- Volkswagen Taos car insurance rates average $1,624 per year (about $135 per month) for full coverage, but vary considerably based on policy limits.

- Volkswagen Taos insurance cost ranges from $1,542 to $1,710 per year on average, depending on trim level.

- Out of 47 vehicles in the small SUV segment for 2024, the Taos ranks 13th for auto insurance affordability.

How much does Volkswagen Taos insurance cost?

Drivers should budget around about $1,624 yearly to insure a Volkswagen Taos. With MSRP ranging from $25,345 to $34,865 for the 2024 model, monthly insurance cost ranges from $129 to $143.

Liability and medical payments insurance costs approximately $588 a year, comprehensive (or other-than-collision) coverage is an estimated $396, and the remaining collision coverage costs about $640.

The rate chart shown below shows how much the cost of insuring a 2024 VW Taos can vary based on different driver ages and policy deductibles.

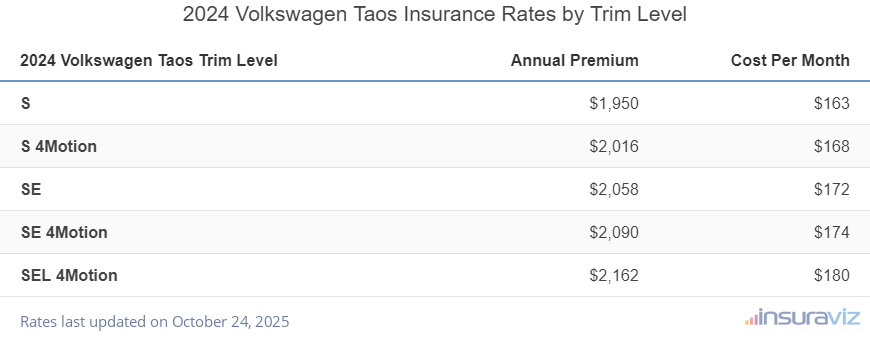

In additional to driver age and policy limits, another factor that influences the cost of insurance is the exact model of vehicle you’re insuring. For the 2024 Taos, the cheapest insurance is on the base S model and the most expensive to insure is the SEL 4Motion trim.

The table below shows average annual, semi-annual, and monthly insurance cost for all the trim levels available for the VW Taos.

| 2024 Volkswagen Taos Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S | $1,542 | $129 |

| S 4Motion | $1,592 | $133 |

| SE | $1,628 | $136 |

| SE 4Motion | $1,652 | $138 |

| SEL 4Motion | $1,710 | $143 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

Is the VW Taos cheap to insure?

The Volkswagen Taos ranks 13th in the compact SUV segment for insurance affordability out of 47 total models. The Taos costs an average of $1,624 per year to insure, while the category average rate is $1,745 per year, a difference of $121 per year.

When compared to the best-selling models in the small SUV category, insurance prices for a Volkswagen Taos cost $124 less per year than the Toyota RAV4, $6 more than the Honda CR-V, and $80 less than the Nissan Rogue.

The table below ranks all 47 models in the 2024 compact SUV segment, with the Taos highlighted and ranked at position 13th.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,402 | -$222 |

| 2 | Chevrolet Trailblazer | $1,424 | -$200 |

| 3 | Kia Soul | $1,482 | -$142 |

| 4 | Nissan Kicks | $1,494 | -$130 |

| 5 | Buick Envision | $1,520 | -$104 |

| 6 | Toyota Corolla Cross | $1,530 | -$94 |

| 7 | Hyundai Venue | $1,540 | -$84 |

| 8 | Mazda CX-5 | $1,548 | -$76 |

| 9 | Ford Bronco Sport | $1,554 | -$70 |

| 10 | Volkswagen Tiguan | $1,570 | -$54 |

| 11 | Buick Encore | $1,612 | -$12 |

| 12 | Honda CR-V | $1,618 | -$6 |

| 13 | Volkswagen Taos | $1,624 | -- |

| 14 | Kia Niro | $1,626 | $2 |

| 15 | Honda HR-V | $1,650 | $26 |

| 16 | Subaru Forester | $1,692 | $68 |

| 17 | Kia Seltos | $1,694 | $70 |

| 18 | GMC Terrain | $1,698 | $74 |

| 19 | Nissan Rogue | $1,704 | $80 |

| 20 | Hyundai Kona | $1,706 | $82 |

| 21 | Mazda CX-30 | $1,710 | $86 |

| 22 | Volkswagen ID4 | $1,720 | $96 |

| 23 | Ford Escape | $1,730 | $106 |

| 24 | Chevrolet Equinox | $1,746 | $122 |

| 25 | Toyota RAV4 | $1,748 | $124 |

| 26 | Mazda MX-30 | $1,760 | $136 |

| 27 | Hyundai Tucson | $1,764 | $140 |

| 28 | Chevrolet Trax | $1,794 | $170 |

| 29 | Mini Cooper Clubman | $1,798 | $174 |

| 30 | Mini Cooper | $1,800 | $176 |

| 31 | Mitsubishi Eclipse Cross | $1,820 | $196 |

| 32 | Jeep Renegade | $1,824 | $200 |

| 33 | Mitsubishi Outlander | $1,848 | $224 |

| 34 | Nissan Ariya | $1,856 | $232 |

| 35 | Kia Sportage | $1,858 | $234 |

| 36 | Hyundai Ioniq 5 | $1,864 | $240 |

| 37 | Fiat 500X | $1,870 | $246 |

| 38 | Mazda CX-50 | $1,884 | $260 |

| 39 | Toyota bz4X | $1,890 | $266 |

| 40 | Mini Cooper Countryman | $1,892 | $268 |

| 41 | Subaru Solterra | $1,898 | $274 |

| 42 | Mitsubishi Mirage | $1,900 | $276 |

| 43 | Kia EV6 | $1,958 | $334 |

| 44 | Dodge Hornet | $2,018 | $394 |

| 45 | Jeep Compass | $2,054 | $430 |

| 46 | Hyundai Nexo | $2,094 | $470 |

| 47 | Ford Mustang Mach-E | $2,220 | $596 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated February 23, 2024

Additional insurance rates and insights

There are so many variables that affect the cost of car insurance that it’s difficult to include them all in a single article. The list below discusses some additional factors that can increase or decrease the price of insurance on a VW Taos, along with some tips that may save you some money.

- Insuring teenagers can be very expensive. Average rates for full coverage Taos insurance costs $5,850 per year for a 16-year-old driver, $5,630 per year for a 17-year-old driver, $4,979 per year for an 18-year-old driver, and $4,562 per year for a 19-year-old driver.

- Negligent driving raises insurance rates. Causing too many accidents will raise rates, as much as $788 per year for a 30-year-old driver and even $412 per year for a 60-year-old driver.

- Getting older means more affordable car insurance rates. The difference in 2024 Taos insurance rates between a 50-year-old driver ($1,450 per year) and a 20-year-old driver ($3,256 per year) is $1,806, or a savings of 76.8%.

- Better credit scores yield better car insurance rates. Having excellent credit of 800+ could save up to $255 per year when compared to a lower credit score of 670-739. Conversely, a mediocre credit rating could cost up to $296 more per year.

- Qualify for discounts to lower insurance cost. Discounts may be available if the insureds take a defensive driving course, are military or federal employees, work in certain occupations, choose electronic billing, are good students, or many other discounts which could save the average driver as much as $274 per year on the cost of insuring a Volkswagen Taos.

- Tickets and violations cost money. In order to have the most affordable price on Taos insurance rates, it’s necessary to not be an aggressive driver. Not surprisingly, just one or two moving violations could result in spiking rates by at least $434 per year. Serious violations like reckless driving and leaving the scene of an accident, DUI, or driving on a revoked license could raise rates by an additional $1,510 or more.

- Lower the cost of your policy by increasing deductibles. Boosting your physical damage deductibles from $500 to $1,000 could save around $234 per year for a 40-year-old driver and $454 per year for a 20-year-old driver.

- The lower deductible you choose, the higher the policy cost. Lowering your physical damage coverage deductibles from $500 to $250 could cost an additional $246 per year for a 40-year-old driver and $476 per year for a 20-year-old driver.