- Ford Explorer insurance costs an average of $2,176 per year, or around $181 per month for full coverage.

- With an insurance cost range of $414, the cheapest Ford Explorer insurance is the base Explorer XLT 2WD model at around $1,902 per year, and the most expensive trim being the King Ranch 4WD at $2,316 annually.

- When compared to other midsize SUVs, the 2024 Ford Explorer is one of the cheaper midsize SUVs to insure, costing $194 less per year on average and ranking eighth out of 34 competitors.

- Our top picks for the best Ford Explorer insurance are Progressive, State Farm, and GEICO.

How much does Ford Explorer insurance cost?

Insurance on a Ford Explorer costs an average of $2,176 a year for full coverage. Depending on the trim level being insured, monthly car insurance for a 2024 Explorer averages from $159 to $193.

As the three main components of a car insurance policy, comprehensive (or other-than-collision) coverage will cost about $524 a year, liability and medical (or PIP) coverage costs approximately $636, and collision insurance is around $1,016.

When compared to all other 2024 model-year vehicles, insurance for an Explorer costs 16.7% less than the national average car insurance rate of $2,572 per year.

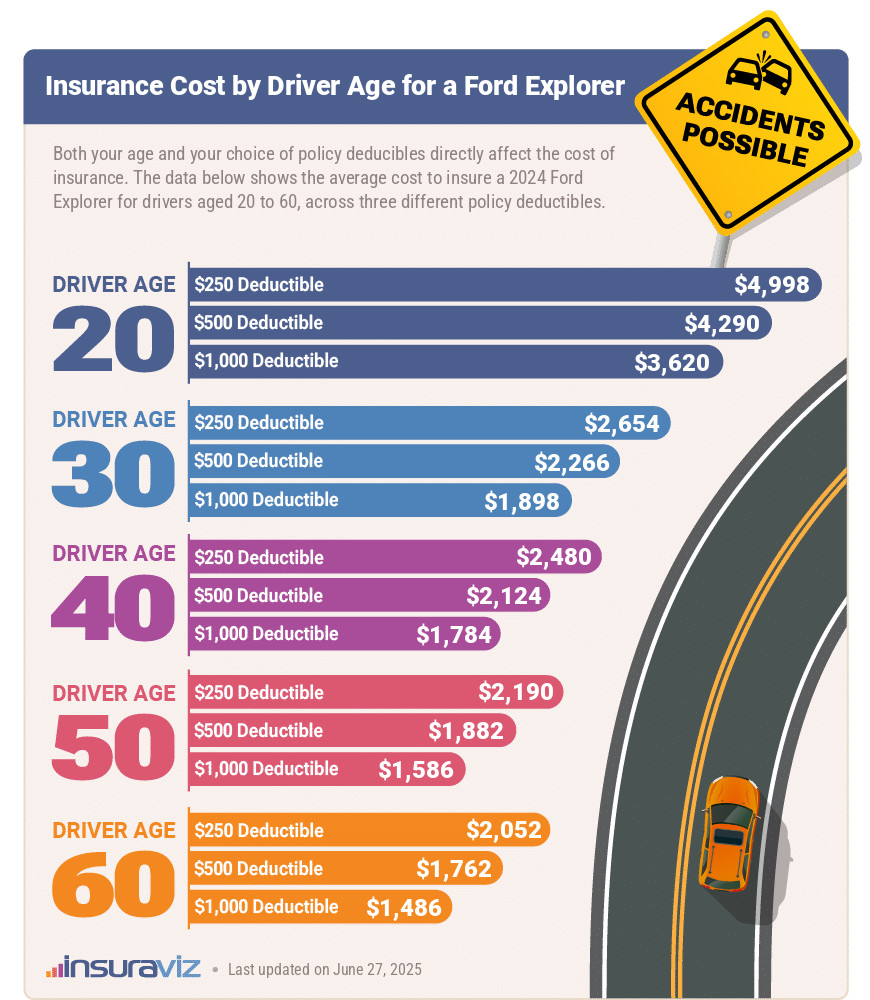

The following graphic shows how average Ford Explorer car insurance cost varies based on driver age and coverage deductibles. Prices range from $1,524 per year for a 60-year-old driver with a $1,000 policy deductible to $5,120 annually for a 20-year-old driver with a deductible of $250.

To give you a better sense of how variable car insurance rates can be, keep in mind that buying liability-only insurance on an Explorer in some parts of Virginia or Wisconsin can cost as little as $239 a year, while a 16-year-old driver with a tendency to speed in specific higher-theft California zip codes could have to pay as much as $15,598 a year for a policy with full coverage.

The table below breaks down average full-coverage insurance rates for the Ford Explorer for the 2005 to 2024 model years. Linked models have a full cost analysis that can be viewed by clicking the link.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Ford Explorer | $2,176 | $181 |

| 2023 Ford Explorer | $1,996 | $166 |

| 2022 Ford Explorer | $2,058 | $172 |

| 2021 Ford Explorer | $2,110 | $176 |

| 2020 Ford Explorer | $2,006 | $167 |

| 2019 Ford Explorer | $1,930 | $161 |

| 2018 Ford Explorer | $1,828 | $152 |

| 2017 Ford Explorer | $1,754 | $146 |

| 2016 Ford Explorer | $1,812 | $151 |

| 2015 Ford Explorer | $1,632 | $136 |

| 2014 Ford Explorer | $1,466 | $122 |

| 2013 Ford Explorer | $1,554 | $130 |

| 2012 Ford Explorer | $1,523 | $127 |

| 2011 Ford Explorer | $1,492 | $124 |

| 2010 Ford Explorer | $1,463 | $122 |

| 2009 Ford Explorer | $1,433 | $119 |

| 2008 Ford Explorer | $1,405 | $117 |

| 2007 Ford Explorer | $1,377 | $115 |

| 2006 Ford Explorer | $1,349 | $112 |

| 2005 Ford Explorer | $1,322 | $110 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ford Explorer trim levels for each model year. Updated October 24, 2025

Which Explorer model has the cheapest insurance?

The cheapest trim level of Ford Explorer to insure is the base XLT 2WD model at $1,902 per year, or about $159 per month. The second cheapest trim is the XLT 4WD model at $1,968 per year, and the third cheapest model to insure is the ST-Line 2WD at $2,114 per year.

If you’re a safe driver, a usage-based program could make car insurance less expensive. Drivers can save an average of $202 per year when insuring a 2024 Ford Explorer.

The two most expensive trim levels of Ford Explorer to insure are the King Ranch 4WD at $2,316 and the Platinum 4WD at $2,312 per year. Those will cost an extra $414 and $410 per year, respectively, over the cheapest base Explorer XLT 2WD model.

The table below demonstrates how the average cost of car insurance increases with trim level and powertrain options for the Ford Explorer.

| 2024 Ford Explorer Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| XLT 2WD | $1,902 | $159 |

| XLT 4WD | $1,968 | $164 |

| ST-Line 2WD | $2,114 | $176 |

| Limited 2WD | $2,144 | $179 |

| ST-Line 4WD | $2,164 | $180 |

| Limited 4WD | $2,184 | $182 |

| Timberline 4WD | $2,184 | $182 |

| ST 2WD | $2,208 | $184 |

| ST 4WD | $2,246 | $187 |

| Platinum 2WD | $2,276 | $190 |

| King Ranch 2WD | $2,284 | $190 |

| Platinum 4WD | $2,312 | $193 |

| King Ranch 4WD | $2,316 | $193 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How do insurance rates compare to similar vehicles?

The Ford Explorer ranks eighth out of 34 comparison vehicles in the 2024 midsize SUV category. The Explorer costs an average of $2,176 per year to insure and the class average cost is $2,370 annually, a difference of around $194 per year.

When compared directly to the top-selling other midsize SUVs, car insurance for a Ford Explorer costs $222 less per year than Jeep Grand Cherokee insurance, $4 less than Toyota Highlander insurance rates, $160 less than the cost of Honda Pilot insurance, and $134 more than Subaru Outback insurance rates.

The chart below visualizes where the Explorer ranks in relation to the other top 10 selling midsize SUVs in the U.S. for insurance affordability. In addition, a table is also included after the chart that ranks typical insurance rates for all 34 vehicles in the 2024 midsize SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$266 |

| 2 | Nissan Murano | $2,016 | -$160 |

| 3 | Subaru Outback | $2,042 | -$134 |

| 4 | Buick Envista | $2,050 | -$126 |

| 5 | Subaru Ascent | $2,088 | -$88 |

| 6 | Volkswagen Atlas | $2,128 | -$48 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$40 |

| 8 | Ford Explorer | $2,176 | -- |

| 9 | Toyota Highlander | $2,180 | $4 |

| 10 | Toyota Venza | $2,190 | $14 |

| 11 | Chevrolet Traverse | $2,238 | $62 |

| 12 | Mitsubishi Outlander Sport | $2,254 | $78 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | $86 |

| 14 | Ford Edge | $2,270 | $94 |

| 15 | Kia Sorento | $2,278 | $102 |

| 16 | GMC Acadia | $2,316 | $140 |

| 17 | Buick Enclave | $2,320 | $144 |

| 18 | Honda Pilot | $2,336 | $160 |

| 19 | Mazda CX-9 | $2,342 | $166 |

| 20 | Jeep Grand Cherokee | $2,398 | $222 |

| 21 | Hyundai Santa Fe | $2,426 | $250 |

| 22 | Nissan Pathfinder | $2,440 | $264 |

| 23 | Hyundai Palisade | $2,450 | $274 |

| 24 | Chevrolet Blazer | $2,476 | $300 |

| 25 | Kia Telluride | $2,504 | $328 |

| 26 | Toyota 4Runner | $2,572 | $396 |

| 27 | Mazda CX-90 | $2,582 | $406 |

| 28 | Toyota Grand Highlander | $2,610 | $434 |

| 29 | Kia EV9 | $2,630 | $454 |

| 30 | Tesla Model Y | $2,654 | $478 |

| 31 | Ford Bronco | $2,662 | $486 |

| 32 | Jeep Wrangler | $2,740 | $564 |

| 33 | Dodge Durango | $2,942 | $766 |

| 34 | Rivian R1S | $2,950 | $774 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Another useful way we can look at the cost of insurance within the midsize SUV segment is to see how rates stack up for the models that are closest in purchase price to a 2024 Explorer.

A 2024 Ford Explorer has an average sticker price of $49,236, ranging from the XLT 2WD trim at $38,570 to the King Ranch 4WD trim at $56,075.

The midsize SUVs that are closest in average price to the Explorer are the Toyota Grand Highlander, Toyota 4Runner, Mazda CX-90, and Kia Telluride.

The data below shows how those models compare to a Ford Explorer for both MSRP and the average cost of car insurance.

- Ford Explorer vs. Toyota Grand Highlander – Having an average purchase price of $50,652 and ranging from $44,465 to $59,520, the 2024 Toyota Grand Highlander costs $1,416 more than the Ford Explorer. The average insurance cost for the Ford Explorer compared to the Toyota Grand Highlander is $434 less each year.

- Ford Explorer vs. Toyota 4Runner – The average MSRP for a 2024 Ford Explorer is $1,686 more expensive than the Toyota 4Runner, at $49,236 compared to $47,550. The average insurance cost for a Ford Explorer compared to the Toyota 4Runner is $396 less every 12 months.

- Ford Explorer vs. Mazda CX-90 – New off the lot, the sticker price on the Mazda CX-90 averages $1,740 more than the Ford Explorer ($50,976 compared to $49,236). Anticipate paying an average of $406 more every 12 months for insurance on the Mazda CX-90 compared to an Explorer.

- Ford Explorer vs. Kia Telluride – The Kia Telluride has an average sticker price of $46,278, ranging from $35,990 to $53,185, which is $2,959 cheaper than the average cost for the Ford Explorer. The average insurance cost for a Ford Explorer compared to the Kia Telluride is $328 less per year.

To view additional rate comparisons, see our insurance comparisons index for a complete list of available makes and models.

Best insurance for a Ford Explorer

The best insurance for a Ford Explorer is the coverage that fits your situation best.

Maybe you want lower deductibles so you have less out-of-pocket expense if you have a claim. Or maybe you need high liability limits because you have significant assets you want to protect if you are ever sued as the result of an auto accident.

Everyone’s situation is different so finding the best insurance is somewhat of a personal decision. However, we can help point you in the right direction to the companies that can help you find the best coverage.

We recommend comparing rates between at least five different car insurance companies in order to find the best rates. Include several major companies like the ones below in addition to several smaller regional companies.

The companies below are our picks for finding the best insurance on a Ford Explorer. Not every company is perfect, however, so we list some of the pros and cons for each one that you might consider when selecting the best company for you.

1. Progressive

Estimated Progressive car insurance rate on a 2024 Ford Explorer: $2,220 per year

Pros

- Has very easy-to-use online and mobile tools so you can manage your policy, track claims, or make payments

- Sells rideshare insurance for insureds who have a side gig with Lyft or Uber

- Offers additional coverage like accident forgiveness, gap insurance, and a vanishing deductible

Cons

- Claim satisfaction ratings in J.D. Power surveys could be better

- Above-average rates for drivers in their teens and early twenties

Get a Quote Or read more about auto insurance coverages offered at Progressive.com

2. State Farm

Estimated State Farm car insurance rate on a 2024 Ford Explorer: $2,067 per year

Pros

- Pretty good renewal discount of around 14% if you have been with the company for at least three years

- Competitive prices for drivers with speeding tickets on their records

- Good average rates when adding a teen to a parent’s policy

Cons

- High average rates for drivers with bad credit

- Average prices are not great for drivers with a DUI or an accident

Get a Quote Or read more about auto insurance coverages offered at StateFarm.com

3. GEICO

Estimated GEICO car insurance rate on a 2024 Ford Explorer: $1,806 per year

Pros

- Customers can make payments or file claims via iPhone or Android

- On average, they have lower car insurance rates for most drivers

- They have consistently strong financial ratings with agencies like AM Best, Moody’s, and Fitch

Cons

- They do not give customers the option to buy gap insurance

- Does not offer rideshare insurance for drivers who earn income with Uber or Lyft

Get a Quote Or read more about auto insurance coverages offered at GEICO.com

4. Nationwide

Estimated Nationwide car insurance rate on a 2024 Ford Explorer: $2,154 per year

Pros

- Generally has a low level of customer complaints filed with state regulators

- Nationwide has optional coverages like gap insurance and accident forgiveness

- Offer a usage-based discount program, SmartRide, for drivers who think they can save money

Cons

- Expensive rates for drivers who caused an accident with injuries

- Prices are not great for drivers with a bad driving record or prior accidents

Get a Quote Or read more about auto insurance coverages offered at Nationwide.com

5. Farmers Insurance

Estimated Farmers Insurance car insurance rate on a 2024 Ford Explorer: $2,502 per year

Pros

- Offers additional coverage like new car replacement and accident forgiveness

- Extends optional rideshare coverage for insureds who earn money with companies like Uber and Lyft

- Will file SR-22 forms with the state if they are required by a prior conviction

Cons

- Higher average rates for most drivers, especially younger and older

- Doesn’t provide loan/lease gap coverage

Get a Quote Or read more about auto insurance coverages offered at Farmers.com

Five ways to save money on Ford Explorer insurance

Since it ranks near the top of the 2024 midsize sports utility vehicle segment, insurance rates on the Explorer are already pretty decent. However, there are always things you can do to save money on insurance.

The five tips below are some of the best ways you can reduce or maintain affordable rates when insuring your Explorer.

- Don’t file small claims. Most insurers give a discounted rate for not filing any claims. Car insurance should only be used for significant claims, not nickel-and-dime type claims.

- Drive safely. Having frequent at-fault accidents will raise rates, possibly as much as $1,054 per year for a 30-year-old driver and even as much as $532 per year for a 60-year-old driver. So drive safely and save money!

- Shop your coverage around. Taking 5-10 minutes before every policy renewal to get free car insurance quotes is a great way to save money. Rates change frequently and you can switch companies very easily.

- Bundle your auto and home policies. Companies that sell both home and auto insurance usually offer a hefty discount if you insure them both with them. For a 2024 Ford Explorer, savings can range from $22 to $370, depending on the company.

- Qualify for policy discounts to save money. Discounts like the bundling discount we just mentioned are a great way to save money. There are dozens of possible discounts you can qualify for that can reduce the cost of your policy.

During his career as an independent insurance agent,

During his career as an independent insurance agent,