit

- Prices are above average for drivers with prior accidents or serious violations

Get a Quote Or read more about auto insurance coverages offered at StateFarm.com

3. GEICO

Estimated GEICO car insurance rate on a 2024 Jeep Grand Cherokee: $1,990 per year

Pros

- Allows customers to file claims or make payments through a smartphone app

- On average, GEICO tends to have lower car insurance rates for most drivers

- The company has strong financial ratings with rating agencies like AM Best and Standard and Poor’s

Cons

- They don’t give insureds the option of having loan/lease gap insurance

- They do not offer rideshare coverage for insureds who earn money with companies like Uber or Lyft

Get a Quote Or read more about auto insurance coverages offered at GEICO.com

4. Nationwide

Estimated Nationwide car insurance rate on a 2024 Jeep Grand Cherokee: $2,374 per year

Pros

- Generally a low level of complaints filed by customers with state regulators

- Optional coverages are available like accident forgiveness, vanishing deductible, and total loss deductible waiver

- Company offers a usage-based price option called SmartRide for drivers who might be able to save money

Cons

- Expensive average rates for drivers who have previously had an accident with injuries

- Prices are not great for drivers with accidents or major violations

Get a Quote Or read more about auto insurance coverages offered at Nationwide.com

5. Allstate

Estimated Allstate car insurance rate on a 2024 Jeep Grand Cherokee: $3,189 per year

Pros

- Offers perks like accident forgiveness and a disappearing deductible

- They have a generally good customer satisfaction level with a low level of complaints filed with state insurance departments

- They offer a usage-based insurance rating option, Drivewise, for drivers who want to try to get a discount

Cons

- Average prices are not great for drivers with speeding tickets or other violations

- Rates are above average for drivers who have prior at-fault accidents or lapses in coverage

Get a Quote Or read more about auto insurance coverages offered at Allstate.com

6. Travelers

Estimated Travelers car insurance rate on a 2024 Jeep Grand Cherokee: $2,158 per year

Pros

- Has some of the most affordable loan/lease gap insurance

- Perks are available like a decreasing deductible and minor violation and accident forgiveness

- They offer a usage-based price option to help save money on car insurance

Cons

- Prices are on the high side when adding a teenage driver to their parent’s policy

- Has some of the more expensive rates for drivers over the age of 60

Get a Quote Or read more about auto insurance coverages offered at Travelers.com

During his career as an independent insurance agent,

During his career as an independent insurance agent,