- Jeep Wrangler insurance prices average $2,740 per year, or about $228 per month, ranging from the Wrangler Sport 2-Door trim level at $2,436 per year up to the Rubicon 392 at $3,004 per year.

- The 2024 Wrangler ranks 32nd out of 34 vehicles in the midsize sport utility vehicle segment for insurance affordability.

- In a comparison of larger companies, USAA, GEICO, and Progressive had the best insurance prices on a 2024 Wrangler.

- Larger policy discounts can help you save anywhere from $142 to $384 per year on Wrangler insurance.

How much does Jeep Wrangler insurance cost?

2024 Jeep Wrangler insurance costs an average of $2,740 a year, or $228 each month. When compared to other 2024 model-year midsize SUVs, expect to pay around $370 more each year to insure a Jeep Wrangler over the segment average rate.

When compared to all 2024 vehicles, not just midsize sport utility vehicles, insurance for a Jeep Wrangler averages $168 more than the average rate of $2,572 per year.

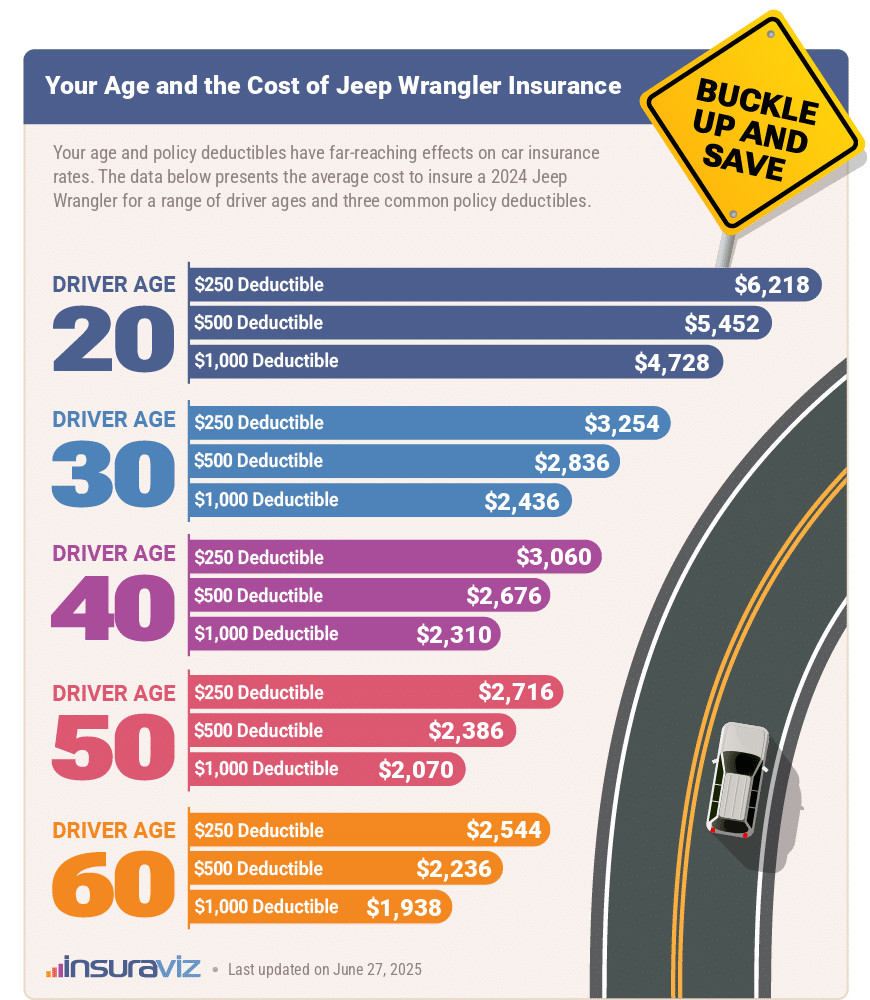

Two factors that really impact the cost of Wrangler insurance are the age of the driver and the policy deductibles for physical damage coverage (comprehensive and collision).

The following infographic illustrates how these two factors affect 2024 Jeep Wrangler insurance rates.

As shown in the graphic above, rates for a 20-year-old driver are much higher than other age groups. Younger drivers pay higher car insurance rates on any vehicle, not just the Jeep Wrangler.

Insurance rates for teen drivers on a Jeep Wrangler are even higher. An 18-year-old male driver rated on a 2024 Wrangler average $8,606 per year, and rates for a 16-year-old driver average an astonishing $10,183 per year.

There are ways to save money when insuring younger drivers on a Wrangler, however. Older models cost less to insure, and raising deductibles is another way to save. As a last resort, you can consider dropping full coverage altogether and insuring with just liability insurance.

The following table shows the average insurance rates for a Jeep Wrangler from the 2013 model year up to the 2024 model year.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Jeep Wrangler | $2,740 | $228 |

| 2023 Jeep Wrangler | $2,574 | $215 |

| 2022 Jeep Wrangler | $2,506 | $209 |

| 2021 Jeep Wrangler | $2,450 | $204 |

| 2020 Jeep Wrangler | $2,356 | $196 |

| 2019 Jeep Wrangler | $2,242 | $187 |

| 2018 Jeep Wrangler | $2,066 | $172 |

| 2017 Jeep Wrangler | $2,022 | $169 |

| 2016 Jeep Wrangler | $1,776 | $148 |

| 2015 Jeep Wrangler | $1,698 | $142 |

| 2014 Jeep Wrangler | $1,596 | $133 |

| 2013 Jeep Wrangler | $1,532 | $128 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Jeep Wrangler trim levels for each model year. Updated October 24, 2025

The rates in the table make a couple of assumptions. First, average rates are determined by using a 40-year-old male driver with a good driving record. Second, physical damage deductibles are $500. Different driver ages will change rates, as will lower or higher deductibles. We touched on that in the first chart.

Other factors that will influence car insurance rates include having a speeding ticket or two, any prior at-fault accidents, the exact model of Wrangler you’re insuring, where you live, the company you use, and even your credit level in some states.

The list below details some of the factors and situations that can impact the rate you pay for Wrangler insurance.

- The older you are, the lower your insurance rates are. The difference in insurance rates for a Jeep Wrangler between a 60-year-old driver ($2,290 per year) and a 30-year-old driver ($2,906 per year) is $616, or a savings of 23.7%.

- Be a safe driver and save on insurance. Too frequent at-fault accidents can raise rates, possibly by an additional $1,370 per year for a 30-year-old driver and even as much as $750 per year for a 60-year-old driver.

- Improve your credit to save money. In states that have insurance regulations that allow a driver’s credit information to be used as a rating factor, insureds with excellent credit scores of 800+ could save as much as $430 per year when compared to a lower credit score of 670-739. Conversely, a poor credit score could cost up to $499 more per year.

- Get a discount from your employer. Just about all auto insurance companies offer policy discounts for being employed in professions like doctors, scientists, law enforcement, members of the military, nurses, and other occupations. If you qualify for this occupational discount, you may save between $82 and $233 on your annual insurance cost, depending on the age of the driver.

- Obey the law to get lower insurance rates. If you want the most economical Wrangler insurance rates, it pays off to be a safe driver. A few minor traffic violations have the consequence of raising insurance costs by at least $756 per year. Serious infractions such as DWI and driving without insurance could raise rates by an additional $2,624 or more.

- Higher deductibles lower insurance costs. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $376 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Decreasing deductibles cost more money. Cutting your deductibles from $500 to $250 could cost an additional $392 per year for a 40-year-old driver and $786 per year for a 20-year-old driver.

- Qualify for policy discounts to lower auto insurance costs. Discounts may be available if the policyholder drives a vehicle with safety or anti-theft features, is a senior citizen, is a good student, is a member of the military or a federal employee, or other policy discounts which could save the average driver as much as $470 per year on their insurance cost.

Jeep Wrangler insurance rates by trim level

With Jeep Wrangler car insurance cost ranging from $2,436 to $3,004 annually on average, the cheapest model to insure is the Sport 2-Door. The second cheapest trim level to insure is the Sport S 2-Door at $2,520 per year.

Expect to budget at least $203 per month to insure a Wrangler for full coverage since average Jeep Wrangler insurance cost per month ranges from $203 to $250 depending on the trim level.

The Jeep Wrangler models with the most expensive insurance rates are the Rubicon 392 at $3,004 and the Rubicon X 4xe at $2,916 per year. Those will cost an extra $568 and $480 per year, respectively, over the least expensive Sport 2-Door model.

In most instances, as vehicle cost increases as feature packages are added, the cost of insurance coverage also increases. The Wrangler follows this generality pretty closely, with the more expensive models being the most expensive to insure.

The table below shows average insurance rates for trim levels and options available on the 2024 Jeep Wrangler. Rates are shown for both annual and semi-annual policy terms.

| 2024 Jeep Wrangler Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sport 2-Door | $2,436 | $203 |

| Sport S 2-Door | $2,520 | $210 |

| Sport 4-Door | $2,534 | $211 |

| Willys 2-Door | $2,616 | $218 |

| Sport S 4-Door | $2,616 | $218 |

| Willys 4-Door | $2,678 | $223 |

| Sahara | $2,736 | $228 |

| Sport S 4xe | $2,750 | $229 |

| Willys 4xe | $2,806 | $234 |

| Rubicon X 2-Door | $2,812 | $234 |

| Sahara 4xe | $2,824 | $235 |

| Rubicon X 4-Door | $2,846 | $237 |

| Rubicon 4xe | $2,852 | $238 |

| High Altitude 4xe | $2,894 | $241 |

| Rubicon X 4xe | $2,916 | $243 |

| Rubicon 392 | $3,004 | $250 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How does Wrangler insurance compare?

The Jeep Wrangler ranks 32nd out of 34 total vehicles in the 2024 midsize SUV segment. The Wrangler costs an average of $2,740 per year for insurance and the category average is $2,370 annually, a difference of $370 per year.

When compared to the most popular models in the midsize SUV category, insurance for a Jeep Wrangler costs $564 more per year than the Ford Explorer, is $168 more than the Toyota 4Runner, costs $342 more than the Jeep Grand Cherokee, and is $78 more per year than the Ford Bronco.

The chart below shows how Wrangler insurance rates compare to the top ten best-selling midsize SUVs for the 2024 model year. Additionally, you can also view a larger table after the chart breaking down insurance rate rankings for every vehicle in the 2024 midsize SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$830 |

| 2 | Nissan Murano | $2,016 | -$724 |

| 3 | Subaru Outback | $2,042 | -$698 |

| 4 | Buick Envista | $2,050 | -$690 |

| 5 | Subaru Ascent | $2,088 | -$652 |

| 6 | Volkswagen Atlas | $2,128 | -$612 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$604 |

| 8 | Ford Explorer | $2,176 | -$564 |

| 9 | Toyota Highlander | $2,180 | -$560 |

| 10 | Toyota Venza | $2,190 | -$550 |

| 11 | Chevrolet Traverse | $2,238 | -$502 |

| 12 | Mitsubishi Outlander Sport | $2,254 | -$486 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | -$478 |

| 14 | Ford Edge | $2,270 | -$470 |

| 15 | Kia Sorento | $2,278 | -$462 |

| 16 | GMC Acadia | $2,316 | -$424 |

| 17 | Buick Enclave | $2,320 | -$420 |

| 18 | Honda Pilot | $2,336 | -$404 |

| 19 | Mazda CX-9 | $2,342 | -$398 |

| 2024 Midsize SUV Average | $2,370 | -$370 | |

| 20 | Jeep Grand Cherokee | $2,398 | -$342 |

| 21 | Hyundai Santa Fe | $2,426 | -$314 |

| 22 | Nissan Pathfinder | $2,440 | -$300 |

| 23 | Hyundai Palisade | $2,450 | -$290 |

| 24 | Chevrolet Blazer | $2,476 | -$264 |

| 25 | Kia Telluride | $2,504 | -$236 |

| 26 | Toyota 4Runner | $2,572 | -$168 |

| 27 | Mazda CX-90 | $2,582 | -$158 |

| 28 | Toyota Grand Highlander | $2,610 | -$130 |

| 29 | Kia EV9 | $2,630 | -$110 |

| 30 | Tesla Model Y | $2,654 | -$86 |

| 31 | Ford Bronco | $2,662 | -$78 |

| 32 | Jeep Wrangler | $2,740 | -- |

| 33 | Dodge Durango | $2,942 | $202 |

| 34 | Rivian R1S | $2,950 | $210 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each model. Updated October 24, 2025

The table above shows how the insurance cost for a 2024 Jeep Wrangler compares to all other midsize sport utility vehicles for the same model year.

The ‘Difference’ column shows the average insurance price difference between each model and the Wrangler. Green values indicate a cheaper insurance price for that specific model when compared to the Wrangler, while red values indicate a higher average rate.

Comparison of purchase price to insurance cost

Another useful way to compare insurance rates between the Wrangler and other midsize SUV models is to factor in the MSRP for each model. When shopping for a new vehicle, knowing how insurance rates differ between similarly-priced vehicles can save a considerable amount over the life of a vehicle.

For the 2024 model, the average MSRP for a Jeep Wrangler is $52,852, before destination and documentation fees.

The other vehicles in the midsize SUV segment that have the most similar cost to the Jeep Wrangler are the Buick Enclave, Jeep Grand Cherokee, Mazda CX-90, and Toyota Grand Highlander.

Here’s how they compare to the Jeep Wrangler by MSRP and the average cost of insurance.

- Compared to the Buick Enclave – The 2024 Buick Enclave has an average sticker price of $53,642, ranging from $45,940 to $60,895, which is $790 more expensive than the average cost for the Jeep Wrangler. Full-coverage insurance for the Buick Enclave costs an average of $420 less each year than the Jeep Wrangler.

- Compared to the Jeep Grand Cherokee – With an average price of $54,456 ($36,495 to $78,525), the Jeep Grand Cherokee costs $1,604 more than the average MSRP for the Jeep Wrangler. Full-coverage car insurance on the Jeep Grand Cherokee costs an average of $342 less per year than the Jeep Wrangler.

- Compared to the Mazda CX-90 – With an average price of $50,976 ($39,595 to $59,950), the 2024 Mazda CX-90 costs $1,876 less than the average sticker price for the Jeep Wrangler. Drivers can expect to pay an average of $158 less every 12 months for insurance on the Mazda CX-90 compared to a Wrangler.

- Compared to the Toyota Grand Highlander – With an average price of $50,652 and ranging from $44,465 to $59,520, the Toyota Grand Highlander costs $2,200 less than the average cost for the Jeep Wrangler. Car insurance for the Toyota Grand Highlander costs an average of $130 less annually than the Jeep Wrangler.

For additional car insurance rate comparisons, see our full comparison index which includes many more makes and models.

Best insurance for a Jeep Wrangler

In a comparison of some of the larger insurance companies, we found that USAA had the cheapest overall insurance rates on a 2024 Jeep Wrangler at $2,271 per year. GEICO and Progressive came in second and third at $2,337 and $2,439, respectively.

Travelers, State Farm, and Safeco were slightly more expensive than the top three companies in the comparison.

USAA is well-known for having very good car insurance rates. However, if you’re not a veteran or active military, you’re out of luck, as they don’t sell to just anyone.

This is obviously a very small comparison, and there are many other companies to choose from. We focused on companies that offer coverage nationwide for this comparison.

Other companies that offer coverage in most states include Allstate, Farmers, Nationwide, and Liberty Mutual. Companies that offer coverage in some states but not all include Erie Insurance, Auto-Owners, Westfield, and American Family.

We recommend comparing rates between at least five different car insurance companies in order to find the best rates. Include several major companies (Progressive, State Farm, GEICO, etc.) as well as smaller companies in your area.

If discount Jeep Wrangler insurance is your top priority, you’ll want to compare rates with not only the larger carriers but some of the smaller companies as well. The more apples-to-apples price quotes you get, the better chance you’ll have of finding cheap insurance on your Wrangler.

If the cheapest price isn’t your top priority, but rather customer service or claims handling, you’ll want to do a little research into customer satisfaction ratings like those performed annually by J.D. Power. They rate companies by region and state so users can see how companies rate. This is a great way to find some of the smaller, lesser-known companies in your area.

How to get discount Jeep Wrangler insurance

Discounts are a great way to reduce the cost of car insurance. Chances are you won’t qualify for every discount offered by most companies, but even if you can earn one or two of the larger discounts, it can save a lot on your premiums.

The table below shows ten of the top discounts to look for when insuring a 2024 Jeep Wrangler and the average savings offered by each discount.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $384 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $301 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $255 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $216 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $206 |

| Military Savings of 5% to 15% | Alfa, American Family, Direct General, Farmers, GEICO, Liberty Mutual, Shelter, USAA | $192 |

| Pay in Full Savings of 5% to 10% | Allstate, Nationwide, Progressive, State Farm, Travelers | $173 |

| Multiple Vehicles Savings of 4% to 15% | Allstate, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Progressive, Travelers, USAA | $164 |

| Student Away at School Savings of 4% to 25% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $159 |

| Good Student Savings of 3% to 20% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $142 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated October 24, 2025

Other discounts like driver’s education, early signing, homeowner, customer loyalty, and paperless billing may be offered as well. Those are generally smaller discounts but every little bit can help you get cheaper Wrangler insurance.

Many discounts will be applied automatically. For example, if you have a clean driving record and are claim-free, you’ll already qualify for a good driver discount with most companies. They pull your MVR report and claim reports upon application, so they know if you have any prior violations or claims (so be honest about these on your application).

However, some discounts may require you to follow up with some paperwork proving your eligibility. Examples of these discounts include driver’s education, having a student with good grades, or being a member of a professional organization (that’s another discount to check for).

Many occupations like medical professionals, first responders, teachers, and pilots can earn discounts on car insurance. If you qualify, you could save anywhere from $82 to $329 per year when insuring your 2024 Jeep Wrangler.

Another thing to mention is that you can’t necessarily stack all the discounts and receive what amounts to free car insurance. It doesn’t quite work that way as companies place a limit on the number of discounts that will apply. But if you do qualify for multiple discounts, that will go a long way to cutting the cost of insurance on your Jeep Wrangler.

During his career as an independent insurance agent,

During his career as an independent insurance agent,