- Toyota Highlander car insurance costs an average of $2,180 per year or around $182 per month, depending on the trim level.

- Drivers can find the cheapest Highlander insurance on the base LE 2WD model, costing an average of $2,006 per year. The Highlander Hybrid XLE AWD has the highest rates at $2,370 per year.

- Out of 34 vehicles in the 2024 midsize SUV segment, the Highlander ranks ninth for insurance affordability.

- Policy premium discounts for being a good driver, bundling policies, being in the military and more can reduce the cost of insurance significantly.

How much does Toyota Highlander insurance cost?

Toyota Highlander car insurance costs an average of $2,180 a year, or about $182 a month. Expect to pay about $190 less annually for Toyota Highlander insurance compared to the midsize SUV average rate.

When average Highlander insurance rates are compared to the cost to insure all vehicles (not just midsize SUVs), the Highlander costs about $96 less to insure than the national average rate of $2,276 per year, which is a 4.3% difference.

If we just compare rates for new 2024 models, the Highlander costs about 16.5% less to insure than the national average rate for 2024 model year vehicles of $2,572 per year.

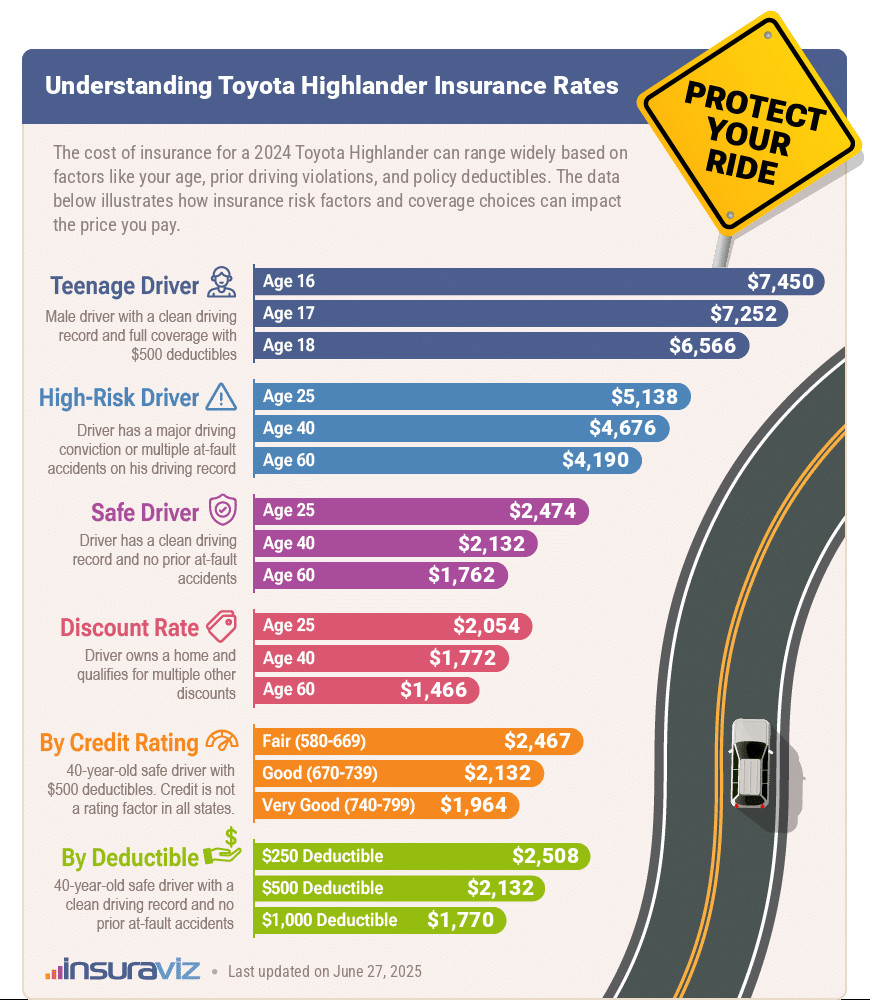

The graphic below breaks down average Toyota Highlander auto insurance cost using a variety of different driver ages and risk scenarios. The average rate for comparison purposes is the ‘Safe Driver Age 40’ data point shown below.

The data shown in the graphic above points out a couple of key concepts:

- Younger drivers and high-risk drivers pay higher car insurance rates.

- Safe drivers (those without at-fault accidents or driving citations) will pay less.

- The more discounts you qualify for (homeowner, multi-vehicle, multi-policy, etc.), the better your chance of getting a low rate.

- Drivers with good or excellent credit pay considerably less than drivers with fair or poor credit scores. Not all states use credit as a rating factor, however, so this may not impact your rate.

- Higher deductibles save money by placing more of the financial impact of a claim on you rather than your insurance company.

What is the cheapest Toyota Highlander insurance?

With 2024 Toyota Highlander car insurance rates ranging from $2,006 to $2,370 per year for the average driver, the lowest-cost trim level to insure is the Highlander LE 2WD. The second cheapest model to insure is the Highlander Hybrid LE 2WD at $2,050 per year.

Plan on budgeting at least $167 per month for full coverage Highlander insurance but less if insuring for liability-only. Average Toyota Highlander insurance cost per month ranges from $167 to $198 depending on the trim level.

For the more expensive models, the three highest cost Highlander models to insure are the Highlander Hybrid Platinum AWD, the Hybrid LE AWD, and the Hybrid XLE AWD trim levels at an estimated $2,288, $2,300, and $2,370 per year, respectively.

In most instances, as the MSRP expands as the package or trim level increases, insurance cost goes up accordingly. Glancing at the chart below reinforces that theory, as the base models have the cheapest insurance rates and the high-end Hybrid Platinum trim is the most expensive.

| 2024 Toyota Highlander Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LE 2WD | $2,006 | $167 |

| Hybrid LE 2WD | $2,050 | $171 |

| LE AWD | $2,050 | $171 |

| XLE 2WD | $2,084 | $174 |

| Hybrid XLE 2WD | $2,120 | $177 |

| XLE AWD | $2,120 | $177 |

| XSE 2WD | $2,120 | $177 |

| XSE AWD | $2,160 | $180 |

| Limited 2WD | $2,176 | $181 |

| Bronze Edition 2WD | $2,176 | $181 |

| Bronze Edition AWD | $2,204 | $184 |

| Hybrid Limited 2WD | $2,212 | $184 |

| Limited AWD | $2,212 | $184 |

| Platinum 2WD | $2,232 | $186 |

| Hybrid Limited AWD | $2,238 | $187 |

| Hybrid Platinum 2WD | $2,262 | $189 |

| Platinum AWD | $2,262 | $189 |

| Hybrid Platinum AWD | $2,288 | $191 |

| Hybrid LE AWD | $2,300 | $192 |

| Hybrid XLE AWD | $2,370 | $198 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Is Toyota Highlander insurance expensive?

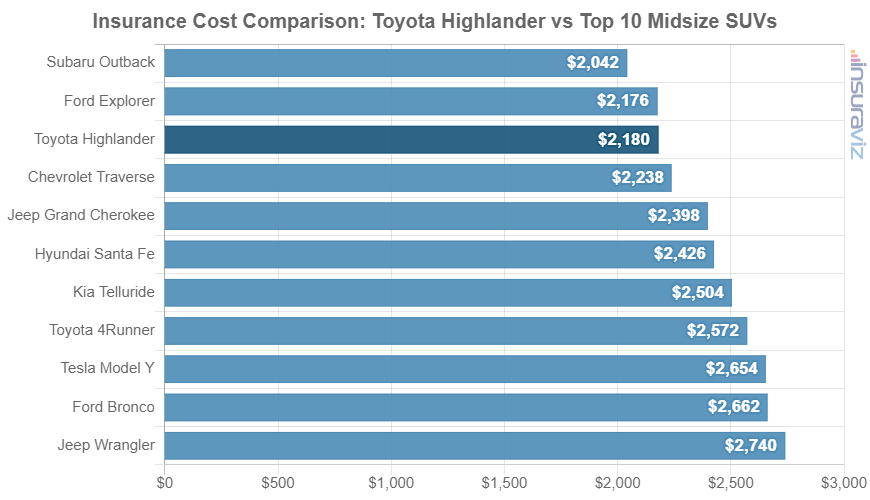

The 2024 Toyota Highlander ranks ninth out of 34 total comparison vehicles in the midsize SUV segment. Highlander insurance costs an average of $2,180 per year, while the category average rate is $2,370 per year, a difference of $190 per year.

When compared to popular vehicles in the midsize SUV segment, car insurance for a Toyota Highlander costs $218 less per year than the Jeep Grand Cherokee, $156 less than the Honda Pilot, $430 less than the Toyota Grand Highlander, and $138 more than the Subaru Outback.

Since rates vary considerably based on the trim level you’re insuring, Highlander car insurance could conceivably cost less than many of the other models that rank better in the chart. We average rates for all trim levels of each model, so it’s best to just get a quote so you know exactly how much insurance will cost for your personal situation and zip code.

The chart below shows how the Highlander compares to the rest of the top 10 selling midsize SUVs in the U.S. We also include a more comprehensive rate table after the chart that ranks car insurance affordability for the entire 2024 midsize sport utility vehicle class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$270 |

| 2 | Nissan Murano | $2,016 | -$164 |

| 3 | Subaru Outback | $2,042 | -$138 |

| 4 | Buick Envista | $2,050 | -$130 |

| 5 | Subaru Ascent | $2,088 | -$92 |

| 6 | Volkswagen Atlas | $2,128 | -$52 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$44 |

| 8 | Ford Explorer | $2,176 | -$4 |

| 9 | Toyota Highlander | $2,180 | -- |

| 10 | Toyota Venza | $2,190 | $10 |

| 11 | Chevrolet Traverse | $2,238 | $58 |

| 12 | Mitsubishi Outlander Sport | $2,254 | $74 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | $82 |

| 14 | Ford Edge | $2,270 | $90 |

| 15 | Kia Sorento | $2,278 | $98 |

| 16 | GMC Acadia | $2,316 | $136 |

| 17 | Buick Enclave | $2,320 | $140 |

| 18 | Honda Pilot | $2,336 | $156 |

| 19 | Mazda CX-9 | $2,342 | $162 |

| 20 | Jeep Grand Cherokee | $2,398 | $218 |

| 21 | Hyundai Santa Fe | $2,426 | $246 |

| 22 | Nissan Pathfinder | $2,440 | $260 |

| 23 | Hyundai Palisade | $2,450 | $270 |

| 24 | Chevrolet Blazer | $2,476 | $296 |

| 25 | Kia Telluride | $2,504 | $324 |

| 26 | Toyota 4Runner | $2,572 | $392 |

| 27 | Mazda CX-90 | $2,582 | $402 |

| 28 | Toyota Grand Highlander | $2,610 | $430 |

| 29 | Kia EV9 | $2,630 | $450 |

| 30 | Tesla Model Y | $2,654 | $474 |

| 31 | Ford Bronco | $2,662 | $482 |

| 32 | Jeep Wrangler | $2,740 | $560 |

| 33 | Dodge Durango | $2,942 | $762 |

| 34 | Rivian R1S | $2,950 | $770 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Comparing car insurance quotes on a Toyota Highlander to models in a similar price range gives more insight into how rates compare. The 2024 Highlander has an average purchase price of $44,533 with MSRP ranging from $37,625 to $43,825.

The models in the midsize non-luxury SUV segment that have the most similar average MSRP to the Toyota Highlander are the Hyundai Palisade, Honda Passport, Honda Pilot, and Volkswagen Atlas.

Here’s how those models compare to the Toyota Highlander both by sticker price and average full-coverage insurance cost. For comparisons of other makes and models, see our insurance rate comparisons page.

- Toyota Highlander vs. Hyundai Palisade – The 2024 Hyundai Palisade sells for an average of $44,750, ranging from $36,400 to $53,600, which is $217 more expensive than the average cost of the Highlander. The cost to insure a Toyota Highlander compared to the Hyundai Palisade is $270 less per year on average.

- Toyota Highlander vs. Honda Passport – The average MSRP for a 2024 Toyota Highlander is $257 cheaper than the Honda Passport, at $44,533 compared to $44,790. Insurance on a 2024 Toyota Highlander costs an average of $270 more every 12 months than the Honda Passport.

- Toyota Highlander vs. Honda Pilot – Having an average price of $44,166 ($37,090 to $52,480), the Honda Pilot costs $367 less than the average cost for the Highlander. Insurance on the Toyota Highlander costs an average of $156 less per year than the Honda Pilot.

- Toyota Highlander vs. Volkswagen Atlas – New off the lot, the MSRP for the Volkswagen Atlas averages $422 less than the average sticker price for the Highlander ($44,111 compared to $44,533). Insuring the Highlander compared to the Volkswagen Atlas costs an average of $52 more annually.

Insurance rates on new vs. used models

As a vehicle gets older, it’s worth less due to depreciation. The value of a vehicle from an insurance standpoint affects the cost to insure it due to the lower payment that the company would have to make if the vehicle is totaled in an accident, stolen, or destroyed by a fire or flood.

Most vehicles will cost less to insure than newer model years, but there are exceptions. If a car manufacturer adds significant new safety features to a vehicle that helps prevent occupant injuries or collisions, the newer model can actually cost less to insure.

The table below breaks down average insurance rates for the Toyota Highlander models from a new 2024 model back to a 2013 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Toyota Highlander | $4,372 | $2,180 | $1,804 |

| 2023 Toyota Highlander | $4,746 | $2,340 | $1,938 |

| 2022 Toyota Highlander | $4,476 | $2,204 | $1,828 |

| 2021 Toyota Highlander | $4,598 | $2,254 | $1,874 |

| 2020 Toyota Highlander | $4,472 | $2,192 | $1,824 |

| 2019 Toyota Highlander | $4,208 | $2,062 | $1,716 |

| 2018 Toyota Highlander | $4,014 | $1,970 | $1,642 |

| 2017 Toyota Highlander | $3,820 | $1,878 | $1,566 |

| 2016 Toyota Highlander | $3,748 | $1,848 | $1,544 |

| 2015 Toyota Highlander | $3,356 | $1,660 | $1,386 |

| 2014 Toyota Highlander | $3,234 | $1,606 | $1,342 |

| 2013 Toyota Highlander | $2,996 | $1,492 | $1,254 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Toyota Highlander trim levels for each model year. Updated October 24, 2025

Also shown in the table are rates for three different driver age groups. We touched on this earlier in the article, but younger drivers are more expensive to insure, all things being equal. In the case of the Highlander, a 20-year-old driver has significantly higher insurance rates than either a 40 or 60-year-old driver for all model years.

Car insurance rates trend downward as you age, but around age 65 they start to creep back up. If you’re older, you know that reflexes and response times are not as good as they were in our prime. This results in a slightly higher frequency of accidents when we get into our golden years, and hence, higher insurance rates.

Additional rate factors and policy discounts

There are a lot of different things that affect the amount we pay each year for car insurance. But thankfully, there are also a lot of things you can do to help lower the cost of insurance on your Highlander.

The list below details some things that impact rates and also ways you can mitigate their effect on your insurance premiums.

- Get a discount from your job. The large majority of auto insurance providers offer policy discounts for working in professions like high school and elementary teachers, accountants, police officers and law enforcement, architects, lawyers, and others. Getting this discount could save between $65 and $233 on your annual insurance cost, subject to policy limits.

- Clean up your credit to lower your rates. In states that have laws that do not prevent a driver’s credit information to be used for the purpose of determining insurance rates, having an excellent credit score over 800 could save as much as $342 per year when compared to a credit score ranging from 670-739. Conversely, a subpar credit score could cost up to $397 more per year.

- Being a good driver saves money. Having frequent at-fault accidents will raise rates, possibly as much as $3,080 per year for a 20-year-old driver and as much as $504 per year for a 60-year-old driver.

- Increasing deductibles makes car insurance cheaper. Boosting your deductibles from $500 to $1,000 could save around $370 per year for a 40-year-old driver and $724 per year for a 20-year-old driver.

- The lower deductible you choose, the higher the policy cost. Lowering deductibles from $500 to $250 could cost an additional $388 per year for a 40-year-old driver and $770 per year for a 20-year-old driver.

- Highlander insurance is expensive for high-risk drivers. For a 50-year-old driver, having enough accidents and violations to require a high-risk insurance policy can cause a rate increase of $2,524 or more per year.

- Young male drivers pay the highest rates. For a 2024 Toyota Highlander, a 20-year-old man will have an average rate of $4,372 per year, while a 20-year-old woman will get a rate of $3,132, a difference of $1,240 per year in the women’s favor by a large margin. But by age 50, the cost for male drivers is $1,928 and female rates are $1,882, a difference of only $46.

- Obey the law to get a lower policy price. To earn the lowest Highlander insurance rates, it pays to not be aggressive behind the wheel. As few as two minor moving violations could result in a rate hike of up to $570 per year. Serious misdemeanors like driving without insurance could raise rates by an additional $2,004 or more.

One of the best ways to reduce the cost of car insurance is to bundle it with your home insurance, if possible. Doing this can save an average of $240 per year when insuring a 2024 Toyota Highlander.

Policy discounts you may have missed

Most companies offer a wide variety of discounts that can really reduce your premiums. It’s definitely worth checking to see if you qualify for the discounts listed below.

There may also be other discounts unique to your company, so ask your agent or a customer service representative to see if there are discounts that have been missed.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $305 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $240 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $203 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $172 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $164 |

| Military Savings of 5% to 15% | Alfa, American Family, Direct General, Farmers, GEICO, Liberty Mutual, Shelter, USAA | $153 |

| Pay in Full Savings of 5% to 10% | Allstate, Nationwide, Progressive, State Farm, Travelers | $137 |

| Multiple Vehicles Savings of 4% to 15% | Allstate, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Progressive, Travelers, USAA | $131 |

| Student Away at School Savings of 4% to 25% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $126 |

| Good Student Savings of 3% to 20% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $113 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated October 24, 2025

Some additional smaller discounts that may be available include an early-signing discount, a homeowner discount, and a discount for using paperless billing.

Discounts can add up to big savings if you qualify, but just keep in mind that each company has a limit to the amount that discounts can reduce your premium. So if you’re running the numbers through your head thinking you can basically get free insurance due to discounts, that’s unfortunately not the case.

Companies to consider for Highlander insurance

There are literally hundreds of car insurance companies across the U.S. that can insure your Highlander. So that makes finding the best insurance for a Toyota Highlander a little more difficult.

There are some larger companies that we can recommend based on things like their financial stability, the convenience of filing claims and making payments, and the ability to find a local agent or office.

We list five of our top recommendations for finding the best Highlander insurance below, along with some pros and cons of each one.

1. Progressive

Estimated Progressive car insurance rate on a 2024 Toyota Highlander: $2,006 per year

Pros

- Available through many local independent agents or online

- Extends optional insurance for ridesharing for drivers who have a side job with a company like Uber or Lyft

- Has optional coverages like accident forgiveness and a vanishing deductible

Cons

- They don’t have a very high claim satisfaction rating with J.D. Power

- Higher than average premiums when adding a teenager to your policy

Get a Quote Or read more about auto insurance coverages offered at Progressive.com

2. State Farm

Estimated State Farm car insurance rate on a 2024 Toyota Highlander: $2,136 per year

Pros

- Nice renewal discount of about 14% if you have longevity

- Good rates if you’ve had a speeding ticket or two

- Good rates when adding a teenage driver to a policy

Cons

- Expensive rates if your credit rating is not great

- Prices are not great for drivers with at-fault accidents on their record

Get a Quote Or read more about auto insurance coverages offered at StateFarm.com

3. GEICO

Estimated GEICO car insurance rate on a 2024 Toyota Highlander: $1,853 per year

Pros

- Allows customers to pay their bill or file a claim on the GEICO mobile app

- On average, GEICO tends to have cheaper insurance than most companies

- GEICO has excellent ratings with rating agencies like AM Best and Standard and Poor’s

Cons

- They do not offer the option to buy gap insurance coverage

- Company does not offer rideshare coverage for drivers who earn income with a company like Uber or Lyft

Get a Quote Or read more about auto insurance coverages offered at GEICO.com

4. USAA

Estimated USAA car insurance rate on a 2024 Toyota Highlander: $1,570 per year

Pros

- Rates are pretty good for drivers with a prior accident

- Rates are pretty good for teen drivers

- They offer rideshare insurance for drivers who have a side job with companies like Uber and Lyft

Cons

- Savings for bundling your homeowners and auto policies is less than other companies at only 6%

- Better rates can be found elsewhere when adding a teenager to your policy

- Only sells car insurance to active military members, veterans, and their immediate families

Get a Quote Or read more about auto insurance coverages offered at USAA.com

5. Auto-Owners

Estimated Auto-Owners car insurance rate on a 2024 Toyota Highlander: $1,722 per year

Pros

- Rates are good for drivers who have caused an accident

- Coverages are available like accident forgiveness, diminished value protection, and gap coverage

- Perks are available like deductible waiver and a common loss deductible

Cons

- Will not cover high-risk drivers

- Expensive rates for drivers with below-average credit

- Is not available nationwide as only available in 26 states

Get a Quote Or read more about auto insurance coverages offered at Auto-owners.com

During his career as an independent insurance agent,

During his career as an independent insurance agent,