- Rating factors like driver age, vehicle model, prior claim history, driving record, and location all influence average car insurance rates

- Average car insurance cost in the U.S. for 2024 is currently $1,883 per year, ranging from $1,745 for compact SUVs up to well over $3,036 per year for luxury cars.

- The average monthly cost of car insurance in the U.S. ranges from $134 to $227, depending on the type of vehicle insured.

- The five vehicles with the cheapest average car insurance rates are all SUVs.

Since the beginning of the automobile, the most popular question asked by drivers is “How much does car insurance cost?”. Financially-savvy consumers ask this question BEFORE buying a car in order to avoid sticker shock when the first insurance bill arrives.

When we get asked about the average cost of car insurance, it’s really a very vague term because the intent of the person wanting an answer could mean any of the following:

- Average cost of insurance for EVERY vehicle model

- Average cost of insurance for EVERY car insurance company

- Average cost for a specific model like a Honda CR-V or Ford F-150 pickup

- Average cost for a specific segment of vehicles like luxury sedans or compact SUVs

- Average cost for a specific driver profile like teenagers, seniors, or drivers with a prior DUI

- Average cost for policies with only liability insurance

- Average cost for residents of California, or even more specifically, San Diego

We could go on and on with this list, drilling down deeper with each item. Each one is more specific than the one before it, but each ultimately does result in a valid average cost despite being completely different.

Factors that impact average car insurance cost

Here’s an example of the types of factors car insurance companies use when developing auto insurance prices. Each of the following rating factors would trigger a premium price change (either positive or negative) and we indicate how rates would be affected.

- 33-year-old driver – cheaper than a younger driver, not as cheap as an older driver

- Male – more expensive than females

- Married – cheaper than single (marriage settles you down you know)

- Honda Accord – better than average rates for a midsize sedan

- 2016 model year – older model year so cheaper than a new model

- Credit score of 822 – In most states, car insurance is cheaper with excellent credit

- Owns his home – demonstrates financial responsibility so rates go down

- Has homeowners insurance with same company – policy bundling saves money

- Same insurance for 10 years – may earn a loyalty discount

- Occupation is a teacher – may earn a professional discount

- One speeding ticket – traffic violations increase rates

- No prior claims – may earn a claim-free discount

- Also insures a 2007 Ford F-150 – earns multi-vehicle discount

- Lives in South Carolina – Cheaper than most states for car insurance

- Lives in Charleston – Higher rates than some more rural areas

- Lives in 29407 Zip Code in Charleston – Even higher rates due to higher property crime rate

That’s 16 different factors and that’s not even close to a comprehensive list. But it should give you a better idea of how many variables go into calculating car insurance rates and how broad the term “average cost of car insurance” actually is.

For the purpose of this article, we are going to use the KISS principle (Keep It Simple, Stupid) and present the average cost of car insurance from a very broad standpoint.

What we mean by “average car insurance cost”

Just so you (the reader) are clear on what we are presenting when we say average car insurance cost, here are the assumptions used in the tables below. Average car insurance rates are based on the following:

- The rated driver is a 40-year-old male with a clean driving record

- When full coverage rates are used, comprehensive and collision deductibles are both $500

- Rates are averaged across all U.S. states

- For each specific vehicle model, rates are averaged for all trim levels

Female readers might be shouting sexism that we are using a male driver instead of a female driver for our average rates, but take solace in the fact that your rates generally cost less. We all know men tend get a little more aggressive behind the wheel (blame the testosterone), so for that reason they pay a little more for car insurance.

So without further ado, let’s get into the meat of this article and get you some average rates!

How much is average car insurance cost?

The average cost of car insurance for 2024 in the U.S. is currently $1,883 per year for full coverage. Rates on 2024 models range from an average of $1,745 per year for compact SUVs up to $3,036 for the large luxury car segment.

Average car insurance rates do adjust periodically, as auto insurance companies can change their rates at any time to make adjustments for periods of increased or decreased exposure and profitability.

For example, during the Coronavirus epidemic, the national lockdown kept most drivers home, reducing accidents and claims.

Many car insurance companies responded by either decreasing their average rates or issuing checks directly to policyholders to refund premiums. Since the insurance companies had fewer claims to pay out, they had excess profits that could be returned to their customers.

However, after drivers began hitting the road again (along with hitting other vehicles), claims increased along with repair costs due to shortages of parts. This caused essentially a kneejerk reaction by car insurance companies to hike rates in 2022 in order to maintain profitability.

The table below details the average cost of car insurance for 2024 for each vehicle segment.

| Vehicle Segment | Average Insurance Cost |

|---|---|

| Compact Cars | $1,876 |

| Midsize Cars | $1,923 |

| Large Cars | $2,730 |

| Compact SUVs | $1,745 |

| Midsize SUVs | $1,874 |

| Large SUVs | $2,096 |

| Compact Luxury Cars | $1,953 |

| Midsize Luxury Cars | $2,284 |

| Large Luxury Cars | $3,036 |

| Compact Luxury SUVs | $2,058 |

| Midsize Luxury SUVs | $2,253 |

| Large Luxury SUVs | $2,939 |

| Midsize Pickup Trucks | $1,911 |

| Large Pickup Trucks | $2,104 |

| Sports Cars | $2,611 |

| Minivans | $1,879 |

How much is average car insurance cost per month?

The average cost of car insurance is approximately $157 per month for a full coverage policy. For specific vehicle segments, compact SUVs average $145 per month, midsize SUVs average $156 per month, and sports cars average $218 per month.

The table below shows average monthly car insurance rates for 2022 for the different vehicle segments.

| Vehicle Segment | Average Monthly Insurance Cost |

|---|---|

| Compact Cars | $156 |

| Midsize Cars | $160 |

| Large Cars | $228 |

| Compact SUVs | $145 |

| Midsize SUVs | $156 |

| Large SUVs | $175 |

| Compact Luxury Cars | $163 |

| Midsize Luxury Cars | $190 |

| Large Luxury Cars | $253 |

| Compact Luxury SUVs | $172 |

| Midsize Luxury SUVs | $188 |

| Large Luxury SUVs | $245 |

| Midsize Pickup Trucks | $159 |

| Large Pickup Trucks | $175 |

| Sports Cars | $218 |

| Minivans | $157 |

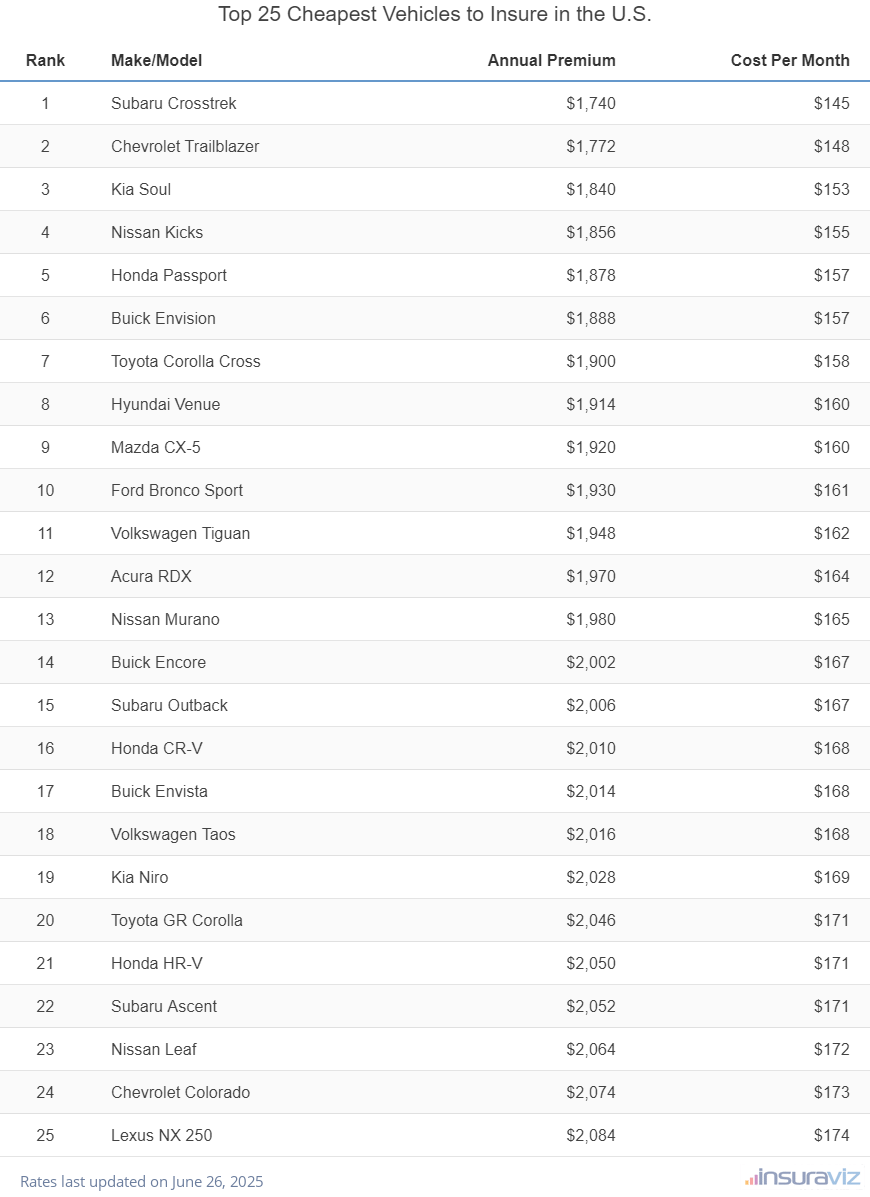

Which vehicles have the cheapest average insurance cost?

The vehicles with the cheapest average car insurance rates are the Subaru Crosstrek, Chevrolet Trailblazer, Kia Soul, and Nissan Kicks. Average full-coverage insurance rates for 2024 for these vehicles range from $117 to $125 per month.

The top five vehicles with the cheapest average car insurance rates all happen to be SUVs. The reason these models have the cheapest rates is due to the fact that strike the perfect balance between safety and affordability.

Safe vehicles tend to have lower liability and collision insurance rates and cheaper vehicles tend to have lower comprehensive and collision insurance rates. Combine the two and it’s the perfect recipe for cheap car insurance rates.

The table below details average car insurance cost sorted by price from low to high for the top 25 cheapest 2024 models to insure in America.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,402 | $117 |

| 2 | Chevrolet Trailblazer | $1,424 | $119 |

| 3 | Kia Soul | $1,482 | $124 |

| 4 | Nissan Kicks | $1,494 | $125 |

| 5 | Honda Passport | $1,512 | $126 |

| 6 | Buick Envision | $1,520 | $127 |

| 7 | Toyota Corolla Cross | $1,530 | $128 |

| 8 | Hyundai Venue | $1,540 | $128 |

| 9 | Mazda CX-5 | $1,548 | $129 |

| 10 | Ford Bronco Sport | $1,554 | $130 |

| 11 | Volkswagen Tiguan | $1,570 | $131 |

| 12 | Acura RDX | $1,586 | $132 |

| 13 | Nissan Murano | $1,594 | $133 |

| 14 | Buick Encore | $1,612 | $134 |

| 15 | Honda CR-V | $1,618 | $135 |

| 16 | Subaru Outback | $1,618 | $135 |

| 17 | Buick Envista | $1,622 | $135 |

| 18 | Chevrolet Colorado | $1,624 | $135 |

| 19 | Volkswagen Taos | $1,624 | $135 |

| 20 | Kia Niro | $1,626 | $136 |

| 21 | Honda HR-V | $1,650 | $138 |

| 22 | Toyota GR Corolla | $1,650 | $138 |

| 23 | Subaru Ascent | $1,652 | $138 |

| 24 | Nissan Leaf | $1,662 | $139 |

| 25 | Honda Civic | $1,680 | $140 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all the United States Zip Codes. Updated February 22, 2024

Article Summary

The tables above should give you a decent idea of how much average insurance prices are in the U.S. for different vehicle segments. Each segment in the tables are linked to pages that break down rates for every model within each category, and each specific model is linked to pages with detailed rates by model year and trim level.

We hope you found the information helpful in determining an average rate, and realize that there is really quite a lot that goes into car insurance rates.

If you’re wanting to compare rates for a new vehicle or just trying to determine if your current policy is a decent deal, we recommend getting some free car insurance quotes that will give you the exact rate you’ll pay, not averages or estimates.